Fueling the Future: The Benefits of Charging Electric Cars

If you’re considering an electric car, you may have heard of the fuel benefit charge. It’s a subject that often confuses people who are new to the world of electric vehicles, and rightfully so. In short, the fuel benefit charge is a tax on electric cars that are provided as company vehicles.

However, it’s important to note that this only applies to company cars, not privately-owned vehicles. In this article, we’ll explore what the fuel benefit charge is, how it works, and what it means for you as an electric car owner. So buckle up and let’s dive in!

Overview

The fuel benefit charge currently in place in the UK is causing some controversy when it comes to electric cars. The charge is a tax on the provision of fuel for employees, which employers are required to pay. However, while traditional fuel is taxed, electricity is not.

This means that employees who drive electric cars, who may not receive any fuel from their employer, are still subject to the fuel benefit charge. Critics argue that this is unfair, as electric car drivers are already making environmentally conscious choices, and should not be unduly punished with an extra tax. On the other hand, supporters of the fuel benefit charge argue that the tax is necessary to maintain the UK’s transport infrastructure, and that electric car drivers still benefit from the roads and other services that are paid for through this tax.

It remains to be seen if any changes will be made to the fuel benefit charge to make it more fair for electric car drivers.

What is a Fuel Benefit Charge?

A fuel benefit charge is a tax levied on employers who provide free or subsidized fuel to their employees for use in a company vehicle or for personal use. This charge is typically applied to businesses with a fleet of vehicles or those who offer company cars to their employees, and it is based on the distance traveled and the type of fuel used. The purpose of the fuel benefit charge is to discourage the unnecessary use of company vehicles for personal purposes and to encourage employees to use public transportation or carpooling instead.

Employers are responsible for reporting and paying the fuel benefit charge to HM Revenue and Customs in the UK, and failure to do so can result in penalties and fines. It is essential for businesses to understand the regulations surrounding fuel benefit charges and to ensure that they remain compliant with the law.

How Does the Charge Apply to Electric Cars?

Electric cars are becoming more and more popular as people seek greener modes of transportation. But how do charges apply to electric cars? Well, to put it simply, charging an electric car is similar to charging a mobile phone or laptop. Electric cars require electricity to be charged, and this can be done through a charging station.

The cost of charging an electric car varies depending on factors such as the type of charging station used, the time of day, and the location. Some charging stations are free, while others require payment for use. As electric cars become more mainstream, the charging infrastructure is growing, and charging is becoming easier and more convenient.

So, if you are considering purchasing an electric car, make sure to familiarize yourself with charging options and costs.

Benefits of Electric Cars in Regards to Fuel Benefit Charges

When it comes to fuel benefit charges, electric cars have a significant advantage over their gas-guzzling counterparts. Unlike traditional vehicles that rely on gasoline or diesel to power their engines, electric cars are powered by electricity. This means that they are not subject to the same fuel benefit charges as petrol or diesel vehicles.

Fuel benefit charges are taxes that are applied to company cars based on their fuel type and emissions. Since electric cars emit zero emissions, they are exempt from these charges, which can save businesses and individuals a significant amount of money each year. Moreover, electric cars are also exempt from road tax, which further contributes to their cost-effectiveness.

Overall, electric cars are an excellent choice for those looking to reduce their fuel benefit charges and lower their carbon footprint.

Lower Costs Compared to Traditional Cars

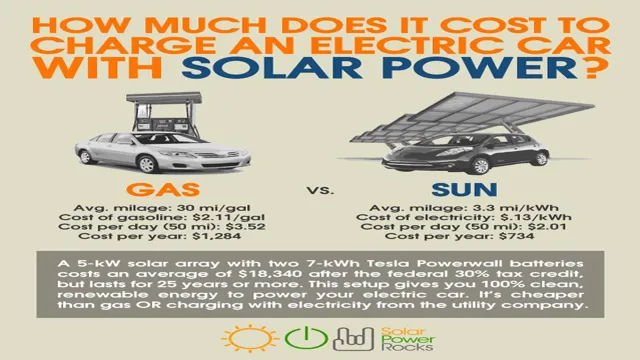

Electric cars are the future of transportation, and one major benefit they offer is lower costs compared to traditional cars. One of these cost savings is in regards to fuel benefit charges. The cost of electricity is much lower than that of gasoline or diesel fuel, meaning that your electric car will be much cheaper to fill up at the charger than your gas car would be at the pump.

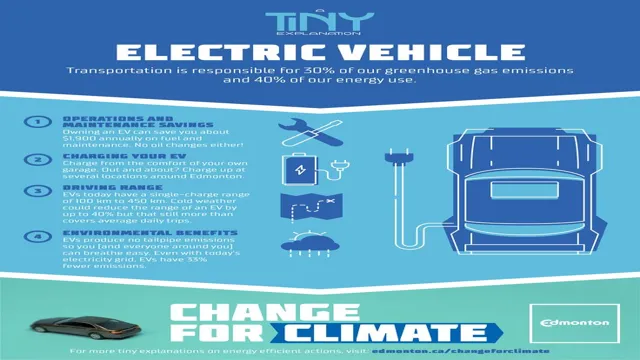

Not only do electric cars have lower fuel costs, but they also benefit from reduced maintenance costs. The electric drivetrain requires far less maintenance than traditional engines, and you will never need to change the oil or replace spark plugs. While electric cars may have a higher upfront cost, they will save you money in the long run thanks to the lower cost of fuel and maintenance.

So, not only are electric cars environmentally friendly, but they also offer financial benefits that make them a great investment for anyone looking to save money on their transportation costs.

Exemption from Fuel Duty and VAT

Electric cars have a range of benefits over their gas-guzzling counterparts, one of which is exemption from fuel duty and VAT. In the UK, electric car owners don’t have to pay fuel duty which means a lower running cost compared to fuel-powered vehicles. Moreover, electric cars are VAT exempt which can save car owners up to 20% of the cost of purchasing a new vehicle.

This is because electric cars are considered environmentally friendly and the government wants to incentivize drivers to switch to greener modes of transport. The money saved on fuel duty and VAT can be used for maintenance, repairs, or even to buy a new car with better features. With these benefits, it’s no wonder that more and more people are choosing to go electric.

Not only are electric cars more environmentally friendly, they are also more economical and can save drivers a great deal in the long run.

Reduced Carbon Emissions and Climate Impact

Electric cars not only provide economic benefits through reduced fuel costs, but they also have significant environmental benefits. One of the most significant benefits of electric cars is their potential to reduce carbon emissions and mitigate climate impact. With the rising concerns over climate change, governments and individuals are increasingly looking for ways to reduce their carbon footprints.

Electric cars offer one solution to this problem. They are powered by electricity, which is generally cleaner and emits less greenhouse gas than gasoline or diesel. In fact, studies have shown that electric cars emit 50-60% fewer carbon emissions compared to traditional cars.

As a result, electric car owners can enjoy reduced fuel benefit charges and contribute to the global effort towards a more sustainable future. Moreover, electric cars also have reduced noise pollution, contributing to an overall healthier environment. By adopting electric cars, we can reduce our carbon footprint and contribute to a cleaner, greener world.

Potential Drawbacks of Fuel Benefit Charge for Electric Cars

The Fuel Benefit Charge, which came into effect in 2020, is currently being levied on electric car drivers in the UK. While the idea behind it is to promote fairness and maintain revenue in the context of fuel duty loss, there are some potential drawbacks. Firstly, it could discourage people from going electric, which could slow progress towards the country’s net-zero goals.

Additionally, it could place an unfair burden on individuals who own electric cars and primarily drive for work. Finally, the technicalities of fuel benefit charges could be difficult to navigate and implement, leading to confusion and frustration among drivers. That being said, the government has made it clear that the charges will be reviewed and altered depending on future developments in the industry.

Limited Availability of Electric Cars on the Market

The limited availability of electric cars on the market is one of the potential drawbacks of the fuel benefit charge for electric vehicles. While the popularity of electric cars is growing, there are still only a few models available on the market, making it challenging for consumers to find the right vehicle that meets their needs. This lack of choice can also limit competition, which may lead to higher prices for electric cars and make it difficult for low-income families to afford them.

Furthermore, the long charging times and limited range of electric cars mean that they may not be suitable for everyone, particularly those who frequently travel long distances. But as more automakers focus on electric vehicle production and infrastructure continues to expand, these limitations will likely diminish. In the meantime, policymakers must ensure that fuel benefit charges do not discourage the transition to electric cars.

Challenges with Range Anxiety and Charging Infrastructure

Electric cars have come a long way in recent years, but there are still some challenges that need to be addressed. Range anxiety, for example, is a common concern among electric vehicle drivers. This refers to the fear of running out of battery power while on the road, which can be especially stressful when traveling long distances.

While the availability of charging stations has improved over time, there are still many areas where these stations are few and far between. This can make it difficult for drivers to plan their routes and feel confident in their ability to make it to their destination without running out of power. Additionally, the fuel benefit charge that some countries are implementing on electric cars may be seen as a drawback to potential buyers.

While these charges are meant to offset the revenue lost from gasoline taxes, they can make electric cars less attractive to consumers who are already hesitant to make the switch. As the popularity of electric vehicles continues to grow, it is important to address these concerns in order to make the transition to electric as smooth and efficient as possible.

Conclusion: Should Electric Car Owners Worry About the Fuel Benefit Charge?

As we continue to navigate the ever-evolving landscape of transportation, it’s clear that electric cars are a game-changer. Not only do they offer a greener alternative to traditional gasoline-powered vehicles, but they also come with their own set of unique benefits – including the fuel benefit charge. This policy not only incentivizes eco-friendly transportation, but it also helps to level the playing field and ensure that all drivers are contributing fairly towards our collective impact on the planet.

So whether you’re a die-hard gearhead or a staunch environmentalist, there’s no denying that electric cars are a win-win for everyone involved. Finally, we can all enjoy the ride – without worrying about the price we’re paying at the pump.”

FAQs

What is the fuel benefit charge for electric cars?

Electric cars are exempt from fuel benefit charge.

Are there any incentives for purchasing electric cars?

Yes, the UK government offers a grant of up to £3,000 for eligible electric and hybrid vehicles.

Can electric car owners claim back VAT on charging costs?

Yes, VAT on charging costs can be claimed back if charging is for business purposes.

What is the current rate of the fuel benefit charge for petrol and diesel cars?

The current rate for the fuel benefit charge is £24,600 for petrol and diesel cars.