Is Ford Losing Money on Electric Cars The Shocking Truth Revealed

Featured image for is ford losing money on electric cars

Yes, Ford is currently losing money on its electric vehicles (EVs), with its Model e division reporting billions in losses despite rising sales. The automaker faces steep upfront costs for EV development, production challenges, and pricing pressures, delaying profitability—but Ford remains committed, betting long-term on a $50 billion EV strategy to catch Tesla and rising rivals.

Key Takeaways

- Ford loses $66k per EV: High production costs currently outpace revenue.

- Long-term bets continue: Ford invests $50B+ in EVs through 2026 despite losses.

- Scale will cut costs: Profitability expected by 2025 with higher production volume.

- Hybrid demand surges: Traditional hybrids outsell EVs, offering short-term profits.

- Battery innovation critical: Lowering battery costs is key to future EV margins.

📑 Table of Contents

The Electric Gamble: Ford’s Big Bet on EVs

Imagine you’re at a poker table, staring at a mountain of chips. The dealer flips a card—your move. Do you double down on your current hand, or fold and walk away? For Ford, that’s the reality of their electric vehicle (EV) strategy right now. The company’s recent financial reports have raised eyebrows, with headlines like “Ford loses $60,000 on every EV sold” making the rounds. But is it really that simple? Are they losing money on electric cars, or is there more to the story?

As someone who’s followed the auto industry for years (and owns a Ford Mustang Mach-E, by the way), I’ve seen how quickly perceptions can shift. EVs are the future—no question. But transitioning from gas-powered vehicles to battery-powered ones isn’t cheap, and Ford’s journey has been anything but smooth. In this deep dive, we’ll unpack the financials, explore the challenges, and reveal the surprising truths behind Ford’s EV gamble. Whether you’re a car enthusiast, an investor, or just curious about the future of transportation, this one’s for you.

Ford’s EV Financials: The Hard Numbers

The $60,000 Loss Myth (and Why It’s Complicated)

Let’s address the elephant in the room: Ford losing money on electric cars. In 2023, Ford’s Model e division—their EV arm—reported a staggering $4.7 billion in losses. On average, that’s about $38,000 per EV sold (some estimates go as high as $60,000). But here’s the twist: this isn’t just about Ford selling cars at a loss. It’s about the massive upfront costs of building an EV business from scratch.

Think of it like opening a restaurant. You spend a ton of money on renovations, hiring staff, and buying ingredients before you even serve your first customer. Ford’s losses are similar. They’re investing in:

- Battery plants: Building BlueOval SK joint venture facilities in Kentucky and Tennessee.

- R&D: Developing new battery tech, software, and autonomous driving features.

- Production retooling: Converting gas-car factories to EV lines (like the Rouge Electric Vehicle Center).

So, while the per-car loss looks scary, it’s a temporary phase. Ford’s CEO, Jim Farley, has called this the “investment phase” of their EV strategy. The goal? Scale up, drive down costs, and eventually turn a profit.

How Ford’s EV Sales Stack Up

Now, let’s talk sales. Ford sold 72,608 EVs in the U.S. in 2023—a 18% increase from 2022. Their top models? The F-150 Lightning (44,291 units) and the Mustang Mach-E (34,764 units). Sounds great, right? But here’s the catch: Ford’s EV sales are still a tiny fraction of their overall volume. For comparison, Ford sold over 1.8 million gas-powered vehicles in 2023. EVs made up just 4% of their total sales.

This imbalance is key. Ford’s legacy gas-powered business (like the F-150 pickup) is still their cash cow, funding the EV transition. But as EV competition heats up (hello, Tesla, Hyundai, and Chinese automakers), Ford needs to scale faster to stay relevant.

The Real Cost of Building EVs

Battery Costs: The Hidden Expense

If you’ve ever priced a new EV, you know batteries are the biggest cost. For Ford, this is a double-edged sword. On one hand, battery prices are dropping—down 89% since 2010, according to BloombergNEF. On the other hand, Ford’s current batteries are expensive to produce. Why?

- Supply chain hiccups: The pandemic and geopolitical tensions disrupted lithium, nickel, and cobalt supplies.

- New tech: Ford’s LFP (lithium iron phosphate) batteries—rolled out in 2023—are cheaper but require new production lines.

- Scale: Tesla and Chinese rivals have been making batteries for years. Ford’s still catching up.

Example: The F-150 Lightning’s battery pack costs around $18,000 to produce. At a starting price of $50,000, that’s nearly 36% of the car’s value—before you even factor in labor, software, or profit margins.

Software and Tech: The New Arms Race

Here’s something many people don’t realize: EVs aren’t just about batteries. They’re computers on wheels. And Ford’s playing catch-up in the software department. Tesla’s built an entire ecosystem—over-the-air updates, self-driving features, and a seamless user experience. Ford’s SYNC system? It’s… functional, but not revolutionary.

To compete, Ford’s investing heavily in:

- BlueCruise: Their hands-free highway driving system (still in beta).

- Ford Pro: Fleet management software for business customers.

- AI and data: Using machine learning to improve battery efficiency and predictive maintenance.

This tech isn’t cheap. Ford’s spending $50 billion on EVs and AVs (autonomous vehicles) through 2026. But without it, they risk becoming a “dumb” EV maker—selling cars with outdated software and losing customers to more innovative rivals.

Competition and Market Pressures

Tesla’s Shadow: The Pricing War

Tesla’s 2023 price cuts hit Ford hard. When Tesla slashed Model Y prices by 20%, it forced Ford to follow suit. The Mustang Mach-E’s base price dropped from $51,000 to $42,000—a move that boosted sales but squeezed margins even further. Ford’s now in a tough spot: lower prices to compete, or risk losing market share.

But Tesla has an advantage. They’ve been making EVs for 20 years. Their factories are optimized, their batteries are cheaper, and they’ve got a loyal customer base. Ford’s playing catch-up in a game where the rules keep changing.

Chinese EVs: The Next Big Threat

While Tesla dominates the premium EV market, Chinese automakers like BYD and NIO are targeting the mid-range segment. BYD’s Seagull EV, for example, sells for just $10,000 in China. Even with tariffs, these cars could flood the U.S. market in a few years. Ford’s response? The Explorer EV (due in 2025), priced at $40,000–$50,000. But will it be enough?

Tip for Ford: Focus on what they do best—trucks and SUVs. The F-150 Lightning’s success shows there’s demand for electric pickups. Lean into that niche while improving software and battery tech.

Ford’s Strategy: Can They Turn It Around?

Cost-Cutting and Efficiency

Ford’s not sitting idle. They’ve launched a massive cost-cutting initiative, aiming to save $3 billion by 2025. How? By:

- Simplifying vehicle platforms: Using the same chassis for multiple EVs (like the F-150 Lightning and future Explorer EV).

- Reducing battery costs: Switching to LFP batteries (cheaper and longer-lasting).

- Streamlining software: Cutting redundant features and focusing on core tech.

Example: The upcoming Ford Explorer EV will share 70% of its parts with the gas-powered Explorer. That’s a smart move—it reduces R&D costs and speeds up production.

Partnerships and Alliances

Ford’s also betting on partnerships to reduce costs. Their BlueOval SK joint venture with SK On (a Korean battery maker) will produce batteries in the U.S., cutting import costs. They’ve also teamed up with Google for AI-powered infotainment and with Tesla for access to the Supercharger network.

Pro tip: These alliances could be a game-changer. By sharing resources, Ford avoids reinventing the wheel and accelerates their EV timeline.

The Road Ahead: Will Ford’s EV Business Survive?

Profitability Timeline

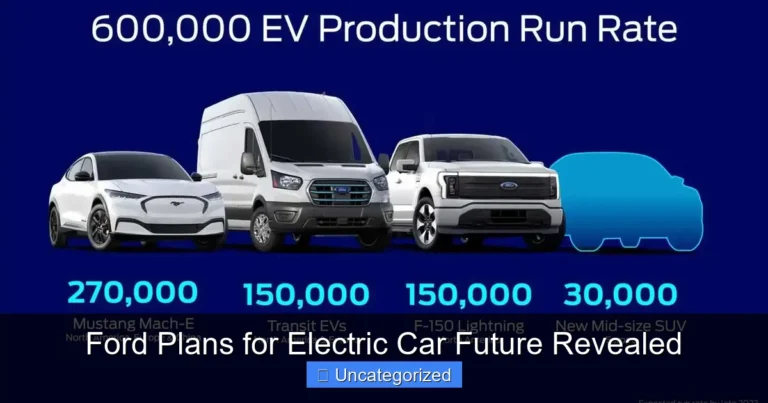

Here’s the million-dollar question: When will Ford’s EVs turn a profit? The company’s betting on 2026. By then, they expect:

- Annual EV production to hit 600,000 units (up from 100,000 in 2023).

- Battery costs to drop below $100/kWh (from $150/kWh today).

- Software revenue to offset hardware losses.

But it’s a tight race. If battery tech advances slower than expected, or if demand for EVs plateaus, Ford’s timeline could slip. And with interest rates rising, financing these investments gets harder.

Data Table: Ford’s EV Financial Snapshot (2023 vs. 2026 Projections)

| Metric | 2023 (Actual) | 2026 (Projected) |

|---|---|---|

| EV Sales (U.S.) | 72,608 | 200,000+ |

| Average Loss per EV | $38,000–$60,000 | Break-even |

| Battery Cost | $150/kWh | $100/kWh |

| EV Production Capacity | 100,000 units/year | 600,000 units/year |

| Software Revenue | $500 million | $2 billion+ |

The Shocking Truth: Ford’s EV Losses Aren’t the Whole Story

So, is Ford losing money on electric cars? The short answer: yes, for now. But the long answer? It’s more nuanced. Ford’s losses are the price of admission in the EV game. They’re investing in factories, batteries, and tech—not to make a quick buck, but to secure a seat at the table for the next decade.

Think of it like a startup. You lose money in the early years to build a product, scale, and outlast competitors. Ford’s doing the same. The real question isn’t whether they’re losing money today, but whether they can survive the transition. And there’s reason for optimism. Their F-150 Lightning is a hit, their battery partnerships are smart, and their cost-cutting plan is aggressive.

But challenges remain. Tesla’s dominance, Chinese competition, and the high cost of software development are all hurdles. For Ford to succeed, they need to:

- Scale fast: Hit their 2026 production targets without cutting corners.

- Innovate: Build better software and user experiences.

- Stay flexible: Adapt to market changes (like new regulations or tech breakthroughs).

As someone who’s seen Ford’s ups and downs, I believe they’ve got a shot. But it won’t be easy. The next 3–5 years will decide whether Ford’s EV gamble pays off—or becomes a cautionary tale.

One thing’s for sure: the EV race isn’t just about cars. It’s about who can adapt, innovate, and outlast the competition. And Ford’s all in. The question is: will the bet pay off? Time will tell.

Frequently Asked Questions

Is Ford losing money on electric cars right now?

Yes, Ford has openly admitted it’s currently losing money on its electric vehicles (EVs), with its Model e division reporting significant losses in recent quarters. The high costs of battery materials, supply chain challenges, and aggressive pricing to compete with Tesla are key factors.

Why is Ford losing money on EVs despite growing sales?

While Ford’s EV sales are rising, the company faces steep upfront investments in battery plants, R&D, and factory retooling—costs that outweigh short-term profits. Additionally, price cuts to stay competitive in the EV market further squeeze margins.

Can Ford turn a profit on electric cars by 2025?

Ford aims to reach a 8% profit margin for its EV segment by late 2025, driven by cost reductions from its new lithium iron phosphate (LFP) batteries and scaled production. However, this depends on overcoming ongoing supply chain and battery cost hurdles.

How much money is Ford losing per electric car sold?

Exact per-vehicle losses aren’t public, but Ford’s $1.3 billion loss in its EV division in Q1 2023 suggests losses run into thousands of dollars per car. The company hopes to break even by 2026 as production efficiencies improve.

Is Ford’s electric car strategy sustainable given the losses?

Ford is betting long-term, prioritizing market share over immediate profits. With $50+ billion allocated to electrification by 2026, the strategy hinges on future scale, battery cost declines, and software-driven revenue streams.

Are Ford’s EV losses worse than other automakers’?

Ford’s EV losses are comparable to rivals like GM and Volkswagen, who also face high transition costs. However, Ford’s aggressive EV push and transparency about losses make its financial challenges more visible to investors.