Is Toyota Going to Stop Making Electric Cars Find Out Here

Featured image for is toyota going to stop making electric cars

Image source: upload.wikimedia.org

Toyota is not stopping electric car production—instead, it’s accelerating its EV roadmap with a $70 billion investment by 2030. The automaker plans to launch 30 new electric models globally, reaffirming its commitment to electrification despite earlier reliance on hybrids. This shift proves Toyota is betting big on an electric future, not abandoning it.

Key Takeaways

- Toyota isn’t stopping EVs: They’re expanding, not exiting, their electric vehicle lineup.

- Hybrid focus continues: Toyota prioritizes hybrids but commits to growing EV offerings.

- 2026 targets 1.5M EVs: Aggressive production plans confirm long-term EV commitment.

- Solid-state batteries coming: Major EV range and charging upgrades expected by 2027-2028.

- Global market strategy: Toyota tailors EV production to regional demand and regulations.

- Legacy automaker adapting: Combines EV innovation with existing hybrid and hydrogen tech.

📑 Table of Contents

- The Electric Car Crossroads: Is Toyota Stepping Back?

- Understanding Toyota’s Historical Approach to Electrification

- Current State of Toyota’s Electric Vehicle Strategy (2023-2024)

- Why Toyota Isn’t Abandoning EVs: Strategic Shifts

- Challenges and Roadblocks Ahead

- The Future: Toyota’s 2030 Roadmap and Beyond

- Conclusion: Toyota’s Electric Future is Just Beginning

The Electric Car Crossroads: Is Toyota Stepping Back?

In the rapidly evolving automotive landscape, few questions have sparked as much debate as whether Toyota is going to stop making electric cars. As the world’s largest automaker by volume, Toyota’s decisions carry immense weight in shaping the future of sustainable transportation. For years, the Japanese giant has been a pioneer in hybrid technology, with the Prius becoming synonymous with eco-friendly driving. However, its approach to fully electric vehicles (EVs) has been notably cautious, leading to speculation about whether Toyota is retreating from the EV race or simply redefining its strategy. This uncertainty has left consumers, investors, and environmental advocates alike asking: Is Toyota going to stop making electric cars, or is it merely recalibrating its path to electrification?

The automotive industry is undergoing a seismic shift. Governments worldwide are tightening emissions regulations, consumers are demanding cleaner alternatives, and competitors like Tesla, Volkswagen, and Ford are accelerating their EV offerings. Amid this transformation, Toyota’s public statements have often seemed contradictory. While the company has committed to carbon neutrality by 2050, its investment in battery electric vehicles (BEVs) has lagged behind rivals. Yet recent announcements—including a $35 billion EV investment plan and the launch of the bZ4X—suggest a more nuanced picture. In this article, we’ll dissect Toyota’s electric vehicle strategy, examine its historical context, analyze current initiatives, and explore what the future holds for one of the world’s most influential automakers.

Understanding Toyota’s Historical Approach to Electrification

The Hybrid Pioneer: A Legacy of Pragmatism

Toyota’s journey into electrification began not with fully electric cars, but with hybrids. The 1997 launch of the Toyota Prius marked a watershed moment in automotive history, proving that hybrid vehicles could achieve both fuel efficiency and mainstream appeal. Over the next two decades, Toyota refined its Hybrid Synergy Drive technology, selling over 20 million hybrid vehicles globally by 2023. This success created a powerful legacy—one that both enabled and constrained Toyota’s EV strategy.

Visual guide about is toyota going to stop making electric cars

Image source: pngall.com

Key advantages of Toyota’s hybrid-first approach include:

- Established manufacturing expertise and supply chains

- Consumer trust in reliable, efficient technology

- Proven business model with strong profit margins

- RAV4 EV (1997-2003): A collaboration with Tesla, producing 1,484 units with 100-mile range

- eQ (2012-2014): A tiny city car sold only in limited markets

- Urban Cruiser EV (2020): A rebadged Suzuki, not developed in-house

- Scarce hydrogen refueling infrastructure (under 200 stations in the U.S.)

- High production costs (Mirai starts at $49,500)

- Lower efficiency compared to BEVs

- 250-mile range (EPA estimate)

- Available all-wheel drive

- Solar charging roof (adds up to 1,000 miles/year)

- Starting price of $42,000

- bZ3: A compact sedan developed with BYD for the Chinese market

- bZ Compact SUV: A smaller crossover (expected 2025)

- bZ Large SUV: A three-row family SUV (expected 2026)

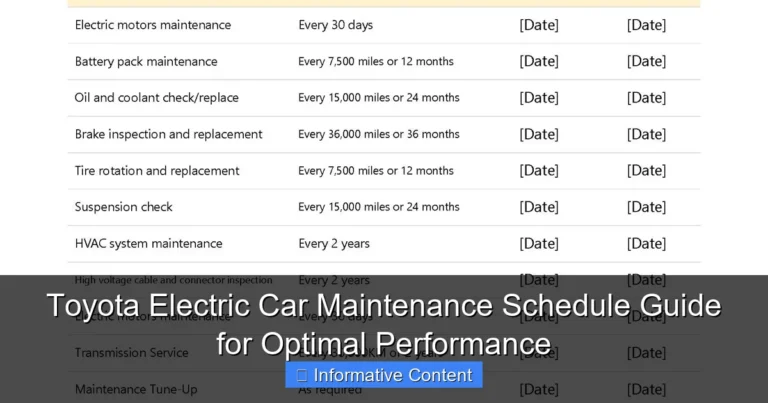

- $17.6 billion dedicated to BEVs and batteries

- 10 new BEV models by 2026

- 30 BEV models by 2030

- 3.5 million annual BEV sales target by 2030

- New battery plants in the U.S. and Japan

- Solid-state battery research

- Software development for connected features

- China: Aggressive BEV push with local partners (e.g., BYD)

- Europe: Full electrification by 2035 (EU mandate)

- U.S.: Hybrid focus continues, but BEV expansion planned

- Japan: Mix of hybrids, BEVs, and FCEVs

- EU: 100% zero-emission vehicle sales by 2035

- California: 100% BEV/PHEV sales by 2035

- China: 25% NEV (new energy vehicle) sales by 2025

- 41% of U.S. car buyers consider a BEV for their next vehicle

- BEV market share grew from 3.2% (2021) to 7.6% (2023)

- Tesla’s Model Y outsold Toyota’s RAV4 in California (2023)

- Hyundai/Kia: 10% global BEV market share (2023)

- Ford: 120,000 Mustang Mach-E sales (2023)

- BYD: 1.8 million BEV sales (2023)

- Energy density: 250+ Wh/kg (up from 150 Wh/kg in 2015)

- Fast charging: 80% charge in 15-20 minutes (new models)

- Solid-state batteries: Toyota’s 1,200 patent filings (most in industry)

- 745-mile range

- 10-minute charging

- Longer lifespan (10,000+ cycles)

- Created a dedicated BEV business unit

- Hired software engineers from Silicon Valley

- Accelerated partnerships with tech companies

- Lithium shortages: Prices up 500% (2020-2022)

- Cobalt concerns: Ethical sourcing challenges

- Production capacity: Global battery demand outstrips supply

- Investing $5.6 billion in U.S. battery plants (2025 start)

- Developing cobalt-free batteries

- Partnering with Panasonic and CATL

- Over-the-air updates

- Driver assistance systems

- Energy management

- Hiring 2,000 software engineers (2023-2025)

- Partnering with Aurora for autonomous tech

- Developing its own OS (Arene)

- Perception as a hybrid company, not an EV leader

- Lack of “hero” BEV (like Tesla’s Roadster or Ford’s F-150 Lightning)

- Slow adoption of cutting-edge features (e.g., bidirectional charging)

- Launching high-performance BEVs (e.g., electric Supra)

- Emphasizing sustainability in marketing

- Offering unique features (e.g., solar roof)

- Recession risks: BEVs are more expensive

- Trade tensions: U.S.-China tariffs affect supply chains

- Energy costs: High electricity prices in Europe

- Launching 10 new BEVs by 2026

- Scaling battery production (1.8 million cells/year)

- Entering new segments (e.g., electric pickup trucks)

- Solid-state battery production (2027)

- 30 BEV models covering all segments

- 3.5 million annual BEV sales (15% of global volume)

- Carbon-neutral manufacturing

- Develop a modular EV platform for cost efficiency

- Integrate vehicle-to-grid (V2G) technology

- Expand autonomous driving capabilities

- Achieve carbon neutrality across all operations

- Develop next-gen solid-state batteries (500+ Wh/kg)

- Explore hydrogen-powered BEVs (using fuel cells as range extenders)

- Create circular economy for battery recycling

- Top 5 global BEV brand (competing with Tesla, BYD, VW, Hyundai)

- Leader in reliability (building on its reputation)

- Innovator in battery tech (through solid-state R&D)

- Balanced portfolio player (offering hybrids, BEVs, FCEVs)

- Expect gradual but steady progress: Don’t look for Tesla-style disruption, but for reliable, practical EVs

- Hybrids remain important: They’ll bridge the gap until BEV infrastructure improves

- Watch battery tech: Toyota’s solid-state breakthroughs could be game-changing

- Regional differences matter: Toyota’s strategy varies by market, so check local offerings

However, this success also bred institutional inertia. As competitors invested heavily in BEVs, Toyota executives expressed skepticism about the readiness of battery technology, charging infrastructure, and consumer demand. “We believe in a multi-pathway approach,” stated former CEO Akio Toyoda in 2021, emphasizing hybrids, plug-in hybrids, hydrogen fuel cells, and eventually BEVs.

Early EV Experiments: Limited Editions and Missed Opportunities

While Toyota’s hybrid focus dominated, it did experiment with fully electric models:

These projects revealed a pattern: Toyota approached EVs as niche products rather than mainstream offerings. The RAV4 EV, for example, was discontinued just as battery technology was improving. This hesitation allowed competitors to establish early leadership in the EV space, with Tesla’s Model 3 and Nissan’s Leaf gaining significant market share.

The Hydrogen Diversion: Fuel Cell Focus

Another factor shaping Toyota’s EV strategy was its heavy investment in hydrogen fuel cell vehicles (FCEVs). The Toyota Mirai, launched in 2014, represented a $1 billion+ bet on hydrogen as a zero-emission alternative. While FCEVs offer advantages like fast refueling and long range, the technology faces major hurdles:

This diversion of resources—both financial and engineering talent—further slowed Toyota’s BEV development. By 2020, while competitors were scaling up battery production, Toyota remained cautious, calling BEVs “just one option” in its sustainability portfolio.

Current State of Toyota’s Electric Vehicle Strategy (2023-2024)

The bZ4X: Toyota’s First Global BEV

In 2022, Toyota launched its first dedicated battery electric vehicle—the bZ4X—marking a significant shift in strategy. Built on the new e-TNGA platform, the bZ4X offers:

However, the launch was marred by early setbacks, including a recall for potential wheel detachment. These quality issues reinforced Toyota’s reputation for caution—while competitors pushed aggressive EV timelines, Toyota prioritized reliability. As one industry analyst noted, “Toyota’s bZ4X isn’t a Tesla killer, but it’s a credible entry that meets their standards for durability.”

Expanded bZ Lineup: The “Beyond Zero” Promise

Toyota’s “bZ” (Beyond Zero) sub-brand signals its commitment to electrification. The planned lineup includes:

Notably, the bZ3 uses BYD’s Blade battery technology—a sign that Toyota is collaborating rather than going it alone. This partnership approach may accelerate development while mitigating risks. “We’re leveraging global expertise,” explained a Toyota spokesperson, “not trying to reinvent the wheel.”

Financial Commitments: $35 Billion by 2030

In December 2021, Toyota announced a sweeping $35 billion investment in electrified vehicles, with:

This represents a dramatic escalation from previous plans. In 2021, Toyota projected only 2 million BEV sales by 2030—a target now increased by 75%. The funding will support:

Regional Strategies: Tailored Approaches

Toyota’s EV strategy varies by market:

This regional flexibility reflects Toyota’s pragmatic approach—meeting regulatory requirements while maintaining profitable hybrid sales where BEV adoption is slower.

Why Toyota Isn’t Abandoning EVs: Strategic Shifts

Regulatory Pressure: The Compliance Imperative

Toyota’s shift isn’t voluntary—it’s driven by tightening regulations. Key examples:

Failure to comply risks massive fines. In the EU alone, missing 2030 targets could cost Toyota €25 billion annually. This regulatory pressure has forced Toyota to accelerate its BEV plans, with CEO Koji Sato stating in 2023, “We have no choice but to transform.”

Market Realities: Consumer Demand and Competition

Consumer preferences are shifting rapidly. A 2023 J.D. Power study found:

Meanwhile, competitors are gaining ground:

These trends make it impossible for Toyota to ignore BEVs. As one analyst noted, “Toyota can’t rely on hybrids forever—the market is moving too fast.”

Technological Advances: Battery Breakthroughs

Toyota’s initial skepticism about BEVs was partly justified by early battery limitations. However, recent advances address these concerns:

Toyota plans to launch solid-state batteries by 2027, promising:

These innovations could finally make BEVs viable for Toyota’s reliability standards.

Corporate Culture: From Skepticism to Commitment

Internally, Toyota’s culture has shifted. The appointment of Koji Sato as CEO in 2023—a former Lexus chief—signaled a new direction. Sato has:

This cultural change is critical. As one Toyota engineer explained, “The old guard focused on incremental improvement. Now we’re thinking like startups—faster, bolder, more agile.”

Challenges and Roadblocks Ahead

Battery Supply Chain Constraints

Toyota faces significant hurdles in securing batteries:

To address this, Toyota is:

Software and Technology Gap

Modern BEVs require advanced software for:

Toyota’s traditional strengths in hardware don’t translate to software. The company is:

Consumer Trust and Brand Perception

Toyota’s “reliable but boring” reputation doesn’t excite EV buyers. Challenges include:

To combat this, Toyota is:

Global Economic Uncertainties

Macroeconomic factors add complexity:

Toyota’s multi-pathway strategy (hybrids, BEVs, FCEVs) provides flexibility, but also risks spreading resources too thin.

The Future: Toyota’s 2030 Roadmap and Beyond

Short-Term (2024-2026): Rapid Expansion

Toyota’s immediate focus includes:

Key models expected:

| Model | Type | Expected Range | Launch Year |

|---|---|---|---|

| bZ Compact SUV | Crossover | 250 miles | 2025 |

| Electric Pickup | Light Truck | 300+ miles | 2026 |

| bZ Large SUV | Three-Row SUV | 300 miles | 2026 |

Mid-Term (2027-2030): Technological Leadership

Toyota’s 2030 vision includes:

The company plans to:

Long-Term (2030+): Sustainability and Innovation

Beyond 2030, Toyota aims to:

This long-term vision reflects Toyota’s holistic approach—electrification is just one piece of a larger sustainability puzzle.

Competitive Landscape: Where Toyota Fits

By 2030, Toyota won’t dominate BEVs like it does hybrids, but it aims to be:

This strategy acknowledges that Toyota can’t—and shouldn’t—try to be Tesla. Instead, it’s leveraging its strengths in manufacturing, quality, and global reach.

Conclusion: Toyota’s Electric Future is Just Beginning

So, is Toyota going to stop making electric cars? The answer is a resounding no. Far from abandoning EVs, Toyota is undergoing its most significant transformation since the Prius revolution. The company’s strategy has evolved from skepticism to cautious investment to full-scale commitment, driven by regulatory pressure, technological advances, and changing market dynamics. While Toyota won’t dominate the BEV market overnight, its pragmatic, multi-pathway approach—combining hybrids, BEVs, and hydrogen—positions it for long-term success.

What sets Toyota apart is its focus on reliability and sustainability over speed and hype. Where competitors rush to market with software-heavy, cutting-edge models, Toyota prioritizes durability, safety, and real-world performance. This approach may mean slower initial adoption, but it could pay dividends as BEVs mature. The bZ4X recall, for example, was an embarrassment—but it also reflected Toyota’s commitment to fixing problems quickly, a trait that builds long-term trust.

For consumers, Toyota’s electric future offers several key takeaways:

The road ahead isn’t without challenges—battery costs, software development, and brand perception remain hurdles. But with $35 billion committed and a clear roadmap through 2030, Toyota’s electric future is brighter than ever. As the automotive industry evolves, one thing is certain: Toyota’s approach to electrification will continue to shape the market, not just follow it. The company that revolutionized hybrids may yet do the same for electric cars—just on its own terms and timeline.

Frequently Asked Questions

Is Toyota going to stop making electric cars?

Toyota has no plans to stop making electric cars. In fact, the company is actively expanding its EV lineup with models like the bZ4X and future solid-state battery vehicles. The automaker remains committed to electrification as part of its long-term sustainability goals.

Why does Toyota seem slow to adopt electric cars compared to other brands?

Toyota has prioritized hybrid and hydrogen fuel cell technologies, which has made its EV rollout appear slower. However, the company is now accelerating its electric car investments, aiming for 3.5 million EV sales annually by 2030.

Will Toyota stop making electric cars to focus on hybrids instead?

No, Toyota isn’t abandoning electric cars for hybrids. While hybrids remain a core part of its strategy, the company is simultaneously developing a full range of battery-electric vehicles (BEVs) to meet global market demands.

What are Toyota’s future plans for electric cars?

Toyota plans to launch 30 new battery-electric models by 2030 and invest heavily in solid-state battery technology. This signals a major push to make electric cars more affordable and efficient in the coming years.

Has Toyota stopped making electric cars in certain markets?

Toyota hasn’t discontinued electric cars in any market. Instead, it’s tailoring its EV offerings to regional needs, with the bZ4X and other upcoming models being sold in North America, Europe, and Asia.

Are Toyota’s electric cars failing, leading to a potential shutdown?

Toyota’s electric cars, like the bZ4X, have had a modest start but aren’t failing. The company is learning from early feedback and iterating on designs, with newer models expected to boost sales and market presence.