Maximize Your Savings: How Fringe Benefit Tax Breaks for Electric Cars Can Revolutionize Your Business

As the world becomes more aware of the environmental impacts of traditional fuel-powered cars, more people are beginning to embrace electric cars. Apart from being eco-friendly and better for the environment, electric cars have financial benefits, particularly in the area of fringe benefit tax savings. As an employer, the decision to offer electric cars as a fringe benefit to employees can significantly reduce your tax liability while promoting a green agenda.

In this blog post, we explore the various ways employers can maximize fringe benefit tax savings with electric cars and the benefits that come with it. So, how can you maximize your tax savings while boosting your environmental impact with electric cars? Let’s find out!

What is a Fringe Benefit Tax?

Fringe benefit tax is a tax levied on the benefits given by employers to their employees as a part of their remuneration package. Electric cars have become increasingly popular as a fringe benefit paid by employers to their employees. These vehicles are considered eco-friendly and cost-efficient, but they come with a tax implication.

Employers who provide electric cars as a fringe benefit to their employees should be aware that they are subject to fringe benefit tax. The amount of tax paid on an electric car provided as a fringe benefit is based on various factors including the value of the car, the distance traveled, and the total usage. Companies that provide electric cars as a fringe benefit can still claim deductions for income tax purposes, but they need to keep accurate records of all expenses related to the vehicle.

Fringe benefit tax is a complex area of taxation, and employers and employees should seek professional advice to ensure compliance with tax laws and regulations.

Definition and Explanation

Fringe Benefit Tax When you receive additional benefits from your employer other than your salary, it is known as a fringe benefit. These benefits can include company vehicles, health insurance, and gym memberships. A Fringe Benefit Tax (FBT) is a tax imposed by the government on employers who provide their employees with fringe benefits.

The amount of FBT depends on the total taxable value of the benefits provided and the FBT rate applicable at the time. Employers are responsible for paying the FBT but often pass on the cost to their employees. The FBT was introduced by the government to ensure that all employees are fairly taxed on the benefits they receive and to prevent employers from providing fringe benefits as a way of hiding taxable income.

It’s important to note that not all benefits are subject to FBT – some are exempt, while others have different rules applied to them. As an employee, it’s important to be aware of the FBT and any potential costs that may arise from receiving fringe benefits from your employer.

Tax Rates and Thresholds

Fringe Benefit Tax If you’re an employer and you offer your employees additional perks (apart from their salary), such as health insurance, company car, or subsidized housing, you may be liable to pay Fringe Benefit Tax (FBT). The FBT is applied to any non-monetary benefit given to employees, and it’s calculated separately from the employee’s salary. What this means is that you (as the employer) will need to pay tax on these benefits, which will be deducted from your overall tax liability at the end of the financial year.

Because FBT is separate from your income tax liability, you’ll need to keep accurate records of any non-cash benefits you give to your employees. Whether you’re a small business owner or a large corporation, it’s essential that you familiarize yourself with Fringe Benefit Tax so you can ensure you’re meeting your obligations and avoiding any penalties.

Why Electric Cars?

Electric vehicles are becoming increasingly popular among individuals and companies alike due to the many benefits they offer. One particular advantage is the fringe benefit tax deduction that electric car owners can enjoy. This tax deduction applies to businesses that provide their employees with electric cars as part of their employee benefits package.

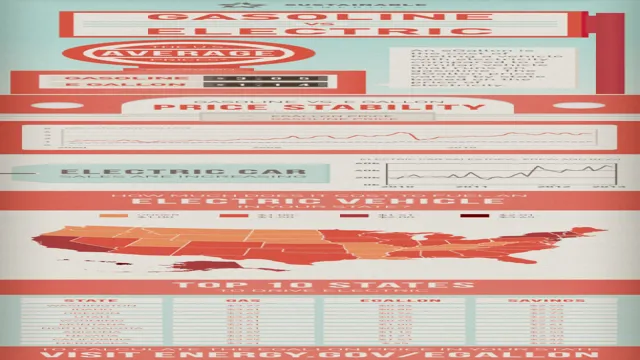

The fringe benefit tax is calculated based on the percentage of the car’s private use, and electric cars receive a lower rate than their fuel-powered counterparts. This creates a financial incentive for companies to switch to electric cars and offer them as employee benefits. Furthermore, electric cars have lower operational costs and greenhouse gas emissions, making them an environmentally friendly option.

With the increasing availability of charging stations and the affordability of electric cars, it’s no wonder that many individuals and companies are making the switch.

Overview of Tax Incentives

Electric cars have become increasingly popular in recent years, not just because they are great for the environment, but also because of the enticing tax incentives that come with them. These incentives vary depending on where you live, but they often include federal tax credits, state tax incentives, and even local rebates. So, why should you consider buying an electric car? Apart from the tax incentives, electric cars are a fantastic investment in the long run because they are incredibly cost-effective.

Compared to gas-powered cars, electric cars require less maintenance and have lower operating costs. Additionally, electric cars are silent, energy-efficient, and they produce zero emissions. With so many benefits, it’s no wonder why electric cars are gaining rapid popularity worldwide.

So the next time you’re in the market for a new vehicle, consider investing in an electric car and taking advantage of the attractive tax incentives that come with it.

Comparison with Traditional Cars

Electric cars have quickly gained popularity in recent years, thanks to their significant advantages over traditional cars. With increasing concerns over environmental pollution and fuel costs, electric cars appear to be the best way forward. These eco-friendly vehicles produce far less carbon emissions, making them a much cleaner option than traditional gas-guzzling cars.

Additionally, electric cars are more cost-effective to operate, with lower costs associated with electricity as opposed to gas or diesel. While some argue that electric cars are expensive to buy and may not have the same power as traditional cars, advances in technology have significantly improved their performance over time. Furthermore, with government incentives and increased availability, electric cars are becoming more accessible to the masses.

In conclusion, the benefits of electric cars are undeniable, making them an excellent choice for drivers who desire both economic and environmental sustainability.

Examples of Savings

Electric cars are becoming an increasingly popular choice for those looking to save money in the long-term. One of the biggest reasons why electric cars are so financially beneficial is their efficiency. Electric motors convert energy into motion with much greater efficiency than internal combustion engines do.

This means that electric cars require less energy to travel the same distance as a traditional gasoline vehicle would, resulting in lower fuel and maintenance costs over time. Additionally, electric cars have a simpler design, with fewer moving parts that require maintenance or replacement. Fewer parts mean less money spent on repairs, and electric cars often don’t require oil changes or other regular maintenance tasks that can add up over time.

Moreover, many governments offer incentives like tax credits or rebates to encourage drivers to switch to electric vehicles. When all of these factors are taken into account, it’s clear that electric cars offer a compelling financial advantage over traditional gasoline vehicles. So, why not take the plunge and save some money on your daily commute?

How to Use Electric Cars as a Fringe Benefit

Are you considering using electric cars as a fringe benefit for your employees? It’s a great move, not just for eco-friendliness, but also for the tax benefits that come with it. In fact, if you provide electric cars to your employees, it is considered a tax-exempt benefit. That means, not only are your employees getting access to an environmentally-friendly ride, but you’re also helping them save on their taxes.

It’s a win-win! However, it’s important to note that there are some specifics to consider. Make sure you’re providing charging stations and have a clear policy for personal use of the vehicle. Additionally, it’s important to keep in mind that the exemption is only available if the vehicle is provided for work purposes and not just for personal use.

By using electric cars as a fringe benefit, you’re also sending a positive message to your employees and stakeholders that your company is committed to reducing our carbon footprint and being a part of the solution to climate change.

Options for Employers

If you’re an employer who wants to offer a unique benefit to your employees, consider providing access to electric cars. Electric cars are not only better for the environment, but they are also more affordable to operate and maintain. Moreover, providing this benefit can help your business attract and retain talented employees who appreciate efforts towards sustainability.

You could provide electric car charging stations on-site or offer access to a car-sharing program, allowing employees to use the vehicles for personal or business use. By providing options for employees to drive electric cars, you can demonstrate your commitment to the environment and encourage others to switch to sustainable modes of transportation. Offering electric cars as a fringe benefit can help your business stay ahead of the curve as more individuals seek out eco-friendly companies to work for.

Options for Employees

Electric cars are becoming more and more popular, and employees looking for fringe benefit options have started to take notice. Companies offering electric cars as a fringe benefit not only promote environmental sustainability but also offer financial incentives for both the employees and the company. Employees can receive tax relief on the cost of the car and enjoy lower maintenance costs, as electric cars generally require less upkeep.

Moreover, charging infrastructure is becoming increasingly accessible, particularly in urban areas. For companies, offering electric cars as a fringe benefit can attract and retain talented employees as well as enhance the company’s green image. It’s a win-win situation for both parties.

So, if you’re an employee looking for a new car, why not consider an electric car as a fringe benefit option? With the growing availability and benefits, it may just make financial and environmental sense.

Conclusion and Future Outlook

In conclusion, the fringe benefits tax on electric cars is a unique and exciting way to promote the adoption of eco-friendly vehicles. By incentivizing companies to provide electric cars to their employees, we can create a greener future while also providing a tax break for those who choose to do their part. So let’s charge up those electric cars and zip down the road less traveled, all while saving money and the planet!”

FAQs

What is fringe benefit tax?

Fringe benefit tax is a tax on non-wage benefits provided to employees in addition to their regular salary or wages.

How does fringe benefit tax apply to electric cars?

If an employer provides an electric car to an employee for personal use, the value of the benefit is subject to fringe benefit tax.

Are there any exemptions for fringe benefit tax on electric cars?

Yes, if the electric car qualifies as a work-related vehicle and is used primarily for work-related purposes, then the value of the benefit may be exempt from fringe benefit tax.

What is the rate of fringe benefit tax on electric cars?

The rate of fringe benefit tax on electric cars varies depending on the value of the benefit, the employee’s marginal tax rate, and the type of employer providing the benefit. It is best to consult with a tax professional to determine the specific rate.