Maximize Your Savings: Discover the Unbeatable Tax Benefits of Buying a Used Electric Car

Are you in the market for a new car and considering an electric vehicle? You may want to take a closer look at used electric cars as they can offer a multitude of tax benefits. This not only helps reduce your carbon footprint but can save you money in the long run. Buying a used electric car can provide various tax incentives such as federal tax credits, state-level rebates, and exemptions from certain taxes and fees.

These benefits could potentially save you thousands of dollars and make your eco-friendly purchase an even smarter financial decision. Let’s dive into the details of how buying a used electric car can provide substantial tax advantages.

Lower Purchase Price

One of the biggest tax benefits of buying a used electric car is the lower purchase price. When you buy a used electric car, you don’t have to pay the steep depreciation that comes with a new car. This means you can get a high-quality electric car for a much lower price.

Additionally, many states offer tax incentives for buying a used electric car. For example, California offers a $2,500 rebate for used electric cars, while Colorado offers a $5,000 tax credit. These tax incentives can help offset the higher upfront costs of electric cars and make them a more affordable option for many people.

So if you’re looking to go green and save some money, buying a used electric car is a smart choice.

Pre-Owned Electric Cars are More Affordable

When it comes to purchasing an electric car, the upfront cost can be a major concern for many people. Luckily, buying a pre-owned electric car can be a smart and more affordable option. Pre-owned electric cars often have a lower purchase price compared to brand new models, which is great news for budget-conscious buyers.

Because electric cars generally have a longer lifespan than traditional gas-guzzling vehicles, many pre-owned electric cars have plenty of life left in them. Plus, with advancements in technology, even slightly older models can still offer cutting-edge features and impressive performance. So, don’t think that buying a pre-owned electric car means sacrificing quality or features.

You can save some money upfront and still enjoy the many benefits of owning an electric car.

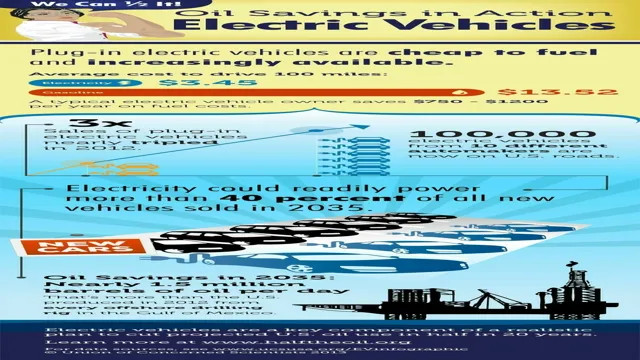

Federal Tax Credits for Electric Vehicles

If you’re considering purchasing an electric vehicle, you may be able to take advantage of federal tax credits that can help lower the purchase price. These tax credits are designed to incentivize consumers to choose electric vehicles over traditional gasoline-powered cars. The amount of the credit depends on the make and model of the vehicle, but it could be worth up to $7,500.

This can make a big difference in affordability, especially for those on a budget. Keep in mind that these tax credits are only available for a limited time and may expire soon, so act fast if you’re interested in taking advantage! By opting for an electric vehicle, not only are you making a more environmentally friendly choice, but you could also save money in the long run on fuel and maintenance costs. So, why not consider an electric vehicle with the added bonus of federal tax credits to help lower the purchase price?

Lower Registration Fees

One of the best tax benefits of buying a used electric car is lower registration fees. When you purchase a new electric vehicle, you’re typically required to pay higher registration fees, which can be quite costly depending on the state you live in. However, buying a used electric car can save you a considerable amount of money in registration fees, which can be a welcome relief for those wanting to reduce their expenses.

States like California, for example, offer significant discounts on registration fees for electric car owners, and this can add up to hundreds of dollars in savings over time. Plus, by purchasing a used electric car, you’ll still be able to enjoy the tax incentives and rebates offered to new electric car buyers. So, not only will you be helping the environment by driving a more sustainable vehicle, but you’ll also be saving money in the long run.

It’s a win-win situation!

Fewer Sales Taxes on Used Cars

When it comes to purchasing a car, there are various expenses to consider beyond the sticker price. One of those costs is sales taxes, which can add up quickly. However, if you’re in the market for a used car, you may be in luck.

Many states offer lower sales taxes on used vehicles, which can save you significant money upfront. Additionally, some states have lower registration fees for used cars as well. These fees can vary depending on the car’s age and value, but in general, they tend to be more affordable than for new cars.

Overall, opting for a used car can not only be cost-effective in terms of the initial purchase price, but it can also save you money in other areas such as taxes and registration fees. It’s important to research your state’s policies on used car taxes and registration fees to determine how much you can expect to save.

Lower Annual Registration Fees

If you’re a vehicle owner, then one of the costs you have to deal with is annual registration fees. These fees can vary depending on the state or territory you live in and the type of vehicle you own. However, some states are taking steps to lower these fees to help ease the burden on vehicle owners.

Lower registration fees can mean more money in your pocket, which is always a good thing. Plus, it makes owning a vehicle more affordable for everyone, especially those who are struggling financially. So, keep an eye out for any changes to registration fees in your state to see if you can save some money each year.

Lower Insurance Costs

Buying a used electric car comes with a multitude of benefits, including tax benefits and lower insurance costs. When you buy a new electric car, you can also claim a federal tax credit, but this credit doesn’t apply to used electric cars. However, buying used electric cars can still help you save money in the long run.

One major way this is possible is that insurance companies see electric cars as less risky because they typically have fewer mechanical problems compared to traditional gasoline cars. As a result, insurance rates for electric cars tend to be lower, and when you buy a used electric car, you can even save more on insurance costs since the car has already depreciated in value over time. So, when you consider how much you can save on insurance costs and the potential tax credits you can still qualify for, buying a used electric car may be one of the best decisions you’ll ever make.

Electric Cars are Cheaper to Insure

Electric cars are changing the way we think about transportation, and one of their many benefits is lower insurance costs. Electric cars are cheaper to insure than traditional gas-powered cars due to their advanced safety features and lower risk of accidents. Insurance companies are taking notice of the growing popularity of electric cars and are offering lower rates for electric car owners.

This not only saves you money but also encourages you to make a more environmentally friendly choice. Additionally, with fewer moving parts and less maintenance required, electric cars can have lower repair costs, further reducing insurance premiums. Overall, electric cars offer a more affordable and sustainable option for daily commuting.

Discounts on Car Insurance for Electric Cars

If you’re considering purchasing an electric car, you may be pleasantly surprised to know that it could save you money on car insurance. Many insurance companies now offer discounts specifically for electric vehicle owners. This is because electric cars are generally safer and less likely to be involved in accidents than traditional gasoline-powered cars.

Additionally, electric cars tend to have lower maintenance and repair costs, which reduces the overall cost of ownership. Insurance companies recognize these benefits and are now offering lower premiums for electric car drivers. By making the switch to an electric car, you not only help the environment but also save money in the long run.

So why not consider taking advantage of these discounts and join the growing number of electric car owners on the road today?

Lower Depreciation Rates

One of the key tax benefits of buying a used electric car is lower depreciation rates. Unlike traditional gasoline vehicles that lose a significant amount of their value immediately after being driven off the lot, electric cars tend to hold their value much better. This means that when you purchase a used electric car, you can be confident that its resale value won’t plummet as quickly as it would for a gas-powered vehicle.

This can be a major advantage when it comes to calculating your tax deductions, as it means you may be able to claim a larger portion of the car’s original purchase price as a tax deduction. Plus, knowing that your investment in a used electric car will hold its value better over time can make the decision to buy one even more appealing.

Electric Cars Retain their Value Longer than Gas Cars

When it comes to electric cars versus gas cars, one of the biggest advantages of electric cars is their ability to retain their value longer than gas cars. This is due to the fact that electric cars typically have lower depreciation rates compared to gas cars. Electric cars have fewer mechanical parts compared to gas cars, which means there is less wear and tear on the car.

In addition, electric cars have longer lasting batteries, which means they can retain their value longer. So, if you’re interested in buying an electric car, it’s important to keep in mind that it may cost more upfront, but you can expect to get a better resale value down the line. Ultimately, choosing an electric car can be a smart investment in the long run, as they retain their value better than gas cars.

Conclusion

In conclusion, buying a used electric car not only helps save the environment, but also provides a plethora of tax benefits. You’ll not only feel good about reducing your carbon footprint, but also your tax bill. It’s a win-win situation that’s hard to pass up – both for your wallet and the planet.

“

FAQs

What tax benefits can I receive when buying a used electric car?

When buying a used electric car, you may still be eligible for federal tax incentives, such as the Alternative Fuel Vehicle Refueling Property Credit or the Plug-In Electric Drive Vehicle Credit. Additionally, some states offer their own tax incentives for purchasing a used electric car.

How much can I save on taxes by purchasing a used electric car?

The amount you can save on taxes when purchasing a used electric car varies depending on the specific tax incentives available to you and the cost of the car. However, you could potentially save thousands of dollars in taxes.

What do I need to do to qualify for tax benefits when purchasing a used electric car?

To qualify for tax benefits when purchasing a used electric car, you will typically need to meet certain criteria, such as owning the car for a certain period of time and using it for personal use. It is important to research the specific requirements for the tax incentives available to you.

What happens if I buy a used electric car and later find out I am not eligible for tax benefits?

If you purchase a used electric car with the expectation of receiving tax benefits but later find out you are not eligible, you will not receive the tax benefits. It is important to thoroughly research and understand the eligibility requirements before making a purchase.