Electrify Your Savings: Unveiling the Tax Benefits of Buying an Electric Car

Electric cars are gaining in popularity, and it’s no wonder why. Not only are they eco-friendly, but they also offer numerous tax benefits that make them an attractive choice for those looking to save money. In this blog post, we’ll delve into the tax benefits of buying an electric car and what you need to know before making the switch.

First and foremost, electric vehicles qualify for a federal tax credit of up to $7,500. The exact credit amount is based on the vehicle’s battery capacity and is gradually phased out as more EVs are sold. Additionally, certain states offer additional incentives such as rebates or tax credits.

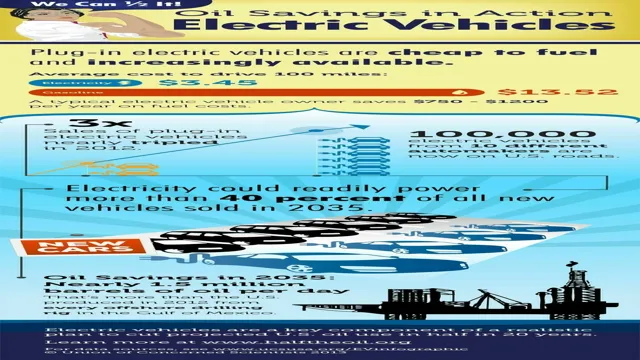

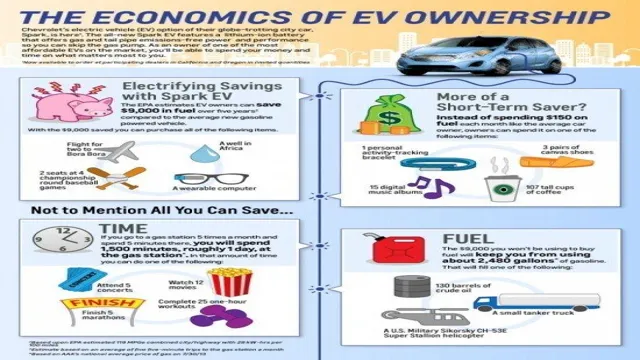

For instance, in California, EV buyers can receive up to $2,000 in rebates on top of the federal tax credit. Aside from tax credits, electric car owners can enjoy lower maintenance costs and fuel expenses. Electric vehicles require less maintenance than their gas-powered counterparts since they have fewer moving parts, and their energy source is much simpler.

Moreover, the cost of electricity to power an electric vehicle is significantly lower than gasoline, resulting in substantial savings over time. Moreover, EV owners can enjoy access to carpool lanes and free parking. Some cities even offer free charging at public charging stations for EVs.

These perks not only promote green transportation but also provide practical benefits for EV owners. In conclusion, purchasing an electric car can provide cost savings and tax benefits that more than offset its higher upfront cost. Beyond saving money, electric vehicles contribute to cleaner air and a healthier planet.

What’s not to love?

Federal Tax Credits

If you’re thinking about buying an electric car, you’ll be pleased to know that there are plenty of tax benefits that come with your purchase! Federal Tax Credits, for example, can offer you up to $7,500 in tax credits – although the exact amount will depend on the model of car you decide to buy. This means you’ll be able to keep more money in your purse or wallet, and can even offset some of the initial costs of buying the vehicle. There’s also a range of state-level incentives available too, so be sure to check what’s on offer in your area before you make your final decision.

Overall, the benefits of buying an electric car are clear – not only will you be doing your bit for the environment, but you’ll also be saving money through these fantastic tax breaks. So why not take the plunge and make your next car an electric one? You won’t regret it!

Up to $7,500 in tax credits available

Did you know that you could be eligible for up to $7,500 in federal tax credits? Yes, you heard that right! These tax credits are available for those who own or lease an electric vehicle (EV), a plug-in hybrid electric vehicle (PHEV), or a fuel cell vehicle. If you meet the eligibility criteria, you can claim up to $7,500 in federal tax credits. This credit is based on the size of the vehicle’s battery and the number of vehicles sold by its manufacturer.

For instance, a PHEV with a battery capacity of 16 kWh or more is eligible for a federal tax credit of up to $4,50 On the other hand, an EV with a 16 kWh battery capacity or more is eligible for the full credit of $7,500. This is a great incentive to make the switch to an electric vehicle and reduce your carbon footprint.

So why not take advantage of this tax credit and invest in a cleaner, greener, and more sustainable future for yourself and the planet?

Credit amount depends on battery size

If you’re considering purchasing an electric vehicle, you may have heard of federal tax credits as an incentive to make the switch. However, it’s important to note that the amount of credit you receive depends on the battery size of your new EV. The federal tax credits range from $2,500 to $7,500, but only for vehicles with batteries that have 16 kWh or more of capacity.

This means that smaller hybrid vehicles may not qualify for the full credit, while larger all-electric vehicles may receive the maximum amount. It’s important to understand the specifics of the credit before making a purchase, as it can significantly impact your overall cost. Keep in mind that the tax credit also has a phase-out period, meaning that once a manufacturer sells 200,000 qualified vehicles, the credit begins to decrease.

As we move towards a more sustainable future, it’s exciting to see the government offering incentives to help make the transition easier.

State Incentives

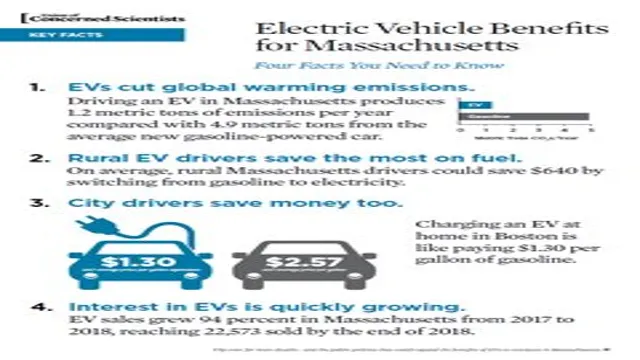

If you’re thinking about making the switch to an electric car, you might be pleasantly surprised to learn about the tax benefits that are available. Many states offer incentives and tax breaks to encourage people to buy electric cars. For example, in California, you can receive up to $7,000 in rebates for purchasing an electric vehicle.

Other states offer tax credits that can help offset the cost of an electric car. These incentives can help make an electric car more affordable and accessible to the average consumer. Not only are electric cars better for the environment, but they can also save you money in the long run through reduced fuel and maintenance costs.

So, if you’re considering buying an electric car, be sure to look into the state incentives that are available and take advantage of these tax benefits today!

State-specific incentives can save you even more money

When it comes to buying an electric car, state-specific incentives can provide significant savings in addition to federal tax credits. In fact, some states offer a variety of incentives such as rebates, tax breaks, reduced charging fees, and even carpool lane access. California offers the most extensive incentives, including a rebate of up to $7,000, HOV lane access, and tax credits on electric vehicle charging equipment.

Other states such as Colorado, Washington, and New York offer similar incentives, with some states even providing incentives for used electric vehicles. Be sure to check your state’s policies and incentives before purchasing an electric car, as the savings can vary widely depending on where you live. Overall, researching state-specific incentives can save you even more money on your electric car purchase.

Examples: CA offers up to $2,500 rebate on EV purchase

State incentives can be a major factor in encouraging drivers to switch to electric vehicles. California is a great example of this, with the state offering up to $2,500 in rebates for the purchase of an EV. This kind of incentive can drastically reduce the cost to own an EV and make it a much more attractive option for potential buyers.

Additionally, some states offer perks like free parking or reduced tolls for drivers of electric vehicles, further incentivizing their adoption. These state incentives are a great way to help promote sustainability and reduce carbon emissions, all while providing a tangible benefit to those who choose to make the switch to an EV.

Additional Benefits

Buying an electric car not only benefits the environment, but it also comes with numerous tax incentives. For instance, in the US, federal government incentives can provide a tax credit of up to $7,500 for those who purchase an electric vehicle. Furthermore, many state governments offer tax deductions, and some cities provide rebates or discounts.

In addition to these monetary savings, electric car owners benefit from lower fuel and maintenance costs. Electric cars have fewer parts and don’t require oil changes or other expensive maintenance services. Overall, the tax incentives and lifetime savings associated with buying an electric car make it a smart financial decision, as well as an eco-friendly one.

So, if you’re thinking of purchasing a new car, consider an electric model that not only saves the planet but also saves you money in the long run.

Lower operating costs

One of the biggest benefits of switching to energy-efficient operations is lower operating costs. By using less energy, companies can significantly reduce their monthly bills and save money in the long run. This can be achieved through a variety of means, such as upgrading equipment and lighting systems or implementing better insulation and heating/cooling methods.

Not only does this save money, but it can also help reduce a company’s carbon footprint and contribute to a more sustainable future. By taking the initiative to implement these changes, businesses can show their commitment to a cleaner environment while simultaneously saving money. In fact, studies have shown that companies can save up to 20% on their operating expenses by implementing energy-efficient practices.

By investing in the necessary upgrades and changes, companies can reap the rewards of lower costs and a more sustainable future.

Reduced emissions

Reduced emissions In addition to reducing the amount of harmful greenhouse gases released into the atmosphere, efforts to reduce emissions can have a number of other benefits as well. For example, many of these initiatives can lead to significant savings on energy costs. By improving energy efficiency, businesses and households alike can reduce their reliance on expensive fossil fuels and save money in the long run.

Additionally, moving towards more sustainable practices often involves developing and utilizing innovative new technologies, leading to increased investment and job creation. Finally, reducing emissions can help to create cleaner and healthier living environments by reducing the negative impacts of air pollution. By implementing policies and technologies that minimize our carbon footprint, we can take meaningful steps towards building a more sustainable future for all.

Conclusion

In conclusion, buying an electric car not only helps save the environment, but also pays off in the long run through tax benefits. It’s like putting a little green into your wallet while putting a little less carbon in the atmosphere. So, go ahead and make the daring decision to switch to an electric car, and enjoy the satisfaction of knowing that you’re reducing your carbon footprint while enjoying a little extra green in your pocket.

“

FAQs

What are the tax benefits available for buying an electric car?

There are several tax incentives for purchasing an electric car such as federal tax credit up to $7,500, state-level incentives, and exemption from sales tax.

Are all electric vehicles eligible for tax benefits?

No, not all electric vehicles are eligible for tax benefits. The incentives depend on the model, battery capacity, and other criteria.

How do I claim the tax credit for buying an electric car?

To claim the tax credit for buying an electric car, you need to file Form 8936 with your federal tax return. You also need to keep the proof of purchase and other required documents.

Is the tax credit for buying an electric car a one-time benefit?

Yes, the tax credit for buying an electric car is a one-time benefit. Once you claim the credit for a particular electric car, you cannot claim it again for the same car or any other car.