Unlocking the Benefits of HMRC’s Electric Car Charging Benefit-in-Kind Scheme

Have you considered making the switch to an electric car? Not only are they better for the environment, but they also come with some significant cost-saving benefits. One of these benefits is the HMRC electric car charging Benefit in Kind. But what exactly does that mean? Put simply, Benefit in Kind (BIK) is a tax that an employee pays on any non-cash benefits they receive from their employer, such as a company car.

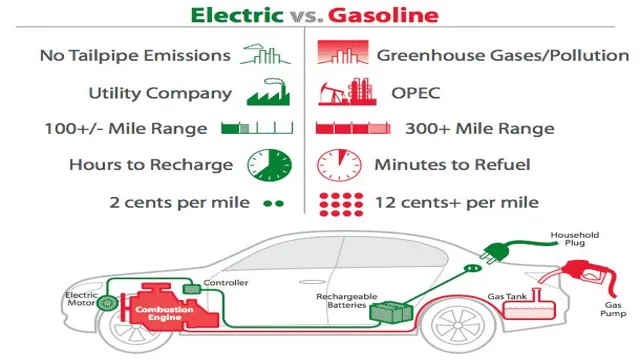

However, with electric cars, this tax is significantly reduced. In fact, for the tax year 2021-22, the BIK rate for electric cars is 1% compared to the 37% rate for petrol and diesel cars. This means that an electric car can save employees hundreds or even thousands of pounds in taxes each year.

But what about the cost of charging an electric car? Well, employers can also provide tax-free charging to their employees, either at their workplace or at home. This means that employees can charge their electric car without having to pay any tax on the benefit. So not only are electric cars good for the planet, but they can also be great for your wallet.

With the HMRC electric car charging Benefit in Kind, employees can save significant amounts on their taxes while also enjoying tax-free charging. If you’re considering making the switch, now might be the perfect time to do so.

What is Benefit in Kind?

If you’re an electric car owner, you may be wondering about the HMRC electric car charging benefit in kind. Benefit in kind is a tax on non-salary perks provided by an employer, and this includes electric car charging. With the increase in electric vehicle adoption, the HMRC has recognized the importance of providing incentives for employers who provide charging facilities for their employees.

This means that if your employer provides electric car charging facilities, you may have to pay benefit in kind tax on this perk. However, the good news is that the current tax rate is significantly lower for electric charging than for other company benefits. In fact, the rate is currently set at 1% of the vehicle’s recommended retail price, which is much lower than the rates for other benefits.

So, while you may have to pay some tax on electric car charging, it’s generally more affordable than other taxable benefits.

Explaining Benefit in Kind and HMRC Regulations

Benefit in Kind (BIK) refers to any non-cash or additional benefits that an employer provides to an employee on top of their usual salary. These benefits can range from company cars, gym memberships, health insurance, and even accommodation. BIK is taxable by law, and the employer is required to pay National Insurance (NI) contributions on it.

There are different tax rates for BIK, depending on the type of benefit. These regulations are enforced by HM Revenue and Customs (HMRC), and employers must correctly report BIK to avoid any penalties. Understanding BIK is essential for both employers and employees since it affects income tax, NI contributions, and other benefits.

If you’re unsure about BIK regulations, it’s always best to consult with a tax advisor or contact HMRC for guidance.

Electric Car Charging Benefit

If you’re considering buying an electric vehicle, it’s worth knowing about the HMRC electric car charging benefit in kind. Essentially, if your employer provides charging facilities for your electric car, you may be eligible for a reduced benefit in kind charge. This means that the amount added to your taxable income for the benefit of using the charging facilities will be lower than it would be for other types of company car benefits.

The good news is that the benefit in kind charge for electric car charging is set to decrease even further in the coming years, making it an increasingly attractive option for both employers and employees alike. So not only is driving an electric car better for the environment, but it can also save you money in the long run.

How the Benefit Works for Electric Cars

Electric Car Charging Benefit The electric car charging benefit is a program that encourages the use of electric cars by providing free charging for electric car owners. This benefit helps reduce the cost of owning an electric car and makes it more accessible for people who may not have considered purchasing one. The program also helps to reduce the environmental impact of driving gas-powered vehicles by promoting the use of clean energy.

To take advantage of this benefit, electric car owners simply need to have access to a public charging station that is participating in the program. They can then plug in their car and receive free charging, which can save a significant amount of money on electricity costs. This benefit is just one of the many initiatives that are aimed at promoting the use of electric cars.

As more people adopt these vehicles, the demand for fossil fuels will decrease and our planet will become a cleaner and more sustainable place to live. So, if you own an electric car or are considering purchasing one, be sure to take advantage of this benefit and help make the world a better place for future generations.

Tax Implications for Employers and Employees

Employers and employees who offer and use electric car charging benefits should be aware of the tax implications that come with this perk. For employers, offering electric car charging as a benefit is considered a non-taxable fringe benefit as long as it meets certain requirements. However, any expenses related to the charging equipment and installation may be deductible as a business expense.

On the employee side, any charging benefits received are considered a taxable fringe benefit and should be reported as income. This means that the employee may owe additional taxes on the value of the benefit received. It’s important for employers and employees to properly report and document electric car charging benefits to avoid any potential tax issues.

Overall, while electric car charging benefits provide a great incentive for employees and show a commitment to environmental sustainability, it’s important to consider the tax implications for both parties involved.

Benefits of Electric Cars for Companies and Staff

Electric Car Charging Benefit One of the biggest benefits of electric cars for companies and staff is the ability to provide on-site charging stations. With the growing popularity of electric vehicles, it’s becoming increasingly important for businesses to offer employees a place where they can charge up their cars during the workday. This not only encourages the use of electric cars but also helps to reduce carbon emissions and promotes sustainability.

Providing access to on-site charging stations also shows employees that the company is committed to supporting eco-friendly practices and can even be a selling point when it comes to attracting potential new staff. Additionally, offering electric car charging benefits can save staff members money on fuel and reduce their overall carbon footprint, leading to a happier and more engaged workforce.

How to Claim the Benefit

If you are an employee who uses an electric company car, then you may be eligible for the HMRC electric car charging benefit in kind. Claiming this benefit is straightforward, and all you need to do is report it as part of your payroll information. Your employer will then calculate the benefit and deduct the tax and National Insurance contributions accordingly.

It is essential to keep track of your electric car charging expenses, as these will come in handy when calculating the benefit. Whether you charge your electric car at home or use a public charging station, you can claim the full costs back from your employer. The HMRC electric car charging benefit in kind is an incentive provided by the UK government to encourage the use of electric vehicles, which are better for the environment.

By taking advantage of this scheme, you can save money and help reduce greenhouse gas emissions.

Steps to Follow for Claiming the Benefit for Charging Electric Cars

When it comes to claiming benefits for charging electric cars, the process can seem overwhelming. However, by following a few simple steps, you can make sure you receive the benefit you’re entitled to. First, check with your electricity supplier to see if they offer any schemes or discounts for electric car charging.

Many suppliers now have partnerships with car manufacturers or offer reduced tariffs for off-peak charging. Next, keep all receipts and records of your charging processes, as you may need to provide evidence of your electricity usage to claim any benefits. Finally, check with the government or local authorities to see if they offer any grants or incentives for electric car charging.

By following these steps and staying informed, you can make the most of the benefits available to you and help support a more sustainable future.

Important Deadlines and Filing Requirements

To claim the benefit of your taxes, it is important to know the deadlines and filing requirements. The first step is to gather all necessary documentation such as W2s, 1099s, and other income statements. Then, you can file your taxes by either doing them yourself or seeking the help of a professional.

If you’re filing late, you may incur penalties and interest fees, so it’s important to double-check the deadlines. Additionally, filing your taxes electronically can speed up the process and ensure a quick refund if applicable. It’s also important to keep track of any deductions or credits you may qualify for, such as those related to education expenses, charitable donations, or medical expenses.

By staying organized and informed, you can claim the benefit of your taxes and potentially save money in the process.

Conclusion

So there you have it folks, the age of electric cars is upon us, and with it comes a new benefit in kind tax system. Not only will you be saving the planet, but also your wallet! HMRC’s electric car charging benefit in kind is a clear indication of the government’s push towards greener and sustainable transport options. So next time you’re cruising around in your electric vehicle and someone asks you why you made the switch, just tell them it’s not only eco-friendly, but also tax-friendly.

And who doesn’t love a good tax break?”

FAQs

What is the HMRC benefit in kind for electric car charging?

The HMRC benefit in kind for electric car charging is currently set at 4 pence per mile.

Does the benefit in kind apply to both company cars and personal vehicles?

Yes, the benefit in kind applies to both company cars and personal vehicles.

Are there any exemptions to the benefit in kind for electric car charging?

Yes, the benefit in kind exemption applies to home charging points if they are available for use by employees at their normal workplace.

How is the benefit in kind calculated for electric car charging?

The benefit in kind for electric car charging is based on the actual costs incurred by the employer for providing the charging facilities, including any installation costs and the cost of electricity used.