Going Green with Your Wallet: Exploring the Tax Benefits of Electric Cars

Have you been considering making the switch to an electric car but are unsure about the financial benefits? It’s no secret that electric cars have numerous environmental advantages, but did you know that they also offer significant tax benefits? In this blog, we’ll dive into the tax benefits of electric cars and how you can take advantage of them. Think of it like having a personal ATM machine that dispenses cash every time you plug in your car! So let’s buckle up and explore the financial perks of going electric.

Why Electric Cars Come with Tax Benefits

Tax benefit of electric cars is an attractive incentive for car owners to switch to eco-friendly technology. Governments around the world offer tax credits and deductions for electric vehicle purchasers, making them a more cost-effective option than traditional gasoline-powered cars. These tax benefits vary from country to country and from state to state, but they all have one common goal: to encourage people to make the switch to cleaner and more efficient transportation.

The tax credit can range from a few thousand to several thousand dollars, making it a significant reduction in the overall cost of the car. Simply put, the tax benefit of electric cars can offset the higher upfront cost of purchasing an EV as compared to a traditional car. Additionally, this incentive helps to mitigate the climate change crisis by reducing greenhouse gas emissions, proving to be beneficial for the environment and our planet in the long haul.

Ultimately, these tax benefits aim to support the shift towards sustainable transportation in the global community.

Federal EV tax credit

Electric cars have become increasingly popular in recent years, due in part to the federal EV tax credit. The tax credit is a financial incentive for consumers to purchase an electric vehicle, helping to offset the higher initial cost. This credit, which ranges from $2,500 to $7,500 depending on the battery size of the car, is only available for a limited number of vehicles manufactured by certain automakers.

The goal of the incentive is to encourage Americans to choose clean, electric transportation, reducing the country’s reliance on fossil fuels and lowering carbon emissions. While the tax credit is set to eventually decrease and phase out as electric cars become more mainstream, it is still a valuable benefit for those looking to make the switch to a more eco-friendly mode of transportation. So, not only are electric cars better for the environment, they can save you money in the long run as well!

State tax credits and rebates

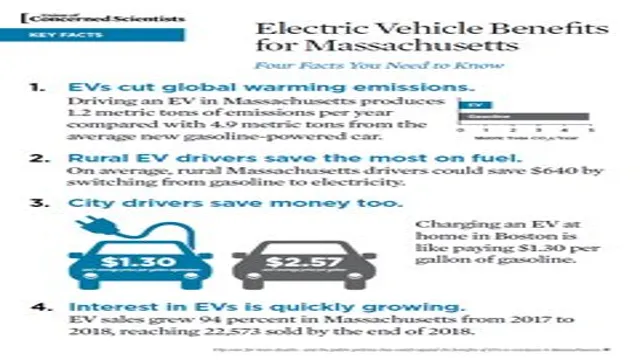

Electric cars, State tax credits, Tax benefits One of the many benefits of owning an electric car is that it comes with state tax credits and rebates. This gives electric car owners a financial incentive to make the switch from traditional gasoline-fueled vehicles, which can help offset the higher initial cost of purchasing an electric car. State tax credits vary by state but can range anywhere from several hundred dollars to several thousand dollars, depending on the state and the car.

Additionally, electric cars may also qualify for federal tax credits, which can further reduce the cost of owning an electric car. These tax benefits not only save electric car owners money but also help to promote the use of eco-friendly, sustainable vehicles. By making the switch to an electric car, you can not only save money on fuel but also help to reduce your carbon footprint.

So, consider purchasing an electric car and take advantage of the many tax benefits that come with it.

Sales and use tax exemptions

Electric cars have become increasingly popular in recent years, not only for their eco-friendliness but also for the tax benefits that come with purchasing one. Governments around the world have recognized the importance of incentivizing the adoption of electric vehicles (EVs) to reduce greenhouse gas emissions and dependence on fossil fuels. In the US, many states offer sales and use tax exemptions on EV purchases, which can save buyers thousands of dollars.

For example, in California, EV buyers are exempt from paying state sales tax, which can equate to savings of up to $7,500 on a $50,000 vehicle. Additionally, some states offer rebates or tax credits to EV buyers, further reducing the cost of purchasing an electric car. These incentives are designed to make EVs more accessible and affordable to the average consumer, and many predict that they will continue to increase as governments push for a transition to clean energy.

How Much Can You Save with Tax Benefits?

If you’re considering purchasing an electric car, you may be wondering how much you can save with tax benefits. The good news is that there are several tax incentives available to electric car owners. One of the most significant tax benefits is the federal electric vehicle tax credit, which ranges from $2,500 to $7,500, depending on the size of the battery.

Some states also offer additional tax incentives, such as rebates or tax credits on electric car purchases. Additionally, electric car owners can save money on fuel costs, maintenance, and repairs over the lifetime of the vehicle compared to traditional gas-powered cars. So not only are electric cars better for the environment, but they can also help you save money in the long run.

Federal tax credit amount

If you’re considering purchasing an electric vehicle, you might be wondering how much you can save with tax benefits. Well, the good news is that the federal government is offering a tax credit of up to $7,500 for eligible vehicles. However, the actual amount of credit you can receive depends on the specific make and model of your electric car.

For example, if you purchase a Tesla Model S, you’ll be eligible for the full $7,500 tax credit, whereas if you purchase a Chevy Bolt, the credit amount might be slightly lower. It’s also important to note that the tax credit isn’t a rebate – you’ll have to claim it on your federal tax return for the year in which you purchased the vehicle. That being said, the savings can be substantial, especially if you’re purchasing a more expensive electric car.

So, if you’re thinking about going electric, be sure to do your research on the different available models and their corresponding tax credit amounts.

State tax credit and rebate amounts

If you’re wondering how much you can save with state tax credit and rebate amounts, the answer is, it depends. Different states offer different amounts depending on a variety of factors, including income level, home value, and the type of energy-efficient upgrades you make to your home. For example, California offers up to $7,000 in tax credits for installing solar panels, while Massachusetts offers up to $1,000 for installing Energy Star certified HVAC systems.

It’s important to do your research to determine what credits and rebates you’re eligible for, as well as how much you can expect to save. Keep in mind that these incentives can significantly offset the cost of home upgrades, making them more affordable in the long run. So if you’re looking to improve your home’s energy efficiency, be sure to explore your state’s tax credit and rebate options.

Sales and use tax exemption savings

If you’re running a business, you should be aware of the tax benefits that come with sales and use tax exemption. The savings you can enjoy entirely depend on the state where your business is based and what the exemptions cover. Most exemptions are specific to certain types of goods or industries.

Some states exclude sales tax on some goods exempted from sales tax, such as raw materials bought to manufacture products for sale or resale. Others exclude taxes on utility bills, waste disposal, or any other vital business services. By taking advantage of state exemption policies, you can significantly reduce your tax burden, allowing you to invest more in your business.

So, it makes sense to explore sales and use tax exemptions available in your business’ state to get the maximum benefit.

Are There Any Limitations to Tax Benefits?

Electric cars have surged in popularity in recent years due to their eco-friendliness and cost-effectiveness. However, some may wonder if there are any limitations to their tax benefits. While electric car owners can qualify for federal tax incentives, state incentives may vary, and there may also be income limitations for eligibility.

Additionally, tax credits may only apply to new vehicles and may not cover used or leased cars. It’s important to research thoroughly and consult with a tax professional to understand the specific details and limitations of the tax benefits for electric cars in your state and situation. Despite the potential limitations, electric cars remain a smart choice for those looking to reduce their carbon footprint and save money in the long run.

Federal tax credit phase-out and expiration

As appealing as federal tax credits may seem, there are some limitations that need to be considered. In particular, these tax credits may be subject to phase-out or expiration. At present, certain tax credits for renewable energy and energy efficiency, as well as some electric vehicle credits, are set to expire or decrease in value over time.

This means that the amount of money taxpayers can save on their overall tax bill may be reduced or eliminated as these tax credits are phased out. However, it’s worth noting that these phase-outs and expirations are generally designed to be gradual, giving taxpayers ample time to plan accordingly. To maximize the benefits of these credits, individuals and businesses need to stay informed about changes in the tax code and plan accordingly.

With careful planning and attention, taxpayers can take advantage of federal tax credits and save money on their tax bill while reducing their carbon footprint.

State tax credit and rebate program limits

When it comes to state tax credit and rebate programs, it’s important to keep in mind that there may be limitations to the tax benefits you can receive. These limitations can vary depending on the specific program and state you live in, so it’s always a good idea to do some research and speak with a tax professional before applying. Some common limitations may include income limits, maximum credit amounts, or certain eligible expenses.

It’s also possible that some programs may have a limited amount of funding available, so it’s important to apply as early as possible. While there may be limitations to tax benefits, these programs can still be a great way to save money on your taxes and support important causes and initiatives in your community.

Conclusion: Taking Advantage of Tax Benefits for Electric Cars

In conclusion, owning an electric car not only benefits the environment but also provides significant tax benefits. By reducing our carbon footprint and taking advantage of tax credits and deductions, electric cars help put more money back in our pockets and promote a healthier planet for future generations. So why not charge up your ride and take advantage of these electrifying tax benefits today? Your wallet and the earth will thank you.

“

FAQs

What tax benefits are available for electric cars?

Electric car owners are eligible for a federal tax credit of up to $7,500, depending on the car’s battery capacity and range. Additionally, some states offer their own tax credits or rebates for electric car purchases.

Are there any tax benefits for businesses that use electric cars?

Yes, businesses can also take advantage of the federal tax credit for electric cars, as well as potentially qualifying for other tax incentives such as accelerated depreciation.

How long will the federal tax credit for electric cars be available?

The federal tax credit for electric cars begins to phase out once a manufacturer has sold over 200,000 qualifying vehicles in the U.S. Once this threshold is reached, the tax credit will begin to decrease and eventually disappear.

Can the tax credit for electric cars be applied to a lease?

Yes, if you lease an electric car you can still qualify for the federal tax credit. However, the dealership or leasing company may be the one to claim the tax credit rather than the lessee. It is recommended to confirm with the leasing company before signing the lease agreement.

Are there any other tax benefits for electric car charging infrastructure?

Yes, businesses and individuals who install electric car charging stations may be eligible for tax credits or other incentives, including a federal tax credit of up to 30% of the installation cost. Additionally, some states and local governments may offer their own tax incentives or grants for charging infrastructure installation.