Tax Benefits Electric Cars: Unlock Savings Today!

Electric cars are becoming popular. Many people want to drive them. They are good for the environment. They help reduce air pollution. But there is more to electric cars. They come with tax benefits. In this article, we will explore these benefits. Let’s see how they can help you save money.

What Are Tax Benefits?

Tax benefits mean you pay less tax. The government gives benefits for certain things. They do this to encourage people to buy electric cars. When you buy an electric car, you may get a tax credit. This can lower how much tax you owe.

Federal Tax Credit for Electric Cars

The federal government offers a tax credit. This credit can be up to $7,500. It depends on the car’s battery size. The bigger the battery, the bigger the credit. This helps you pay less tax. You can claim this credit when you file your taxes.

How To Claim The Federal Tax Credit

- Buy a qualified electric vehicle.

- Keep your purchase receipt.

- Fill out IRS Form 8834.

- Include this form with your tax return.

Make sure your car is eligible. Not all electric cars qualify. Check with the manufacturer. They can tell you if your car qualifies for the credit.

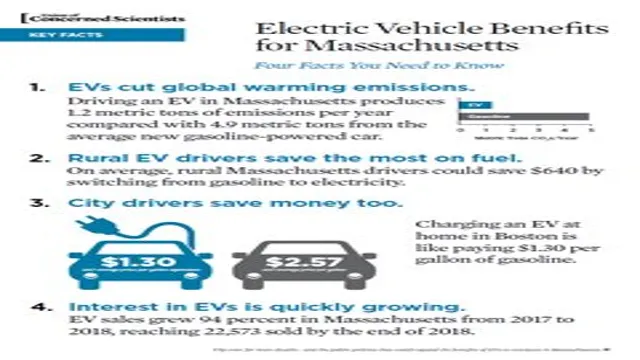

State Tax Benefits

Many states offer their own tax benefits. Each state has different rules. Some states give tax credits. Others offer rebates. These benefits can help you save more money.

Examples Of State Tax Benefits

- California: Offers a rebate of up to $2,500.

- New York: Offers a credit of up to $2,000.

- Texas: Offers a rebate of $2,500 for certain electric vehicles.

- Florida: Offers a sales tax exemption for electric cars.

Check your state’s rules. You can find this information online. Look for your state’s tax agency website.

Local Incentives

Some cities and counties have local incentives. These can be additional savings. Local governments may offer rebates or discounts. They may also have special programs.

Examples Of Local Incentives

- Free charging stations.

- Reduced parking fees.

- Access to carpool lanes.

Local incentives can make owning an electric car easier. They can help you save money on daily driving costs.

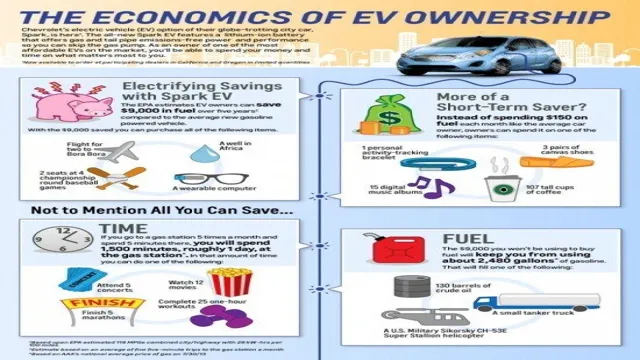

Other Financial Benefits

Tax benefits are not the only savings. Electric cars can save money in other ways. Here are some examples:

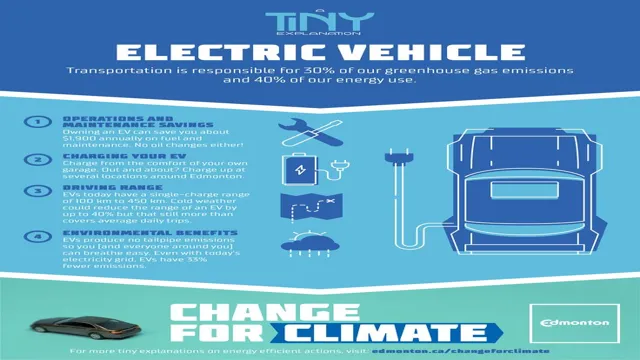

Lower Fuel Costs

Electric cars cost less to fuel. Charging is cheaper than gas. This can save you money over time.

Less Maintenance

Electric cars have fewer moving parts. They do not need oil changes. This means less money spent on maintenance.

Insurance Discounts

Some insurance companies offer discounts. They may lower your premium for driving an electric car. Check with your insurance agent.

Environmental Benefits

Driving an electric car helps the planet. These cars produce less pollution. Less pollution means cleaner air. This is better for everyone’s health.

Many people care about the environment. They want to help. Choosing an electric car is a great way to do this.

Considerations Before Buying

There are a few things to think about. Electric cars may have a higher purchase price. But remember, tax benefits can help. You will also save money on fuel and maintenance.

Charging stations are important. Make sure there are charging stations near you. This will make owning an electric car easier.

Frequently Asked Questions

What Are Tax Benefits For Electric Cars?

Tax benefits for electric cars include credits, deductions, and exemptions that lower your tax bill.

How Much Can I Save On Taxes With An Electric Car?

You can save up to $7,500 on your federal taxes, depending on the vehicle.

Do All Electric Cars Qualify For Tax Credits?

Not all electric cars qualify. Check the IRS list for eligible models.

How Do I Claim Tax Credits For My Electric Car?

Claim your tax credits using IRS Form 8834 when you file your taxes.

Conclusion

Electric cars offer many tax benefits. The federal tax credit is helpful. State and local incentives can provide more savings. You also save on fuel and maintenance. Plus, you help the environment.

Before buying, consider your options. Research your state’s benefits. Look for local incentives. Make sure you can charge your car easily. Electric cars can be a smart choice. They save money and help our planet.