Powering Up Your Portfolio: Top Stocks to Cash In on the Electric Car Revolution

Investing your money can be a daunting task, especially if you’re new to the game. With so many strategies, types of investments, and outcome possibilities, it’s hard to know where to start. That’s why we’re here to make it easier by powering your portfolio.

Building a portfolio is all about finding the right balance between diversification, risk, and reward. It’s like creating a recipe- too much salt, and the dish is ruined; too little, and it will be bland. Together, we’ll find the perfect blend of investments that will leave you satisfied with your profits and secure in your future.

Let’s dive in and explore the world of investing, starting with powering your portfolio.

The Electric Car Revolution

The electric car revolution is upon us, and with it comes a wealth of investing opportunities. Many companies are already positioning themselves to benefit from the rise of electric vehicles, and savvy investors are taking notice. One such company is Tesla, which has quickly become a household name synonymous with electric cars.

Tesla has seen a surge in stock prices over the past year as more and more consumers embrace the idea of sustainable transportation. Other companies to watch include electric car manufacturers like NIO and XPeng, as well as battery producers like QuantumScape and Panasonic. With governments around the world pushing for more electric cars on the road, now is a great time to invest in the stocks that stand to benefit from this trend.

By doing so, you can not only support the growth of sustainable transportation, but also potentially earn solid returns on your investment.

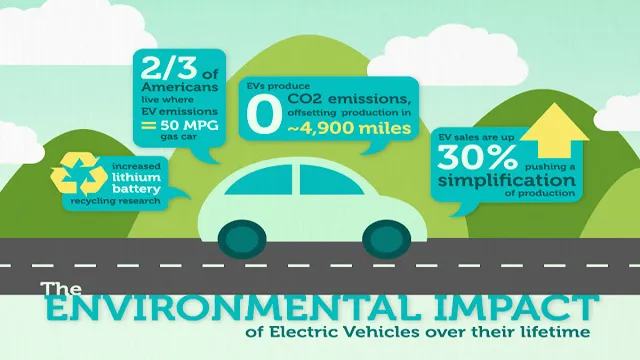

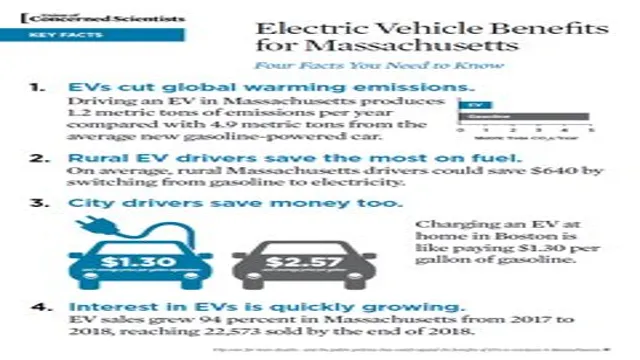

Growing Adoption of Electric Vehicles

The electric car revolution is happening right now, with growing adoption of electric vehicles (EVs) around the world. As more people become aware of the impact of traditional gasoline vehicles on the environment, and as technological advancements make EVs more affordable and reliable, the popularity of these cars is set to skyrocket. One major advantage of EVs is their efficiency: they can travel longer distances on a single charge than ever before, and some models can even recharge their batteries in a matter of minutes.

This means that EVs are becoming a viable option for people who need to travel long distances or need to charge their vehicles quickly. Another advantage of EVs is their smooth, quiet ride, which is both practical and enjoyable. With these benefits, it’s no wonder that the electric car revolution is gaining speed.

So, are you ready to join the movement and drive an eco-friendly car?

The Influence of Climate Change Regulations

The influence of climate change regulations is driving the electric car revolution, which is gaining momentum around the world. Governments are implementing policies that incentivize consumers to buy electric cars and penalize automakers that produce gas-guzzling vehicles. This has led to a surge in demand for electric cars, as consumers become more environmentally aware and seek greener modes of transportation.

The benefits of electric cars are manifold and include lower emissions, reduced noise pollution, and improved air quality. Additionally, electric cars are becoming cheaper and more efficient as technology improves, making them a practical alternative to traditional cars. As consumers become more aware of the benefits of electric cars, the demand for them is only set to increase, driving innovation and further technological advancements in the industry.

Supercharged Stock Picks

Are you looking to invest in the growing trend of electric cars but unsure which stocks to pick? Here are some top contenders that could give your portfolio a supercharged boost. First up, Tesla (TSLA), the pioneer of electric vehicles, continues to dominate the market with its sleek designs and advanced technology. Additionally, General Motors (GM) is investing heavily in electric cars, with a goal to have 30 electric models available by 202

Another contender is NIO (NIO), the Chinese electric vehicle company that’s been quickly gaining popularity due to its affordable prices and impressive performance. And let’s not forget about charging infrastructure companies such as ChargePoint (CHPT) and Blink Charging (BLNK), which will be crucial in supporting the growing number of electric vehicles on the road. By diversifying your portfolio with stocks that stand to benefit from the electric vehicle revolution, you could potentially reap the rewards of this rapidly expanding market.

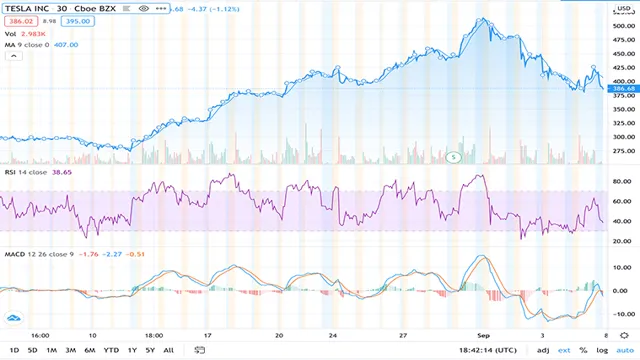

Tesla Inc. (TSLA)

Tesla Inc. (TSLA) has taken the electric car market by storm, and its stock has been supercharged as a result. The company has been on a meteoric rise, with its stock price increasing by over 1400% in the past five years.

Tesla’s unique approach to manufacturing electric vehicles has made it a leader in the industry, and investors have taken notice. In addition to its cars, Tesla also has several other products and services in the works that could further boost its stock price, such as its solar panels and energy storage solutions. While there are certainly risks associated with investing in any individual stock, Tesla’s innovative spirit and consistently strong financial performance make it an attractive option for investors looking to capitalize on the growing trend towards sustainable energy.

General Motors Company (GM)

General Motors Company (GM) is a stock that is worth considering for any investor looking for long-term growth. With the auto industry witnessing a strong resurgence, GM is well positioned to capitalize on the current market trend. The company has invested heavily in electric and self-driving vehicles, which is expected to contribute significantly to future growth.

GM’s latest earnings report showed impressive results, with revenue and net income exceeding Wall Street’s expectations. The company’s strong financial position and brand recognition make it an attractive investment option. To add to this, GM has also been investing in on-demand mobility services that are expected to offer profitable returns in the future.

Overall, investing in GM’s stock is certainly a supercharged pick with a potential for solid returns over time.

NIO Limited (NIO)

When it comes to investing in the electric vehicle market, one name that has been making waves is NIO Limited (NIO). This Chinese electric vehicle manufacturer has been experiencing a surge in its stock value, making it a hot pick for investors looking to ride the EV wave. With NIO already claiming a notable market share in China, and expanding its reach globally, analysts predict that its stock price will continue to grow.

However, as with any investment, there are risks to consider. It’s crucial to research thoroughly before investing and understand that the EV market is still in its early stages, with numerous factors such as government policies, technological advancements, and market competition that can impact the company’s performance. Therefore, having a well-rounded portfolio that spreads across different industries and sectors is crucial to mitigate risks and maximize returns.

Beyond the Auto Industry

While the electric car revolution has primarily impacted the auto industry, other sectors are seeing opportunities for growth as well. One such sector is the semiconductor industry. Electric cars use various electronic components, including sensors, processors, and memory chips, all of which are produced by semiconductor companies.

As the demand for electric cars continues to rise, so does the demand for these components. Companies such as Intel and Texas Instruments are well-positioned to benefit from this trend. Another industry that stands to gain from electric cars is renewable energy.

As more people switch to electric cars, the demand for charging stations also increases. Many of these stations are powered by renewable energy sources, such as solar or wind power. This presents a significant opportunity for companies that provide renewable energy solutions, such as Tesla’s SolarCity and SunPower Corporation.

As the electric car revolution continues to gain momentum, there are plenty of stocks to consider that go beyond the auto industry.

Battery Manufacturers for Electric Cars

Electric car battery manufacturers are not just limited to the auto industry. Beyond producing batteries for cars, these companies are also partnering with other industries to bring efficient and sustainable power alternatives. For instance, Tesla, one of the leading electric vehicle battery manufacturers, recently partnered with Southern California Edison to construct the world’s largest battery storage system for Southern California.

This project aims to combat energy shortages and reduce peak hour electricity consumption. Another battery manufacturer, Panasonic, is supplying batteries for the largest energy storage project in Europe, providing efficient energy solutions to the electricity grid. These efforts prove that battery manufacturers are not only contributing to the automotive industry but also to the overall sustainability of our planet.

Charging Station Networks for Electric Vehicles

As the world shifts towards greener energy solutions, electric vehicles are becoming increasingly popular. With this rise in demand, electric vehicle charging station networks are also popping up all over. However, charging station networks go beyond just the auto industry – they have the potential to impact our daily lives in a multitude of ways.

By providing convenient and accessible charging options for electric cars, these networks encourage people to make the switch to more sustainable modes of transportation. They also offer a great opportunity for businesses to attract eco-conscious customers by providing charging stations as an added amenity. Additionally, charging station networks could help reduce our reliance on non-renewable energy sources by encouraging the use of solar panels and battery storage technology.

The possibilities are endless, and it’s exciting to see how electric vehicle charging station networks will continue to evolve and impact our world in a positive way.

Bright Future for Electric Vehicle Stocks

Investors looking for stocks to benefit from the rise of electric vehicles should consider putting their money into companies like Tesla, NIO, and General Motors. These forward-thinking companies are at the forefront of the electric vehicle revolution and are poised to reap the rewards of this rapidly expanding market. Tesla, in particular, has become a household name and is widely regarded as the leader in the electric vehicle industry.

With their innovative approach to electric cars and renewable energy technology, it’s no surprise that Tesla’s stock has skyrocketed in recent years. Similarly, NIO has seen a surge in demand for their electric vehicles as more and more consumers are looking to switch to eco-friendly transportation. General Motors’ has also jumped on the electric vehicle bandwagon with the Chevy Bolt, further solidifying their position as one of the most promising stocks to benefit from the shift towards electric cars.

As the demand for electric vehicles continues to grow, these companies are poised for a bright future.

Conclusion

In conclusion, investing in stocks that benefit from the growing popularity of electric cars is a smart move. As the world continues to shift towards cleaner and more sustainable transportation, companies that provide key components for electric vehicles or develop charging infrastructure will likely see significant growth. So don’t get left behind in the gas-guzzling past– invest in the electrifying future with these stocks!”

FAQs

What are some stocks that can benefit from the rise of electric cars?

Some stocks that can benefit from the rise of electric cars include Tesla, NIO Inc., and BYD Company.

Will the shift towards electric cars have a significant impact on the stock market?

Yes, the shift towards electric cars is expected to have a significant impact on the stock market, particularly for companies that are involved in electric vehicle production, charging infrastructure, and battery technology.

What are some risks associated with investing in stocks related to electric cars?

Some risks associated with investing in stocks related to electric cars include high volatility, regulatory changes, and competition in the industry.

How can investors stay up-to-date with the latest developments in the electric car market?

Investors can stay up-to-date with the latest developments in the electric car market by following news and industry publications, attending conferences, and following relevant companies on social media.