Income Tax Benefit for Electric Cars: Maximize Savings!

Electric cars are becoming more popular. Many people are choosing them for various reasons. One of the biggest reasons is the income tax benefit. This article will explain how you can save money on taxes when you buy an electric car. We will talk about what these benefits are. We will also discuss how they work.

What is an Electric Car?

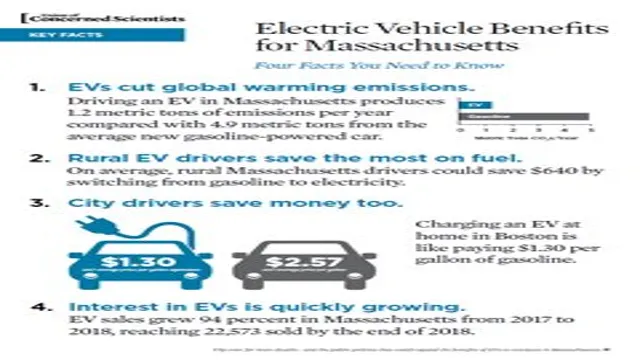

Before we talk about tax benefits, let’s understand electric cars. An electric car runs on electricity. It uses a battery instead of gasoline. This means electric cars are good for the environment. They produce less pollution. They also reduce our need for fossil fuels.

Why Choose an Electric Car?

Choosing an electric car has many advantages:

- They are cheaper to run.

- They need less maintenance.

- They often have a quiet ride.

- They are better for the environment.

Income Tax Benefits Explained

Now let’s talk about money. Buying an electric car can save you money on your taxes. This is called a tax credit. A tax credit reduces the amount of tax you owe. It is different from a tax deduction. A deduction lowers your taxable income. A credit lowers the tax itself.

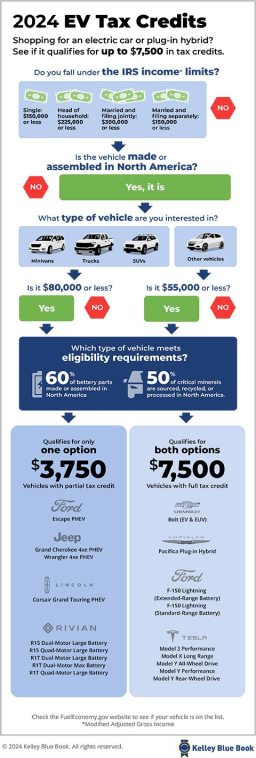

Federal Tax Credit

The U.S. government offers a federal tax credit for electric cars. This credit can be up to $7,500. However, this amount can change. It depends on the car manufacturer. When a company sells many electric cars, the credit starts to decrease.

For example, if you buy a Tesla or a Chevrolet Bolt, you may qualify for the full credit. But if you buy a car from a company that sold many electric cars, the credit may be less.

State Tax Benefits

Besides the federal tax credit, many states offer their own tax benefits. These benefits vary by state. Some states offer extra credits. Others provide rebates or lower registration fees.

| State | Tax Benefit |

|---|---|

| California | Up to $7,000 in credits |

| New York | Up to $2,000 in credits |

| Texas | $2,500 rebate |

| Florida | No state tax but lower fees |

Check your state for specific benefits. Each state has different rules. Make sure to understand them before buying an electric car.

How to Claim the Tax Credit

Claiming the tax credit is simple. You need to follow these steps:

- Buy a qualified electric car.

- Keep the purchase receipt.

- Fill out IRS Form 8834.

- Attach the form to your tax return.

It is important to file your taxes correctly. If you are unsure, ask a tax professional. They can help you understand the process.

Eligibility Requirements

Not every electric car qualifies for the tax credit. Here are the main requirements:

- The car must be new and purchased.

- The car must be for personal use.

- The car must have a battery capacity of at least 4 kWh.

- The car must be manufactured by a qualifying company.

Make sure to check if your chosen car meets these requirements. You can find this information on the IRS website.

Other Savings with Electric Cars

Besides tax credits, electric cars offer other savings. Here are a few:

- Lower fuel costs: Electricity is often cheaper than gasoline.

- Tax rebates: Some states offer rebates when you buy an electric car.

- Free or reduced parking: Many cities offer free parking for electric cars.

- HOV lane access: Some areas allow electric cars in carpool lanes.

Final Thoughts

Buying an electric car can be a smart choice. The income tax benefits help make it more affordable. You can save money on federal and state taxes. Plus, there are other savings in fuel and parking.

Before buying, research the tax credits available. Check your state’s rules too. Understanding these benefits can help you save more money.

In conclusion, electric cars not only help the environment. They also help your wallet. Consider making the switch today!

Frequently Asked Questions

What Is The Income Tax Benefit For Electric Cars?

Electric cars may qualify for tax credits. These credits reduce your taxable income, lowering your tax bill.

How Much Can I Save On Taxes With An Electric Car?

Tax savings vary by state and vehicle model. Many buyers can save up to $7,500 in federal tax credits.

Who Is Eligible For Electric Vehicle Tax Credits?

Most taxpayers who buy a new electric car can qualify. Check specific vehicle requirements for exact eligibility.

Are There State Incentives For Electric Cars?

Many states offer additional incentives. These can include tax credits, rebates, and other financial benefits for electric car owners.