Powering Up Your Portfolio: Top Stocks Set to Boost Profits from India’s Electric Car Boom

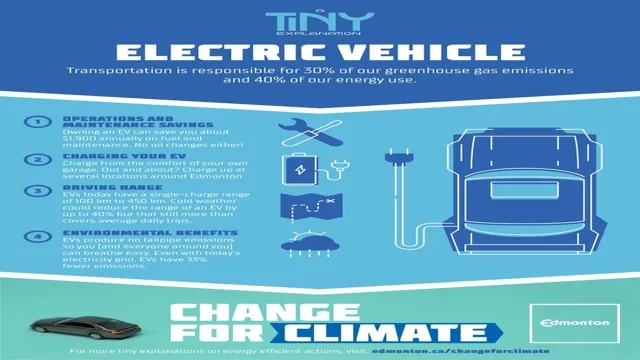

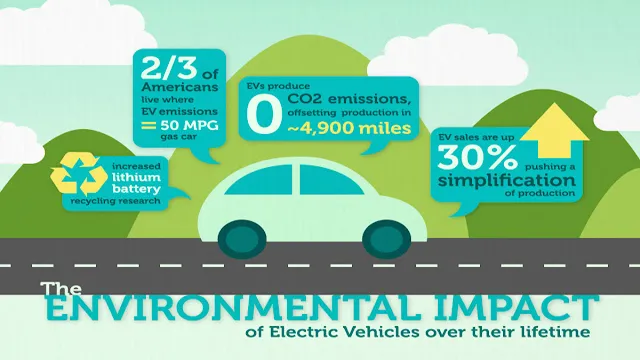

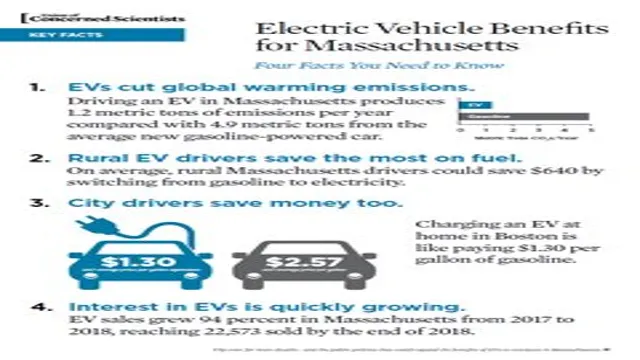

Electric cars are quickly gaining popularity, and for good reason. Not only are they environmentally friendly, but they are also cost-effective in the long run. With India set to become one of the world’s largest electric vehicle markets in the coming years, investors are looking for opportunities to invest in the sector.

If you’re interested in investing in the growth of electric vehicles in India, then you’ll want to consider some of the top electric car stocks. In this blog post, we’ll explore some of the best electric car stocks that are available in India, providing you with everything you need to know to make an informed investment decision. So buckle up and let’s get started!

Market Overview

With the current push towards electric transportation in India, several stocks are poised to benefit from this emerging trend. Specifically, companies involved in EV manufacturing, battery production, charging infrastructure, and renewable energy are expected to see substantial growth in the coming years. Tata Motors, one of India’s largest carmakers, has already introduced an electric vehicle, the Tata Tigor EV, which is gaining popularity in the country.

Similarly, players such as Mahindra & Mahindra, Ashok Leyland, and Hero Electric are making significant investments in EV technology. Battery manufacturers such as Exide Industries and Amara Raja Batteries could also see an uptick in demand as EVs require advanced lithium-ion batteries. Additionally, with the Indian government offering incentives and subsidies for EV purchases, the adoption rate is likely to accelerate rapidly.

As such, these stocks represent promising investment opportunities for those seeking exposure to the electric vehicle revolution in India.

Growth of Electric Cars in India

The growth of electric cars in India has been relatively slow compared to other countries around the world. A lack of infrastructure, particularly charging stations, has hindered the widespread adoption of electric vehicles in India. However, there has been a gradual shift towards electric cars as consumers become more environmentally conscious.

The Indian government has also been promoting the use of electric vehicles through various incentives, such as tax reductions and subsidies. This has resulted in an increase in the number of electric vehicles on the streets of India, with major automobile companies launching their electric models in the market. The demand for electric cars is expected to increase exponentially in the coming years, with analysts projecting an annual growth rate of around 36% until 202

While still a niche market, the potential for electric cars in India is enormous, as the country seeks to reduce its carbon footprint and meet its commitments to combat climate change.

Projected Market Share

Market Overview: Forecasted Market Share in the Upcoming Decade As businesses continue to innovate and expand their operations, the market landscape is constantly evolving. Companies are always looking for ways to gain an edge on their competitors, and understanding market share is a crucial aspect of this. Market share represents the percentage of total industry sales held by a company or group of companies.

In the upcoming decade, the global market share is projected to experience significant growth in various sectors, such as healthcare, technology, and e-commerce. As consumers’ preferences continue to shift, businesses need to stay ahead of the curve to retain their market share. Understanding the demographics, geography, and trends is key to success in this highly competitive landscape.

As more players enter the market, businesses need to invest in research and development, marketing, and building a strong brand to stay relevant. By keeping an eye on the projected market share and trends, companies can stay ahead of the game and remain competitive for years to come.

Best Electric Car Stocks

If you’re looking for stocks to benefit from the electric car industry boom in India, you’re in luck. There are several promising options to consider. One of the top contenders is Tata Motors, with their electric car subsidiary, Tata Power.

They have been investing heavily in renewable energy sources, including electric vehicles, and are poised to benefit from India’s ambitious goal of using only electric vehicles on their roads by 2030. Another option to consider is Mahindra & Mahindra, who have already established themselves as a leader in the electric vehicle market with their e2o model. These two companies are just the tip of the iceberg when it comes to investing in the electric car industry in India.

As more and more people switch to electric vehicles, companies that provide the infrastructure and technology for these vehicles will undoubtedly benefit. Keep your eye on the market and look for companies that are committed to innovation and sustainability.

Tata Motors Limited (TML)

If you’ve been keeping an eye on the electric vehicle (EV) industry, you’ll know that Tata Motors Limited (TML) is one of the leading players in the market. As one of the biggest automobile manufacturers in India, TML’s EV offerings include the Tata Nexon and the Tata Tigor, both of which have received positive reviews for their performance and design. What makes TML stand out from the competition is their commitment to sustainability and innovation.

For example, they recently launched the Ziptron technology platform, which promises to offer a superior driving experience, longer range, and better battery life. With the global shift towards renewable energy and the growing demand for EVs, TML is well-positioned to become one of the biggest players in the market. If you’re interested in investing in electric car stocks, TML is definitely worth considering.

Mahindra & Mahindra Limited (M&M)

When we talk about investing in the future of electric vehicles, one of the first companies that come to mind is Mahindra & Mahindra Limited (M&M). This Indian multinational corporation has been making strides in the EV market, particularly with the launch of their all-electric SUV, the eKUV100. While the company is primarily known for its automotive division, they are also making significant investments in other areas, such as renewable energy and clean technology.

One thing that sets Mahindra apart from other EV companies is their commitment to sustainability. They have implemented eco-friendly manufacturing processes and are working towards reducing their carbon footprint. For investors looking for a long-term option in the EV market, Mahindra is certainly a company to watch.

Exide Industries Limited (EIL)

Exide Industries Limited (EIL) Exide Industries Limited (EIL) has emerged as one of the best electric car stocks in recent times. The company has been at the forefront of providing batteries for electric cars and has been successful in carving a niche for itself in this space. The increasing demand for electric cars has further boosted the market for Exide Industries Limited.

The company has invested heavily in research and development to keep pace with the changing landscape of the industry. They have also made strategic partnerships to collaborate with other players in the market. Exide Industries Limited boasts of a diversified product portfolio and is well-positioned to cater to the needs of the electric car industry.

The company’s commitment to sustainability and reducing carbon footprint has won them accolades and support from environmentally-conscious consumers. With the growing trend towards electric cars, Exide Industries Limited is definitely a stock to watch out for.

Investing in Electric Car Stocks

If you’re considering investing in electric car stocks in India, you should definitely check out Tata Motors. The company is one of the largest manufacturers of electric vehicles in the country and continues to expand its product offerings to meet the increasing demand for EVs. With the Indian government’s push towards reducing carbon emissions and promoting electric vehicles, Tata Motors is poised for significant growth in the coming years.

Another promising stock to consider is Mahindra & Mahindra, which owns a majority stake in Reva Electric, one of India’s leading EV manufacturers. The company has been investing heavily in research and development of electric and hybrid vehicles, positioning itself as a major player in the EV market. By investing in these stocks, you’ll not only be supporting the adoption of cleaner energy in India, but you’ll also have the potential for significant financial returns as the electric vehicle market continues to gain momentum.

Factors to Consider

Investing in electric car stocks can be a profitable venture, but it’s important to consider a few factors before taking the plunge. One of the most crucial factors to consider is the success and growth potential of the electric car industry as a whole. With the push towards sustainable energy and the increasing demand for electric cars, the industry is set to see significant growth in the coming years.

Another factor to consider is the specific company you’re looking to invest in and their track record when it comes to developing and producing electric cars. Companies with a proven track record and strong future plans are typically better investments. Additionally, it’s crucial to keep an eye on government regulations and incentives related to electric cars, as they can heavily impact the success of the industry and individual companies.

Overall, investing in electric car stocks can be a smart move, but only if you take the time to research and consider these important factors.

Potential Risks

While investing in electric car stocks has the potential for significant returns, it also comes with potential risks. One major factor to consider is the competitive nature of the industry. As more and more companies enter the electric car market, there is a risk of oversaturation and price competition.

Another risk to consider is the potential for changing government regulations, which may impact the growth and profitability of electric car manufacturers. Additionally, while the demand for electric cars is on the rise, it is still uncertain how quickly the market will fully adopt electric cars over traditional gasoline-powered vehicles. Investors should also consider the financial stability and track record of the specific electric car manufacturers before investing.

Overall, while there is potential for high returns in the electric car industry, investors should carefully weigh the risks before making any investment decisions.

Conclusion

So, as India gears up for the electric car revolution, investors have a golden opportunity to capitalize on this shift by choosing the right stocks. From battery makers to charging infrastructure providers, the market is ripe with possibilities for those with a keen eye for profitable investments. With this in mind, it’s clear that the electrification of India’s transport sector is not only good news for the environment but also for savvy investors looking for the next big thing.

So, let’s charge ahead and invest in the bright future of electric cars in India!”

FAQs

What are some Indian companies that are poised to benefit from the rise of electric cars in the country?

There are several companies in India that are likely to see a boost from the growing electric car market, including Tata Motors, Mahindra & Mahindra, Hero Electric, and Bajaj Auto.

Are there any specific stocks in the electric car industry that investors should consider in India?

Some potential stocks to watch in the Indian electric car market include Exide Industries, Ashok Leyland, and Bharat Forge.

How is the Indian government supporting the growth of electric cars in the country?

The Indian government has implemented several policies to promote the use of electric vehicles, including tax breaks, subsidies, and incentives for manufacturers and buyers.

What are some of the biggest challenges facing the electric car industry in India?

Challenges for the Indian electric car market include a lack of infrastructure such as charging stations, high battery costs, and consumer hesitancy to switch from traditional vehicles.