Ford to Stop Making Electric Cars What It Means for Buyers

Featured image for ford to stop making electric cars

Image source: cdn.motor1.com

Ford is discontinning its current lineup of electric cars, including the Mustang Mach-E and F-150 Lightning, to pivot toward hybrids and next-gen EVs. This strategic shift means buyers will face fewer electric options from Ford in the near term, but the company promises more affordable, long-term electric vehicle choices by 2026.

Key Takeaways

- Ford halts EV production: Shift focus to hybrids and ICE vehicles.

- Existing EVs unaffected: Warranty and service remain intact for current models.

- Buyers gain leverage: Negotiate better deals on remaining EV inventory.

- Resale values may drop: Anticipate lower long-term EV depreciation rates.

- Charging network expands: Ford still supports BlueOval Charge Network access.

- Future models uncertain: No new EV launches announced until 2026.

📑 Table of Contents

- Ford to Stop Making Electric Cars: What It Means for Buyers

- Why Ford Is Stepping Back from All-Electric Vehicles

- Impact on Current and Future Ford EV Models

- What This Means for Buyers: Pricing, Availability, and Incentives

- Ford’s Hybrid and ICE Shift: What’s Coming Next

- Comparing Ford’s Strategy to Competitors

- Data Table: Ford EV and Hybrid Comparison (2024–2026)

- Conclusion: Navigating the New Ford Landscape

Ford to Stop Making Electric Cars: What It Means for Buyers

The automotive landscape is shifting rapidly, and one of the most surprising developments in recent years has been Ford’s decision to stop making electric cars—at least in the way many consumers have come to expect. Once a frontrunner in the electric vehicle (EV) race, Ford has announced a strategic pivot away from mass-market battery electric vehicles (BEVs), focusing instead on hybrid and internal combustion engine (ICE) models. This announcement has sent ripples through the industry, leaving potential buyers, investors, and environmental advocates questioning the future of Ford’s EV lineup and what it means for the broader market.

For years, Ford positioned itself as a leader in the EV revolution with models like the Mustang Mach-E and F-150 Lightning. These vehicles were celebrated for their performance, innovation, and appeal to both traditional Ford loyalists and new EV adopters. However, in 2024, the company revealed a major shift: it will pause or discontinue the production of certain all-electric models, delay new EV investments, and reallocate billions of dollars toward hybrid technology and next-generation ICE platforms. This blog post explores the implications of this decision, offering buyers a comprehensive guide to what Ford’s retreat from electric cars means for pricing, availability, resale value, and long-term ownership. Whether you’re considering a Ford EV today or planning for the future, this analysis will help you navigate the changing landscape with confidence.

Why Ford Is Stepping Back from All-Electric Vehicles

Ford’s decision to scale back its EV ambitions didn’t happen overnight. It’s the result of a confluence of market, financial, and technological factors that have reshaped the company’s long-term strategy.

Visual guide about ford to stop making electric cars

Image source: magazine.utoronto.ca

Declining EV Demand and Market Saturation

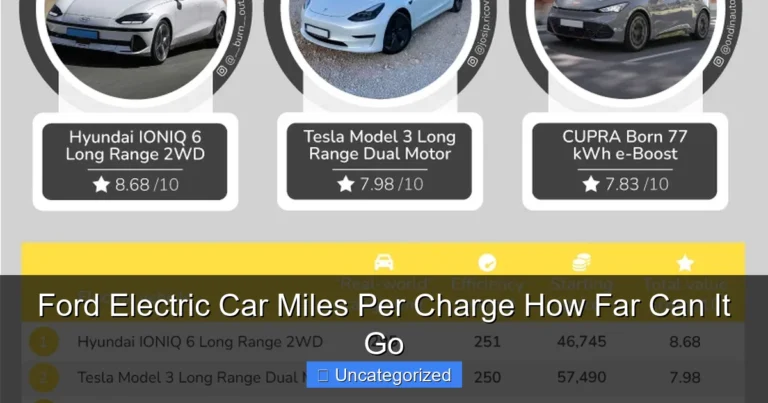

While early adopters rushed to buy EVs, mainstream consumer interest has plateaued. According to data from Cox Automotive, EV sales growth in the U.S. slowed to just 4.2% in Q1 2024, down from over 40% in previous years. Ford’s own sales reflect this trend: the Mustang Mach-E saw a 15% year-over-year decline in 2023, while the F-150 Lightning’s sales were down 18% despite strong initial demand.

- Consumers are hesitant due to high prices, charging infrastructure gaps, and range anxiety.

- Many are opting for plug-in hybrids (PHEVs) or conventional hybrids as a middle ground.

- Ford’s internal data shows that hybrid sales grew by 32% in 2023, outpacing EVs.

This shift in demand has forced Ford to rethink its EV-first approach. As CEO Jim Farley stated in a 2024 earnings call, “We’re not abandoning EVs, but we’re adapting to where the market is—not where we thought it would be.”

Financial Pressures and Production Costs

Building EVs is expensive. Ford has invested over $50 billion in electrification since 2021, including new battery plants, retooled factories, and software development. Despite this, the company reported a $1.3 billion loss in its EV division in 2023. In contrast, its ICE and hybrid divisions remained profitable.

- The average cost of producing an EV is 25–30% higher than a comparable ICE vehicle.

- Battery raw materials (lithium, cobalt, nickel) have seen volatile pricing, increasing production risk.

- Ford’s EV margins were negative, while hybrid margins were positive and growing.

To preserve profitability, Ford is shifting focus to platforms with lower upfront costs and faster return on investment. The company plans to launch 10 new hybrid models by 2026, including hybrid versions of the F-150, Explorer, and Bronco.

Strategic Rebranding and Market Positioning

Ford is not exiting the EV space entirely. Instead, it’s repositioning itself as a “flex-fuel” automaker, offering a spectrum of powertrains: ICE, hybrid, plug-in hybrid, and limited EV options. This allows Ford to cater to diverse consumer needs without overcommitting to unproven EV markets.

- Ford will continue producing the E-Transit commercial van, targeting fleet buyers.

- Future EVs will be niche models (e.g., performance or luxury variants), not volume vehicles.

- The company is investing in hydrogen fuel cell technology for long-haul trucks.

This hybrid-first strategy is designed to maintain Ford’s market share while reducing exposure to EV volatility.

Impact on Current and Future Ford EV Models

Ford’s pivot has immediate and long-term consequences for its existing and upcoming EV lineup. Buyers need to understand which models are affected and how.

Visual guide about ford to stop making electric cars

Image source: i.ytimg.com

Models Being Discontinued or Paused

As of mid-2024, Ford has confirmed the following changes:

- Mustang Mach-E: Production will continue through 2025, but no new generations are planned. The 2026 model year will be the last.

- F-150 Lightning: Production will be scaled back by 40% in 2025. The 2026 model may be the last unless demand rebounds.

- Explorer EV: The planned all-electric version has been canceled. A hybrid version will launch in 2025 instead.

- Lincoln EV lineup: The all-electric Nautilus and Aviator have been delayed indefinitely.

These changes mean that buyers interested in Ford EVs should act quickly. Once production ends, new units will become scarce, and dealerships may raise prices due to limited supply.

What’s Staying in the Lineup

Not all Ford EVs are disappearing. The following models will remain available, though with limited availability:

- E-Transit: Ford’s electric cargo van will continue production, targeting commercial fleets. Over 30,000 units were sold in 2023, and demand remains strong.

- Ford Pro Charging Solutions: Ford’s EV charging infrastructure arm will expand, offering home and fleet charging stations.

- Performance EVs: Ford may release limited-edition electric performance models (e.g., Mach-E GT variants) as halo products.

For individual buyers, the E-Transit is the only Ford EV likely to remain in production beyond 2026. All other models will be phased out.

Future of Ford’s EV Platforms and Technology

Ford is not abandoning EV technology—just its mass-market application. The company will repurpose its EV platforms for hybrid and hydrogen vehicles. For example:

- The GE2 platform (used for Mach-E) will be adapted for next-gen hybrids.

- Ford’s BlueOval SK battery plants in Kentucky and Tennessee will produce batteries for hybrids and hydrogen fuel cells.

- Software and over-the-air (OTA) update systems developed for EVs will be used in hybrid models.

While this means fewer all-electric Fords, it ensures that Ford’s EV innovations will still influence its broader product portfolio.

What This Means for Buyers: Pricing, Availability, and Incentives

Ford’s EV retreat has direct implications for consumers considering a purchase. Here’s what you need to know before making a decision.

Short-Term Price Drops and Incentives

With declining demand and excess inventory, Ford dealerships are offering aggressive incentives to clear out remaining EV stock. As of June 2024, buyers can expect:

- Up to $10,000 in discounts on 2023–2024 Mach-E and F-150 Lightning models.

- 0% APR financing for 72 months on select EVs.

- Free home charger installation (valued at $1,200) with purchase.

- Extended warranties (up to 10 years/150,000 miles) on battery systems.

Tip: If you’re set on buying a Ford EV, now is the time to act. These deals won’t last once inventory runs out.

Long-Term Resale Value Concerns

One of the biggest risks for EV buyers is depreciation. With Ford stepping back from EVs, resale values for Mach-E and Lightning models are expected to decline faster than average.

- Used EVs from brands that exit the market typically lose 5–10% more value annually.

- Fewer service centers and parts availability will make maintenance harder.

- Buyers may face challenges with software updates and battery health monitoring.

For example, a 2023 Mach-E purchased new for $55,000 may be worth only $28,000 after three years—a 49% depreciation rate, compared to 35% for a comparable Tesla Model Y.

Availability and Waiting Times

While Ford EVs are still available, supply is dwindling. Here’s what to expect:

- Most 2024 models are sold out; buyers must wait for dealer trades or leftover 2023s.

- Custom orders may take 6–12 months due to reduced production capacity.

- Dealers may prioritize hybrid and ICE vehicles in their showrooms.

Pro tip: Use Ford’s online inventory tool to find available EVs in your region. Act quickly—popular trims (e.g., Mach-E GT) are selling out fast.

Ford’s Hybrid and ICE Shift: What’s Coming Next

Ford isn’t leaving the market—it’s pivoting. The company plans to launch a wave of hybrid and next-gen ICE vehicles, offering buyers a compelling alternative to EVs.

New Hybrid Models on the Horizon

By 2026, Ford will introduce at least 10 new hybrid models, including:

- F-150 Hybrid: A full hybrid version of the best-selling truck, with 35 mpg combined and 30 miles of electric-only range.

- Bronco Hybrid: Off-road capable with a 400-hp hybrid powertrain.

- Explorer Hybrid: A three-row SUV with 30 mpg and 500-mile range.

- Escape Hybrid: A compact SUV with 42 mpg and $30,000 starting price.

These hybrids will use Ford’s new “PowerBoost” platform, which combines turbocharged engines with electric motors for better fuel economy and performance.

Next-Generation ICE Vehicles

Ford is also investing in cleaner, more efficient gasoline engines. The new “EcoBoost 3.0” engine (launching in 2025) will feature:

- 30% better fuel efficiency than current models.

- Reduced emissions (meeting Euro 7 standards).

- Compatibility with synthetic fuels (e-fuels).

Additionally, Ford is exploring hydrogen combustion engines for heavy-duty trucks, aiming for zero CO2 emissions without the weight of batteries.

Charging and Infrastructure: A Hybrid-First Approach

While Ford won’t expand its public EV charging network, it will enhance hybrid-specific services:

- Free charging for the first 24 months on hybrid models (at partner stations).

- Home charging kits for plug-in hybrids (PHEVs).

- “Hybrid Concierge” service for route planning and fuel optimization.

This focus on hybrids reflects Ford’s belief that the transition to full electrification will be slower than anticipated.

Comparing Ford’s Strategy to Competitors

Ford’s retreat from EVs contrasts sharply with other automakers. Here’s how it stacks up.

Tesla, GM, and Hyundai: Full Speed Ahead

While Ford pulls back, competitors are doubling down:

- Tesla: Expanding Gigafactories in Texas and Mexico; launching a $25,000 compact EV in 2025.

- General Motors: Committing to 30 new EVs by 2025, including affordable models like the Equinox EV.

- Hyundai/Kia: Investing $18 billion in U.S. EV production; launching 11 new EVs by 2026.

These brands are betting that early EV adoption will lead to long-term dominance.

Stellantis and Toyota: The Hybrid Holdouts

Ford isn’t alone in favoring hybrids. Stellantis (Jeep, Ram) and Toyota are also prioritizing PHEVs and hybrids:

- Stellantis: Will launch 25 new hybrids by 2025; delaying full EV rollout.

- Toyota: Still skeptical of BEVs; plans to sell 1.5 million hybrids annually.

This “hybrid bridge” strategy is gaining traction among automakers wary of EV market risks.

What This Means for Consumer Choice

Buyers now have a wider range of options:

- EV-first buyers: Should consider Tesla, Hyundai, or GM.

- Hybrid/ICE buyers: Ford, Toyota, and Stellantis offer strong alternatives.

- Fleet/commercial buyers: Ford’s E-Transit and GM’s BrightDrop remain top choices.

The market is fragmenting, giving consumers more power—but also more complexity.

Data Table: Ford EV and Hybrid Comparison (2024–2026)

| Model | Type | Status (2024) | Status (2025–2026) | Avg. Price | Range (miles) | Key Incentives |

|---|---|---|---|---|---|---|

| Mustang Mach-E | All-Electric | Available | Discontinued | $48,000 | 305 | $10k off, 0% APR |

| F-150 Lightning | All-Electric | Available | Scaled back | $55,000 | 320 | Free charger, $7.5k tax credit |

| E-Transit | All-Electric | Available | Continued | $45,000 | 126 | Fleet discounts |

| F-150 Hybrid | Hybrid | Not available | Launching 2025 | $42,000 | 700 (combined) | 24mo free charging |

| Explorer Hybrid | Hybrid | Not available | Launching 2025 | $38,000 | 500 | $3k cash back |

Conclusion: Navigating the New Ford Landscape

Ford’s decision to stop making electric cars—at least in the traditional sense—marks a pivotal moment in the automotive industry. For buyers, it means a narrowing window to purchase all-electric Fords, with significant short-term savings but long-term ownership risks. The company’s shift toward hybrids and ICE vehicles reflects a pragmatic response to market realities, not a rejection of innovation.

If you’re considering a Ford EV, act quickly. Take advantage of current incentives, but be mindful of future resale value and support. For those open to hybrids, Ford’s upcoming lineup offers strong fuel efficiency, performance, and affordability—without the EV adoption hurdles.

The broader lesson? The EV transition is not a one-size-fits-all journey. While some automakers charge full speed ahead, others like Ford are choosing a more measured path. As a buyer, your best strategy is to align your choice with your driving needs, budget, and long-term goals. Whether you go electric, hybrid, or stick with gasoline, Ford’s evolving portfolio ensures there’s still a vehicle—just not the one you might have expected.

Frequently Asked Questions

Why is Ford stopping the production of electric cars?

Ford has announced plans to scale back or halt certain electric vehicle (EV) models due to shifting market demands, high production costs, and slower-than-expected EV adoption. The company aims to refocus on hybrids and more profitable vehicle segments.

What does “Ford to stop making electric cars” mean for current EV owners?

Current Ford EV owners will still receive service, parts, and software updates as per existing warranties. Ford has pledged ongoing support for its electric car lineup despite the strategic shift.

Which Ford electric cars are being discontinued?

Specific models affected by Ford’s decision include the Mustang Mach-E and F-150 Lightning, though final details are pending. The automaker will likely phase them out gradually while prioritizing hybrid alternatives.

Will Ford stop making electric cars completely or just reduce production?

Ford isn’t exiting the EV market entirely but will significantly reduce output of certain models. The focus will pivot to hybrid vehicles and next-gen EVs with better cost efficiency.

Are Ford electric cars still worth buying after this announcement?

Yes, especially for buyers seeking short-term value and access to Ford’s established EV charging network. However, long-term software and feature updates may be limited compared to future models.

How will Ford’s exit from electric cars affect used EV prices?

Used Ford EV prices may dip initially due to perceived uncertainty, creating bargains for savvy buyers. However, well-maintained models with strong demand (e.g., Mach-E) could retain value better.