Exploring the Benefits of P11D Fuel Benefit for Electric Cars: A Greener Solution for Your Business

As electric vehicles become increasingly popular, many drivers are curious about the P11D fuel benefit they may receive. But what exactly is the P11D fuel benefit, and how does it apply to electric cars? Essentially, this benefit is a tax exemption that some car users receive for fuel they are provided with by their employer or company. However, the rules surrounding this benefit can be complex, especially when it comes to electric vehicles.

In this blog, we’ll explore the ins and outs of the P11D fuel benefit for electric cars, and what you need to know if you’re considering an EV for personal or business use.

Overview of P11D Fuel Benefit

If you own an electric car and receive it as a company vehicle, you may be wondering how it affects your p11d fuel benefit. Luckily, electric cars are exempt from fuel benefit charges under certain conditions. This includes if the car’s battery capacity is over 40kWh and your employer has installed charging facilities on your premises that you can use for private purposes.

If this applies to you, congratulations! You won’t be subject to any fuel benefit charges for your electric vehicle. However, it’s worth noting that if you drive a company-owned electric car, but don’t have access to home charging facilities, then you may still be subject to fuel benefit charges. It’s always best to check with your employer and keep up-to-date with the latest guidance on p11d fuel benefits to ensure you’re not caught out.

Overall, owning an electric vehicle can be a great way to reduce your company car tax bill and help the environment at the same time.

What is P11D Fuel Benefit?

P11D Fuel Benefit is a government scheme that taxes employees who have been given the privilege of company cars or company-paid fuel services. This tax applies to employees who use their company car for personal use, including commuting to and from work, as well as personal trips. The purpose of P11D Fuel Benefit is to ensure that employees who have been given company cars or fuel for personal use are taxed accordingly.

The tax is based on the type of vehicle used and the amount of fuel consumed. Companies that wish to offer this benefit to their employees must ensure that they keep accurate records of fuel consumption and vehicle usage to enable the tax authorities to calculate the correct amount of tax due. If you are unsure about whether you will be affected by P11D Fuel Benefit, speak to your employer or a tax adviser for more information.

How is P11D Fuel Benefit Calculated?

P11D Fuel Benefit P11D Fuel Benefit is a type of benefit that is provided to employees who receive company cars as part of their remuneration package. The benefit is calculated based on the fuel type of the car and the CO2 emissions that it produces. Essentially, the benefit is calculated as a percentage of the car’s list price and the CO2 emissions that the car produces.

The percentage applied to the list price of the car is determined based on the fuel type of the car, with diesel cars receiving a higher percentage than petrol cars due to the higher emissions they produce. The benefit is then added to the employee’s taxable income, and they are required to pay tax on the value of the benefit. While P11D Fuel Benefit can be a valuable addition to an employee’s remuneration package, it can also be a complex and confusing process to understand, particularly for those who are new to the world of company cars and benefits.

Understanding the ins and outs of P11D Fuel Benefit is important for both employers and employees, as it can have a significant impact on their financial situation.

Electric Cars and P11D Fuel Benefit

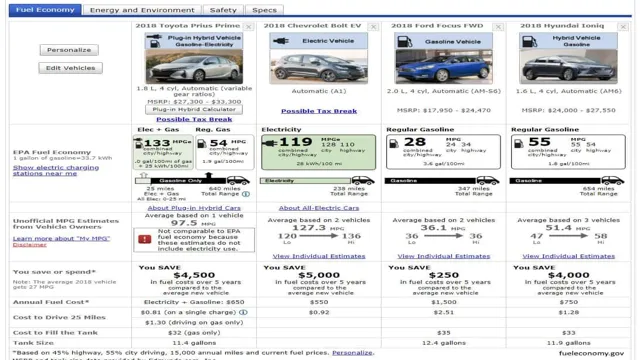

If you’re considering an electric car, you may be wondering how it affects your P11D fuel benefit. Well, the good news is that electric cars aren’t subject to the same fuel benefit as traditional petrol or diesel cars. As electric cars don’t rely on fuel, the P11D benefit is calculated differently, based on the cost of the car and battery.

In fact, electric cars can have significant tax benefits for both employee and employer. Not only are electric cars exempt from fuel benefit tax, but they also qualify for significantly reduced company car tax rates, making them a more cost-effective option for those looking to go green. Plus, as electric cars emit less CO2 than petrol or diesel cars, employers can also benefit from lower National Insurance Contributions.

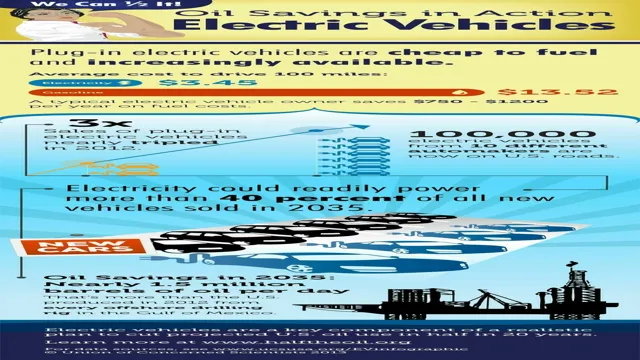

But it’s not just about tax savings. Electric cars are becoming increasingly popular due to their low running costs, environmental benefits, and a growing network of charging infrastructure. Plus, with advances in technology, many electric cars now have a range similar to that of petrol or diesel counterparts, making them a practical option for many drivers.

So, if you’re looking for a more environmentally-friendly and cost-effective option, an electric car could be the way to go. And the good news is, you won’t have to worry about P11D fuel benefit tax!

What is the Benefit for Electric Cars?

Electric cars are revolutionizing the automobile industry and providing numerous benefits for both the environment and businesses alike. One of these advantages is related to the P11D fuel benefit. In simple terms, this benefit is a tax on fuel that is provided by the employer for the employee’s use.

However, this tax does not apply to electric cars, as they consume no fuel. This means that employees who drive electric cars are exempt from paying this tax, which can result in significant savings on their annual tax bill. Moreover, businesses that purchase electric cars can claim a 100% first-year allowance on their purchase, which can result in further savings.

The P11D fuel benefit is just one of many reasons why electric cars are becoming increasingly popular among companies and individuals looking to make a positive impact on the environment and their finances. By investing in electric cars, businesses can not only reduce their carbon footprint but also save money in the long run.

How Does the Benefit Compare to Petrol and Diesel Cars?

When it comes to the benefits of electric cars compared to petrol and diesel vehicles, the P11D fuel benefit is definitely a factor to consider. The P11D value is used to calculate the amount of company car tax an employee needs to pay based on the car’s value, emissions, and fuel type. With electric cars, the P11D value can be significantly lower than their petrol and diesel counterparts, which means that employees who use these cars for work purposes could end up paying less tax.

This is because electric cars have zero emissions, which means they fall into lower tax brackets. In addition, electric cars are exempt from road tax, which can also be a significant saving. Overall, the P11D fuel benefit of electric cars can make them a more appealing option for both employers and employees, as it can save money and contribute to a greener environment.

Examples of P11D Fuel Benefit for Electric Cars

If you’re considering purchasing an electric car for your business, it’s important to be aware of the P11D fuel benefit that applies to these vehicles. Essentially, this is the benefit in kind that employees receive as a result of having access to company fuel. However, when it comes to electric cars, these benefits are much lower (or sometimes non-existent) compared to their petrol or diesel counterparts.

This is because electric cars are a much greener and more sustainable option, and as such, they’re seen as an incentive for businesses to invest in. For example, in the UK, for the 2021-2022 tax year, the P11D fuel benefits for electric cars range from £0 to £940, depending on the car’s CO2 emissions and the number of miles driven. It’s important to note that the figures may differ depending on where you are located geographically and should be checked with local authorities.

Therefore, electric cars are a great option for those looking to reduce their company’s carbon footprint, while also enjoying the financial benefits that come with them.

Reducing P11D Fuel Benefit for Electric Cars

If you’re an employer looking to reduce the P11D fuel benefit for your company’s electric cars, you’re in luck! The UK government recently announced that the fuel benefit charge for electric cars would be reduced to zero for the 2020-21 tax year, meaning that employees won’t be taxed on the electricity they use to power their company vehicles. This change in policy is part of the government’s effort to promote the use of electric cars and reduce carbon emissions. It’s a win-win situation for both employers and employees – not only will the company save on taxes, but employees will also benefit from the lower fuel costs associated with electric cars.

So if you’re considering adding electric cars to your company’s fleet, now is the perfect time to do so!

Strategies for Reducing P11D Fuel Benefit on Electric Cars

If your company has made the switch to electric cars, then you may be concerned about the P11D fuel benefit that your employees have to pay on them. However, there are strategies you can use to reduce this cost. One of the best ways is to install workplace charging stations, which will allow your employees to charge their cars at work instead of having to pay for it themselves.

You can also encourage your employees to charge their cars at home during off-peak hours when electricity is cheaper. Another option is to offer your employees a salary sacrifice scheme, where they give up part of their salary in exchange for a non-cash benefit such as a free charge card or discounted electricity rates. By using these strategies, you can reduce the P11D fuel benefit on electric cars and make them a more attractive option for your company.

Benefits of Reducing P11D Fuel Benefit on Electric Cars

Electric cars are increasingly popular due to their eco-friendly nature, and the UK government is incentivizing their use by reducing the P11D fuel benefit on these vehicles. This move is expected to promote the adoption of electric cars, leading to a significant reduction in greenhouse gas emissions. A lower P11D fuel benefit for electric cars means that there will be reduced tax burdens for employees who use these cars.

Employers, on the other hand, will benefit from a reduction in National Insurance Contributions. Additionally, reduced P11D fuel benefit on electric cars will encourage companies to incorporate them into their fleets, leading to significant cost savings on fuel and maintenance. Considering these benefits, it is not surprising that more and more companies in the UK are making the switch to electric cars.

Conclusion

In conclusion, if you want to feel like a superhero with a fuel-efficient and eco-friendly vehicle, then an electric car may be the solution for you. Not only will you save money on fuel costs, but you’ll also feel good about reducing your carbon footprint. Plus, with the P11D fuel benefit for electric cars, the government is sending a clear message that they support this movement towards sustainable transportation.

So, don’t wait any longer, join the electric car revolution and feel like a real-life superhero every time you hit the road.”

FAQs

What is a P11D form and why is it important?

A P11D form is a tax form that employers use to report the cash equivalent value of any benefits or expenses they provide to their employees. It is important because it helps the government to track the value of benefits being provided and calculate the correct amount of tax that should be paid.

How does the P11D form relate to fuel benefits for electric cars?

If an employer provides an employee with a company car, the P11D form will include the cash equivalent value of any fuel benefit that is provided in addition to the car. If the car is an electric car, and no fuel is provided, then no fuel benefit will be included on the form.

Are there any tax benefits to choosing an electric car as a company car?

Yes, there are tax benefits to choosing an electric car as a company car. For example, employees who are provided with electric cars by their employer will not have to pay any Benefit-in-Kind tax on the car, making it a more financially attractive option.

How can employers encourage their employees to choose electric cars instead of traditional petrol or diesel cars?

Employers can offer incentives to employees who choose electric cars, such as free or subsidised charging at work or access to preferential parking spaces. By making it more convenient and financially beneficial for employees to choose electric cars, employers can help to create a more sustainable and eco-friendly workforce.