Rev Up Your Savings: How Buying an Electric Car can Boost Your Tax Benefits

Are you considering purchasing an electric car? Aside from the environmental benefits, you may be surprised to learn about the tax benefits that come with it. With the increasing popularity of electric vehicles, the government is encouraging more people to switch to eco-friendly modes of transportation by providing various incentives. One of the most significant tax benefits of purchasing an electric car is the federal tax credit, which can range from $2,500 to $7,500, depending on the vehicle’s battery size and overall efficiency.

This credit can be applied directly to your tax liability and can even help reduce the overall cost of the vehicle. In addition to the federal tax credit, some states also offer their own incentives, such as tax rebates, reductions, or exemptions. Some states even provide free parking and allow electric vehicles to use HOV lanes, saving commuters time and money.

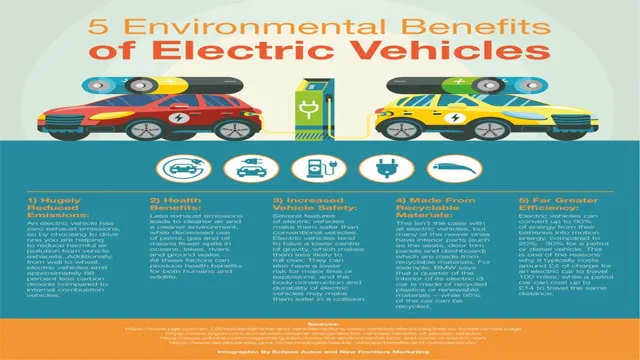

Apart from the financial advantages, owning an electric car is an excellent way to reduce your carbon footprint and contribute to a healthier planet. With the growing concerns about climate change, more individuals are making the switch to renewable energy sources such as electric cars. In conclusion, purchasing an electric car can have significant benefits, including tax incentives and reducing your carbon footprint.

So, if you’re thinking of buying a new car, it’s worth considering an electric vehicle and taking advantage of the available incentives.

Federal Tax Credit

Thinking about buying an electric car? There are significant tax benefits to owning an electric vehicle, with one of the most notable being the federal tax credit. This credit can provide up to $7,500 in savings on your taxes, which can go a long way towards offsetting the higher upfront cost of electric cars. However, it’s important to note that this credit only applies to new, qualifying vehicles and is subject to phase-out over time.

Additionally, state and local incentives may also be available, so it’s worth doing your research to see what savings you may be eligible for. Overall, the federal tax credit is just one of the many reasons why electric cars are becoming an increasingly attractive option for environmentally-conscious drivers looking to save some money in the long run.

Up to $7,500 on Eligible Vehicles

If you’re in the market for a new vehicle, you may be wondering how you can save money on your purchase. One option to consider is the federal tax credit available for eligible vehicles. This credit can save you up to $7,500 on your new car, making it an attractive incentive for many buyers.

The credit is available for electric and plug-in hybrid vehicles, and the amount varies based on the battery capacity of the car. For example, a vehicle with a battery capacity of 16 kilowatt-hours (kWh) is eligible for a $4,000 tax credit, while a car with a battery capacity of 30 kWh or more is eligible for the full $7,500 credit. Keep in mind that this credit is only available for the first 200,000 eligible vehicles sold by each manufacturer, so it’s important to act fast if you want to take advantage of this savings opportunity.

Overall, the federal tax credit can be a great way to save money on your next car purchase while also making a positive impact on the environment.

Phasing Out Soon for Some Models

As we head towards the end of 2021, it’s important to note that the federal tax credit for electric vehicles is phasing out soon for some models. This program offers a substantial tax credit to those who purchase an electric vehicle, up to $7,500 in some cases. However, this credit only applies to certain makes and models of electric vehicles, and the credit amount varies depending on the battery size of the vehicle.

Unfortunately, some popular models like the Tesla Model S and Model X are already starting to phase out of eligibility for the tax credit. So if you’re in the market for an electric vehicle, it’s important to do your research and purchase before the tax credit runs out for your specific model.

State and Local Incentives

When it comes to buying an electric car, there are many incentives available at the state and local level that can help reduce the cost and make it a more affordable option. Tax benefits are often the most significant incentive, with many states offering rebates, credits, or exemptions for those who purchase an electric vehicle. These benefits vary depending on where you live but can help offset the initial cost of the car and save you money on the purchase.

In addition to tax benefits, there are other incentives available, such as free charging station access or access to HOV lanes, which can provide additional value over time. It’s important to research the specific incentives available in your area before making a purchase to ensure you’re taking full advantage of everything that’s available to you. Overall, the tax benefits of buying an electric car can make it an attractive option for anyone looking to save money and reduce their environmental impact.

Vary by State and City

When it comes to state and local incentives, the rules and regulations can vary greatly depending on where you are located. Some areas may offer tax credits or exemptions to businesses that meet certain criteria, while others may provide grants or low-interest loans to help fund new projects. In some cases, these incentives can make a big difference in a company’s bottom line, especially for small businesses and startups that may not have the resources to fund major expansions on their own.

However, it’s important to keep in mind that not all incentives are created equal, and it’s worth doing your research to determine which ones are best suited to your particular situation. Nonetheless, it’s clear that state and local incentives can be an important tool in promoting economic growth and providing opportunities for businesses to succeed in different areas.

Examples: Rebates, Tax Credits, HOV Lane Access

State and local incentives can be a great way to save money on your next vehicle purchase. Rebates, tax credits, and access to high occupancy vehicle (HOV) lanes are just a few examples of the incentives that may be available to you. Each state and locality has its own set of incentives, so it’s important to research what’s available in your area.

In some cases, you may be eligible for a combination of incentives, which can significantly reduce the cost of your new car. For instance, a rebate could be offered in addition to a tax credit, providing you with even greater savings. If you’re in the market for a new car, it’s worth taking the time to explore the incentives that are available to you.

These incentives can make a big difference in your overall cost, and could help you afford a higher-end model that might be out of reach otherwise. So, don’t hesitate to look into what’s available in your area, and take advantage of these savings opportunities for your next vehicle purchase.

Find Out What’s Available in Your Area

If you’re thinking about making the switch to clean energy for your home or business, it’s important to know what incentives are available in your area. Many states and local governments offer incentives to encourage the adoption of renewable energy systems, such as solar panels or wind turbines. These incentives can vary widely depending on where you are, but some common ones include tax credits, rebates, and grants.

Checking with your state or local energy office can help you find out what incentives are available to you. You may be pleasantly surprised to learn that the costs of going green are offset by these incentives, making the transition more affordable than you thought. So, why not take advantage of what your state or local government has to offer and make the switch to clean energy?

Savings on Fuel and Maintenance

Buying an electric car not only reduces emissions and helps the environment, but it also offers tax benefits and significant savings on fuel and maintenance costs. Electric cars use electricity instead of gas, which means they can be charged at home and require very little maintenance. Additionally, buyers of new electric cars can receive a federal tax credit of up to $7,500, depending on the make and model.

Some states also offer additional tax incentives or rebates for electric cars, further reducing the overall cost. In comparison to traditional gas cars, electric cars can save owners thousands of dollars in fuel costs over the lifetime of the vehicle. While electric cars may have a higher upfront cost, the long-term savings and tax benefits can make them a viable and smart investment for both the environment and your wallet.

Lower Charging Costs Compared to Gasoline

One of the biggest advantages of owning an electric vehicle (EV) is the lower charging costs compared to gasoline. Indeed, despite the higher initial purchase price of an EV, the savings on fuel and maintenance can be significant in the long run. Let’s break it down.

First of all, the cost of electricity for charging an EV is generally much cheaper than the cost of gasoline for a conventional car. This is particularly true if you take advantage of off-peak electricity rates, which are typically much lower than peak rates. Additionally, because EVs have fewer moving parts than combustion engines, their maintenance costs are generally lower as well.

Think about it: an EV doesn’t need oil changes, spark plug replacements, or emissions testing, among other things. All in all, if you’re looking for a more financially sustainable and eco-friendly way to get around, an EV may be the way to go.

Fewer Moving Parts means Cheaper Maintenance

When it comes to maintaining vehicles, every penny saved counts, and one way to save a significant amount of money is by opting for a vehicle with fewer moving parts. Cars with minimal moving parts have simpler mechanisms and require less maintenance, which translates to lower maintenance costs. This is because fewer pieces mean less wear and tear, less friction, and reduced need for lubrication.

Additionally, vehicles with less complex systems require fewer repairs over their lifetime. As a result, you save not only on maintenance costs but also on the time you would have spent visiting the auto shop. Choosing a car with fewer moving parts not only means fewer worries about mechanical failures, but it also means more savings in your pocket.

So, if you want to cut down on maintenance expenses, consider choosing a car with minimal moving parts.

Environmental Impact and Long-Term Savings

When it comes to buying an electric car, there are several tax benefits that can make the purchase more appealing. Not only do electric cars have a lower environmental impact compared to traditional gasoline vehicles, but the long-term savings can also be substantial. Federal tax credits range from $2,500 to $7,500, depending on the vehicle’s battery size.

Additionally, some states offer their own incentives, such as rebates, reduced registration fees, and exemption from tolls and HOV lane restrictions. These benefits can significantly reduce the overall cost and make electric cars a more affordable option in the long run. Plus, choosing an eco-friendly vehicle is increasingly becoming a necessity for individuals who prioritize making a positive impact on the environment.

So, if you’re considering buying an electric car, it’s worth looking into the tax benefits available in your area.

Reduce Carbon Footprint and Improve Air Quality

Reducing your carbon footprint can have a significant impact on the environment while also providing long-term savings. By minimizing the amount of greenhouse gas emissions you produce, you’re helping to improve air quality and reduce the negative effects of climate change. Simple changes like turning off electronics when not in use, using public transportation or carpooling, and replacing incandescent light bulbs with LED ones can go a long way in reducing your carbon footprint.

Not only are these changes eco-friendly, but they can also lead to long-term savings on energy bills. It’s like investing in the future of our planet while simultaneously investing in your wallet. So, let’s strive to reduce our carbon footprint and make a positive impact on the environment for generations to come.

Electric Cars have Longer Lifespan and Higher Resale Value

When it comes to electric cars, not only are they better for the environment, but they also have longer lifespans and higher resale values compared to their gas-powered counterparts. This is due in part to the fact that electric cars have fewer moving parts and require less maintenance. Additionally, as more and more people become environmentally conscious, the demand for electric cars is expected to grow, resulting in higher resale values.

In fact, a recent study found that electric cars depreciate at a much slower rate than gas-powered cars, meaning that you’ll get more money back when it’s time to sell. So not only are you reducing your carbon footprint when you choose an electric car, but you’re also making a smart long-term investment.

Take Advantage of Tax Benefits TODAY

If you’re in the market for a new car, there’s never been a better time to consider an electric vehicle. Apart from all the obvious environmental benefits that electric cars offer, there are also serious tax advantages for buyers looking to purchase one. In fact, buyers of electric vehicles can claim up to $7,500 in federal tax credits.

But with these tax credits being phased out for certain manufacturers, it’s important to act quickly before they disappear altogether. And with the total credit amount decreasing after a certain amount of vehicles is sold, it’s crucial to take advantage of this opportunity while it lasts. Not only will you be doing your part to reduce your carbon footprint, but you’ll also be saving money in the long run, both on fuel costs and on your taxes.

So why wait? Take advantage of these tax benefits while they last, and make the switch to an electric vehicle today!

Conclusion

In conclusion, buying an electric car not only benefits the environment, but it also benefits your wallet. With tax credits and incentives offered by both federal and state governments, owning an electric car can significantly lower your tax bill. So, not only will you be reducing your carbon footprint, but you’ll also be driving away with some extra cash in your pocket.

It’s a win-win situation for both you and the planet. So, let’s all join the electric vehicle revolution and enjoy the ride, both environmentally and financially.”

FAQs

What are the tax benefits of buying an electric car?

The tax benefits of buying an electric car include a federal tax credit of up to $7,500 and potential state or local incentives. These incentives vary depending on your location and individual circumstances, so it’s important to research what is available to you.

How does the federal tax credit for electric cars work?

The federal tax credit for electric cars works by allowing eligible buyers to deduct up to $7,500 from their federal income tax liability. The credit amount varies depending on the battery size and energy efficiency of the vehicle, and it begins to phase out once the manufacturer has sold a certain number of qualified electric vehicles.

Are there any other incentives for buying an electric car besides the federal tax credit?

Yes, there are often state and local incentives for buying an electric car. These can include rebates, tax credits, reduced registration fees, or access to HOV lanes. Some utility companies also offer special rates or credits for electric car owners.

Can I still get tax benefits if I lease an electric car?

Yes, if you lease an electric car, the tax credit usually goes to the leasing company, which can then be passed on to the lessee in the form of lower lease payments. However, it’s important to review the lease agreement carefully to understand how the tax credit is being handled.