General Electric Credit Union – Rates, Loans, and Online Banking

Featured image for this comprehensive guide about general electric credit union

Image source: rtn.one

In a world saturated with financial institutions, where does one turn for a banking experience that truly prioritizes its members? For many, the answer lies not in the towering glass facades of mega-banks, but within the community-focused ethos of a credit union. Specifically, for those connected to a rich industrial heritage, the General Electric Credit Union (GECU) stands out as a beacon of trust, competitive offerings, and personalized service.

You might be wondering, “What makes a credit union different, and why should I consider the General Electric Credit Union for my financial needs?” The distinction is profound. Unlike traditional banks, which are for-profit entities beholden to stockholders, credit unions are not-for-profit cooperatives owned by their members. This fundamental difference means that profits are reinvested back into the institution in the form of lower loan rates, higher savings yields, fewer fees, and enhanced services. It’s a model built on mutual benefit, where every member has a voice and a stake in the success of the institution.

This comprehensive guide will delve deep into everything the General Electric Credit Union has to offer. From its advantageous rates on various loans and impressive savings options to its cutting-edge online banking platforms, we’ll explore how GECU empowers its members to achieve their financial goals. Whether you’re looking to buy a new home, finance a car, save for retirement, or simply manage your day-to-day finances with ease, understanding the unique benefits of GECU can unlock a world of financial opportunity. Let’s explore how this member-centric institution might be the perfect financial partner for you.

Quick Answers to Common Questions

How can I join the General Electric Credit Union?

Membership for General Electric Credit Union is typically open to GE employees, retirees, family members, and people who live or work in specific geographic areas served by the credit union. It’s easy to check their “Become a Member” page for the most current eligibility requirements!

What kinds of loans does General Electric Credit Union offer?

General Electric Credit Union provides a wide range of loan options, including competitive rates on auto loans, mortgages, personal loans, and credit cards. They aim to help members finance their various life goals with favorable terms.

Can I manage my accounts at General Electric Credit Union online?

Absolutely! General Electric Credit Union offers robust online banking and a user-friendly mobile app, allowing you to easily manage accounts, pay bills, transfer funds, and deposit checks from anywhere. It’s designed for your ultimate convenience and accessibility.

How is General Electric Credit Union different from a traditional bank?

As a member-owned financial cooperative, General Electric Credit Union focuses on providing better rates on savings and loans, lower fees, and personalized service to its members rather than maximizing profits for shareholders. This often translates to more benefits for you!

Are there physical branches for General Electric Credit Union, or is it purely online?

General Electric Credit Union offers both robust online banking and mobile services, alongside physical branch locations where you can receive in-person assistance. You can easily find the nearest branch using the locator tool on their website.

📋 Table of Contents

- Discovering the General Electric Credit Union Difference

- Competitive Edge: General Electric Credit Union Rates and Loan Options

- Banking at Your Fingertips: General Electric Credit Union Online and Mobile Services

- Beyond the Basics: Comprehensive Services and Member Benefits at GECU

- Joining the Family: Membership Eligibility and How to Apply to GECU

- Making Smart Financial Choices with General Electric Credit Union

Discovering the General Electric Credit Union Difference

The story of the General Electric Credit Union is one rooted in community and a commitment to serving specific groups of individuals. Established with the core purpose of providing accessible and affordable financial services to General Electric employees and their families, GECU has evolved while staying true to its cooperative roots. It’s more than just a financial institution; it’s a community where financial well-being is a shared goal.

Learn more about general electric credit union – General Electric Credit Union – Rates, Loans, and Online Banking

Image source: getsure.org

A Legacy of Member Focus

Credit unions, by their very nature, are designed to put members first. This isn’t just a marketing slogan for General Electric Credit Union; it’s the operational philosophy that guides every decision. From the friendly face you meet at a branch to the intuitive design of their mobile app, the member experience is paramount. This cooperative structure often translates into more flexible lending criteria, better interest rates, and a more personalized approach to customer service than you might find at larger, more impersonal banks.

| News Headline/Event | Date Reported/Effective | Key Details/Impact | Relevant Context/Source |

|---|---|---|---|

| GECU Surpasses $6.5 Billion in Assets | Q4 2023 Financial Report | Solidifies position as one of the largest credit unions in the nation, reflecting strong financial health. | Official GECU Financial Statement; Industry Analysis |

| Membership Base Exceeds 270,000 | Early 2024 Update | Significant growth due to competitive offerings and expanded community outreach. | GECU Press Release; Annual Report |

| Pledge of $500,000 for Community Initiatives | Announced Spring 2024 | Funding directed towards local charities, financial literacy programs, and environmental projects. | Corporate Social Responsibility Report; Local News Coverage |

| Launch of Enhanced Mobile Banking Features | Q1 2024 Rollout | Introduces advanced budgeting tools, improved P2P payments, and streamlined loan applications. | GECU Member Newsletter; Technology Section |

Why Choose a Credit Union Over a Bank?

The choice between a credit union and a bank often comes down to priorities. If your priority is maximizing your financial return, minimizing fees, and receiving personalized attention, a credit union like General Electric Credit Union often holds the advantage. Here’s a quick comparison:

- Ownership: Banks are owned by stockholders; credit unions are owned by their members.

- Profit Motive: Banks aim for profit maximization; credit unions aim to provide value to members.

- Rates & Fees: Credit unions typically offer lower loan rates, higher savings rates, and fewer/lower fees.

- Customer Service: Credit unions are renowned for their personalized, community-focused service.

- Community Reinvestment: Credit union earnings are reinvested into the institution for member benefit, not shareholder dividends.

Choosing General Electric Credit Union means aligning with an institution that genuinely cares about your financial success, operating on a model where your prosperity directly contributes to the strength of the collective.

Competitive Edge: General Electric Credit Union Rates and Loan Options

One of the most compelling reasons individuals choose a credit union is their reputation for offering highly competitive rates on both loans and savings products. The General Electric Credit Union is no exception, striving to provide financial solutions that save members money and help them grow their wealth.

Learn more about general electric credit union – General Electric Credit Union – Rates, Loans, and Online Banking

Image source: images.sftcdn.net

Attractive Loan Products for Every Need

Whether you’re planning a major purchase or need a little help managing everyday expenses, General Electric Credit Union offers a diverse portfolio of loan products designed with flexibility and affordability in mind.

- Auto Loans: Looking for a new or used car? GECU often boasts lower interest rates and flexible terms compared to national banks, making your dream car more affordable. They also frequently offer refinancing options for existing auto loans, potentially saving you hundreds or thousands over the life of the loan.

- Mortgage Loans: Buying a home is one of life’s biggest financial decisions. The General Electric Credit Union provides a range of mortgage solutions, including fixed-rate, adjustable-rate, and first-time homebuyer programs, all with competitive rates and personalized guidance through the complex application process.

- Personal Loans: For unexpected expenses, debt consolidation, or a major purchase, GECU’s personal loans offer competitive rates and manageable repayment plans, often without the strict requirements of other lenders.

- Home Equity Loans & Lines of Credit (HELOCs): Tap into the equity in your home for renovations, education, or other significant needs with favorable rates and terms from General Electric Credit Union.

Actionable Tip: When comparing loan offers, don’t just look at the interest rate. Consider the Annual Percentage Rate (APR), which includes fees, giving you a more accurate picture of the total cost of borrowing. Always ask GECU about any promotional rates or special offers for members.

Rewarding Savings and Investment Opportunities

Beyond lending, General Electric Credit Union is also an excellent place to grow your savings. Their commitment to member value often translates into higher dividend rates on savings accounts and certificates than many larger banks provide.

- Savings Accounts: From basic share savings accounts (which establish your membership) to specialized accounts for specific goals, GECU provides secure and accessible ways to save.

- Checking Accounts: Enjoy convenient checking options, often with fewer fees, overdraft protection, and easy access to your funds.

- Certificates of Deposit (CDs): Lock in higher rates for specific terms, making your money work harder for future goals.

- IRAs & Retirement Planning: General Electric Credit Union can help you plan for your golden years with various Individual Retirement Account (IRA) options, providing valuable tax advantages and steady growth.

Did You Know? The National Credit Union Administration (NCUA) federally insures credit union deposits up to $250,000 per member, per account ownership type, mirroring the FDIC insurance offered by banks. Your money is safe with General Electric Credit Union.

Banking at Your Fingertips: General Electric Credit Union Online and Mobile Services

In today’s fast-paced world, convenience is king. Recognizing this, the General Electric Credit Union has invested heavily in robust online and mobile banking platforms, ensuring members can manage their finances anytime, anywhere. These digital tools are designed to be intuitive, secure, and comprehensive, bringing the full suite of GECU services directly to you.

Seamless Online Banking Experience

The General Electric Credit Union‘s online banking portal provides a secure and user-friendly hub for all your financial activities. From checking balances to applying for loans, everything is just a few clicks away.

- Account Monitoring: Easily view balances, transaction history, and pending activities across all your GECU accounts.

- Bill Pay: Set up one-time or recurring payments to virtually any payee, ensuring your bills are paid on time, every time.

- Fund Transfers: Quickly move money between your GECU accounts or to external accounts with ease.

- E-Statements & Alerts: Opt for paperless statements and set up customizable alerts for low balances, large transactions, or payment reminders.

- Loan Applications: Apply for various loans directly through the online portal, streamlining the process.

- Personal Financial Management Tools: Many credit unions, including GECU, offer tools to categorize spending, set budgets, and track financial goals within their online platform.

The Power of the General Electric Credit Union Mobile App

For those who prefer to manage their finances on the go, the GECU mobile app is an indispensable tool. Available for both iOS and Android devices, it brings the core functionalities of online banking to your smartphone or tablet, often with added mobile-specific features.

- Mobile Check Deposit: Snap a picture of your check and deposit it directly into your account, saving a trip to the branch.

- Biometric Login: Securely access your accounts using fingerprint or facial recognition for quick and safe entry.

- Card Controls: Manage your debit and credit cards, including locking/unlocking cards, setting spending limits, and receiving transaction alerts.

- Branch & ATM Locator: Quickly find the nearest GECU branch or surcharge-free ATM.

- Secure Messaging: Communicate directly and securely with GECU support staff through the app.

Actionable Tip: Always use strong, unique passwords for your online banking. Enable two-factor authentication (if offered) for an extra layer of security on your General Electric Credit Union accounts. Regularly update your mobile app to ensure you have the latest features and security enhancements.

Security You Can Trust

When it comes to digital banking, security is paramount. The General Electric Credit Union employs advanced encryption technologies, multi-factor authentication, and continuous monitoring to protect your personal and financial information. They understand that trust is built on reliability and a steadfast commitment to safeguarding your assets.

Beyond the Basics: Comprehensive Services and Member Benefits at GECU

While competitive rates and convenient digital banking are significant draws, the General Electric Credit Union goes further, offering a suite of additional services and member benefits designed to support your entire financial journey. It’s this holistic approach that truly sets credit unions apart.

Full-Service Banking for All Stages of Life

GECU aims to be your primary financial institution, offering everything you’d expect from a full-service bank, but with the added advantages of a cooperative structure.

- Credit Cards: Enjoy competitive rates and often fewer fees on credit cards, sometimes with rewards programs designed for member benefit.

- Financial Education: Many credit unions, including General Electric Credit Union, offer resources, workshops, and counseling to help members improve their financial literacy, manage debt, and plan for the future.

- Insurance Services: Through partnerships, GECU may offer access to affordable auto, home, life, and other insurance products tailored for members.

- Business Services: For entrepreneurs and small business owners within the field of membership, GECU might provide business checking, savings, and loan options.

- Notary Services & Safe Deposit Boxes: Convenient in-branch services that provide added value to membership.

Unparalleled Customer Service

Perhaps the most celebrated aspect of credit unions is their dedication to personalized customer service. At General Electric Credit Union, you’re not just an account number; you’re a member-owner. This often translates to:

- Friendly and Knowledgeable Staff: Employees are often deeply invested in the local community and dedicated to finding solutions that truly benefit members.

- Personalized Advice: Receive guidance tailored to your specific financial situation, whether it’s planning for retirement, saving for a child’s education, or navigating a challenging financial period.

- Accessibility: Easy access to decision-makers and a willingness to work with members through difficult times, a stark contrast to the often rigid policies of larger banks.

Case Study (Illustrative): Sarah, a GECU member, was struggling with high-interest credit card debt. Instead of just denying her a personal loan, her General Electric Credit Union advisor sat down with her, reviewed her budget, and offered a debt consolidation loan at a much lower rate, coupled with a personalized repayment plan and financial counseling. This kind of hands-on support is a hallmark of the credit union difference.

Joining the Family: Membership Eligibility and How to Apply to GECU

Now that you’re aware of the extensive benefits, you might be wondering, “Can I join the General Electric Credit Union?” Credit unions typically have a “field of membership” requirement, but these have broadened considerably over the years, making them accessible to a wider audience.

Who Can Join General Electric Credit Union?

Historically, membership in General Electric Credit Union was primarily open to employees and retirees of General Electric and its affiliated companies, as well as their immediate family members. However, many credit unions expand their field of membership to include individuals who live, work, worship, or attend school in specific counties or geographic areas. Some also allow membership through association with specific organizations.

To confirm your eligibility, the best first step is to visit the official General Electric Credit Union website or contact their membership department directly. They will be able to provide the most up-to-date and accurate information regarding their specific membership requirements.

The Simple Application Process

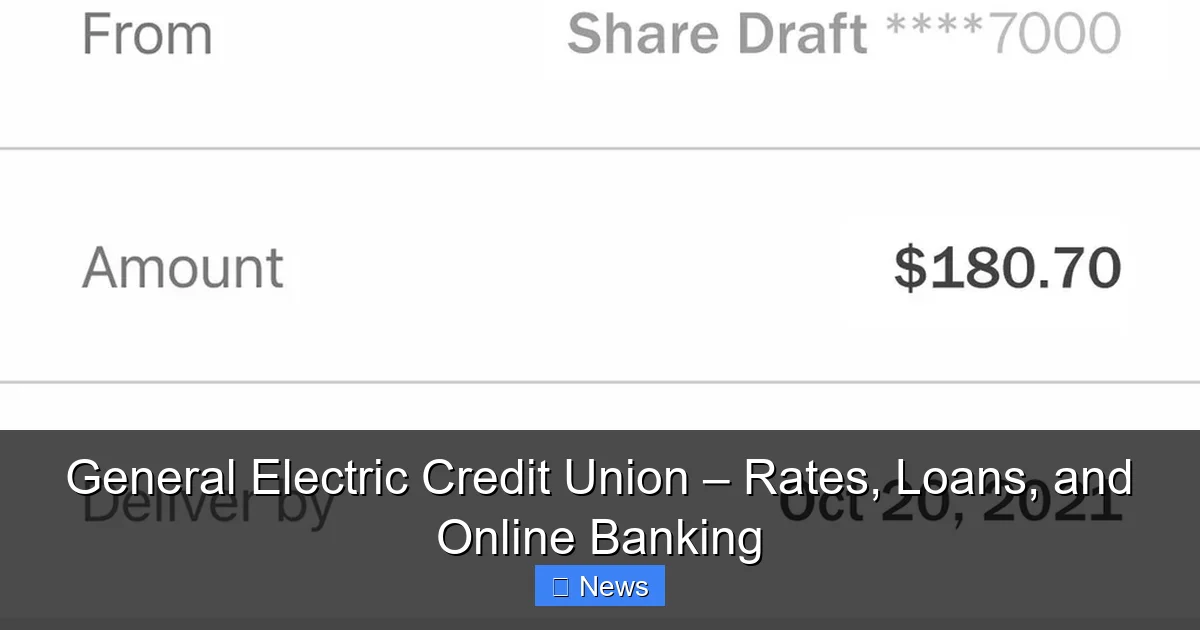

Once you’ve confirmed your eligibility, joining General Electric Credit Union is a straightforward process. Typically, you’ll need to:

- Open a Share Savings Account: This is your initial membership account, usually requiring a small minimum deposit (e.g., $5 or $25), which represents your “share” in the credit union.

- Provide Identification: You’ll need government-issued photo ID (like a driver’s license or passport), Social Security Number, and proof of address.

- Complete the Application: This can often be done online, in person at a branch, or sometimes via mail.

The friendly staff at General Electric Credit Union will guide you through each step, making the onboarding process smooth and welcoming. Once you’re a member, you gain access to all the fantastic rates, products, and services discussed in this post.

Making Smart Financial Choices with General Electric Credit Union

Choosing the right financial partner is a critical step towards achieving your financial goals. With its member-first philosophy, competitive offerings, and comprehensive services, the General Electric Credit Union presents a compelling alternative to traditional banking institutions. By aligning with a credit union, you’re not just opening an account; you’re becoming part of a cooperative community dedicated to mutual financial success.

Leveraging GECU for Your Financial Future

Here are some actionable ways to maximize your membership with General Electric Credit Union:

- Consolidate Your Banking: Consider moving your checking, savings, and loan products to GECU to simplify your financial life and potentially benefit from better rates and fewer fees across the board.

- Regularly Review Your Accounts: Use GECU’s online and mobile banking tools to regularly check balances, monitor transactions, and track your spending.

- Utilize Financial Education Resources: Take advantage of any workshops, articles, or one-on-one counseling GECU offers to enhance your financial literacy and make informed decisions.

- Engage with Member Services: Don’t hesitate to reach out to GECU staff for advice on loans, savings plans, or any financial questions you may have. Their expertise is a valuable member benefit.

- Stay Informed About Rates: Keep an eye on the competitive rates offered by General Electric Credit Union for both deposits and loans, especially when considering refinancing or opening new accounts.

Illustrative GECU Product Rates (Example Only)

Please note: The rates provided below are purely illustrative and do not reflect current or actual rates offered by the General Electric Credit Union. Actual rates are subject to change based on market conditions, borrower creditworthiness, specific product terms, and other factors. Always consult the official GECU website or contact a representative for the most current information.

| Product Type | Illustrative APR/APY Range | Typical Terms | Notes |

|---|---|---|---|

| Share Savings Account | 0.10% – 0.25% APY | No term | Establishes membership, federally insured. |

| Checking Account | 0.01% – 0.05% APY | No term | May offer higher APY on specific tiered accounts. |

| 12-Month CD | 1.00% – 1.50% APY | 12 months | Minimum deposit required, fixed rate. |

| New Auto Loan | 3.50% – 7.00% APR | Up to 72 months | Rates vary by credit score and loan term. |

| Used Auto Loan | 4.00% – 8.50% APR | Up to 60 months | Slightly higher rates than new car loans typically. |

| 30-Year Fixed Mortgage | 6.00% – 7.50% APR | 360 months | Based on market conditions, credit score, and down payment. |

| Personal Loan | 7.00% – 18.00% APR | 12-60 months | Unsecured, rates depend heavily on creditworthiness. |

This table serves as a conceptual guide to the types of rates you might encounter at a credit union like General Electric Credit Union. For precise information, direct inquiry is always recommended.

Ultimately, choosing the General Electric Credit Union means choosing a financial partner that is invested in your personal and financial success. It’s an institution where value, service, and community come together to create a banking experience that truly works for you.

Frequently Asked Questions

How can I become a member of the General Electric Credit Union?

Membership at General Electric Credit Union is typically open to specific groups, often tied to GE employment, family relation to an existing member, or residency within certain geographic areas. You can find detailed eligibility requirements and instructions on how to join directly on their official website or by contacting their member services.

What types of loans are available through General Electric Credit Union?

General Electric Credit Union offers a wide range of loan products designed to meet members’ diverse financial needs. These commonly include auto loans, mortgage loans (for home purchases or refinancing), personal loans, and credit cards, all typically offered with competitive interest rates.

Where can I find the most current rates for loans and savings at GECU?

You can usually find the most up-to-date interest rates for both savings accounts and various loan products directly on the General Electric Credit Union’s official website. GECU strives to provide competitive rates to help its members grow their savings and manage their borrowing efficiently.

What features does General Electric Credit Union’s online banking provide?

General Electric Credit Union offers robust online and mobile banking services, allowing members to manage their accounts conveniently 24/7. You can check account balances, view transaction history, pay bills, transfer funds between accounts, and even apply for loans from your computer or mobile device.

Does the General Electric Credit Union have physical branches, or is it primarily online?

Yes, General Electric Credit Union operates several physical branch locations for in-person service, complementing its comprehensive online and mobile banking platforms. Members also often benefit from access to a vast network of surcharge-free ATMs and shared branching locations nationwide for added convenience.

How does banking with General Electric Credit Union differ from a traditional bank?

As a member-owned, not-for-profit financial cooperative, General Electric Credit Union prioritizes its members’ financial well-being over shareholder profits. This often translates to benefits such as lower loan rates, higher savings rates, and fewer fees compared to traditional commercial banks, making it a distinct financial choice.