Electrify Your Savings: Unlocking Tax Benefits for Electric Cars

Electric cars are becoming more popular with each passing day, and there are various reasons why. Sure, they offer a quieter ride and eliminate the need for gasoline, which is better for the environment. However, did you know that owning an electric car can also provide some significant tax benefits? That’s right.

If you’re a taxpayer, you could potentially save thousands of dollars on your tax bill by investing in an electric vehicle. In this blog post, we’re going to break down some of the major tax benefits of owning an electric car and show you why it may be a smart financial move.

Federal Tax Credit

If you’re considering purchasing an electric car, one of the biggest financial advantages to keep in mind is the federal tax credit. This tax benefit for electric cars can potentially save you thousands of dollars on your income taxes. However, it’s important to note that not every electric vehicle is eligible for this credit.

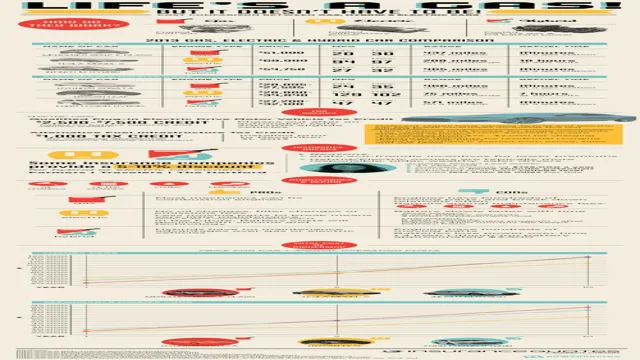

In order to receive the full credit amount, which can be up to $7,500 depending on the model, the EV must meet certain qualifications. These include having a battery capacity of at least 5 kWh and being manufactured by a qualifying automaker. It’s also worth mentioning that this tax credit begins to phase out once an automaker sells over 200,000 qualifying vehicles in the US.

So, if you’re in the market for an electric car, be sure to do your research and check if the model you’re interested in qualifies for this valuable tax benefit.

Up to $7,500 tax credit for qualified vehicles

If you’re in the market for a new car and looking to save some money, then you might be interested in the federal tax credit for qualified vehicles. This tax credit can save you up to $7,500 on your new purchase, depending on the make and model of the vehicle. It’s important to note that not all electric vehicles qualify for this credit, so it’s essential to do your research before making a purchase.

Typically, vehicles with larger battery packs and longer driving ranges will have a higher tax credit, while smaller vehicles with shorter ranges will have a lower credit. The federal tax credit can be a significant incentive for those looking to purchase an electric vehicle, and it’s worth considering when shopping around. Keep in mind that this credit might not be around forever, so take advantage of it while you can and reap the benefits of a new, efficient vehicle on the road.

Phases out after the first 200,000 vehicles of each manufacturer sold in the US

Federal Tax Credit If you’re considering buying an electric vehicle, you may have heard of the Federal Tax Credit. This credit is a financial incentive offered by the US government to encourage people to buy electric vehicles and reduce their carbon footprint. However, it’s important to note that the credit phases out after the first 200,000 vehicles of each manufacturer are sold in the US.

This means that if you’re interested in a Tesla or GM electric car, you may not be eligible for the credit. If you are eligible, the amount of the tax credit varies based on the battery capacity of the vehicle and your tax liability. For example, if you buy a electric vehicle with a 75 kWh battery and have a tax liability of $7,500, you may receive the full tax credit.

However, if your tax liability is only $5,000, you would only receive a $5,000 tax credit. It’s important to consult with a tax professional to determine if you’re eligible for the Federal Tax Credit and how much you may be able to receive.

State Incentives

One of the most significant incentives that electric car buyers can take advantage of is the tax benefit. The tax benefit for electric cars is a great way to offset the higher price of electric cars. The federal government offers a tax credit of up to $7,500 for the purchase of electric vehicles.

This credit can be applied to the buyer’s federal income tax bill in the year of purchase or lease. Additionally, many states offer their incentives for electric vehicle buyers, which can vary significantly. Some states offer rebates of up to $5,000, while others offer exemptions from sales taxes or other fees.

It’s important to research the incentives available in your state to maximize the benefits of owning an electric vehicle. By taking advantage of these tax benefits, electric car buyers can reduce their costs and make the switch to a more sustainable and efficient form of transportation.

Various state-level incentives available

When it comes to incentivizing the adoption of clean energy, several states across the US offer various programs that can provide significant cost savings for businesses and homeowners alike. For example, the state of California offers a Solar Initiative Rebate Program, which provides cash back incentives to customers who install solar panels for their homes or businesses. Massachusetts offers a similar program in the form of the Solar Loan Program, which provides interest-free loans to eligible residents who want to purchase and install solar systems.

In addition to these state-level incentives, many local governments also offer additional tax credits and rebate programs, which can further incentivize the adoption of clean energy technologies. While the specific details of these programs may vary from state to state, the overall goal remains the same: to encourage the adoption of clean energy technologies and help reduce our carbon footprint. By taking advantage of these state-level incentives, businesses and homeowners can not only save money but also contribute to a more sustainable future for generations to come.

Check your state’s regulations online

If you’re considering purchasing an electric or hybrid vehicle, you may be eligible for state incentives to help offset the cost. But the incentives available can vary widely depending on where you live. That’s why it’s important to check your state’s regulations online to see what benefits are available.

Some states offer tax credits or rebates for purchasing an eligible vehicle, while others may provide HOV lane access or free parking. In addition, some states offer incentives for installing EV charging stations in your home. By taking the time to research what your state offers, you could save thousands of dollars on your next vehicle purchase and contribute to a more sustainable future.

So, be sure to check your state’s regulations online before making your decision.

Additional Savings

One significant benefit of owning an electric car is the tax break that comes with it. The government offers tax incentives to those who purchase electric cars, which can significantly reduce the car’s sticker price. The tax credit amount varies depending on the car’s battery size, but it can range from $2,500 to $7,500.

This tax break can be used to offset some of the costs associated with purchasing an electric car. Additionally, some states offer additional incentives, such as free charging or reduced tolls, which can further decrease expenses. Overall, owning an electric car not only saves money on gas but also provides tax benefits that can make it a more affordable and attractive option for eco-conscious drivers.

Lower fuel and maintenance costs

Lower fuel and maintenance costs are some of the most significant advantages of owning an electric vehicle (EV). Not only do EVs consume less energy than their gasoline-powered counterparts, but they also require less maintenance. EVs don’t have the same complex system of engines, fuel pumps, and exhaust systems that traditional cars do, which means there are fewer parts to break down or wear out.

Another bonus is that electric motors have fewer moving parts that require regular maintenance, and they do not need oil changes. By changing to an EV, you will have peace of mind from saving on the high costs of fuel and keeping your car maintained.

Reduced carbon footprint

Reduced carbon footprint When it comes to reducing your carbon footprint, the benefits go beyond just helping the environment. It can also lead to additional savings for you and your business. By implementing eco-friendly initiatives such as reducing water usage, energy-efficient lighting, and recycling programs, you can lower your operating costs.

For example, switching to LED lights can lead to savings on your electricity bills. Additionally, recycling programs can reduce waste disposal costs. By reducing your carbon footprint, you’re not only doing your part to help the environment but also improving your bottom line.

So, why not implement some simple initiatives and reap the benefits of a reduced carbon footprint?

Conclusion

In conclusion, the tax benefits for electric cars can be summed up in three words: “green, clean, and mean.” Not only do they help reduce our carbon footprint and promote a healthier planet, but they also save us money in the long run through lower fuel and maintenance costs. So, why not make the switch to an electric vehicle and enjoy the benefits of a more sustainable, cost-effective lifestyle? It’s a win-win situation for both you and the environment.

FAQs

What is the tax benefit for buying an electric car?

The tax benefit for buying an electric car varies by country and region. In the United States, buyers of electric cars may be eligible for a federal tax credit of up to $7,500.

Are there any state-specific tax benefits for electric cars?

Many states in the United States offer additional tax benefits for electric car buyers, such as tax credits, reduced registration fees, or exemption from toll charges.

Is the tax benefit for electric cars applicable only for new cars?

In most cases, the tax benefit for electric cars is applicable only for new cars. However, some regions may offer incentives for purchasing used electric cars as well.

How can I claim the tax benefit for my electric car?

To claim the tax benefit for your electric car, you need to file your taxes using form 8936 with the Internal Revenue Service (IRS) in the United States. Other countries may have different filing procedures. It is best to consult with a tax professional or the local government agency for guidance.