Rev Up Your Portfolio: A Guide to Investing in Electric Car Technology

Electric cars have grown in popularity in recent years, and the trend is only accelerating. With more and more automakers committing to electric vehicles (EVs), investing in electric cars has become a hot topic for many people. But for those new to the world of electric cars, it can be a confusing and overwhelming topic.

Fear not, however, as we’ve got you covered with this beginner’s guide to investing in electric cars. In this guide, we’ll cover everything from the basics of EVs to the different types of electric cars available, the benefits of investing in an electric car, and even some of the potential drawbacks to keep in mind. Whether you’re simply curious about electric cars or seriously considering investing in one, this guide will provide you with the information you need to get started.

So why invest in an electric car? For starters, electric cars are environmentally friendly and emit zero or significantly less greenhouse gas emissions than traditional cars. Plus, you can save money in the long run by not having to pay for gas. Additionally, electric cars are known for their performance and smooth driving experience.

With electric cars, you can take advantage of instant torque, which provides an exhilarating driving experience. Investing in an electric car might seem like a big decision, but with the right resources and knowledge, it doesn’t have to be. Follow along with us as we dive into the world of EVs and explore the benefits and potential drawbacks of investing in an electric car.

With this guide as your starting point, you’ll be well on your way to making an informed decision and joining the growing number of electric car owners.

Why Invest in Electric Car Technology?

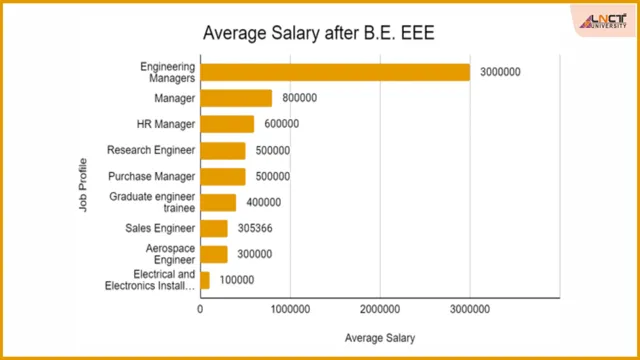

If you’re thinking about investing in electric car technology, then you’re on the right track. The demand for electric vehicles is increasing rapidly, and with it, the need for advancements in technology to support these vehicles. Investing in electric car technology can be a wise decision as it can create opportunities for both personal and financial growth.

In addition, this investment can contribute to a cleaner and more sustainable future by reducing our dependence on fossil fuels. There are various ways you can invest in electric car technology, including buying stocks in electric vehicle manufacturers or investing in companies that produce batteries, charging stations, or electric car components. By investing in this technology, you can help drive the shift towards sustainability and innovation.

In short, investing in electric car technology can benefit both you and the planet in significant ways.

The Environmental Impact of Gasoline Cars

Investing in electric car technology is crucial for reducing the environmental impact of gasoline cars. Gasoline cars produce harmful emissions that contribute to air pollution, global warming, and climate change, while electric cars run on clean and renewable energy sources. By switching to electric cars, we can significantly reduce our carbon footprint and improve our air quality.

Furthermore, investing in electric car technology will drive innovation and advancements in battery technology, charging infrastructure, and renewable energy storage. While there may be some upfront costs associated with transitioning to electric cars, the long-term benefits for both the environment and our wallets are undeniable. By embracing electric car technology, we can help create a cleaner and more sustainable future for ourselves and future generations.

The Market Opportunities of Electric Cars

Investing in electric car technology is a no-brainer for anyone looking to capitalize on the ever-growing market demand for green and sustainable solutions. As governments push for the electrification of transportation, the industry is set to expand at a rapid pace. In addition to being environmentally friendly, electric cars are also cost-effective, efficient, and offer a smooth driving experience.

From automakers to battery manufacturers and charging infrastructure providers, the electric car industry presents a lucrative investment opportunity. As an investor, you could enjoy a significant return on investment as the market continues to grow exponentially. With the demand for electric cars expected to reach unprecedented levels over the next decade, now is the ideal time to invest in this innovative technology.

Getting Started with Electric Car Stocks

If you’re looking to invest in the future of transportation and make a positive impact on the environment, electric car stocks may just be the way to go. But where do you start? First, it’s important to do your research on the different electric car companies and their offerings. From there, you can decide which ones align with your investment goals and values.

Tesla is one of the most well-known electric car companies, but there are also lesser-known options such as NIO, Rivian, and Fisker Inc. It’s also important to pay attention to industry trends, such as advancements in battery technology and government regulations promoting electric vehicles. While there is always risk involved with investing, electric car technology is an industry that is likely to grow in the coming years and could potentially provide both financial returns and a better future for our planet.

Researching Electric Car Companies and Stocks

If you’re looking to invest in the electric car industry, it’s important to start researching the various companies and stocks available. One of the first things you’ll want to consider is the company’s track record in the industry. What kind of electric cars do they produce and how well have those models been received by consumers? You’ll also want to consider the overall financial health of the company and its potential for future growth.

Some of the major players in the electric car market include Tesla, NIO, and General Motors. While there are risks involved with any investment, the demand for electric cars is only expected to continue growing in the years ahead, making this an exciting and potentially profitable industry to be a part of. So why not start doing your research today and see where electric car stocks can take you?

Diversifying Your Portfolio with Electric Car ETFs

If you’re interested in diversifying your investment portfolio with a focus on electric car stocks, getting started might feel overwhelming. However, one approach you might consider is investing in Electric Car ETFs – funds that hold a range of electric car companies, including manufacturers, suppliers, and service providers. With an ETF, you get the opportunity to invest in a diversified portfolio with as little as one trade, including companies that you might not have discovered on your own.

Notably, some of these funds also provide exposure to specific sectors such as battery technology or charging infrastructure. Examples include the Global X Autonomous & Electric Vehicles ETF and the iShares Self-Driving EV and Tech ETF. By investing in Electric Car ETFs, you can pursue your investment goals in a more dynamic, exciting, and sustainable industry.

Understanding the Risks of Investing in Electric Car Stocks

Investing in electric car stocks can be a tempting option for those looking to capitalize on the growing popularity of electric vehicles. However, it’s important to understand the risks associated with this type of investment. One major factor to consider is the volatility of the stock market.

Electric car companies are still relatively new players in the market and therefore subject to sudden shifts in share prices. Additionally, the industry is heavily dependent on government subsidies and regulations, which can drastically impact the profitability of these companies. It’s also important to research the individual companies before investing, as some may be more financially stable than others.

While investing in electric car stocks can potentially yield high returns, it’s crucial to have a thorough understanding of the risks involved before diving in.

Alternative Ways to Invest in Electric Car Technology

Investing in electric car technology has become a popular topic for investors who are looking for ways to diversify their portfolios. Instead of investing in traditional options such as individual stocks or exchange-traded funds (ETFs), there are alternative ways to invest in the electric car industry. One such method is investing in a mutual fund or index fund that holds electric car technology companies.

This allows investors to gain exposure to multiple companies within the industry without having to invest in individual stocks. Another option is investing in companies that manufacture the components used in electric car production, such as lithium ion battery manufacturers and semiconductor companies. These companies are essential to the production of electric cars and can offer investors a unique opportunity for growth.

Overall, there are various ways to invest in electric car technology, and investors can choose the method that best suits their investment goals and risk tolerance.

Investing in Electric Car Charging Stations

As more and more people switch to electric cars, there is an increasing demand for charging stations, and that presents a unique opportunity for investors. By investing in electric car charging stations, you can capitalize on the growing demand for electric vehicles and earn a profit while doing so. Whether you are looking to invest in an established charging company or start your own business, there are many ways to get involved in this emerging sector.

Not only is this a great way to support the infrastructure of electric vehicles, but it’s also a smart investment choice, as electric cars are expected to become more widespread in the coming years. So why not invest in the future of transportation and make a positive impact at the same time?

Investing in Lithium-ion Battery Technology

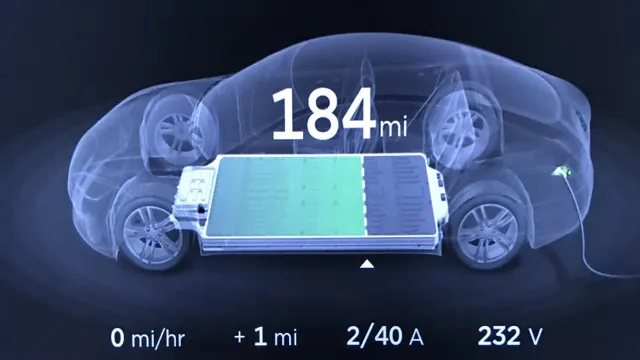

Investing in Lithium-ion Battery Technology is a smart way to invest in the future of electric cars. There are many alternative ways to invest in electric car technology, such as buying shares of electric car companies, purchasing electric car charging station stocks, or investing in lithium-ion battery manufacturers. The demand for electric cars is only going to increase, and this will create a massive demand for lithium-ion batteries.

Lithium-ion batteries are essential for electric cars, as they store the energy that powers the vehicle. Investing in these batteries means investing in the future of clean energy and electric transportation. Additionally, investing in lithium-ion battery technology can also have a positive impact on the environment by reducing greenhouse gas emissions.

So, whether you are an environmentally conscious investor or someone looking to profit from the growing demand for electric cars, investing in lithium-ion battery technology is a wise decision.

Closing Thoughts on Investing in Electric Car Technology

Investing in electric car technology can be a great opportunity for those looking to get involved in the rapidly growing clean energy sector. The first step to investing in this technology is to research and choose the specific companies or funds that align with your investment goals. This may include companies that specialize in electric vehicle production or those that focus on developing batteries and charging infrastructure.

It’s important to keep in mind that investing in any technology comes with risk, and it’s important to diversify your investments to minimize that risk. Additionally, staying up-to-date with industry news and advancements can help you make informed investment decisions. By investing in electric car technology, you not only have the chance to potentially earn a financial return, but you also support the transition to cleaner transportation and a more sustainable future.

Conclusion

Investing in electric car technology is not only a smart financial move but also a step towards a sustainable future. To truly succeed, investors need to keep an eye on the latest developments in the industry, anticipate trends, and stay patient through the inevitable ups and downs. Remember, investing in electric cars is not just about the present, it’s about being a part of a cleaner, greener future – so buckle up and ride the wave of sustainable progress!”

FAQs

What is electric car technology?

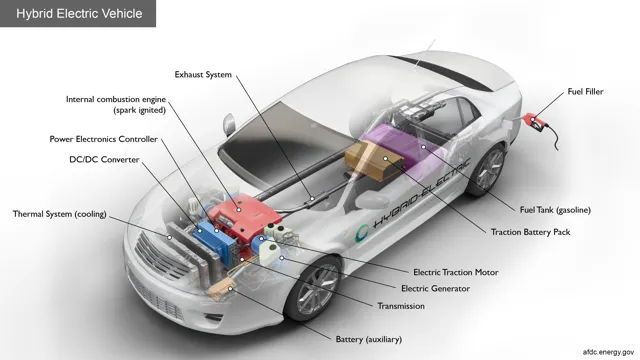

Electric car technology uses electrical energy stored in batteries to power a vehicle instead of conventional gasoline or diesel fuel.

Why should someone invest in electric car technology?

Investing in electric car technology offers numerous benefits, such as reduced emissions, improved fuel efficiency, and increased reliability.

How can one invest in electric car technology?

There are several ways to invest in electric car technology, including buying stocks in electric car companies, investing in battery manufacturers, or funding research and development in the field.

What are some of the top electric car companies to invest in?

Some of the top electric car companies to consider investing in include Tesla, NIO, and BYD. It is important to do some research and consider various factors before making any investment decisions.

Are there any risks associated with investing in electric car technology?

As with any investment, there are risks associated with investing in electric car technology, such as market volatility, regulatory changes, and potential competition. It is important to carefully consider these risks before making any investment decisions.