Exploring the Benefits in Kind for Electric Cars: Are You Missing Out on Tax Savings?

If you’re considering an electric car for personal or business use, it’s worth understanding how Benefit in Kind (BIK) tax works. BIK tax is a tax that employees have to pay when they receive benefits from their employer, like a company car. Electric cars have become increasingly popular in the UK due to their sustainability and efficiency, but many people are still unsure about the tax implications.

In this blog post, we will explain Electric Car Benefit in Kind and how it affects employees who use an electric car for their work. By the end of this article, you’ll have a better understanding of how electric cars can help you save money on your taxes!

What is Benefit in Kind?

Yes, there is a benefit in kind for electric cars, but it depends on certain factors. Benefit in Kind (BIK) is a tax that employees pay on perks they receive from their employers. If an employer provides an employee with a car for personal use, the employee has to pay tax on the benefit in kind received.

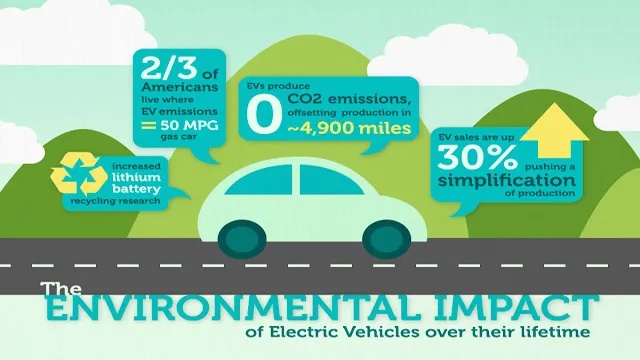

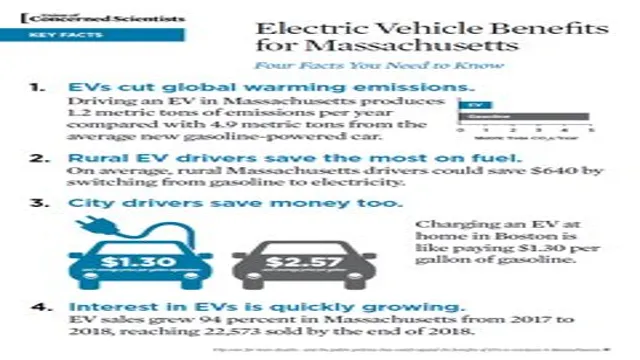

However, electric cars have lower carbon emissions and are more eco-friendly. The UK government has recognized this and offers incentives to encourage the use of electric cars. In 2021, electric cars attract a 0% benefit in kind rate, which means there is no tax to pay on them.

This incentive is intended to encourage more people to switch to electric cars. Moreover, the government provides charging infrastructure grants and reduces the upfront cost of electric cars to make them more affordable. Overall, electric cars are more tax efficient and environmentally friendly, making them an excellent choice for both employers and employees.

Definition and Examples

Benefit in Kind refers to any non-cash compensation or benefits that an employee receives from their employer in addition to their regular salary. Some examples of Benefits in Kind include health insurance, company cars, snacks or meals at work, company phones, memberships to organizations, and more. These benefits are often given to employees as a way to improve their overall well-being and job satisfaction, as well as to incentivize them to work harder or stay with the company for longer periods.

While Benefits in Kind can be great perks for employees, they are also subject to taxation in many countries. This means that employees may have to pay taxes on the value of the benefits they receive, which can decrease their overall take-home pay. Overall, Benefits in Kind can be an excellent way for companies to attract and retain top talent, but both employers and employees need to be aware of the tax implications of receiving such compensation.

Electric Cars and Benefit in Kind

If you’re considering an electric car, you may be wondering if there is a benefit in kind for electric cars. The answer is yes, there is! Benefit in kind is the amount an employee pays in tax for the use of company vehicles for personal journeys. For electric cars, the benefit in kind rate is significantly lower than for petrol or diesel cars.

This is because electric cars emit less carbon dioxide and other harmful pollutants, which is better for the environment. In fact, electric cars are often exempt from paying certain taxes as well. Plus, there are other benefits to owning an electric car, such as cheaper running costs and a smoother, quieter driving experience.

So not only is there a benefit in kind for electric cars, but there are also plenty of reasons to make the switch.

Lower BIK Rates for Electric Cars

The rising popularity of electric cars isn’t just down to their eco-friendly nature and the fact they are cheaper to run. In addition to these, they also come with lower Benefit in Kind (BIK) rates. This is essentially a tax on the personal use of company cars, which is based on the car’s value and CO2 emissions.

As electric cars produce zero emissions, this means that their BIK rate is significantly lower than that of their petrol or diesel counterparts. This makes them a great option for employees who use a company car as a perk, as they will pay less tax on the car’s usage, ultimately leading to savings. In recent years, the government has continued to lower BIK rates in a bid to encourage more drivers to switch to electric cars, making them even more attractive for those in the market for a new vehicle.

So, not only are electric cars better for the environment, but they’re also better for your wallet!

Tax Savings for Electric Car Owners

Electric car owners in the UK are eligible for substantial tax savings when it comes to Benefit in Kind (BIK). This is because electric vehicles emit zero emissions, making them an environmentally friendly alternative to petrol and diesel cars. As of April 2021, BIK rates for electric cars are at 1% compared to 20% for petrol or diesel cars.

What this means is that the tax you pay on your company car will be exponentially lower if you opt for an electric vehicle. For instance, if your electric car has a list price of £30,000, you will only pay £300 a year in BIK tax. This is almost five times less than what you would pay for a petrol car of the same price.

With these tax savings, you don’t have to worry about compromising your budget to own an electric car, which is a win-win situation.

Lease Options for Electric Car Benefit in Kind

Leasing an electric car can be a wise move for those who want to take advantage of the Benefit in Kind (BIK) tax exemption. Since electric cars are classified as Zero Emission Vehicles (ZEVs), they are exempt from BIK for the 2020-2021 tax year. However, these BIK tax benefits will be phased out gradually over the years.

That’s why it’s best to lease an electric car before the exemptions are reduced or eliminated. This way, you can enjoy not just the tax savings, but also the benefits of owning an eco-friendly vehicle. With a lease option, you won’t have to worry about the car’s depreciating value, and you can upgrade to newer models as they become available.

Plus, you can enjoy the peace of mind that comes with driving a car that’s good for the environment. So, if you’re looking for a practical, cost-efficient, and eco-friendly way to own a car, consider leasing an electric vehicle as your next option.

How to Calculate Benefit in Kind for Electric Cars

If you’re considering an electric car, you may be wondering if there’s a benefit in kind tax to consider. The good news is that electric cars are currently taxed at a lower rate than petrol or diesel cars. However, you still need to calculate the benefit in kind (BIK) tax for your vehicle.

BIK tax is based on the list price of your car, its CO2 emissions, and your income tax bracket. With electric cars, the BIK rate is currently 1% for the 2021/22 tax year, but will increase to 2% for the 2022/23 and 2023/24 tax years. To calculate your BIK tax, you’ll need to take the list price of your car (including any optional extras) and multiply it by the BIK rate and your income tax bracket percentage.

So, for example, if you have a list price of £30,000 and you’re in the 20% tax bracket, your BIK tax would be £600 per year. It’s worth noting that if your electric car has a range of more than 130 miles, you can qualify for the government’s Plug-in Car Grant, which reduces the purchase price of the car.

Factors that Affect Calculation

When it comes to calculating the Benefit in Kind (BIK) for electric cars, there are several factors to consider. First, it’s important to know the list price of the vehicle including any optional extras. Then, you need to determine the electric range of the car, as this will affect the BIK rate.

The lower the electric range, the higher the BIK rate will be. Next, you need to figure out the battery capacity and CO2 emissions of the car. These also impact the BIK rate, with lower CO2 emissions and higher battery capacity resulting in a lower rate.

It’s important to note that the BIK rate changes every tax year, so it’s important to stay updated on the latest rates. Overall, calculating the BIK for electric cars can be a complex process, but taking these factors into consideration will help ensure an accurate calculation.

Step-by-Step Guide to Calculation

Calculating Benefit in Kind for electric cars can be a daunting task for many. However, the process is relatively straightforward once you understand the basics. The Benefit in Kind (BIK) tax is applied to any non-cash benefits provided by employers to their employees.

Electric cars are a popular perk due to their positive impact on the environment, and the BIK tax must be calculated for such vehicles. The BIK tax is based on the vehicle’s cost, CO2 emissions, and fuel type, with electric cars having the lowest rates. To calculate the BIK tax for an electric car, you need to multiply the list price of the car by the appropriate percentage for its CO2 emissions, which is 0% for fully electric cars in the 2021-22 tax year.

The resulting figure is then multiplied by your income tax rate. It’s also worth noting that there are tax incentives available for companies that install charging points for electric cars, which can further reduce the costs associated with electric company cars. Overall, understanding how to calculate the BIK tax for electric vehicles is essential for both employers and employees and can lead to significant savings and environmental benefits.

Conclusion

In conclusion, much like the electric vehicles themselves, the answer to whether or not there is a benefit in kind for electric cars is complicated and multifaceted. While there are certainly incentives and advantages for those who are environmentally conscious and looking to reduce their carbon footprint, there are also challenges and limitations that must be considered, such as the range anxiety that comes with relying on a vehicle with potentially limited battery life. Ultimately, the decision to go electric depends on a variety of factors, including personal values, lifestyle, and financial considerations.

So, while there may not be a straightforward answer to the question of whether or not there is a benefit in kind for electric cars, one thing is for sure – the future of transportation is looking electric.

FAQs

What is a benefit in kind for electric cars?

A benefit in kind is a non-cash perk provided by employers to their employees, which is taxable. For electric cars, there is a reduced benefit in kind tax as they have lower CO2 emissions compared to petrol or diesel cars.

How is the benefit in kind tax calculated for electric cars?

The benefit in kind tax is calculated by multiplying the car’s list price (including options) by the appropriate percentage, which is determined by the car’s CO2 emissions. For electric cars, the percentage is much lower, which results in a significantly reduced tax.

Is there a difference in the benefit in kind tax for hybrid cars?

Yes, there is a difference in the benefit in kind tax for hybrid cars, as the tax is calculated based on their CO2 emissions. Hybrid cars that emit less CO2 than petrol or diesel cars will have a lower benefit in kind tax.

Do electric company cars have any additional tax incentives?

Yes, electric company cars also have an exemption from the fuel benefit charge and lower National Insurance Contributions (NICs) for both the employer and employee. This can result in significant savings for both parties.