Unleashing the Power of Green: How Seattle’s Electric Car Tax Benefits Could Help You and the Environment

Electric cars are becoming increasingly popular in Seattle, with many drivers opting for the environmentally-friendly and cost-effective option. The city has also recognized the benefits of electric cars and offers several tax benefits for those who choose to drive them. But what exactly are these benefits, and how can you take advantage of them? In this blog post, we’ll explore Seattle’s electric car tax benefits and how they can benefit you.

So buckle up, and let’s hit the road!

Overview of Seattle’s Electric Car Tax Benefits

If you’re thinking about getting an electric car in Seattle, you’ll be happy to know that there are plenty of tax benefits to take advantage of. One of the biggest perks is the EV tax credit, which can save you up to $2,500 on the purchase or lease of a new electric vehicle. In addition, there’s no sales tax on the purchase of an electric car in the state of Washington, which can save you thousands of dollars.

Seattle also offers free metered parking for electric cars and free charging at many public charging stations. Not to mention, you’ll also be doing your part to help reduce carbon emissions and improve air quality in the city. So, if you’re in the market for a new car, consider going electric and enjoy the many tax benefits that come with it.

Explanation of Seattle’s sales tax exemption

Seattle’s electric car tax benefits are designed to encourage more people to purchase and drive electric cars. One of the most significant tax benefits Seattle offers is the sales tax exemption. This exemption is available to residents of Seattle who purchase a new or used electric car.

The sales tax exemption is equal to 100% of the state sales tax and 0.3% of the motor vehicle sales tax, which can add up to significant savings. To qualify for this benefit, the vehicle must have a battery capacity of at least 10 kilowatt-hours (kWh) and be used primarily for personal purposes.

Overall, the electric car tax benefits in Seattle aim to make it easier and more affordable for residents to switch to sustainable transportation options and reduce their carbon footprint.

Description of Washington State’s EV tax credit

Washington State offers an electric vehicle (EV) tax credit of up to $2,500 for qualified EV purchases. This credit is available through 2025 for both new and used electric vehicles. In addition to the state tax credit, Seattle residents may also be eligible for local tax benefits.

The City of Seattle provides a sales and use tax exemption of up to $2,500 for qualified EV purchases. This exemption applies to both new and used EVs, and is available through 202 Seattle also offers free parking at city-owned charging stations and reduced electricity rates for EV owners.

These tax benefits and incentives are designed to encourage more people to purchase electric vehicles, reducing carbon emissions and promoting a cleaner, healthier environment for all. So, if you are looking to buy an EV in Seattle, make sure to take advantage of these tax benefits to save money on your purchase and contribute to a more sustainable future.

Benefits of Owning an Electric Car in Seattle

If you’re a Seattle resident looking to switch to a more energy-efficient automobile, then buying an electric car would be an excellent idea. One of the biggest benefits of owning an electric vehicle in Seattle is that the city offers attractive tax incentives to environmentally conscious vehicle owners. For example, the city exempts electric car owners from paying sales tax upfront, which could save thousands of dollars on the purchase.

Additionally, drivers of electric cars can use the dedicated HOV lanes on the highways, which can save them from hours of sitting in traffic during peak hours. Apart from the tax benefits, electric cars are also much cheaper to maintain than traditional vehicles. These cars have fewer mechanical parts, which means fewer repair costs down the line.

Additionally, they have fewer fluids that need replacing, leading to fewer oil changes and maintenance costs. Plus, electric vehicles are much quieter and produce fewer emissions, which means cleaner air for all. In conclusion, if you’re looking to own a vehicle that’s both eco-friendly and cost-efficient, buying an electric car in Seattle is an excellent choice.

Lower fuel and maintenance costs

When it comes to owning an electric car in Seattle, one of the biggest benefits is the lower fuel and maintenance costs. Unlike traditional gas-powered cars, electric cars run on electricity, which is much cheaper than gas. In Seattle, the average cost of electricity is around 10 cents per kilowatt-hour, which is significantly less than the average cost of gasoline.

Not only will you save on fuel costs, but electric cars also require less maintenance. There are fewer moving parts in an electric car, which means fewer opportunities for something to break or wear down. This translates to lower maintenance costs over time, as well as fewer trips to the mechanic.

With an electric car, you not only save money on fuel and maintenance, but you also contribute to a cleaner environment by reducing harmful emissions. It’s a win-win situation for both your wallet and the planet.

Access to carpool lanes and HOV lanes

If you’re a Seattle resident considering buying an electric car, one of the perks you can look forward to is access to carpool lanes and HOV lanes. These extra lanes can make your commute significantly smoother and help you avoid sitting in frustrating bumper-to-bumper traffic. Not only is this a time-saver, but it’s also better for the environment as it encourages more people to carpool or use public transportation.

As an electric vehicle owner, you’ll be able to take advantage of these carpool and HOV lanes even when you’re driving alone, thanks to government initiatives encouraging the use of eco-friendly vehicles. So not only will owning an electric car help you save money on gas and maintenance, but it’ll also give you a tangible benefit in your daily commute.

Environmental benefits and reduced carbon footprint

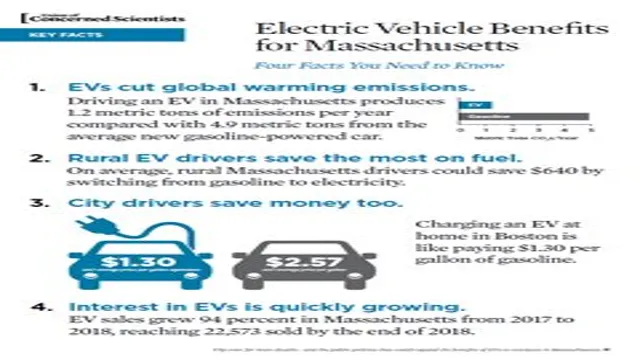

Electric car ownership in Seattle has many benefits, including reducing your carbon footprint and helping the environment. By driving an electric car, you are emitting fewer pollutants and greenhouse gases than a traditional gasoline-powered vehicle, which means you are helping to reduce air pollution and improve local air quality. Additionally, electric cars have a lower operating cost than traditional cars, which can result in savings over time, especially with Seattle’s high gas prices.

Although the upfront cost of purchasing an electric car may seem high, government incentives and tax credits are available to help lessen the financial burden. Electric cars are also quieter and smoother to drive than traditional cars, providing a more enjoyable and peaceful driving experience. Overall, owning an electric car in Seattle is a win for both the environment and your wallet.

How to Claim Seattle’s Electric Car Tax Benefits

If you have recently purchased an electric car in Seattle, you may be eligible for some tax benefits. These benefits are designed to incentivize people to switch to electric vehicles and reduce their carbon footprint. To claim these benefits, there are several steps you need to follow.

First, make sure you have all the necessary documentation, including proof of purchase and registration. Then, submit an application to the Department of Licensing, along with any supporting documents. Make sure you read and understand all the requirements before submitting your application to avoid any delays or rejections.

Once your application is approved, you can enjoy the benefits, which include a sales tax exemption and a carpool lane exemption. Overall, taking advantage of Seattle’s electric car tax benefits can not only save you money but also contribute to a cleaner environment.

Step-by-step guide to claiming sales tax exemption

If you’re a Seattle resident considering buying an electric car, there’s good news for you! The city offers tax benefits for electric vehicle owners. To claim these benefits, you’ll need to follow some simple steps. First, make sure you’re eligible by checking the city’s requirements.

Next, purchase your electric car from a certified dealer. Then, apply for your city tax exemption using the required forms and documentation. This will include proof of your purchase and ownership of an electric car, as well as your income level and residency status.

Once approved, you’ll be eligible for a sales tax exemption on your electric car purchase and, in some cases, other benefits like free parking or charging. So why not take advantage of Seattle’s electric car tax benefits and make the switch to a cleaner, more sustainable way of getting around?

Information on how to claim the Washington State EV tax credit

If you’re a Seattle resident who recently purchased an electric car, you may be eligible for some fantastic tax breaks. Washington State offers an EV tax credit of up to $1,500 to help those who bought an electric vehicle in 2021, and up to $1,000 for those who bought one after July 201 To claim this credit, you’ll need to complete a few simple steps.

First, make sure you have all the necessary documentation, such as the purchase agreement, the registration, and the bill of sale. You’ll also need to file Form 6380, which is the “Washington State Alternative Fuel Vehicle Manufacturer’s Certification” form. Once you’ve gathered all the paperwork, attach it to your tax return, and you’re good to go.

These tax credits can make electric cars more affordable and encourage more people to make the switch to clean transportation. So, take advantage of this opportunity and go green while saving some green!

Conclusion: Is Owning an Electric Car Worth it?

In the rainy city of Seattle, owning an electric car comes with more benefits than just reducing your carbon footprint. With tax credits and discounts, you can save money while driving a car that feels like it was built for this city’s eco-conscious culture. So if you’re looking to take your driving game to the next level, remember that in Seattle, driving electric means driving smarter and greener.

“

FAQs

What are the benefits of owning an electric car in Seattle?

There are various benefits of owning an electric car in Seattle, including tax credits and exemptions, reduced maintenance costs, and lower fuel expenses.

How much tax credit can I receive for buying an electric car in Seattle?

Seattle residents can receive up to $2,500 in tax credits for purchasing new electric vehicles.

Are there any additional incentives for low-income families to buy electric cars in Seattle?

Yes, Seattle’s Multi-Family Affordable Housing Property Tax Exemption Program offers a 12-year property tax exemption for apartment buildings with affordable units and EV charging stations.

Can businesses in Seattle also avail tax benefits for electric vehicles?

Yes, businesses in Seattle can qualify for tax credits of up to $20,000 per vehicle for purchasing or leasing electric vehicles.