Revving Up Savings: Why Electric Cars Receive No Benefit in Kind

Electric cars have been increasing in popularity as more people become aware of the benefits they bring in terms of environmentally friendly transportation and cost savings. This has led to governments starting to offer incentives to encourage their uptake. One such initiative is the announcement by the UK government that there will be no benefit in kind on electric cars from the 2020/21 tax year.

This is a significant change as until now, electric company cars were subject to tax charges. But what exactly does this mean for electric car drivers and the overall market? In this blog post, we’ll examine the implications of this new development and explore how it may impact those considering switching to EVs.

Understanding Benefit in Kind

As we become more aware of the effects of climate change, many people are considering electric cars as a more environmentally friendly option. Not only are they better for the planet, but there is also a financial incentive as well. The government has announced that electric cars will have no Benefit in Kind (BIK), which means that drivers will not have to pay any additional tax on the car.

This is a significant change from previous years when drivers of electric cars had to pay BIK, and it is a welcome relief for those looking to make the switch. In practical terms, this means that electric cars will be cheaper to run than their petrol or diesel counterparts, making them a more accessible option for a wider range of drivers. So if you’re interested in making the switch to an electric car, now is the perfect time to do it!

What is Benefit in Kind?

Benefit in Kind is a term used to describe the non-cash benefits that employees receive from their employer alongside their wages. These benefits can be in the form of a company car, medical insurance, housing, or even vouchers for goods and services. While it might seem like a good deal to get these benefits, employees need to understand that they are taxable and could add significant costs to their income.

Understanding the tax implications of Benefit in Kind is essential in ensuring that employees don’t get hit with an unexpected tax bill at the end of the year. In essence, Benefit in Kind is a way for employers to compensate their employees outside of their basic salary.

How is Benefit in Kind Calculated?

Benefit in Kind (BIK) Do you know how your company car or private healthcare can potentially affect your taxes? It’s all down to Benefit in Kind (BIK). BIK is a tax that you might have to pay on any non-cash benefits that you receive from your employer on top of your salary. This could include anything from a company car to medical insurance.

The cost of the BIK is based on the cash equivalent value of the benefit provided, meaning the amount of money an employee would have to spend personally to receive that benefit. This is calculated by using various factors, such as the original cost of the benefit, the period of use, and the employee’s tax bracket. It’s important to note that BIK can significantly increase your income tax liability, so it’s essential to understand what benefits you are receiving, and how much they are worth.

Keeping track of these benefits can ensure that you won’t be caught off guard at tax time.

Electric Cars Exempt from Benefit in Kind

Good news for anyone thinking about getting an electric car – the government has declared that there will be no benefit in kind on electric cars. This basically means that you won’t have to pay any tax on the car as a benefit for work, which is a very attractive incentive for both employers and employees. This is a huge relief for people who were worried about the cost of electric cars, which can be significantly more expensive than their petrol equivalents.

So, not only are electric cars better for the environment and cheaper to run in the long term, but you’ll now save money on taxes too. It’s truly the perfect time to make the switch to electric and get ahead of the curve.

Government Incentives for Electric Cars

If you’re considering an electric car, you’ll be pleased to know that there are various government incentives available to you. One of the newest is the exemption from benefit in kind, which significantly lowers the tax costs for company car drivers. This is great news for anyone who has been considering an electric company car but was put off by the high tax costs compared to traditional petrol and diesel cars.

It means that electric cars are now a much more affordable option for anyone looking to make the switch. In addition to the tax exemption for company cars, there are also various grants available towards the purchase of electric vehicles, so it’s worth doing your research to see what you might be eligible for. Ultimately, it’s great to see the government taking steps to encourage the adoption of electric cars, which will help to reduce our carbon emissions and improve air quality.

Benefits of Driving an Electric Car

Benefits of Driving an Electric Car One of the main benefits of owning an electric car is that they are exempt from benefit in kind. This means that if you are an employee and use an electric car for your personal use, you won’t have to pay any extra taxes on it. This incentive is given to encourage people to switch to electric cars, which are considered to be more environmentally friendly and sustainable.

Additionally, electric cars are much cheaper to maintain than traditional cars that rely on gas. They have fewer moving parts, which means there is less wear and tear on the vehicle. This also means that you won’t have to spend as much money on repairs and maintenance.

Another benefit of owning an electric car is that they are much quieter than traditional cars. You won’t hear the engine or the sound of the car speeding down the road. Instead, the electric motor produces little to no noise, making for a more peaceful driving experience.

Overall, the benefits of driving an electric car are plentiful, and as more people switch to electric vehicles, we can all look forward to a cleaner, quieter, and more sustainable future.

Savings for Employees and Employers

Electric Cars Exempt from Benefit in Kind – Savings for Employees and Employers Did you know that electric cars are now exempt from Benefit in Kind (BIK) tax? This is great news for both employees and employers, as it can bring significant savings. For employees, it means they no longer have to pay a tax on using an electric car as a company vehicle, which can amount to considerable savings. For employers, it means they can offer electric cars as a benefit to their employees, without having to worry about additional taxes.

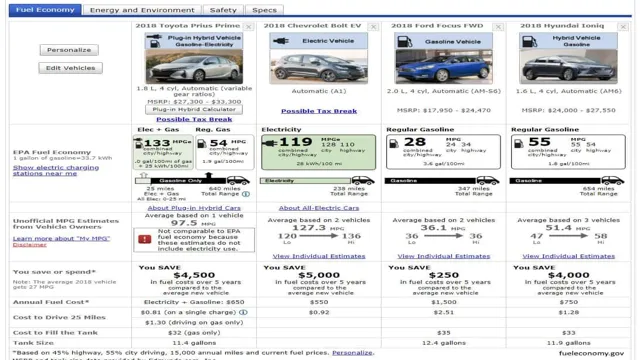

This policy is part of the government’s push to encourage people to switch to electric vehicles, as they are more environmentally friendly. Not only do electric cars save on taxes, but they also bring other savings. They are cheaper to run than traditional petrol or diesel cars, as the electricity needed to charge them is significantly cheaper than fuel.

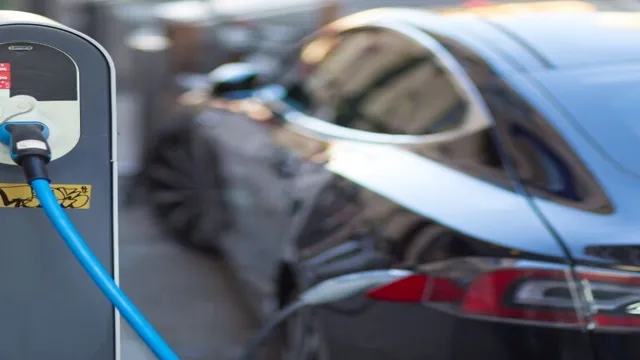

The long-term savings on maintenance costs are also considerable, as electric cars have fewer moving parts and require less frequent servicing. In addition to savings, electric cars also offer other benefits, such as reducing air pollution and noise pollution. They can also be more convenient, as they can be charged at home overnight, eliminating the need to visit a petrol station.

The improved performance of modern electric cars means they are also now a viable option for longer journeys. Overall, the exemption of electric cars from BIK tax is an excellent incentive for both employees and employers to consider switching to electric vehicles. With savings on taxes and running costs, as well as environmental benefits, electric cars are a smart choice for both personal and company cars.

Growing Popularity of Electric Cars

Electric cars are becoming increasingly popular, and one of the reasons for this is the “no benefit in kind” policy that applies to them. This means that those who use electric cars as their company vehicles are not subject to the usual taxation on company cars. This is a significant incentive for many people, as it means that they are able to save a lot of money on their tax bills.

Not only is this good for the individuals who use electric cars, but it is also beneficial for the environment as a whole. The more people who use electric cars, the less damage is done to the planet. Additionally, electric cars are also cheaper to run than their petrol or diesel counterparts, making them an attractive option for those who are looking to save money on their transportation costs.

All in all, the growing popularity of electric cars is a good thing for both individuals and the planet as a whole.

Electric Car Market Trends

The electric car market has been growing exponentially in recent years, with more people looking to drive eco-friendly vehicles. It’s easy to see why, as electric cars offer a range of benefits, such as lower operational costs and less environmental impact. Governments around the world have also been incentivizing the purchase of electric cars, with tax credits and rebates being offered in many countries.

Consumers are starting to realize that electric cars are not only beneficial for the environment but also for their pockets. The trend shows no signs of slowing down, with major car manufacturers racing to release new electric models that are more affordable, have a longer range, and are more convenient to charge. In the coming years, we can expect to see a significant increase in the number of electric cars on the road, paving the way for a more sustainable transportation system.

Impact of Benefit in Kind Exemption on Electric Car Sales

Electric Cars Electric cars are becoming increasingly popular due to a variety of factors, including the environmental benefits and cost savings associated with driving an electric vehicle. One key factor that has helped boost electric car sales is the benefit in kind exemption offered by many governments. This exemption allows employers to offer electric cars to employees as part of their benefits package without incurring additional taxes.

As a result, more and more companies are choosing to offer electric cars to their employees, which has led to a significant increase in sales. Not only does this benefit employees by providing them with a more sustainable and cost-effective mode of transportation, but it also helps to promote the wider adoption of electric vehicles and reduce carbon emissions. Overall, the growing popularity of electric cars is a positive trend, and with continued government support and incentives, it is likely that we will see even more electric cars on the roads in the coming years.

Conclusion

In conclusion, the no benefit in kind on electric cars policy tells us one thing: going green can also mean going tax-free. With this incentive, driving an electric car not only helps the environment, but it also saves you money in the long run. It’s a win-win situation for both the planet and your wallet.

So, if you’re thinking of getting a new car, maybe it’s time to consider an electric model and give your finances a jolt of energy.”

FAQs

What is meant by benefit in kind on electric cars?

Benefit in kind on electric cars refers to the taxable value of any perks or benefits that an employee receives from their employer, such as a company car. In the case of electric cars, there is currently no benefit in kind tax charged, meaning employees do not have to pay tax on the use of an electric company car.

Is there a difference in benefit in kind on electric and petrol cars?

Yes, there is a difference in benefit in kind on electric and petrol cars. While the benefit in kind on petrol and diesel cars is based on carbon emissions, electric cars are currently exempt from benefit in kind tax.

Are there any conditions to be eligible for no benefit in kind on electric cars?

Yes, in order for an electric car to be eligible for no benefit in kind tax, it must be registered and used solely for business purposes. If the car is used for personal reasons, then the normal benefit in kind tax rules will apply.

Can I opt for an electric car to avoid paying benefit in kind tax?

Opting for an electric car solely to avoid paying benefit in kind tax may not be a wise decision. You should consider factors such as the availability of charging infrastructure, the range of the car, and the needs of your business before making a decision.