Tax Benefits Buying Electric Car: Maximize Your Savings!

Buying an electric car can be a smart choice. It helps the environment. It also saves you money. One big way to save money is through tax benefits. In this article, we will explore those benefits. We will help you understand how they work. Let’s dive in!

What is an Electric Car?

First, let’s talk about what an electric car is. An electric car runs on electricity. It uses a big battery to power the motor. This is different from regular cars. Regular cars use gasoline or diesel. Electric cars do not produce exhaust fumes. This is better for the air we breathe.

Why Buy an Electric Car?

Many people choose electric cars. They do this for several reasons:

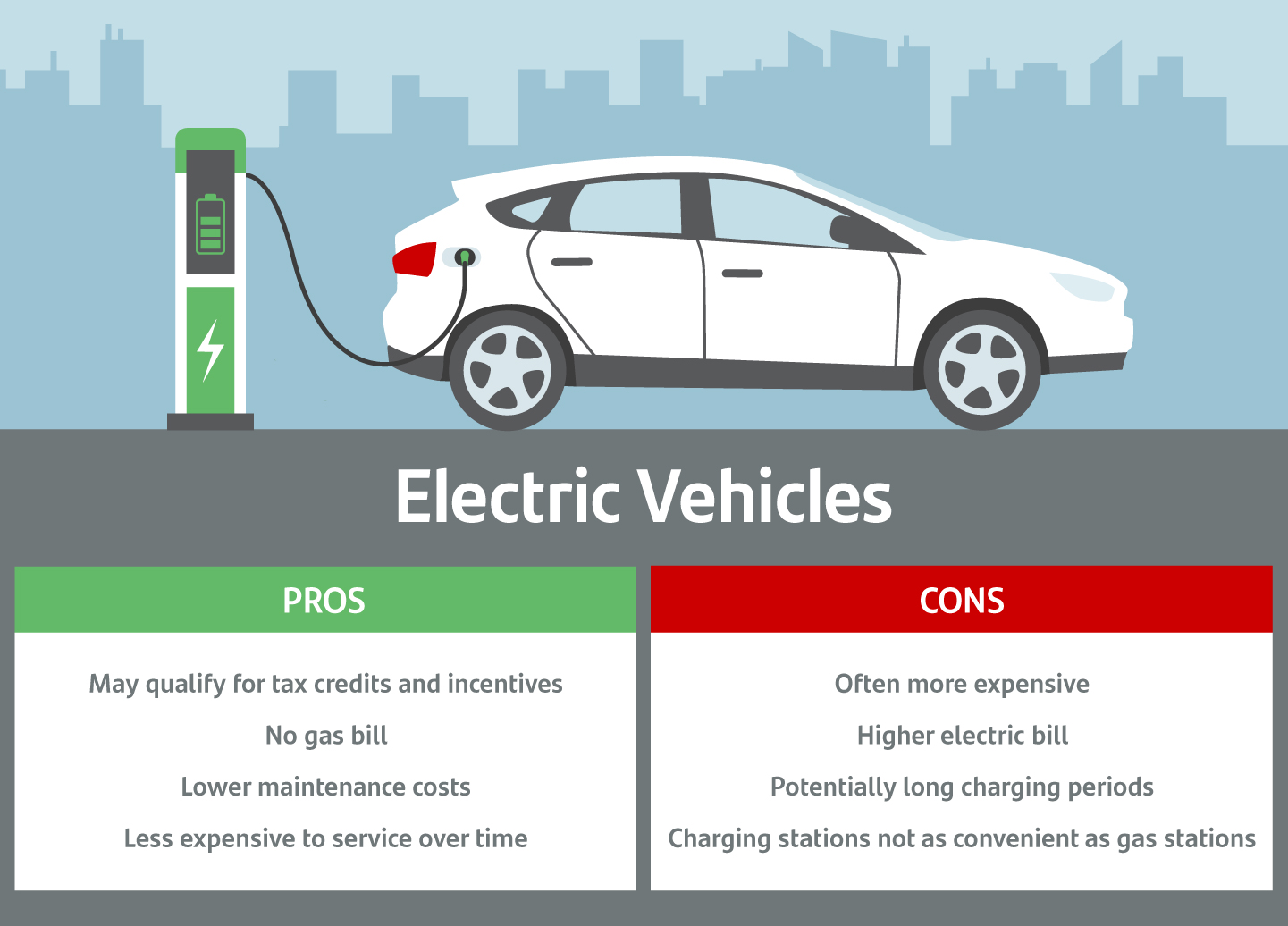

- They are good for the environment.

- They can save you money on fuel.

- They often require less maintenance.

- They can be quiet and smooth to drive.

But one of the best reasons is the tax benefits. Let’s look at those benefits closely.

Tax Credits for Electric Cars

One of the best tax benefits is the federal tax credit. This is money off your taxes. If you buy an electric car, you might get a tax credit. This credit can be up to $7,500. The amount depends on the car you buy. Not all electric cars qualify for the full amount. Some only get a part of it.

How Do Tax Credits Work?

Tax credits lower your tax bill. For example, if you owe $5,000 in taxes, and you have a $7,500 credit, you may not owe any taxes. In some cases, the credit can help you get money back. This is a great way to save money when buying an electric car.

Eligibility For Tax Credits

Not everyone can get the tax credit. Here are some rules:

- You must buy a new electric car.

- The car must be made by a qualified manufacturer.

- The car must have a battery with a certain size.

Be sure to check the latest rules. The government updates these rules often. You can find this information on the IRS website.

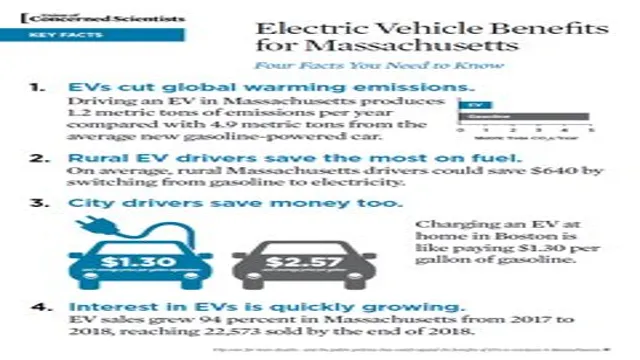

State and Local Incentives

In addition to federal tax credits, some states offer their own incentives. These can be a great way to save more money. Here are some common state incentives:

- State tax credits.

- Sales tax exemptions.

- Rebates for buying electric cars.

- Discounts on registration fees.

Each state has different rules. Some states offer more benefits than others. Check your state’s website. This will help you find the best deals.

Utility Company Rebates

Some electric companies offer rebates. These rebates can help you save money. They may give you money for buying an electric car. They might also give you discounts for charging your car.

Contact your electric company. Ask if they have any programs for electric car owners. This can be another way to save money.

Charging Station Tax Benefits

If you buy a charging station, you may get a tax credit too. This is a great benefit. You can install a charging station at home. The tax credit can be up to 30% of the cost. This means you can save money while making it easier to charge your car.

Why Install A Charging Station?

Having a home charging station is convenient. It allows you to charge your car overnight. You won’t need to visit a public charging station. This saves time and effort.

Business Tax Benefits

If you own a business, buying electric cars can help you save. Businesses can get tax deductions. These deductions can reduce the amount you owe in taxes. If your business uses electric cars, you can claim these benefits too.

- Tax credits for buying electric vehicles.

- Deduction for charging stations.

- Lower fuel costs.

Environmental Benefits

Buying an electric car is good for the environment. It helps reduce pollution. This is important for our planet. The government wants to encourage more people to buy electric cars. That’s why they offer tax benefits.

When more people drive electric cars, air quality improves. Cleaner air means healthier people. This is another reason to consider an electric car.

Frequently Asked Questions

What Are The Tax Benefits Of Buying An Electric Car?

Buying an electric car can provide various tax benefits. These include federal tax credits, state incentives, and deductions for charging equipment.

How Much Is The Federal Tax Credit For Electric Cars?

The federal tax credit can be up to $7,500. The exact amount depends on the car’s battery capacity.

Do All Electric Cars Qualify For Tax Credits?

Not all electric cars qualify. Only specific models meet the requirements set by the IRS.

Can I Get State Tax Benefits For Electric Vehicles?

Yes, many states offer tax credits or rebates for electric vehicle purchases. Check your state’s program for details.

Conclusion

Buying an electric car has many benefits. Tax benefits are a big part of this. You can save money with federal tax credits. State and local incentives add even more savings. Utility company rebates can help too. Plus, if you own a business, there are tax advantages available.

Before you buy, check all your options. Make sure you understand the rules. These rules can change often. Staying informed will help you make the best choice.

So, if you are thinking about buying an electric car, consider the tax benefits. They can make owning an electric car more affordable. Not only do you help the environment, but you also save money.

In the end, buying an electric car is a smart decision. It helps you, your community, and the planet. Take the time to explore your options. You may find that the benefits are worth it!