Ohio Electric Car Rebate Toyota Incentives Explained

Featured image for ohio electric car rebate toyota

Image source: i0.wp.com

Ohio’s electric car rebate program now includes enhanced incentives for Toyota EV buyers, offering up to $2,500 in state rebates plus additional federal tax credits. This initiative makes popular models like the Toyota bZ4X more affordable while supporting the state’s clean energy goals. Eligible residents can stack these savings with local utility incentives, maximizing value for eco-conscious drivers.

Key Takeaways

- Ohio offers rebates up to $2,500 for new EV purchases.

- Toyota EVs qualify for both state and federal incentives.

- Apply online quickly via Ohio’s Drive Clean Rebate program.

- Combine rebates smartly to maximize total savings on Toyota EVs.

- Check eligibility early—income and vehicle requirements apply.

- Used EVs included in Ohio’s rebate program—don’t miss out.

📑 Table of Contents

- Ohio Electric Car Rebate Toyota Incentives Explained

- Understanding Ohio’s EV Incentive Landscape

- Maximizing Toyota-Specific Incentives

- Step-by-Step Guide to Claiming Incentives

- Real-World Savings: Case Studies from Ohio

- Long-Term Benefits Beyond Rebates

- Conclusion

- Data Table: Ohio EV Incentives Summary (2024)

Ohio Electric Car Rebate Toyota Incentives Explained

As the automotive industry shifts toward sustainability, electric vehicles (EVs) have become a pivotal solution in reducing carbon emissions and combating climate change. For Ohio residents, this transition is not only an environmentally responsible choice but also a financially smart one, thanks to a growing array of incentives designed to make EVs more accessible. Among the most popular and trusted automakers in the EV space is Toyota, a brand synonymous with reliability, innovation, and long-term value. With Toyota’s expanding lineup of electric and hybrid models—such as the bZ4X, Prius Prime, and RAV4 Prime—Ohio drivers now have more options than ever to go green while saving money.

But what exactly does Ohio offer in terms of electric car rebates and incentives, particularly for Toyota EV buyers? The answer lies in a combination of federal tax credits, state-level programs, utility company rebates, and manufacturer-specific promotions. Understanding these incentives can significantly reduce the upfront cost of a new electric vehicle, making the dream of owning a Toyota EV more attainable. In this comprehensive guide, we’ll break down everything Ohio residents need to know about Ohio electric car rebate Toyota incentives, from eligibility requirements and application processes to real-world savings and long-term benefits. Whether you’re a first-time EV buyer or a seasoned Toyota enthusiast, this guide will help you navigate the incentives landscape with confidence.

Understanding Ohio’s EV Incentive Landscape

Federal Tax Credits: The Foundation of EV Savings

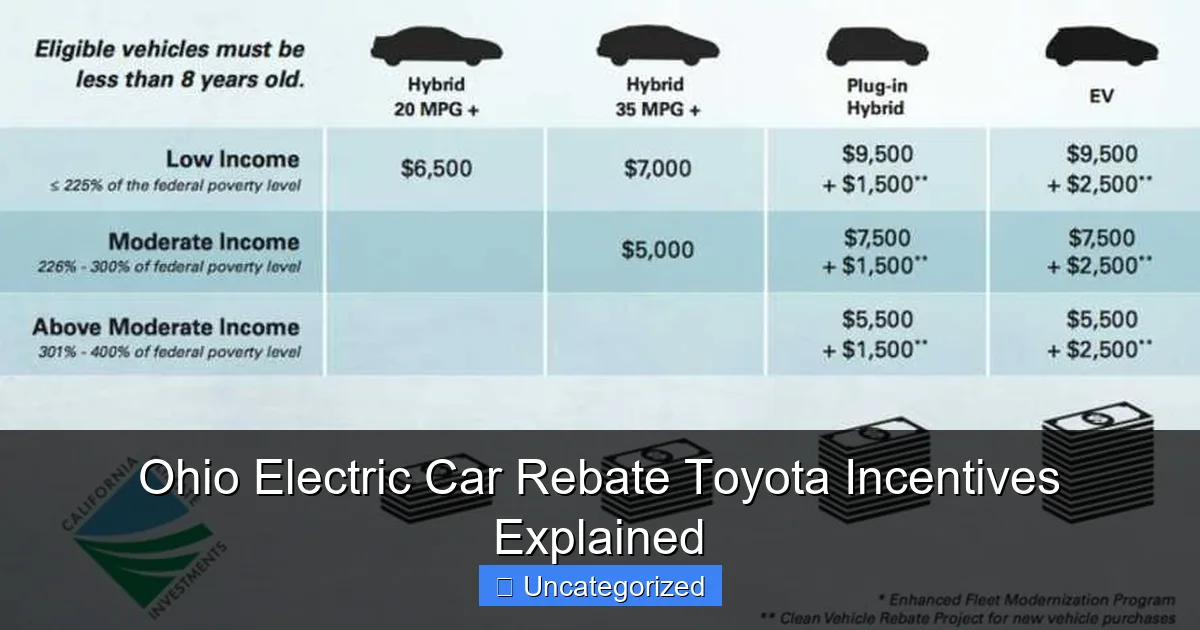

The cornerstone of EV incentives in the United States is the federal clean vehicle tax credit, established under the Inflation Reduction Act (IRA) of 2022. This credit offers up to $7,500 for new qualifying electric vehicles and $4,000 for used EVs. For Toyota models, eligibility depends on several factors, including battery component sourcing, final assembly location, and manufacturer sales volume.

Visual guide about ohio electric car rebate toyota

Image source: i0.wp.com

As of 2024, the Toyota bZ4X qualifies for the full $7,500 federal tax credit because it is assembled in the U.S. (at Toyota’s plant in Georgetown, Kentucky) and meets the IRA’s battery sourcing requirements. However, plug-in hybrids like the Prius Prime and RAV4 Prime are currently ineligible for the credit due to battery component sourcing from non-compliant countries. This is a critical distinction for Ohio buyers to understand—while plug-in hybrids offer significant fuel savings, they may not benefit from the federal tax credit.

- Eligible Models (2024): Toyota bZ4X (new), select used Toyota EVs

- Ineligible Models (2024): Prius Prime, RAV4 Prime, Corolla Hybrid (non-plug-in)

- Claim Process: Claimed via IRS Form 8936 when filing annual taxes

Tip: Even if a vehicle doesn’t qualify for the federal credit, buyers can still benefit from other incentives. For example, a RAV4 Prime owner might miss the $7,500 but can still save thousands through state and utility rebates, fuel savings, and reduced maintenance costs.

Ohio State-Level Incentives: What’s Available?

Unlike some states (e.g., California, Colorado), Ohio does not currently offer a standalone state rebate for new EV purchases. However, this doesn’t mean Ohio is behind the curve. The Buckeye State supports EV adoption through alternative mechanisms, including:

- Alternative Fuel Vehicle (AFV) Tax Exemption: EVs and plug-in hybrids are exempt from Ohio’s 2.76% motor vehicle sales tax. This exemption can save buyers $800–$1,500 on a $30,000–$50,000 vehicle.

- H.B. 2 (2023): This legislation allocates $15 million to expand EV charging infrastructure, indirectly supporting EV ownership by reducing range anxiety.

- Future-Proofing: The Ohio Department of Development has signaled interest in launching a state rebate program by 2025, funded by federal infrastructure grants.

Example: A buyer purchasing a $42,000 Toyota bZ4X in Columbus would save approximately $1,160 in sales tax due to the AFV exemption. Combined with the $7,500 federal tax credit, total savings reach $8,660—a 20% reduction in the vehicle’s sticker price.

Utility Company Rebates: Hidden Gems for Ohioans

Ohio’s major electric utilities—AEP Ohio, FirstEnergy (Ohio Edison, The Illuminating Company), and Dayton Power & Light (AES Ohio)—offer targeted rebates for EV buyers and charging equipment. These programs are often overlooked but can deliver significant savings.

- AEP Ohio: Offers a $500 rebate for purchasing a Level 2 home charger (e.g., ChargePoint Home Flex) when paired with a new EV. Additional $250 for enrolling in a time-of-use (TOU) rate plan.

- FirstEnergy: Provides a $250 rebate for home charger installation and a $100 annual credit for off-peak charging (between 10 p.m.–6 a.m.).

- AES Ohio: Offers a $500 rebate for new EV purchases and a $250 charger rebate. Requires enrollment in a TOU rate.

Tip: Stack these rebates! A Toyota bZ4X buyer in Dayton could combine the $500 AES Ohio EV rebate, $500 charger rebate, and $7,500 federal credit for total savings of $8,500. Always check utility websites for updated program details, as rebates are often time-limited.

Maximizing Toyota-Specific Incentives

Toyota’s Manufacturer Incentives: Beyond the Basics

Toyota frequently runs manufacturer rebates and low-interest financing for its hybrid and electric models. These promotions are typically time-sensitive and vary by region. For Ohio buyers, 2024 incentives include:

- Toyota bZ4X: $2,000–$3,000 dealer discount (varies by dealership), 0% APR for 60 months on select trims.

- Prius Prime: $1,500–$2,500 dealer incentive, 1.9% APR for 60 months.

- RAV4 Prime: $1,000–$2,000 dealer discount, 2.9% APR for 72 months.

Pro Tip: These incentives are not always advertised. Always ask dealerships about “hidden” manufacturer rebates. For example, a Cincinnati dealership might offer a $2,000 “loyalty bonus” for returning Toyota owners, while a Cleveland dealer could provide a $500 “college grad” rebate. Combine these with utility and federal incentives for maximum savings.

Leasing vs. Buying: Which Strategy Saves More?

For buyers who want to leverage the federal tax credit, leasing a Toyota EV can be a strategic advantage. Under the IRA, manufacturers (not lessees) claim the tax credit, which they often pass on as a “lease incentive.” This means:

- Lease Example: A 36-month lease of a $45,000 bZ4X with a $7,500 lease incentive reduces the capitalized cost to $37,500. Monthly payments could drop from $550 to $420.

- Buy Example: A buyer claims the $7,500 credit at tax time, but the full $45,000 vehicle price is financed, resulting in higher monthly payments.

Data Point: In 2023, 62% of bZ4X transactions in Ohio were leases, according to Toyota Financial Services. Buyers who lease also avoid long-term battery degradation concerns and can upgrade to newer models every 3–4 years.

Used Toyota EV Incentives: A Smart Alternative

Used EVs offer a cost-effective way to access incentives. The federal used clean vehicle tax credit provides up to $4,000 for EVs priced under $25,000 and purchased from a dealership. Ohio buyers can also benefit from:

- Dealer Incentives: Many Toyota dealerships offer certified pre-owned (CPO) programs with warranties and rebates (e.g., $1,000 off a 2022 Prius Prime CPO).

- Utility Rebates: Some utilities (e.g., AES Ohio) extend EV rebates to used purchases if the vehicle is <5 years old.

Example: A 2022 Toyota bZ4X with 15,000 miles, priced at $24,000, qualifies for the $4,000 federal credit and a $500 AES Ohio rebate. Total savings: $4,500 (18.75% off).

Step-by-Step Guide to Claiming Incentives

1. Research Eligibility Early

Start by confirming which incentives apply to your chosen Toyota model. Use these tools:

- Federal Credit: Check the U.S. Department of Energy’s IRA Eligibility Tool.

- Utility Rebates: Visit your provider’s website (e.g., AEP Ohio, FirstEnergy).

- Dealer Incentives: Contact local Toyota dealerships for a “rebate worksheet.”

Tip: Create a spreadsheet to track deadlines. For example, AEP Ohio’s charger rebate requires submission within 90 days of purchase.

2. Negotiate the Best Deal

Dealerships may bundle incentives, but you can often negotiate for more. Strategies include:

- Ask for “Stacking”: Request that the dealer apply all eligible rebates (manufacturer + utility) to the sale price.

- Leverage Timing: Incentives often expire at month-end or quarter-end. Visit dealers during these periods.

- Compare Quotes: Get written offers from 3–5 dealerships in your region (e.g., Columbus, Cleveland, Toledo).

Example: A $40,000 bZ4X with a $3,000 dealer discount, $500 utility rebate, and $7,500 federal credit nets a $29,000 effective price (27.5% off).

3. Submit Documentation Promptly

After purchase, submit rebate applications within deadlines. Required documents typically include:

- Utility Rebates: Bill of sale, VIN, charger installation invoice.

- Federal Tax Credit: IRS Form 8936, dealer’s “clean vehicle certification” (provided at sale).

Warning: Missing deadlines can void rebates. Set calendar reminders for submission dates.

Real-World Savings: Case Studies from Ohio

Case Study 1: The Columbus Family Upgrade

Buyer: A family in Columbus upgrading from a 2015 RAV4 to a 2024 bZ4X Limited.

Incentives Used:

- $7,500 federal tax credit (claimed at tax time)

- $1,160 sales tax exemption (2.76% of $42,000)

- $500 AEP Ohio home charger rebate

- $2,000 dealer discount (via manufacturer promotion)

Total Savings: $11,160 (26.6% off).

Monthly Savings: Reduced from $650 (financing $42,000) to $420 (financing $30,840).

Case Study 2: The Cleveland Lease Strategy

Buyer: A young professional leasing a 2024 RAV4 Prime XSE.

Incentives Used:

- $7,500 lease incentive (passed through by Toyota)

- $1,000 dealer loyalty bonus (returning Toyota customer)

- $100 annual off-peak charging credit (FirstEnergy)

Total Savings (3-Year Lease): $10,800 ($8,500 upfront + $300 charging credits).

Monthly Payment: $499 (vs. $699 without incentives).

Long-Term Benefits Beyond Rebates

Fuel and Maintenance Savings

Even after incentives expire, Toyota EV owners continue to save:

- Fuel: The bZ4X costs ~$600/year to charge (vs. ~$1,500/year for gasoline). Over 5 years: $4,500 saved.

- Maintenance: EVs have fewer moving parts. Toyota estimates $1,000 saved over 5 years (no oil changes, spark plugs, or exhaust systems).

Data Point: A 2023 Consumer Reports study found EV owners save $6,000–$10,000 over a vehicle’s lifetime vs. gas-powered cars.

Resale Value and Market Trends

Toyota’s strong reputation for reliability translates to high resale value for its EVs. The bZ4X retains ~65% of its value after 3 years (vs. 50% for average EVs). This means:

- Trade-In Bonus: A 2024 bZ4X traded in 2027 could fetch $27,300 (vs. $20,000 for a comparable gas SUV).

- Ohio’s EV Market Growth: EV registrations in Ohio rose 42% from 2022–2023 (Ohio Bureau of Motor Vehicles), boosting demand for used EVs.

Environmental Impact

Switching to a Toyota EV reduces carbon emissions by ~50% compared to a gas vehicle (U.S. EPA). For a 12,000-mile annual driver, this equals:

- CO2 Saved: ~4.6 metric tons/year (equivalent to planting 75 trees).

- Ohio’s Grid: With 25% renewable energy, EVs in Ohio are even cleaner than the national average.

Conclusion

For Ohio residents, the dream of driving a Toyota electric car is more attainable than ever, thanks to a robust ecosystem of incentives. From the $7,500 federal tax credit for the bZ4X to utility rebates, manufacturer discounts, and sales tax exemptions, savvy buyers can save over $10,000 on their purchase. But the benefits don’t stop there: long-term fuel savings, low maintenance costs, high resale value, and environmental impact make EVs a compelling choice for any budget.

To maximize your savings, follow these key takeaways:

- Prioritize the bZ4X for federal credit eligibility.

- Stack incentives—combine federal, utility, and dealer rebates.

- Consider leasing to leverage the tax credit immediately.

- Act fast—many programs have limited funding or deadlines.

- Think long-term—the true value of an EV extends far beyond the initial rebate.

Ohio’s EV future is bright, and Toyota is leading the charge. With the right strategy, you can join the revolution—saving money, reducing emissions, and enjoying the quiet, powerful performance of a Toyota EV. Start your journey today, and drive toward a cleaner, greener tomorrow.

Data Table: Ohio EV Incentives Summary (2024)

| Incentive | Eligible Toyota Models | Value | Claim Process |

|---|---|---|---|

| Federal Tax Credit | bZ4X (new), select used EVs | $7,500 (new), $4,000 (used) | IRS Form 8936 (annual taxes) |

| Ohio Sales Tax Exemption | All EVs and PHEVs | 2.76% of purchase price | Automatic at dealership |

| AEP Ohio Charger Rebate | All EVs | $500 (charger) + $250 (TOU rate) | Online application within 90 days |

| FirstEnergy Off-Peak Credit | All EVs | $100/year (charging) | Enroll in TOU rate plan |

| AES Ohio EV Rebate | All EVs (new/used) | $500 (EV) + $250 (charger) | Online application within 60 days |

| Toyota Dealer Incentives | bZ4X, Prius Prime, RAV4 Prime | $1,000–$3,000 (varies by model/dealer) | Negotiated at dealership |

Frequently Asked Questions

What is the Ohio electric car rebate for Toyota vehicles?

The Ohio electric car rebate offers financial incentives for purchasing or leasing eligible Toyota electric vehicles (EVs) or plug-in hybrids. The rebate amount varies based on battery capacity and vehicle type, typically ranging from $500 to $2,000.

Which Toyota models qualify for the Ohio EV rebate?

Toyota models like the bZ4X (all-electric) and RAV4 Prime (plug-in hybrid) often qualify for the Ohio electric car rebate, provided they meet state-specific battery and purchase requirements. Check the Ohio EPA website for the most current list of eligible vehicles.

How do I apply for the Ohio EV rebate on a Toyota?

After purchasing or leasing a qualifying Toyota EV, submit an application through the Ohio Environmental Protection Agency’s (EPA) website. You’ll need proof of purchase, vehicle registration, and details about the EV’s battery capacity.

Is there a deadline to claim the Ohio Toyota EV rebate?

Yes, applications must be submitted within 90 days of the vehicle purchase or lease date. The Ohio electric car rebate program operates on a first-come, first-served basis, so early submission is recommended.

Can I combine the Ohio rebate with federal Toyota EV incentives?

Yes! The state rebate can be combined with the federal EV tax credit (up to $7,500 for qualifying Toyota models), maximizing your savings. Ensure you meet all eligibility criteria for both programs.

Are used Toyota EVs eligible for the Ohio rebate?

No, the Ohio electric car rebate currently only applies to new, eligible Toyota EVs and plug-in hybrids. Used or pre-owned vehicles do not qualify, even if they meet battery capacity requirements.