Reaping the Rewards: Why Buying an Electric Car Can Save You Thousands in Tax Benefits

Are you curious about the tax benefits of electric cars? As the world is becoming more environmentally conscious, electric cars have gained popularity in recent years. Not only are they eco-friendly, but they also offer several tax incentives that benefit consumers who opt for an electric vehicle. Surprisingly, there is more to the tax benefits of electric cars than just a reduced carbon footprint.

In this blog, we will dive into the exciting world of electric vehicles and uncover the plethora of tax benefits that they offer. Whether you’re an eco-conscious driver or someone who wants to save a few bucks on taxes, this blog is for you. So, buckle up and let’s explore the tax benefits of electric cars together!

Reduced Income Tax

One of the biggest tax benefits of buying an electric car is reduced income tax. If you are someone who is looking for ways to save money on taxes, purchasing an electric car may be the way to go. The government believes in promoting the use of energy-efficient vehicles, which is why they offer tax benefits for those who make the switch.

When you purchase an electric car, you can receive a federal tax credit of up to $7,500, depending on the model and make. This credit can significantly reduce your taxable income, helping you save money on your tax bill. In addition to the federal credit, some states also offer tax incentives for electric vehicle owners.

Check with your local government to see what options are available to you. Overall, buying an electric car can not only benefit the environment, but it can also benefit your wallet come tax season.

Lower EV Cost and Federal Tax Credit

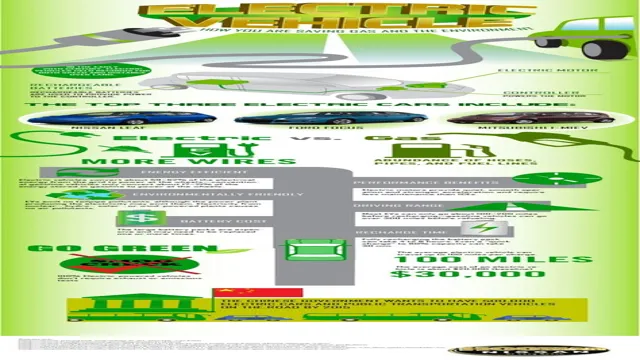

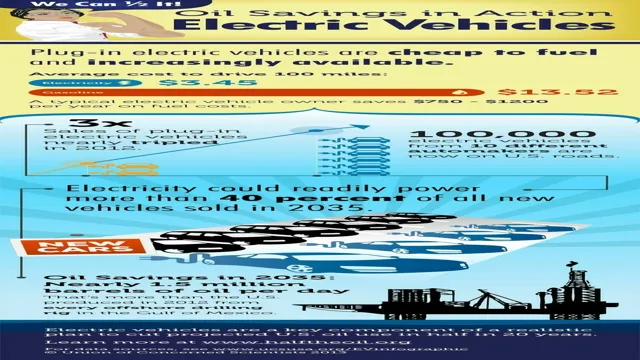

One of the biggest advantages of purchasing an electric vehicle (EV) is the significant reduction in operating costs. The cost of electricity is generally much lower than gasoline or diesel, and maintenance costs are typically much lower as well. However, the upfront cost of purchasing an EV can be a bit higher than a traditional vehicle.

Fortunately, the federal government offers a tax credit to help offset this cost. The amount of the tax credit varies based on the make and model of the vehicle, but it can be quite substantial. In addition, some states offer their own incentives for purchasing an EV, such as rebates or tax credits.

While every individual situation is different, these incentives can make owning an EV more financially feasible for many people. By taking advantage of these incentives, you can enjoy the benefits of driving an electric vehicle while also saving money in the process.

State Incentives and Rebates

State incentives and rebates can be a significant financial benefit for individuals and businesses. One of the most common incentives is a reduced income tax. These tax benefits can vary significantly depending on which state you live in, so it is crucial to research eligibility criteria and application processes.

Some states may require you to meet income thresholds or purchase specific goods or services to qualify for the tax benefits. However, the effort may be worth it, as the reduced income tax can significantly decrease your tax burden and even provide additional funds to invest in your home or business. In some cases, states may offer tax credits for renewable energy investments or specific healthcare expenditures, providing additional incentives for sustainable and health-conscious decisions.

It is essential to take advantage of these incentives and rebates as they can help you save money, support valuable initiatives, and contribute to a better future for us all.

Sales Tax Exemptions

If you’re considering purchasing an electric car, one of the tax benefits you may be eligible for is a sales tax exemption. In some states, electric cars are exempt from state sales tax, which can result in significant savings for the buyer. For example, in California, electric cars are exempt from state sales tax, which can save buyers up to $7,500 on a $50,000 car.

Other states with similar sales tax exemptions include Oregon, Colorado, and Washington. It’s important to note that sales tax exemptions for electric cars vary by state, and the eligibility criteria may also differ. So before you make your purchase, be sure to check with your state government to find out what tax benefits you may be eligible for.

Not only will you save money on sales tax, but you’ll also enjoy the many other benefits of owning an electric car, including lower fuel and maintenance costs, reduced carbon emissions, and a smoother and more responsive driving experience.

State-by-State Coverage

When it comes to sales tax exemptions, each state has its own set of rules and regulations. Understanding the specific exemptions in your state can save your business money in taxes. For example, in New York, clothing and footwear priced less than $110 are exempt from sales tax, while in Louisiana, prescription drugs, certain food items, and certain manufacturing equipment are exempt.

In California, there are no sales tax exemptions for businesses that primarily sell services rather than tangible goods. It’s important to stay up-to-date on any changes to your state’s sales tax exemptions, as they can impact your bottom line. By taking advantage of the exemptions available to you, you can lower your tax burden and keep more money in your business.

Lower Maintenance and Operating Costs

If you are considering purchasing an electric car, you may be pleasantly surprised to learn about the tax benefits that come with it. One of the most significant advantages is the potential tax credit. The federal government offers a tax credit up to $7,500 when you purchase an electric car, which reduces your overall tax liability.

Additionally, some states offer additional incentives such as tax exemptions, reduced registration fees, and access to high-occupancy vehicle lanes. Not only do electric cars provide tax benefits, but they also offer lower maintenance and operating costs. With fewer moving parts, electric cars require less maintenance than gas-powered vehicles and have lower fuel costs.

While the initial purchase price may be higher, the long-term savings from lower maintenance costs and tax benefits can make electric cars a more affordable option over time. Overall, buying an electric car not only benefits the environment but also your wallet.

Cost Savings on Fuel and Maintenance

As a business owner, you’re always looking for ways to make your operations more cost-effective. One way to achieve this is by reducing your fuel and maintenance costs. With the rise of fuel prices, it becomes essential to look for vehicles that offer better fuel economy.

This is where electric vehicles come in. They are not only environmentally friendly, but they also offer lower operating costs because they don’t use gasoline or diesel. Additionally, electric vehicles require minimal maintenance because they have fewer moving parts than traditional gas-powered vehicles.

This means you won’t have to spend as much money on oil changes, tune-ups, and other maintenance tasks. Switching to electric vehicles is a smart move that can save your business a significant amount of money in the long run. So, why not make the switch and reap the cost-saving benefits yourself?

Less Frequent Servicing

When it comes to maintaining and operating a vehicle, costs can add up quickly. However, with advancements in technology, there are ways to reduce these costs. One way is through less frequent servicing.

Some vehicles now require servicing after longer intervals, such as every 10,000 miles instead of the usual 5,000 miles. This means fewer trips to the mechanic and lower maintenance costs overall. Additionally, it can help to choose a vehicle with parts that have a longer lifespan, such as spark plugs and timing belts.

By investing in a vehicle with these features, you can save money on regular maintenance and repairs in the long run. Overall, less frequent servicing leads to lower maintenance and operating costs, which can benefit both your wallet and the environment.

Environmental Benefits

Buying an electric car comes with a number of environmental benefits, one of which is the tax benefit that can be claimed by owners. In many countries, tax credits and incentives are offered to those who purchase electric vehicles, with some offering up to $7,500 in federal tax credits in the United States. This means that not only do drivers save money on fuel costs, but they can also receive a significant tax benefit.

Additionally, electric cars emit less pollution and greenhouse gases compared to traditional fossil-fuel powered cars, helping to reduce air pollution and combat climate change. This is because electric cars do not release emissions from their tailpipes, but rather generate electricity from batteries. As more people switch to electric vehicles, the impact on the environment will only continue to improve, making the purchase of an electric car a wise decision both financially and environmentally.

So, not only can you save on fuel expenses, but you can also positively contribute to the environment while enjoying tax benefits.

Reduced Carbon Footprint

Reducing our carbon footprint has become increasingly important in recent years due to the effects of climate change on our planet. By taking steps to reduce our carbon emissions, we can help to protect the environment and preserve it for future generations. There are numerous environmental benefits to reducing our carbon footprint, including reducing air pollution, improving water quality, and preserving natural habitats.

By using renewable energy sources such as solar, wind, and hydroelectric power, we can significantly reduce our reliance on non-renewable fossil fuels that contribute to greenhouse gas emissions. Additionally, reducing our energy consumption through energy-efficient technologies and practices can help to decrease our overall carbon footprint. By taking small steps to reduce our carbon footprint, we can contribute to a healthier and more sustainable planet for ourselves and future generations.

Local Emissions Reductions

Local emissions reductions can have numerous environmental benefits. By reducing the amount of harmful pollutants released into the air, we can improve the air quality in our communities. This, in turn, can lead to fewer health issues caused by respiratory problems and other related illnesses.

Additionally, reducing emissions can help combat climate change by lowering greenhouse gas levels. This is especially important on a local level, as cities and towns can play a crucial role in reducing emissions. By investing in renewable energy sources and implementing sustainable practices, we can create a more environmentally friendly community.

Imagine a community that has green spaces that give out fresh air and kids can play without getting sick, that’s the type of community we can create with a concerted effort. It takes a collective effort from all members of the community to make this happen. Even small changes can make a big difference in the long run, and by working together, we can achieve a healthier and more sustainable environment for future generations.

Conclusion

In conclusion, buying an electric car not only benefits the environment but also provides a slick tax advantage. Not only will you be reducing your carbon footprint, but you’ll also be driving away with a few extra bucks in your pocket. So why not make the switch to electric? Your wallet and the earth will thank you.

“

FAQs

What tax benefits do I get for buying an electric car?

You may be eligible for a federal tax credit of up to $7,500 and additional state or local incentives for purchasing an electric vehicle.

Do all electric cars qualify for tax benefits?

No, only electric cars that meet specific criteria set by the government are eligible for tax benefits.

Can I claim tax benefits for both buying and leasing an electric car?

Yes, you may be eligible for tax benefits whether you purchase or lease an electric car, but the amount of credit may vary.

What do I need to do to claim the tax credit for my electric car?

You will need to file IRS Form 8936 along with your tax return and provide proof of purchase or lease agreement as well as the vehicle’s VIN number.