Unlock the Big Tax Advantages of Driving an Electric Car: Maximize Your Savings Today!

If you’re considering purchasing an electric car, congratulations! Not only will you be making a smart and eco-friendly choice, but you’ll also have the opportunity to take advantage of various tax benefits. Maximizing those benefits can ultimately end up saving you thousands of dollars. However, navigating the complex world of tax credits and deductions can be overwhelming.

That’s why we’ve put together this guide to help you understand and make the most of the tax benefits available for electric cars. By the end of this read, you’ll have a better understanding of how to take advantage of potentially substantial savings while reducing your carbon footprint.

Overview of Available Tax Credits

When it comes to buying an electric car, tax benefits are one of the main reasons people choose to make the switch. There are a variety of tax credits available to help offset the cost of purchasing an electric car. The federal government provides a tax credit of up to $7,500 for the purchase of a new electric car.

Additionally, some states offer their own tax incentives, such as rebates or tax deductions, to residents who purchase electric vehicles. These incentives can vary depending on the state, so it’s important to check with your local government to see what’s available. By taking advantage of these tax benefits, you can not only save money on your electric car purchase but also do your part in helping the environment by reducing carbon emissions.

Federal Tax Credit for EVs

Electric vehicles (EVs) have become increasingly popular in recent years, with many people making the switch from gas-powered to electric. One of the incentives that makes owning an EV more affordable is the Federal Tax Credit. The credit is available to anyone who purchases a qualifying EV and can range from $2,500 up to $7,500 depending on the make and model of the vehicle.

To qualify for the credit, the vehicle must have a battery capacity of at least 5 kWh, be new, and be purchased for personal use. The tax credit is claimed when you file your federal income tax return and can be applied to reduce your tax liability. It’s important to note that the tax credit is only available until a certain number of vehicles are sold by each manufacturer, so be sure to check with the dealership to see if the vehicle you’re interested in still qualifies.

The Federal Tax Credit is just one of the many incentives available to help make owning an EV more accessible and affordable.

State-Level EV Incentives

If you’re considering purchasing an electric vehicle (EV), you’ll be glad to know that many states offer tax credits to help offset the initial costs. These incentives vary by state, but typically involve a tax credit or rebate for purchasing or leasing an electric car, along with other benefits like access to HOV lanes and reduced registration fees. In California, for example, you could be eligible for up to $7,000 in rebates for buying or leasing an EV, while Colorado offers a tax credit of up to $5,000.

Other states, such as Maryland and New Jersey, offer income tax credits for electric vehicle purchases. With so many incentives available, it’s important to research what your state offers to make the most of potential savings on your new EV.

Other Cost-Saving Benefits

In addition to the numerous environmental benefits of owning an electric car, there are also a variety of financial advantages that come with it, including tax benefits. These incentives vary depending on the country and state you reside in, but generally, electric vehicle (EV) owners can qualify for tax credits, rebates, and exemptions. For instance, in the United States, the federal government offers a tax credit of up to $7,500 for purchasing an EV, while certain states have their own additional tax incentives, such as sales tax exemptions and carpool lane access.

These benefits can help offset the initial cost of buying an EV and make it a more affordable option for car buyers in the long run. Moreover, electric cars have significantly lower fuel and maintenance costs than traditional gas-powered vehicles, which can save car owners a lot of money on gas and regular upkeep expenses. All in all, owning an electric car is not only good for the environment but also for your wallet.

Lower Cost of Maintenance for EVs

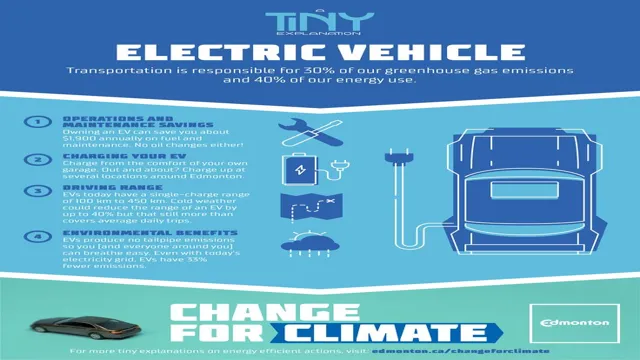

The benefits of owning an electric vehicle (EV) aren’t limited to just reducing your carbon footprint or saving money on gas. Another significant advantage of owning an EV is the lower cost of maintenance. With fewer moving parts and no oil changes needed, EVs have fewer maintenance requirements than traditional gas-powered vehicles.

This means EV owners can save money on routine car maintenance such as replacing belts or spark plugs. Additionally, EVs have regenerative braking systems that can help save money on brake pads and rotors replacement. Overall, owning an EV can lead to significant cost savings over time, making it a smart long-term investment.

Reduced Cost of Fuel

One of the key advantages of switching to renewable energy is the reduced cost of fuel. Traditional sources of energy such as coal or oil can be significantly more expensive than renewable sources like wind or solar. By investing in renewable energy, businesses and households can save a lot of money on their energy bills in the long run.

However, cost savings don’t stop there. Renewable energy sources require less maintenance and are more reliable, which means less money spent on repairs or replacements. Furthermore, renewable energy sources are becoming increasingly accessible, which means people can generate their own energy and reduce their dependency on the grid.

All these cost-saving benefits make switching to renewable energy a no-brainer for both environmentally conscious individuals and businesses looking to cut costs. By doing so, they not only reduce their carbon footprint but also save money in the long run.

Cost Savings with EV Charging at Home

One of the main benefits of owning an electric vehicle (EV) and charging at home is the cost savings over time. However, there are other cost-saving benefits that many EV owners may not be aware of. For example, many utility companies offer lower rates for EV charging during off-peak hours, which can further reduce the cost of charging at home.

Additionally, using solar panels to power your home’s EV charging station can save even more money, as the cost of electricity from the sun is free. Another cost-saving benefit of owning an EV is the reduced maintenance costs, as EVs have fewer moving parts than traditional gas-powered vehicles and therefore require less maintenance. Overall, owning an EV and charging at home can lead to significant cost savings beyond the obvious savings on gas.

Future of EV Tax Benefits

With the push towards a more sustainable future, electric cars have become increasingly popular in recent years. As a result, tax benefits for electric cars have been established to encourage people to make the switch from traditional gas guzzlers to electric vehicles. These tax benefits for electric cars may include federal tax credits, state rebates, or other incentives.

However, the future of these incentives is uncertain. Some states are considering cutting back on their electric vehicle subsidies as states face budget issues due to the COVID-19 pandemic. Additionally, with the change in presidential administration, it is unclear if the federal government will continue to offer tax credits for electric vehicles.

Despite the uncertain future of these incentives, the benefits of owning an electric car, such as lower operating costs and reduced environmental impact, still remain.

Proposed EV Incentives in Current Legislation

The future of electric vehicle (EV) tax benefits is looking bright, with proposed incentives in current legislation. Congress is currently considering a bill that would expand the existing $7,500 tax credit for new EV purchases. The proposed legislation would remove the current cap on the number of EVs eligible for the credit, which would greatly benefit automakers like Tesla and General Motors, whose EVs have already surpassed the cap.

In addition, the bill would create a new tax credit for used EVs, which would help to incentivize more consumers to make the switch to electric. These proposed incentives could help to drive EV adoption and make them more accessible to a wider range of consumers. However, it remains to be seen whether these proposals will ultimately pass and become law.

But, if they do, it could be a significant step forward in the transition to a more sustainable transportation system.

Predicted Changes in Future Tax Codes and Regulations

The future of EV tax benefits is a popular topic of discussion among those interested in electric vehicles. As the push for sustainable energy sources continues, many people are wondering what changes will be made to tax codes and regulations in the coming years. According to recent predictions, it is likely that the current federal tax credit for purchasing an electric vehicle will be expanded or extended.

Additionally, some states may offer additional tax credits or incentives to encourage consumers to switch to electric cars. It is also possible that tax codes may include penalties or fees for gas-powered vehicles to further incentivize the use of electric cars. Ultimately, the future of EV tax benefits will depend on government policies and the continued growth and innovation of the electric vehicle industry.

As more people adopt electric cars, the demand for sustainable transportation options will continue to increase.

Conclusion

In conclusion, electric cars have proven to be more than just a fashion statement for the environmentally conscious – they also come with some serious tax benefits! From federal tax credits and rebates to state incentives, the government is doing its part in encouraging the adoption of sustainable transportation. So, not only can electric car owners feel good about reducing their carbon footprint, but they can also reap the financial benefits of doing so. It’s a win-win for both the pocket and the planet! Now go ahead and (electric) zoom your way into a brighter, more sustainable future.

“

FAQs

What are the tax benefits for owning an electric car?

There are several tax incentives offered for owning an electric car, including the federal tax credit of up to $7,500 and state-level incentives such as tax exemptions and rebates.

Do all electric cars qualify for tax benefits?

No, the tax benefits for electric cars vary depending on the make and model, as well as the state in which the car is registered.

How long will the federal tax credit for electric cars last?

The federal tax credit for electric cars will begin to phase out once a manufacturer has sold 200,000 qualifying vehicles. After that, the tax credit will gradually decrease over a period of time.

Can I still claim tax benefits for buying a used electric car?

It depends on the specific state and federal laws. In some cases, tax credits may only be available for the purchase of new electric cars, while other states may offer tax incentives for used electric cars as well. It is important to check with your local government to determine eligibility.