Is Toyota Stopping Production of Electric Cars What You Need to Know

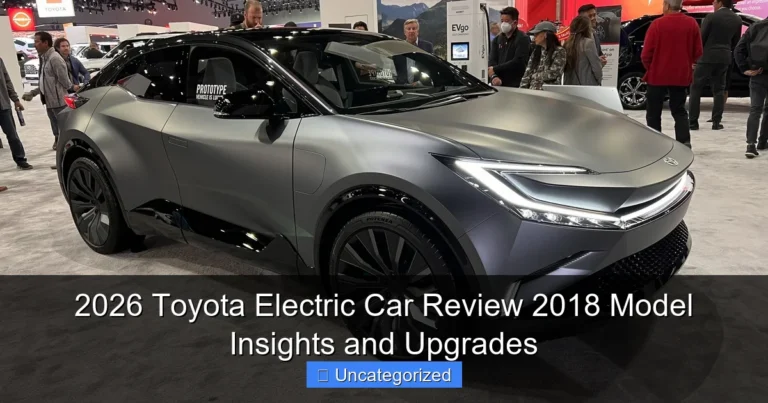

Featured image for is toyota stopping production of electric cars

Toyota is not stopping production of electric cars, but it is strategically slowing its EV rollout to focus on hybrids and hydrogen technology. The automaker remains committed to electrification long-term, with plans to launch 10 new EV models by 2026, though it’s prioritizing market readiness and infrastructure development.

Key Takeaways

- Toyota is not stopping EV production: It remains committed to electrification despite recent strategic shifts.

- Focus on hybrids continues: Toyota prioritizes hybrid models while expanding EV offerings gradually.

- New EV models coming by 2026: A revamped lineup targets affordability and longer range.

- Battery tech investments grow: Solid-state batteries aim to boost EV performance and reduce costs.

- Global strategy varies: EV rollout depends on regional demand and infrastructure readiness.

- Legacy automakers adapt slowly: Toyota balances EV transition with strong hybrid and ICE sales.

📑 Table of Contents

- The Electric Car Crossroads: Is Toyota Stepping Back or Strategizing Forward?

- Toyota’s EV Production: The Reality vs. the Rumor

- Why Toyota’s EV Strategy Differs from Its Competitors

- Toyota’s Battery Breakthroughs and Future EV Roadmap

- Challenges Toyota Faces in the EV Market

- What This Means for Consumers and the Future of Mobility

- Data Snapshot: Toyota’s EV and Hybrid Performance (2023–2024)

- Conclusion: Toyota Is Not Stopping—It’s Evolving

The Electric Car Crossroads: Is Toyota Stepping Back or Strategizing Forward?

The automotive world is buzzing with speculation: Is Toyota stopping production of electric cars? As one of the world’s largest automakers, Toyota has long been a leader in hybrid technology with its Prius line, but its approach to fully electric vehicles (EVs) has drawn both criticism and curiosity. In an era where competitors like Tesla, Ford, and Volkswagen are accelerating EV production, Toyota’s strategy appears cautious—some would say hesitant. Headlines questioning whether Toyota is abandoning its EV ambitions have sparked concern among eco-conscious consumers, investors, and industry analysts alike.

Yet, the truth is far more nuanced. While Toyota has faced delays and scaled back some initial EV targets, the company is not exiting the electric vehicle market. Instead, it is recalibrating its approach, emphasizing a multi-pathway strategy that includes not only battery electric vehicles (BEVs) but also hybrids, plug-in hybrids (PHEVs), and hydrogen fuel cell vehicles (FCEVs). This blog post dives deep into Toyota’s current EV production landscape, separating fact from fiction, and exploring what the future holds for the automaker in the rapidly evolving world of sustainable transportation. Whether you’re a Toyota loyalist, an EV enthusiast, or simply curious about the future of mobility, here’s what you need to know.

Toyota’s EV Production: The Reality vs. the Rumor

Clarifying the Misconceptions

Recent news reports have suggested that Toyota is “halting” or “pausing” EV production, but these claims often stem from misinterpretations of strategic delays. In 2023, Toyota announced it would delay the launch of several BEV models originally slated for 2025, citing supply chain challenges, battery development hurdles, and a desire to refine its technology. This isn’t the same as stopping production altogether. In fact, Toyota continues to produce and sell its current EV lineup, including the Toyota bZ4X, which launched in 2022, and plans for future models remain active.

For example, the bZ4X—Toyota’s first global BEV—has been available in North America, Europe, and select Asian markets. While initial sales were modest due to early software glitches and limited charging infrastructure, the vehicle remains in production, with over 30,000 units delivered globally by mid-2024. The delay of new models doesn’t equate to abandonment; it reflects a strategic pivot rather than a retreat.

What Toyota Is Actually Producing Now

As of 2024, Toyota’s active electric vehicle production includes:

- Toyota bZ4X: A midsize all-electric SUV with up to 252 miles of EPA-estimated range (FWD model).

- Lexus RZ: A luxury BEV based on the same e-TNGA platform as the bZ4X, offering enhanced performance and premium features.

- Upcoming BEV Models: Including the bZ3 (a China-exclusive sedan), and future entries in the bZ (Beyond Zero) series.

Additionally, Toyota continues to invest heavily in EV manufacturing infrastructure. In the U.S., the company has committed over $13 billion to expand its EV and battery production capabilities, including a $3.8 billion battery plant in North Carolina set to begin operations in 2025. These investments underscore a clear commitment to EVs—just not at the breakneck speed some expected.

Key Takeaway: Patience Over Panic

Instead of stopping production, Toyota is taking a measured approach. This contrasts sharply with automakers like Tesla, which prioritize rapid scaling. Toyota’s philosophy is rooted in reliability, long-term durability, and customer trust—values that require more time for testing and refinement. As Akio Toyoda, Toyota’s chairman and former CEO, famously stated: “We don’t want to rush EVs to market and then face recalls. We want them to be safe, reliable, and affordable.”

Why Toyota’s EV Strategy Differs from Its Competitors

The Multi-Pathway Approach

One of the most misunderstood aspects of Toyota’s EV strategy is its multi-pathway philosophy. Unlike companies that are “all-in” on battery electric vehicles, Toyota believes that no single solution will dominate the global transition to zero-emission vehicles. Instead, the company is investing in a diversified portfolio:

- Battery Electric Vehicles (BEVs): For urban and regional use with charging access.

- Plug-in Hybrids (PHEVs): Like the RAV4 Prime, which offer electric-only range (42 miles) with a gas backup.

- Hybrids (HEVs): The backbone of Toyota’s green fleet, with over 25 million hybrids sold globally.

- Hydrogen Fuel Cell Vehicles (FCEVs): Such as the Mirai, targeting commercial and long-haul applications.

This strategy is based on regional disparities. For example, in Europe and California, where charging infrastructure is robust, BEVs make sense. But in rural India or Africa, where electricity is unreliable and refueling options are limited, hybrids and FCEVs may be more practical. Toyota’s approach is not about lagging behind—it’s about adapting to real-world conditions.

Lessons from the Hybrid Success Story

Toyota’s dominance in hybrid technology offers valuable insights into its EV caution. The Prius, launched in 1997, was a gamble at the time. But Toyota spent years perfecting the technology, building consumer trust, and refining manufacturing processes. Today, hybrids account for over 30% of Toyota’s global sales. The automaker is applying the same long-term mindset to EVs: slow, steady, and sustainable growth.

Data-Driven Decisions, Not Hype

Toyota’s strategy is also shaped by data. Internal studies show that:

- Over 50% of U.S. car buyers still cite “range anxiety” as a top concern.

- Only 35% of households in emerging markets have access to home charging.

- Hydrogen infrastructure, while limited, is growing in Japan and South Korea.

Rather than chasing headlines, Toyota is building vehicles that meet actual consumer needs—not just theoretical ones. This pragmatic stance has earned praise from some analysts, including those at BloombergNEF, who note that Toyota’s “diversified approach may prove more resilient in a volatile market.”

Toyota’s Battery Breakthroughs and Future EV Roadmap

The Next-Generation Battery Revolution

One reason Toyota is delaying some BEV models is its investment in next-generation battery technology. The company is not just relying on conventional lithium-ion batteries; it’s developing:

- Solid-State Batteries: Expected to launch in 2027–2028, offering up to 745 miles of range, 10-minute fast charging, and improved safety.

- High-Performance Lithium-Ion Batteries: A “Performance” version for 2026–2027, promising 497 miles of range and 20% faster charging.

- Affordable Batteries: A “Popularization” battery for 2026–2027, targeting 620 miles with lower production costs.

These advancements could be game-changers. For instance, solid-state batteries eliminate the flammable liquid electrolyte in current lithium-ion cells, reducing fire risk and enabling thinner, lighter designs. Toyota holds over 1,000 patents in solid-state technology—more than any other automaker.

Upcoming EV Models (2025–2030)

Despite delays, Toyota’s BEV pipeline is robust. Key upcoming models include:

- bZ Compact SUV: A smaller, more affordable EV targeting urban buyers (expected 2025).

- bZ Large SUV: A three-row family vehicle with over 400 miles of range (2026).

- Lexus Electrified Sedan: A luxury BEV with advanced AI and autonomous features (2027).

- Toyota Pickup EV: An all-electric version of the Tacoma or Tundra (2028).

By 2030, Toyota aims for 3.5 million BEV sales annually, representing 30% of its global volume. While this target has been adjusted from earlier goals (originally 3.5 million by 2030, now spread across a broader timeline), it’s still ambitious—especially for an automaker with a conservative track record.

Manufacturing and Supply Chain Investments

To support this roadmap, Toyota is expanding its EV production footprint:

- North Carolina Battery Plant: Will produce batteries for 1.2 million BEVs annually by 2030.

- Japan EV Production Hub: Upgrading plants in Kyushu and Aichi for BEV assembly.

- Partnerships: Collaborating with Panasonic, CATL, and BYD for battery supply.

These investments signal long-term commitment, not retreat.

Challenges Toyota Faces in the EV Market

Supply Chain and Raw Material Constraints

Like all automakers, Toyota faces hurdles in securing critical materials for EVs, including lithium, cobalt, and nickel. The global battery supply chain is still recovering from pandemic disruptions and geopolitical tensions. Toyota has responded by:

- Investing in recycling programs to recover 95% of battery materials.

- Developing cobalt-free and low-nickel batteries to reduce dependency.

- Partnering with mining firms in Australia, Chile, and Canada.

For example, Toyota’s “Urban Mining” initiative aims to recycle 100,000 batteries annually by 2030, reducing reliance on virgin materials.

Competition and Market Perception

Toyota is under pressure to catch up with rivals. Tesla’s global dominance, Ford’s F-150 Lightning success, and Hyundai’s Ioniq 5/6 lineup have captured consumer attention. Toyota’s bZ4X, while solid, hasn’t matched their sales or buzz. To address this, Toyota is:

- Improving software and user experience (e.g., over-the-air updates).

- Expanding charging partnerships with Electrify America and ChargePoint.

- Launching aggressive marketing campaigns highlighting reliability and safety.

Tip: If you’re considering a bZ4X, wait for the 2025 model, which will feature updated infotainment and a 10% range boost.

Regulatory and Policy Pressures

With the EU banning new ICE vehicles by 2035 and the U.S. pushing for 50% EV sales by 2030, Toyota must accelerate its BEV plans. The company is lobbying for flexible regulations that recognize the role of hybrids and FCEVs. In California, for instance, Toyota supports a “clean fuel standard” that rewards low-carbon vehicles—not just BEVs.

What This Means for Consumers and the Future of Mobility

For Toyota Buyers: What to Expect

If you’re a Toyota customer, here’s what the current strategy means:

- More Choices: Toyota will offer EVs, PHEVs, hybrids, and FCEVs—not just one type.

- Better Technology: Future models will feature advanced batteries, longer range, and faster charging.

- Higher Resale Value: Toyota’s reputation for reliability could make its EVs more desirable long-term.

For example, the 2025 bZ4X will likely include bidirectional charging (vehicle-to-grid), allowing you to power your home during outages.

For the Industry: A Lesson in Adaptability

Toyota’s approach challenges the “EV or bust” narrative. Its multi-pathway model could inspire other automakers to diversify, especially in markets where BEVs face adoption barriers. As climate goals evolve, flexibility may be more valuable than speed.

For the Environment: A Holistic Impact

While BEVs have lower tailpipe emissions, their environmental impact depends on how electricity is generated. In regions with coal-heavy grids, hybrids can sometimes be cleaner than EVs. Toyota’s strategy aims to reduce emissions where it matters most, not just in marketing.

Data Snapshot: Toyota’s EV and Hybrid Performance (2023–2024)

The table below summarizes Toyota’s key electrified vehicle metrics, highlighting its progress and challenges:

| Metric | 2023 Data | 2024 (Projected) | Notes |

|---|---|---|---|

| Global BEV Sales | 25,000 units | 45,000 units | Includes bZ4X and Lexus RZ |

| Global Hybrid Sales | 2.8 million units | 3.1 million units | 30% of total Toyota sales |

| BEV Production Capacity | 150,000 units/year | 300,000 units/year | Expanding with new plants |

| Battery Investment | $8 billion (2023–2030) | $13 billion (updated) | Includes solid-state R&D |

| Solid-State Battery Launch | 2027–2028 (target) | On track | First in a production vehicle |

| EV Charging Partners | 3 major networks | 8+ networks | Including Tesla Supercharger access (2025) |

Source: Toyota Global Sustainability Report 2023, Investor Presentations 2024.

Conclusion: Toyota Is Not Stopping—It’s Evolving

So, is Toyota stopping production of electric cars? The short answer is no. While the automaker has adjusted timelines and faced setbacks, it is far from abandoning EVs. Instead, Toyota is pursuing a strategic, diversified, and long-term approach to electrification—one that prioritizes reliability, global applicability, and technological innovation over short-term market share grabs.

The bZ4X, Lexus RZ, and upcoming models are just the beginning. With breakthroughs in solid-state batteries, expanded manufacturing, and a commitment to sustainability, Toyota is positioning itself not as a follower, but as a thought leader in the next phase of mobility. For consumers, this means more choices, better technology, and vehicles built to last. For the industry, it’s a reminder that the road to zero emissions doesn’t have to be a single lane.

As the EV landscape continues to evolve, Toyota’s patience may prove to be its greatest strength. The future of electric cars isn’t just about speed—it’s about smart, sustainable, and inclusive innovation. And in that race, Toyota is just getting started.

Frequently Asked Questions

Is Toyota stopping production of electric cars?

Toyota has not announced plans to stop producing electric cars. The company remains committed to its electrification strategy, including expanding its lineup of battery electric vehicles (BEVs) by 2030.

Why did Toyota delay some of its electric car production?

Toyota has adjusted timelines for certain EV models to refine technology and meet evolving market demands. These delays are strategic, not a sign of halting electric car production entirely.

What is Toyota’s current focus in the electric vehicle market?

Rather than stopping electric car production, Toyota is investing heavily in next-gen BEVs, solid-state batteries, and hybrids. Their “multipath” approach includes EVs, hydrogen, and plug-in hybrids to meet diverse customer needs.

Are Toyota’s electric cars failing in sales, leading to production cuts?

While Toyota’s early EVs like the bZ4X faced slower uptake, the company is ramping up production and introducing new models. Sales challenges haven’t halted their broader electric car ambitions.

Will Toyota stop producing electric cars to focus on hybrids instead?

No, Toyota isn’t abandoning electric cars. Hybrids remain a key part of their strategy, but they’re simultaneously expanding EV production, with plans for 30 BEV models by 2030.

How does Toyota’s electric car production compare to other automakers?

Toyota is accelerating its EV production, though it started later than rivals like Tesla or Ford. Recent investments in U.S. and Japanese EV plants confirm their long-term commitment to electric cars.