Electric Cars in the UK: Save Money and the Environment with Tax Benefits

Electric cars have been growing in popularity across the UK in recent years, and for good reason. Not only are electric vehicles environmentally friendly, generating zero emissions, but they also offer great financial benefits to their owners. In this blog, we will explore the tax benefits of owning an electric car in the UK and how it can save you money in the long run.

As the UK government continues its efforts to reduce carbon emissions, they have introduced various incentives to encourage electric car ownership. These incentives include reducing road tax, company car tax, and providing grants for electric vehicle charging points. So, if you’re considering purchasing an electric car, keep reading to learn how it can save you money on taxes and ultimately, provide a greener future.

Overview of Electric Car Tax Benefits

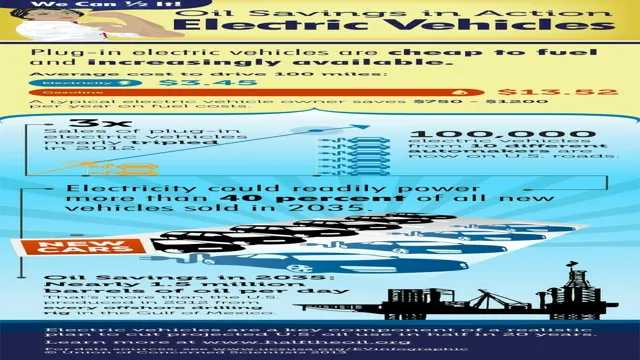

If you’re considering purchasing an electric car in the UK, you’ll be happy to know that there are numerous tax benefits available to you. For starters, electric cars are exempt from road tax, saving you a significant amount of money each year. Additionally, you’ll enjoy lower fuel costs since electricity is cheaper than petrol or diesel.

Another perk of electric car ownership is the government’s Plug-in Car Grant, which provides up to £2,500 towards the cost of a new electric vehicle. Furthermore, businesses can deduct the full cost of a new electric car from their profits before paying tax, resulting in even more savings. With so many tax benefits available, there’s never been a better time to consider making the switch to electric.

Zero Road Tax

As more and more people become aware of the impact fossil fuels have on the environment, electric cars are becoming a popular choice for those who want to reduce their carbon footprint. But beyond just being environmentally friendly, electric cars also come with tax benefits, including the fact that they are exempt from road tax. This is because electric vehicles produce zero emissions, making them a more sustainable choice for the planet.

By going electric, not only are you helping to combat climate change, but you’ll also save on yearly expenses associated with owning a car. So if you’re looking to make a positive change for both your wallet and the environment, an electric car could be the perfect choice for you.

Exemption from London Congestion Charge

As the world becomes increasingly environmentally conscious, electric cars have become more popular than ever before. But did you know that they also come with a range of tax benefits? One of the most significant advantages of owning an electric car is that it’s exempt from the London Congestion Charge. This means that you won’t have to pay the daily fee to drive in certain parts of central London, which can save you a lot of money in the long run.

But that’s not all – electric cars are also exempt from road tax, which can save you hundreds of pounds each year. Moreover, you can also decrease your carbon footprint with electric cars, thus contributing to a greener planet. All in all, purchasing an electric car comes with numerous benefits that can help you save money and reduce your environmental impact.

So if you’re thinking about buying a new car, it might be worth considering an electric one.

Lower Fuel Duty

If you’re considering buying an electric car, you’ll be glad to know that there are a plethora of tax benefits available to you. One of the most significant benefits is the lower fuel duty. Electric cars produce zero emissions, which means they’re exempt from fuel duty.

On the other hand, gasoline-powered vehicles pay a fuel duty tax of 595 pence per liter. This tax is included in the price of the fuel, meaning that you pay more for fuel than you should.

With an electric car, you’ll save money in the long run as you won’t have to pay the fuel duty tax. Plus, you’ll be doing your part to help the environment by driving an emissions-free car. So, if you’re considering a new car, why not go electric and take advantage of the lower fuel duty tax? It’s a win-win situation!

Electric Vehicle Homecharge Scheme

Looking for ways to save money while driving an electric car in the UK? The Electric Vehicle Homecharge Scheme is a tax benefit that can help you do just that! This scheme is designed to help electric car owners install home charging points, allowing them to charge their vehicles from the comfort of their own homes. By taking advantage of this scheme, you can save money on fuel costs and help reduce the environmental impact of driving. With the UK Government’s focus on reducing emissions and promoting green energy, there has never been a better time to switch to an electric car.

So why not take advantage of the tax benefits of the Electric Vehicle Homecharge Scheme and start enjoying the many benefits of owning an electric car today?

Government Funding for Home Charging Stations

The UK government is providing funding for home charging stations for electric vehicles through the Electric Vehicle Homecharge Scheme. This scheme allows eligible homeowners to receive up to 75% off the cost of installing a home charging station, with a maximum grant of £350. This funding is available for those who own or lease a qualifying electric vehicle and have off-street parking.

The aim of this scheme is to encourage the switch to electric vehicles and make it easier for EV owners to charge at home. This initiative not only supports the government’s commitment to reducing carbon emissions but also helps UK residents save money on petrol costs by switching to electric cars. Taking advantage of this scheme is a smart and environmentally responsible decision for any EV owner.

Requirements and Eligibility

The Electric Vehicle Homecharge Scheme is a government program that offers financial incentives to homeowners who want to install an electric vehicle charger at their residence. To be eligible for the scheme, you must meet certain requirements. Firstly, you must be a homeowner or long-term leaseholder of a domestic property in Great Britain.

Secondly, you must have purchased an eligible electric vehicle or leased one for at least six months before you apply for the scheme. Additionally, you must have off-street parking facilities or have access to reserved parking near your residence. This is to ensure that the charging facilities do not disrupt the pedestrian or vehicular traffic on public roads.

Once you meet the requirements, you can apply for a grant covering up to 75% of the cost of purchasing and installing a home charging unit, with a maximum grant of £350. This generous subsidy can significantly reduce the cost of owning an electric vehicle, which will help to reduce your carbon footprint and save you money in the long run.

Company Car Tax Benefits

Tax benefits for electric cars in the UK are abundant and can save businesses a lot of money. First and foremost, electric cars produce zero emissions and are therefore exempt from certain taxes, including the London Congestion Charge and Vehicle Excise Duty. In addition to these cost-saving benefits, companies with electric company cars are also eligible for lower National Insurance contributions and capital allowances.

These incentives are meant to encourage businesses to switch to electric cars, which are more environmentally friendly and can save money in the long run. In fact, with the right incentives, some companies may even be able to afford higher-end electric vehicles, which can provide additional benefits such as longer driving ranges and improved reliability. Overall, companies that are looking to save money and reduce their carbon footprint should certainly consider switching to electric company cars to take advantage of these tax benefits.

Lower Tax Rates for Electric Company Cars

“Electric Company Cars” Company car tax benefits have become a hot topic in recent times, as people are looking for ways to reduce their carbon footprint and save money at the same time. Lower tax rates for electric company cars are a great way to achieve both of these goals. With the rising costs of fuel and the need to reduce emissions, it makes sense for companies to encourage the use of electric cars by offering tax benefits.

Not only do employees get to enjoy lower tax rates, but companies also save money on fuel costs and help reduce their environmental impact. The best part is that electric cars are becoming more affordable, with more companies offering them as options for their employees. Overall, lower tax rates for electric company cars are a win-win situation for everyone involved, and a step in the right direction towards a greener and more sustainable future.

Exemption from Fuel Benefit Charge

If you’re in the market for a company car, it’s important to consider the tax benefits that come with it. One such benefit is exemption from the Fuel Benefit Charge. This means that if your employer pays for any of your fuel costs, you won’t have to pay any tax on it.

However, it’s important to note that this exemption only applies if you use the car solely for business purposes. If you use it for personal use, you will have to pay tax on the fuel benefit. It’s also worth noting that this exemption does not apply to electric cars as they don’t use fuel.

Taking advantage of tax benefits such as this can make company cars a smart financial decision for you and your employer.

Conclusion

In conclusion, owning an electric car in the UK not only helps to reduce harmful emissions, but it also comes with numerous tax benefits. From the exemption of road tax, to reduced company car tax rates and grants towards the purchase of the vehicle, the financial benefits of going electric are clear. So, don’t get charged up about high taxes- switch to an electric car and enjoy the smooth ride towards a cleaner and cheaper future!”

FAQs

What are the tax benefits of owning an electric car in the UK?

Electric car owners in the UK are eligible for several tax benefits, including a £3,500 grant towards the purchase price, exemption from vehicle excise duty, and lower rates of company car tax and benefit-in-kind tax.

Can anyone apply for the UK government’s electric car grant?

No, the grant is only available for eligible vehicles that meet certain criteria, such as being on the government’s list of approved vehicles and having a zero-emission range of at least 70 miles.

What other financial incentives are available for electric car owners in the UK?

Some local authorities offer free or discounted parking for electric cars, as well as access to bus lanes and free charging at certain public charging points.

Are there any downsides to owning an electric car in the UK?

Some potential downsides include the limited range of some models, the need to find and use charging points, and the higher initial purchase cost compared to petrol or diesel cars. However, many drivers find that the cost savings and environmental benefits outweigh these potential drawbacks.