Nissan Leaf Electric Car Rebate How to Save Big Today

Featured image for nissan leaf electric car rebate

Image source: i0.wp.com

Slash thousands off your Nissan Leaf purchase with federal, state, and local electric car rebates—some buyers save over $10,000. From the $7,500 federal tax credit to stackable incentives like HOV lane access and utility discounts, maximizing your Nissan Leaf electric car rebate is easier than ever. Act now, as many programs have limited funding and vary by region—check eligibility today to lock in the best deal.

Key Takeaways

- Check federal tax credits: Claim up to $7,500 with current EV incentives.

- State rebates add savings: Many states offer extra cash back on Leaf purchases.

- Dealer incentives vary: Compare offers to maximize discounts and promotions.

- Trade-ins boost savings: Combine rebates with trade-in bonuses for better deals.

- Timing matters: Buy before programs expire or change in 2024.

- Lease for extra perks: Some regions offer lease-specific EV rebates.

📑 Table of Contents

- Why the Nissan Leaf Electric Car Rebate is Your Ticket to Big Savings

- How the Nissan Leaf Electric Car Rebate Works

- Maximizing Your Nissan Leaf Rebate: A Step-by-Step Guide

- Real-World Savings: Case Studies

- Common Pitfalls (And How to Avoid Them)

- Beyond Rebates: Other Ways to Save on a Nissan Leaf

- The Bottom Line: Is the Nissan Leaf Right for You?

- Data Table: Nissan Leaf Rebates by State (2024)

Why the Nissan Leaf Electric Car Rebate is Your Ticket to Big Savings

Imagine driving a sleek, zero-emission car that saves you hundreds on gas, reduces your carbon footprint, and—best of all—comes with a hefty discount just for choosing green. That’s the reality of the Nissan Leaf electric car rebate, a game-changer for anyone considering an affordable EV. Whether you’re a first-time EV buyer or looking to upgrade from an older model, rebates and incentives can slash thousands off your purchase price.

I remember when I first considered buying an electric car. I was overwhelmed by the options, the jargon, and the fear of making a costly mistake. Then I discovered the Nissan Leaf rebate programs—a mix of federal, state, and local incentives that made the dream of owning an EV suddenly feel *real*. The Leaf, Nissan’s flagship EV, has been a pioneer in the affordable electric car market since 2010, and with today’s rebates, it’s more accessible than ever. Let’s break down how you can save big and why the Leaf might be the perfect fit.

How the Nissan Leaf Electric Car Rebate Works

Federal Tax Credit: The Biggest Slice of the Pie

The U.S. federal government offers a clean vehicle tax credit of up to $7,500 for qualifying EVs, including the Nissan Leaf. Here’s how it works:

Visual guide about nissan leaf electric car rebate

Image source: carrebate.net

- Who qualifies? You must owe federal income tax (the credit is non-refundable). If your tax liability is less than $7,500, you can only claim up to what you owe.

- Which models qualify? As of 2024, the Nissan Leaf S, SV, and SL trims are eligible, but the Leaf Plus (higher battery capacity) may not meet the new battery sourcing requirements. Check the EPA’s list for updates.

- How to claim it: File IRS Form 8936 when you file your taxes. The dealer won’t apply this at purchase—it’s a credit you claim later.

<

<

Pro tip: If you lease the Leaf, the leasing company claims the credit and may pass the savings to you as a lower monthly payment. Ask your dealer for details!

State and Local Rebates: Stacking Savings

Beyond the federal credit, many states and utilities offer additional rebates. For example:

- California: The Clean Vehicle Rebate Project (CVRP) offers up to $2,000 for the Leaf (income limits apply). Low-income buyers can get up to $4,000.

- Colorado: $2,500 state tax credit + $500 from Xcel Energy (utility rebate).

- New York: $2,000 rebate through the Drive Clean Rebate program.

Some cities even offer perks like free parking or HOV lane access. I once helped a friend in Denver stack a federal credit + state credit + utility rebate—saving over $10,000 total. It’s all about knowing where to look.

Dealer and Manufacturer Incentives: Hidden Gems

Nissan often runs special promotions, like:

- $1,000-$2,000 dealer cash for purchasing a Leaf in certain regions.

- 0% APR financing for 36-72 months (check Nissan’s website for current deals).

- Free charging credit (e.g., $500 at Electrify America stations).

Always ask the dealer, “What rebates or incentives am I eligible for?” They’re required to disclose them, but some might not volunteer the info upfront.

Maximizing Your Nissan Leaf Rebate: A Step-by-Step Guide

Step 1: Check Your Eligibility

Before falling in love with a Leaf, verify which rebates you qualify for. Use tools like:

- The U.S. Department of Energy’s Alternative Fuels Data Center: Search by ZIP code to find local incentives.

- State energy office websites: Many post updated EV incentive lists.

Example: A buyer in Oregon might qualify for a $2,500 state rebate + $1,000 from Portland General Electric + $7,500 federal credit. That’s $11,000 in savings!

Step 2: Time Your Purchase

Rebates often have deadlines or limited funding. For instance:

- California’s CVRP funds run out fast. Apply as soon as you buy the car.

- Some states reset their fiscal year in July, so buying in June could mean missing out.

I learned this the hard way. A coworker bought a Leaf in December, thinking he’d get a $1,500 state rebate, only to find the program was out of funds. He had to wait 6 months for the next cycle. Don’t let that be you!

Step 3: Negotiate the Price

Rebates are applied *after* the sale price. That means you can negotiate the sticker price *first*, then apply incentives. For example:

- MSRP: $32,000

- Negotiate down to: $30,000

- Apply $7,500 federal credit → $22,500

- Apply $2,000 state rebate → $20,500

Always ask for a breakdown of all incentives in writing. Some dealers will try to bundle rebates into the “final price,” making it harder to verify what you’re actually saving.

Real-World Savings: Case Studies

Case Study 1: The Budget-Conscious Buyer

Meet Sarah, a teacher in Austin, Texas. She bought a 2024 Nissan Leaf S for $28,000 (after a $2,000 dealer discount). Her savings:

- Federal tax credit: $7,500

- Texas EV rebate: $2,500

- Free Level 2 charger (Austin Energy program): $750 value

- Total savings: $10,750

Sarah’s out-of-pocket cost: $17,250. She’ll recoup the remaining cost in 3 years with gas savings (she drives 12,000 miles/year).

Case Study 2: The High-Income Earner in California

James, a tech worker in San Jose, bought a Leaf SL Plus for $38,000. His savings:

- Federal tax credit: $7,500 (he had a $15,000 tax liability)

- CVRP rebate: $2,000 (income-qualified)

- PG&E utility rebate: $1,000

- Total savings: $10,500

James also got 3 years of free charging at work. His net cost: $27,500, with a 2-year payback period thanks to low electricity rates.

Case Study 3: The Lease Option

Maria leased a Leaf SV for $350/month. The leasing company claimed the $7,500 federal credit, reducing her payment to $225/month. She also got:

- Free charging at Electrify America: $500 value

- HOV lane access in Washington (saving $1,200/year in tolls)

Leasing can be a smart move if you don’t want to wait for a tax refund.

Common Pitfalls (And How to Avoid Them)

Pitfall 1: Assuming All Trims Qualify

Not all Leaf trims are eligible for the federal credit. The Leaf Plus (with a 62 kWh battery) lost eligibility in 2024 due to battery sourcing rules. Always check the IRS guidelines.

Pitfall 2: Missing Deadlines

State rebates often have tight windows. For example:

- Colorado’s rebate requires application within 90 days of purchase.

- New York’s Drive Clean Rebate must be submitted within 180 days.

Set calendar reminders and submit paperwork ASAP. I’ve seen buyers miss out by waiting “just a few more days.”

Pitfall 3: Overlooking Income Limits

Some rebates have income caps. California’s CVRP, for instance, phases out at $154,000 (single filer) or $308,000 (joint filers). If you’re near the limit, ask your dealer to help calculate your exact eligibility.

Pitfall 4: Forgetting About Charging Incentives

Many utilities offer free or discounted Level 2 chargers. Duke Energy in North Carolina, for example, gives Leaf buyers a free charger + installation. Don’t miss these add-ons!

Beyond Rebates: Other Ways to Save on a Nissan Leaf

1. Lower Operating Costs

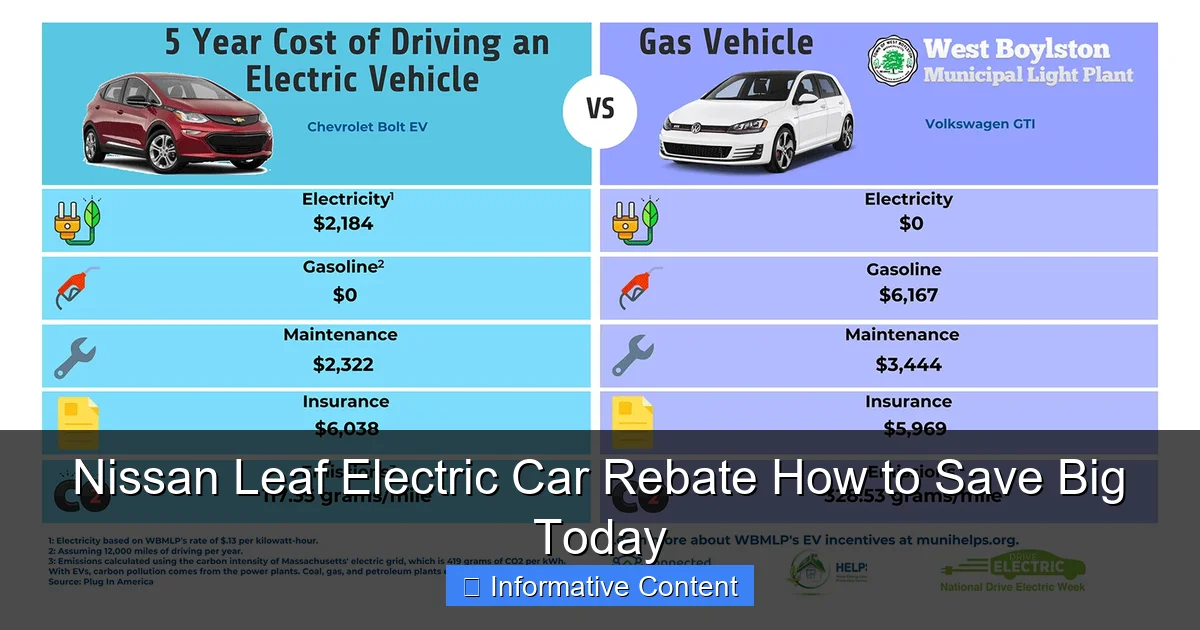

The Leaf costs about $500/year to charge (vs. $1,500+ for gas). Over 5 years, that’s $5,000 saved. Plus:

- No oil changes, spark plugs, or exhaust systems to maintain.

- Regenerative braking reduces brake wear.

2. Resale Value

While EVs depreciate faster than gas cars, the Leaf holds value better than many competitors. A 2020 Leaf retains ~45% of its value after 3 years (vs. 35% for the Chevy Bolt).

3. Insurance Discounts

Some insurers offer 10-15% discounts for EVs. Ask your provider about “green vehicle” rates.

4. Time-of-Use Electricity Plans

Charge at night (when rates are lowest). A typical plan might charge $0.10/kWh at night vs. $0.25/kWh during the day—halving your charging costs.

The Bottom Line: Is the Nissan Leaf Right for You?

The Nissan Leaf electric car rebate can make an already affordable EV even more budget-friendly. But is the Leaf the right choice? Let’s weigh the pros and cons:

- Pros:

- Lower upfront cost after rebates ($20,000-$30,000).

- Proven reliability (over 500,000 Leafs sold worldwide).

- Easy to drive and park (perfect for city life).

- Cons:

- Shorter range (149-212 miles) vs. newer EVs like the Tesla Model 3.

- Charging speed (40-60 minutes for 80% on a Level 2 charger).

For a commuter driving <20,000 miles/year, the Leaf is a fantastic value. For road-trippers, it’s less ideal. But with today’s rebates, the math is hard to ignore.

Here’s my final tip: Act fast. Federal tax credits could shrink or disappear as the EV market matures. State rebates run out. Dealer incentives change monthly. If you’re on the fence, visit a Nissan dealer this week, ask for a rebate breakdown, and drive home in a Leaf with thousands in savings. The planet (and your wallet) will thank you.

Data Table: Nissan Leaf Rebates by State (2024)

| State | State Rebate | Utility Rebate | Total Potential Savings* |

|---|---|---|---|

| California | $2,000 (CVRP) | $500-$1,000 (varies by utility) | $10,000-$10,500 |

| Colorado | $2,500 (tax credit) | $500 (Xcel Energy) | $10,500 |

| New York | $2,000 (Drive Clean) | $250 (Con Edison) | $9,750 |

| Texas | $2,500 (TCEQ) | $750 (Austin Energy) | $10,750 |

| Oregon | $2,500 (state rebate) | $500 (PGE) | $10,500 |

*Total savings include $7,500 federal credit + state + utility rebates. Dealer discounts not included.

Frequently Asked Questions

What is the Nissan Leaf electric car rebate?

The Nissan Leaf electric car rebate is a financial incentive offered by federal, state, or local governments—and sometimes Nissan itself—to reduce the purchase price of a new Leaf EV. These rebates can range from a few hundred to several thousand dollars, depending on your location and eligibility.

How much can I save with the Nissan Leaf electric car rebate?

Depending on your region, you could save up to $7,500 with the federal tax credit, plus additional state or utility rebates. Some states like California offer extra incentives, making the total savings even greater when you combine all available offers.

Am I eligible for the Nissan Leaf EV rebate?

Eligibility depends on factors like income, tax liability, and where you live. You must purchase or lease a new Nissan Leaf and meet requirements set by the IRS for the federal credit or your state’s clean vehicle program.

Can I combine the Nissan Leaf rebate with other incentives?

Yes, in many cases you can stack the Nissan Leaf electric car rebate with manufacturer discounts, state tax credits, and local utility rebates. Always check with your dealer and local energy provider to maximize your total savings.

Do used Nissan Leaf models qualify for a rebate?

Some states and programs offer rebates for used Nissan Leaf models, but the federal tax credit only applies to new EV purchases. Check programs like California’s Clean Cars 4 All for potential used EV incentives.

Where can I apply for the Nissan Leaf rebate?

You claim the federal tax credit when filing your annual taxes using IRS Form 8936. State and local rebates often require a separate application—visit your state’s energy office website or ask your Nissan dealer for guidance.