Drive into Savings: How Electric Cars Offer Major Tax Benefits

Electric cars are becoming increasingly popular in the world of transportation, and it’s not just because they are good for the environment. Driving an electric car can also have tax benefits that are worth considering. As electric cars continue to gain popularity, governments around the world are taking notice and providing incentives to encourage the shift towards electric vehicles.

From income tax credits to sales tax exemptions, there are various kinds of tax benefits available to electric car owners. If you’re considering buying an electric car, it’s important to understand the tax benefits you can expect and how they can benefit you financially. In this blog post, we’ll take a closer look at the tax benefits of electric cars and why they matter.

Federal Tax Credits

If you’re considering purchasing an electric car, you could be eligible for some significant tax benefits. Federal tax credits are available for electric vehicles, with some models even qualifying for up to $7,500 in credit. This is a great way to offset the cost of a new car while also doing your part to reduce your carbon footprint.

It’s important to note, however, that tax credits are subject to certain limitations and requirements. For example, the car must have a battery pack with at least 5 kilowatt-hours of capacity, and the credit amount will phase out once a manufacturer has sold more than 200,000 qualifying vehicles. To take advantage of these benefits, you’ll need to file Form 8936 with your tax return.

Overall, the tax benefit of an electric car can make switching to a more environmentally friendly vehicle even more appealing.

Up to $7,500 tax credit for electric car purchase

Are you considering buying an electric car? If so, you might be eligible for a federal tax credit of up to $7,500! The government offers this credit in an effort to encourage consumers to switch to more environmentally-friendly vehicles. To qualify for the credit, your electric vehicle must have a battery capacity of at least 5 kilowatt-hours, and you must purchase the vehicle new (not used). The credit amount is based on the battery capacity and the manufacturer of the vehicle.

For example, a Tesla Model S would qualify for the full $7,500 credit, while a Nissan Leaf would only qualify for $2,500. It’s important to note that this credit is not a cash rebate, but rather a reduction in your federal income tax liability. So, if your tax liability is only $5,000 and you qualify for the full $7,500 credit, you will not receive a check for the difference.

However, you can carry over any unused portion of the credit to future tax years. Overall, the federal tax credit for electric vehicles can be a significant financial incentive to make a more sustainable transportation choice.

Additional state-level tax incentives

Federal Tax Credits Apart from the federal tax credits, there are some additional state-level tax incentives that can help you save money on your tax bills. These incentives vary greatly by state and the industries they target, but they are worth exploring if you are looking for ways to lower your tax bill. Some common state-level tax incentives include enterprise zones, job creation tax credits, and research and development tax credits.

Enterprise zones are designated geographical areas that offer tax incentives to businesses that locate or expand within those areas. Job creation tax credits, as the name implies, provide credits to businesses that create more jobs in the state. Research and development tax credits, on the other hand, are meant to encourage research and development activities within a state.

If you are a small business owner, it may also be worth checking if there are any state-specific incentives or grants available that you could take advantage of. Overall, these state-level tax incentives provide an additional layer of savings for businesses and individuals, helping them keep more of their hard-earned money.

Lower Operating Costs

Are you contemplating buying an electric car? In addition to the environmental benefits, there are also several tax benefits of owning one. The most notable tax benefit is the potential savings in operating costs. Electric cars have lower operating expenses than traditional cars, and some states offer incentives such as tax credits to encourage their purchase.

For example, in California, electric vehicle owners can get a rebate of up to $2,000. Additionally, electric cars have fewer moving parts, which means less maintenance and repairs that would otherwise be costly. Lastly, some cities offer free parking or reduced rates for electric cars, which reduces the overall cost of ownership.

So why not consider investing in an electric car and enjoy the tax benefits and lower operating costs that come with it? It’s a win-win situation.

No federal gas tax on electric cars

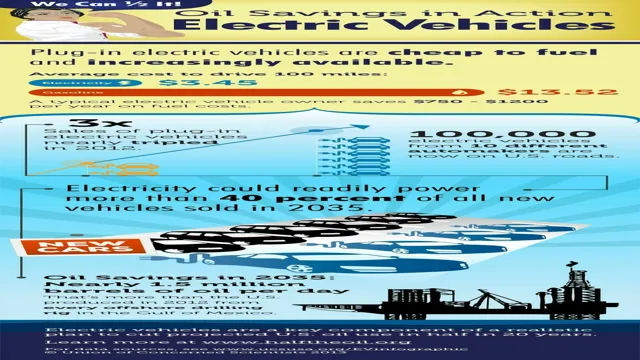

One of the benefits of owning an electric car is the lower operating costs. The federal gas tax, which adds approximately 18 cents per gallon of gas purchased, does not apply to electric cars. This means that not only do electric cars not require gasoline, but they also do not need to pay the gas tax, resulting in significant savings over time.

Additionally, electric cars have fewer moving parts than traditional gas-powered cars, which means that maintenance costs are lower as well. While the initial purchase price of an electric car may be higher, the long-term savings from lower operating costs can make it a more cost-effective choice in the end. So, if you’re looking to save money on transportation costs in the long-run while also reducing your carbon footprint, an electric car may be a smart choice for you.

Lower maintenance and fuel costs

Lower operating costs are a huge benefit to owning a vehicle. One of the key ways to achieve this is by opting for a car that has lower maintenance and fuel costs. These types of cars are typically designed to be efficient and require fewer repairs over time, meaning that you’ll spend less money on upkeep and maintenance.

Additionally, lower fuel costs mean that you’ll save money when filling up at the gas pump. This can add up over time, and can make a big difference in your budget. By choosing a car that is designed with lower operating costs in mind, you can enjoy all the benefits of owning a vehicle without breaking the bank.

So, if you’re looking for a way to save money on your car, consider investing in a make and model that prioritizes efficiency and durability. Not only will you save money in the long run, but you’ll also be doing your part for the environment by reducing your carbon footprint.

Business and Corporate Benefits

Owning an electric car can bring several tax benefits to businesses and corporations. First of all, the government offers various incentives for electric vehicle owners, including tax credits and deductions. For instance, businesses are eligible to claim up to $7,500 in federal tax credits for every new electric car purchased.

Additionally, electric cars can also bring other financial benefits, such as lower fuel and maintenance costs. Since electric cars do not require gasoline, businesses can save a significant amount of money on fuel expenses. Moreover, electric cars generally require less maintenance compared to traditional gasoline engines, reducing maintenance costs even further.

All of these benefits combined make owning electric cars an attractive option for businesses and corporations looking to save money while reducing their carbon footprint.

Tax deductions and credits for electric car usage in business

As businesses are becoming more environmentally conscious, electric cars have become an attractive option to not only reduce their carbon footprint but to also benefit from tax deductions and credits. One of the significant benefits of using an electric car for business purposes is the federal tax credit, which can range up to $7,500, depending on the car’s battery capacity. Additionally, businesses are eligible for state tax credits, which can add up to the money saved in federal credit.

Electric car usage in business can also result in tax deductions for charging stations and electricity used to charge the vehicle. These deductions can be up to 30% of the installation costs and the electricity bill. In conclusion, adopting electric cars for business purposes can be an environmentally conscious decision and has significant financial benefits, including federal and state tax credits and deductions for charging stations and electricity used to charge the vehicle, making it an appealing option for business owners.

Lower taxable income from electric car fleet usage

Electric cars are becoming increasingly popular worldwide, and there are significant benefits for businesses and corporations that use them as their primary mode of transport. One of the most notable advantages is the potential reduction of taxable income. By investing in electric vehicles as part of their fleets, companies can take advantage of government incentives and tax credits.

Moreover, electric cars have lower operating costs compared to traditional gasoline-powered vehicles, which means companies can save on fuel and maintenance expenses. Consequently, reducing taxable income can help businesses and corporations save more money, promote sustainability, and keep employees and customers happy. By opting for electric cars in their fleets, businesses can make a significant difference in the world while enjoying the economic benefits that these vehicles provide.

Environmental Benefits

One of the biggest environmental benefits of owning an electric car is the tax benefit. The government offers a federal tax credit of up to $7,500 for purchasing an electric vehicle. Some states also provide additional incentives to encourage the switch to EVs.

By offering these types of incentives, the government hopes to motivate consumers to purchase electric cars, which ultimately leads to a reduction in greenhouse gas emissions and other forms of pollution. In addition to the tax credit, electric cars also produce zero emissions, which means they do not contribute to air pollution and can help to reduce the carbon footprint. Not only is this good for the environment, but it also helps to improve public health and reduce healthcare costs.

Overall, the tax benefit of electric cars is just one way in which consumers can make a positive impact on the environment while saving money at the same time.

Reduced carbon emissions and pollution

Reducing carbon emissions and pollution benefits not only the environment but also human health. The decrease in harmful greenhouse gases and pollutants in the air leads to better air quality overall. This means fewer cases of respiratory illnesses, asthma attacks, and heart diseases.

Additionally, reducing carbon emissions helps combat climate change, which has long-term effects on the planet and its inhabitants. By using environmentally friendly practices and technologies, such as renewable energy sources and electric vehicles, we can make significant progress in reducing our carbon footprint and preserving the earth for future generations. Ultimately, by prioritizing sustainability and reducing our impact on the environment, we are investing in a healthier and safer future for ourselves and the planet.

Conclusion

In conclusion, the tax benefit of driving an electric car is truly electrifying! Not only are you saving money on gas, but you’re also saving money on taxes. With federal and state tax incentives, the financial benefits of owning an electric vehicle can add up quickly. Not to mention, you’re also doing your part in reducing carbon emissions and protecting the environment.

It’s a win-win situation for both your wallet and the planet. So why wait? Make the move to an electric car and start reaping the benefits today!”

FAQs

What tax benefits do electric cars offer?

Electric cars offer a federal tax credit of up to $7,500, depending on the car’s battery size and range. Additionally, many states offer their own tax incentives for electric vehicle owners.

Do electric car tax credits apply to both new and used vehicles?

No, the federal tax credit only applies to new electric vehicles. However, some states offer tax incentives for the purchase of used electric vehicles.

Can businesses also receive tax benefits for purchasing electric vehicles?

Yes, businesses can take advantage of a federal tax credit of up to $7,500 for each electric vehicle they purchase. Additionally, the cost of charging stations and infrastructure can also be eligible for tax credits.

Are there any income limitations for claiming the electric car tax credit?

No, there are no income limitations for claiming the federal tax credit for electric vehicles. However, some state-level incentives may have income restrictions.