State of Florida Electric Car Incentives You Need to Know

Featured image for state of florida electric car incentives

Image source: internationalelectriccar.com

Florida offers no state-level tax credits for electric vehicle purchases, but residents can still benefit from the federal EV tax credit of up to $7,500 and local utility incentives, including rebates and discounted charging rates—making EV ownership more affordable across the Sunshine State.

Key Takeaways

- Florida offers no state tax credit but provides HOV lane access for EVs.

- Local utility rebates available—check with providers like FPL for EV charger discounts.

- HOV decals permit solo EV drivers in carpool lanes, saving commute time.

- Sales tax exemption applies to EVs under $25,000—verify eligibility before purchase.

- Workplace charging incentives exist—employers can claim grants for installing EV stations.

- Public charging infrastructure expanding—utilize state-funded stations for long-distance travel.

Quick Answers to Common Questions

Does Florida offer a state tax credit for electric cars?

No, Florida does not currently offer a state income tax credit for purchasing an electric car, but there are other state of florida electric car incentives to consider.

Are electric vehicles exempt from Florida registration fees?

Yes, electric vehicles in Florida are exempt from the annual $75 Alternative Fuel Vehicle (AFV) registration fee, which helps reduce ownership costs.

Can I get a rebate for installing a home EV charger in Florida?

While there’s no statewide rebate, some local utilities offer incentives for EV charger installation—check with your provider for available programs.

Do electric cars pay less in tolls in Florida?

No, electric vehicles do not receive toll discounts in Florida, but you can save with SunPass and other electronic toll programs.

Are there any HOV lane perks for electric cars in Florida?

No, Florida no longer offers HOV lane access for electric vehicles, but this perk was discontinued in 2019.

📑 Table of Contents

- State of Florida Electric Car Incentives You Need to Know

- Federal Tax Credits: The Biggest Bang for Your Buck

- Florida State Incentives: What’s Available Right Now

- Utility Company Rebates and Charging Incentives

- Local and Municipal Perks: Don’t Overlook City-Level Benefits

- Charging Infrastructure: Florida’s Growing EV Network

- Real Savings: Putting It All Together

- Final Thoughts: Is Going Electric in Florida Worth It?

State of Florida Electric Car Incentives You Need to Know

Thinking about making the switch to an electric car? You’re not alone. More and more Floridians are trading in their gas guzzlers for sleek, quiet, and eco-friendly electric vehicles (EVs). And while the upfront cost of an EV might seem steep, the good news is that Florida offers a range of incentives that can help ease the financial burden. Whether you’re eyeing a Tesla, a Chevy Bolt, or a Hyundai Ioniq, understanding what support is available can make your transition smoother and more affordable.

Now, let’s be real—Florida isn’t known for having the most generous EV incentives in the country. But don’t let that discourage you. The state still offers meaningful perks, especially when you factor in federal tax credits and utility company rebates. Plus, with gas prices fluctuating and climate concerns growing, going electric in the Sunshine State makes more sense than ever. In this guide, we’ll walk you through the state of Florida electric car incentives you need to know—no fluff, just facts and practical tips to help you save money and drive cleaner.

Federal Tax Credits: The Biggest Bang for Your Buck

Before diving into Florida-specific programs, it’s important to remember that the federal government still offers one of the most valuable incentives for EV buyers. The federal EV tax credit can save you up to $7,500 on qualifying new electric vehicles. This isn’t a rebate you get at the dealership—it’s a dollar-for-dollar reduction in your federal income tax liability.

Visual guide about state of florida electric car incentives

Image source: ev-pros.com

How the Federal Credit Works

The credit applies to new EVs purchased and placed in service after January 1, 2023, under the Inflation Reduction Act. However, not all vehicles qualify. To be eligible, the car must meet strict battery and manufacturing requirements, including being assembled in North America and using a certain percentage of critical minerals sourced from the U.S. or free-trade partners.

Which Cars Qualify?

As of 2024, popular models like the Tesla Model 3, Ford Mustang Mach-E, and Chevrolet Bolt EV may qualify—but it depends on battery sourcing and final assembly. Always check the EPA’s Fuel Economy website or consult your dealer to confirm eligibility. Keep in mind that the credit begins to phase out once a manufacturer sells 200,000 eligible vehicles, though the new rules have reset this threshold under current law.

Pro Tip: Plan Ahead

If you’re close to your tax limit, consider timing your purchase so you can fully use the credit. For example, if you only owe $5,000 in federal taxes, you can only claim $5,000 of the $7,500 credit. The rest won’t roll over. Talk to your tax advisor to maximize your benefit.

Florida State Incentives: What’s Available Right Now

Unlike states such as California or Colorado, Florida doesn’t offer a direct state tax credit or rebate for purchasing an EV. But that doesn’t mean there are no state-level perks. Florida focuses more on infrastructure and long-term savings rather than upfront cash incentives.

Visual guide about state of florida electric car incentives

Image source: images.squarespace-cdn.com

Sales Tax Exemption on EVs

One of the most valuable state-level benefits is Florida’s sales tax exemption on electric vehicles. When you buy a new or used EV, you don’t pay the 6% state sales tax. That’s a savings of $3,000 on a $50,000 vehicle—no paperwork, no waiting. The exemption applies automatically at the time of purchase, so you’ll see the savings right on your invoice.

No Annual EV Registration Fee (Yet)

Some states charge extra fees for EV owners to make up for lost gas tax revenue. Florida does not currently impose an annual EV registration surcharge. While this could change in the future as EV adoption grows, for now, you’ll pay the same registration fee as a gas-powered car owner—typically around $50–$100 per year depending on your county.

HOV Lane Access

Florida allows certain clean fuel vehicles, including EVs, to use high-occupancy vehicle (HOV) lanes—even with just one person in the car. This can save you serious time during rush hour, especially in busy areas like Miami, Orlando, or Tampa. Just make sure your vehicle is registered as a clean fuel vehicle and displays the proper decal.

Utility Company Rebates and Charging Incentives

While the state government keeps its incentives modest, Florida’s electric utilities are stepping up with their own programs. Many offer rebates for home charging equipment, discounted electricity rates, and even free charging during off-peak hours.

FPL’s EVolution Program

Florida Power & Light (FPL), the state’s largest utility, runs the EVolution program, which provides rebates of up to $1,000 for installing a Level 2 home charger. The rebate covers both the charger and installation costs, making it easier to charge overnight at home. FPL also offers a special “EV Rate” that gives you lower electricity prices during off-peak hours (typically overnight), which can cut your charging costs by 30–50%.

TECO and Duke Energy Programs

Tampa Electric (TECO) and Duke Energy Florida also offer similar incentives. TECO provides a $500 rebate for Level 2 charger installation, while Duke Energy offers rebates and time-of-use rates to encourage off-peak charging. These programs are especially helpful if you drive a lot and want to minimize your electricity bill.

Public Charging Discounts

Some utilities partner with charging networks like Electrify America or EVgo to offer discounted or free charging sessions. For example, FPL customers may get free charging at select public stations during certain hours. Check with your utility provider to see what partnerships are available in your area.

Local and Municipal Perks: Don’t Overlook City-Level Benefits

Beyond state and utility programs, some Florida cities and counties offer their own incentives. These are often smaller in scale but can still add up—especially when combined with other savings.

Parking Benefits in Major Cities

In cities like Miami, Orlando, and Tallahassee, EVs often qualify for free or discounted parking in municipal lots and garages. Some cities also offer reserved EV parking spots near popular destinations. For example, Miami Beach provides free parking for EVs in certain zones—just look for the green “EV Only” signs.

Expedited Permitting for Home Chargers

Several counties, including Broward and Orange, have streamlined the permitting process for home EV charger installations. This means faster approvals and lower administrative fees, saving you time and money when setting up your home charging station.

Local Rebate Programs

While rare, some local governments have piloted small rebate programs. For instance, the City of Gainesville once offered a $500 rebate for EV purchases through its municipal utility. Keep an eye on city websites or contact your local energy office to see if any new programs are launching.

Charging Infrastructure: Florida’s Growing EV Network

One of the biggest concerns for new EV owners is “range anxiety”—the fear of running out of charge with no place to plug in. Fortunately, Florida is rapidly expanding its charging network, making long-distance travel and daily commuting more convenient.

Fast-Charging Corridors

Florida has invested in building out fast-charging corridors along major highways like I-95, I-75, and I-4. These stations, often powered by Electrify America or EVgo, can charge your car to 80% in 20–30 minutes. The state aims to have a fast charger every 50 miles along interstates, aligning with federal infrastructure goals.

Public Charging Availability

As of 2024, Florida has over 3,000 public charging ports, with more being added every month. You’ll find chargers at shopping centers, hotels, airports, and rest stops. Apps like PlugShare, ChargePoint, and Electrify America make it easy to locate nearby stations and check availability in real time.

Home Charging: The Best Option

While public charging is growing, home charging remains the most convenient and cost-effective option. A Level 2 charger (240-volt) can fully charge most EVs overnight. With utility rebates and lower off-peak rates, installing a home charger is a smart long-term investment.

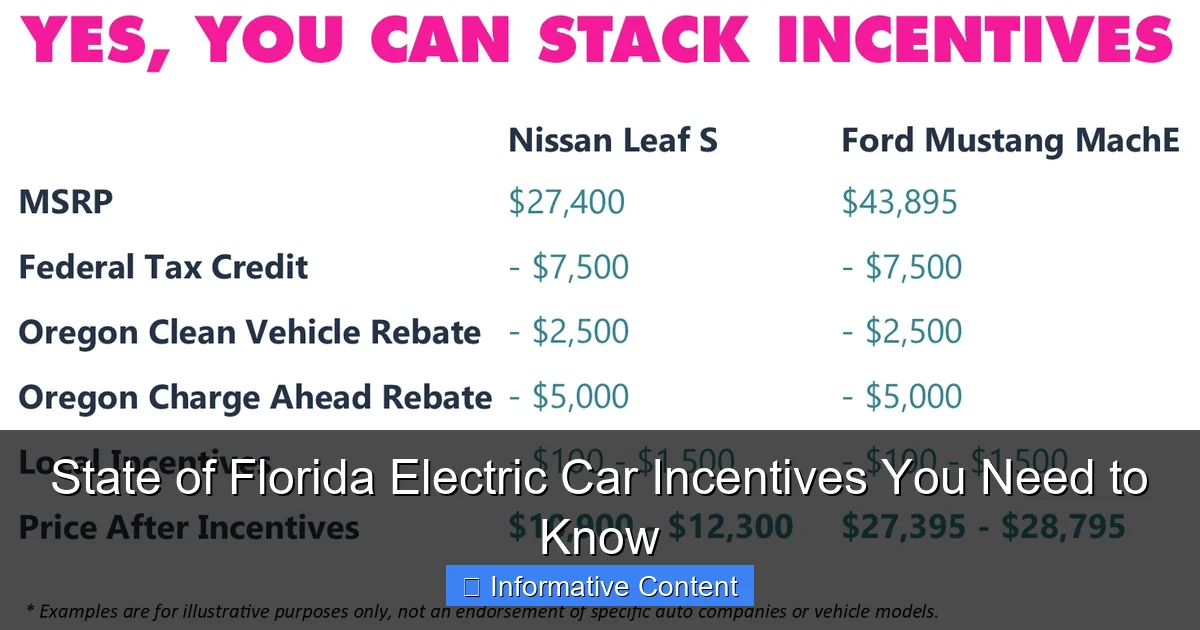

Real Savings: Putting It All Together

Let’s look at a real-world example to see how these incentives add up. Say you’re buying a new Tesla Model 3 with a sticker price of $42,000.

| Incentive | Savings |

|---|---|

| Federal EV Tax Credit | $7,500 |

| Florida Sales Tax Exemption (6% of $42,000) | $2,520 |

| FPL EVolution Charger Rebate | $1,000 |

| Annual Fuel Savings (vs. gas car) | $1,200/year |

| HOV Lane & Parking Perks (estimated) | $300/year |

In this scenario, your upfront savings total over $11,000—before you even factor in long-term fuel and maintenance savings. Over five years, you could save more than $17,000 compared to driving a comparable gas-powered car.

Final Thoughts: Is Going Electric in Florida Worth It?

So, is it worth buying an electric car in Florida? The answer is a resounding yes—especially if you take advantage of every incentive available. While Florida may not offer flashy rebates like some other states, the combination of federal tax credits, sales tax exemptions, utility rebates, and growing infrastructure makes EV ownership more accessible than ever.

And let’s not forget the non-financial benefits: quieter rides, lower maintenance (no oil changes!), and the satisfaction of reducing your carbon footprint. With gas prices unpredictable and climate change a growing concern, going electric isn’t just smart—it’s responsible.

If you’re ready to make the switch, start by researching which EVs qualify for the federal credit, check your utility’s rebate programs, and talk to a local dealer about the sales tax exemption. A little planning now can lead to big savings down the road. The state of Florida electric car incentives may not be the most generous in the nation, but they’re definitely enough to make going green a smart move.

Frequently Asked Questions

What electric car incentives are available in the state of Florida?

The state of Florida electric car incentives primarily include sales tax exemptions on EV purchases and reduced registration fees. While there’s no state income tax credit, local utilities may offer additional rebates or charging discounts.

Does Florida offer a tax credit for buying an electric car?

Florida does not provide a state income tax credit for EV purchases. However, you may qualify for the federal tax credit of up to $7,500, depending on the vehicle and your tax liability.

Are there charging station incentives for Florida EV owners?

Yes, some Florida utilities, like FPL and TECO, offer rebates for installing Level 2 home chargers or discounted electricity rates for off-peak charging. Check your provider’s website for current state of Florida electric car incentives programs.

Is HOV lane access allowed for electric cars in Florida?

Yes, Florida issues green decals for qualifying electric and hybrid vehicles, allowing solo drivers to use HOV lanes. The program is active until 2026, but vehicle eligibility requirements apply.

Do Florida counties or cities offer extra EV incentives?

Some local governments, like Miami-Dade and Orlando, provide additional perks such as free public parking or charging for EVs. These state of Florida electric car incentives vary by location, so verify with your city or county.

How do I apply for Florida’s EV registration fee reduction?

When registering your EV, the Florida DMV automatically applies the reduced registration fee—no separate application is needed. The discount is $25 for EVs and $12.50 for plug-in hybrids.