Tax Benefit of Electric Cars: Maximize Your Savings!

Electric cars are becoming more popular. Many people want to drive them. There are many reasons for this. One big reason is the tax benefits. Let’s explore the tax benefits of electric cars. This will help you understand why they are a good choice.

What are Electric Cars?

Electric cars run on electricity. They do not use gasoline. This means they are better for the environment. They produce less pollution. Many countries support electric cars. They want to reduce air pollution. This is good for our health. It also helps the planet.

Tax Benefits Explained

When you buy an electric car, you might get tax benefits. These are special rules that help you save money. The government wants to encourage people to buy electric cars. They do this by offering tax credits.

What Is A Tax Credit?

A tax credit is money you can subtract from your tax bill. This means you pay less tax. For example, if your tax bill is $3,000 and you have a $2,000 tax credit, you only pay $1,000.

Federal Tax Credit For Electric Cars

In the United States, the government offers a federal tax credit. This credit can be up to $7,500. It depends on the car you buy. Not all electric cars qualify. You must check if your car is eligible.

Here is a simple list of how the federal tax credit works:

- The car must be a new electric vehicle.

- The credit can be up to $7,500.

- Check the car’s eligibility.

- You must file taxes to claim the credit.

State Tax Credits

Many states also offer tax credits. These credits can vary. Each state has its own rules. Some states offer up to $5,000 in tax credits. Others might have rebates or tax exemptions.

Here are some examples of state benefits:

- California offers rebates for electric cars.

- New York has tax credits for EV buyers.

- Texas gives incentives for charging stations.

Sales Tax Exemption

Some states do not charge sales tax on electric cars. This means you save more money when buying your car. Check your state’s rules to see if this applies.

Local Incentives

Local governments may also have incentives. These can include rebates, free parking, or access to carpool lanes. It’s good to look into local benefits. They can add up to a lot of savings.

Benefits of Tax Credits

Tax credits help lower the cost of buying an electric car. This makes them more affordable. Here are some benefits of tax credits:

- Lower upfront cost.

- Encourages environmentally friendly choices.

- Helps you save money on taxes.

How to Claim Tax Benefits

Claiming tax benefits is simple. Here’s how to do it:

- Buy an eligible electric car.

- Keep your purchase receipt.

- Fill out the tax forms during tax season.

- Submit your tax forms with the credit.

It is important to keep good records. This helps if you need to prove your purchase.

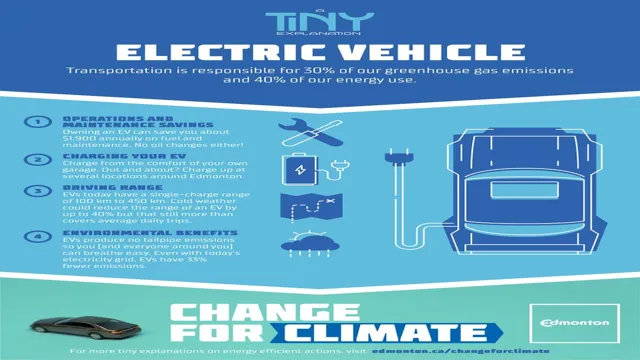

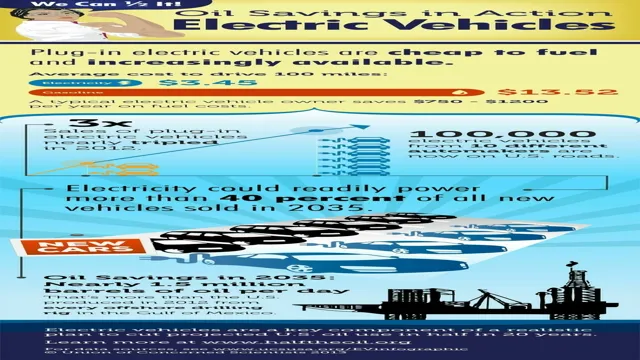

Other Financial Benefits

Besides tax credits, electric cars have other financial benefits. They can save you money in different ways:

- Lower fuel costs: Electricity is cheaper than gasoline.

- Less maintenance: Electric cars have fewer moving parts.

- Insurance discounts: Some companies offer discounts for EV owners.

Environmental Impact

Electric cars are better for the planet. They help reduce carbon emissions. This is important for fighting climate change. Many governments want cleaner air. Electric cars can help achieve this goal.

Choosing an electric car also shows that you care. It sends a message about protecting the environment.

Challenges of Electric Cars

While there are many benefits, there are also challenges. Here are some common concerns:

- Charging infrastructure: Not all areas have charging stations.

- Range anxiety: Some people worry about running out of battery.

- Higher upfront costs: Some electric cars are more expensive.

However, the benefits often outweigh these challenges. Many people find that the savings are worth it.

Frequently Asked Questions

What Are The Tax Benefits Of Electric Cars?

Electric cars often qualify for federal and state tax credits. These can lower your overall tax bill.

How Much Can I Save On Taxes With An Electric Car?

Tax credits can range from $2,500 to $7,500 depending on the vehicle and location.

Do All Electric Cars Qualify For Tax Credits?

Not all electric cars qualify. Check the IRS list for eligible vehicles.

How Do I Claim The Electric Car Tax Credit?

Claim the credit using IRS Form 8834 when you file your taxes.

Conclusion

Electric cars offer many tax benefits. They also help the environment. If you are thinking about buying an electric car, consider the tax credits. They can save you a lot of money.

Check both federal and state benefits. Also, look into local incentives. Each benefit helps reduce the cost of driving an electric car. In the end, it is a smart choice for your wallet and the planet.

So, if you want to save money and help the environment, think about an electric car. The tax benefits make it easier to make this choice.

FAQs about Electric Cars and Tax Benefits

1. Can I Get A Tax Credit For Used Electric Cars?

No, the federal tax credit is only for new electric cars.

2. How Do I Know If My Electric Car Qualifies For A Tax Credit?

You can check the IRS website or your car dealer.

3. What If I Do Not Owe Taxes? Can I Still Claim A Credit?

If you do not owe taxes, you cannot use the credit.

4. How Long Will The Tax Credit Last?

The tax credit may change. It depends on new laws.

5. Are There Any Other Benefits Besides Tax Credits?

Yes, you can save on fuel and maintenance costs.