Tax Benefits for Buying Electric Car: Maximize Savings!

Buying an electric car can be a smart choice. Not only do they help the environment, but they also come with tax benefits. These benefits can make owning an electric car more affordable. In this article, we will explore these tax benefits in detail.

What is an Electric Car?

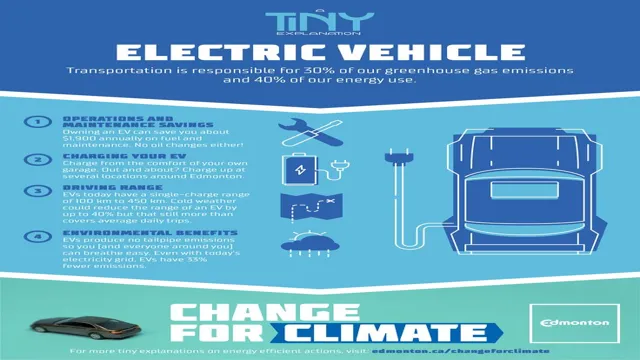

An electric car runs on electricity instead of gasoline. They have batteries that store energy. This energy powers the car. Electric cars are quiet and produce no tailpipe emissions. They are better for the air we breathe.

Why Consider Buying an Electric Car?

Buying an electric car has many advantages. Here are a few reasons to think about:

- Lower fuel costs.

- Less maintenance needed.

- Quieter rides.

- Good for the environment.

Now, let’s look at tax benefits that come with buying an electric car.

Tax Credits for Electric Cars

One of the main benefits is tax credits. A tax credit lowers the amount of tax you owe. The federal government offers a credit for electric cars. This credit can be up to $7,500. The amount depends on the car’s battery size.

To qualify for this credit, you must meet some conditions:

- The car must be new and purchased.

- The car must be fully electric or a plug-in hybrid.

- You must have enough tax liability to use the credit.

State Tax Incentives

Many states also offer tax benefits. These benefits can be different in each state. Some states offer additional tax credits. Others provide rebates or grants. Check with your state’s tax office. They can tell you about local incentives.

Sales Tax Exemptions

Some states do not charge sales tax on electric cars. This means you pay less when buying the car. This exemption can save you a lot of money. Always check your state’s tax laws. This will help you understand the savings.

Charging Station Benefits

If you buy a home charging station, you may get tax credits. The federal government offers credits for installing charging stations. You can get up to 30% of the cost back. This helps with the costs of home charging.

Employer Benefits

Some companies offer benefits for employees who buy electric cars. They may provide incentives like rebates. Check with your employer. They might have special programs for electric car buyers.

How to Claim Your Tax Benefits

Claiming tax benefits is simple. Here are the steps to follow:

- Purchase your electric car.

- Keep all receipts and documents.

- Fill out IRS Form 8834 for the federal credit.

- Submit your tax return with the form.

Make sure to keep copies of everything. This way, you have proof if needed.

Additional Benefits of Electric Cars

Besides tax benefits, electric cars offer more advantages:

- Lower operating costs.

- Access to carpool lanes.

- Less noise pollution.

- Better resale value.

Common Misconceptions About Electric Cars

Many people have wrong ideas about electric cars. Here are some common myths:

- Myth: Electric cars are too expensive.

- Truth: Tax benefits can lower the cost.

- Myth: Electric cars have short ranges.

- Truth: Many can travel over 200 miles.

Frequently Asked Questions

What Tax Credits Are Available For Electric Cars?

Many countries offer tax credits or deductions for electric car buyers. Check local laws for specifics.

How Much Can I Save On Taxes With An Electric Car?

Tax savings vary by location and vehicle type. Some credits can be several thousand dollars.

Do All Electric Cars Qualify For Tax Benefits?

Not all electric cars qualify. Eligibility often depends on the model and purchase date.

Can I Claim Tax Benefits For Used Electric Cars?

Yes, some regions allow tax credits for used electric cars. Verify your local regulations.

Conclusion

Buying an electric car is a smart decision. The tax benefits make it more affordable. You can save money on taxes, sales, and charging stations. If you are thinking about an electric car, consider these benefits. They can help you save money while helping the environment.

Make sure to check local and federal rules. Understand how to claim your benefits. Do your research to find the best options. The savings can be significant. Enjoy driving your electric car while benefiting from tax advantages.