Unlocking the Tax Benefits of Electric Cars in India: Save Money and the Environment

If you’re considering purchasing an electric car in India, it’s important to know that you may be eligible for tax benefits. While electric cars in India can be more expensive than their gasoline-powered counterparts, these incentives can help make them a more attractive option. In this blog post, we’ll explore the tax benefits you can receive when you buy an electric car in India, and how they can help you make the switch to a more sustainable mode of transportation.

From lower road taxes to reduced GST rates, we’ll break down the various incentives available to electric car owners. So let’s dive in and see how you can save money while doing your part for the environment!

What are Electric Cars?

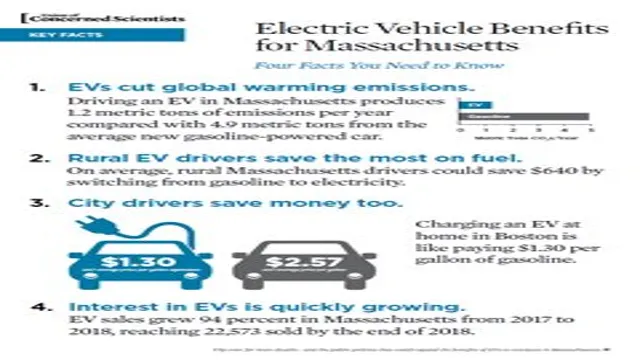

Electric cars provide a clear advantage over traditional gas-powered vehicles when it comes to tax benefits in India. The government has implemented a number of incentives to encourage citizens to make the transition to electric cars. Not only do electric cars produce fewer emissions, but they also come with a number of financial benefits.

For example, electric cars are exempt from paying road tax, and owners can receive a subsidy of up to Rs. 5 lakhs when purchasing an electric car.

Additionally, electric car owners are eligible for a lower GST rate of 5%, compared to the 28% GST rate for traditional vehicles. These tax benefits make electric cars a more attractive and affordable option for those looking to make an environmentally friendly choice. So, if you’re considering purchasing an electric car, be sure to take advantage of these tax benefits to save some extra money in the long run!

Explanation of Electric Cars

Electric cars are an innovative type of vehicle that runs on electricity instead of gasoline or diesel fuel. They are powered by rechargeable batteries, which are located under the hood and can be recharged by plugging the car into an electrical outlet or charging station. The popularity and demand for electric cars have increased greatly in recent years due to environmental concerns and technology advancements.

Electric cars are environmentally friendly as they do not emit any carbon dioxide or pollutants into the atmosphere, reduce dependence on oil imports, have low operating costs, and are quiet and smooth to drive. Although they have a shorter range than traditional gas-powered vehicles, the increasing network of charging stations and continued advancements in battery technology are making electric cars a convenient and viable option for daily transportation.

Government-Provided Incentives

If you’re considering buying an electric car in India, you may be pleasantly surprised to learn about the tax benefits that come with it. The Indian Government has been taking active steps to encourage the adoption of electric vehicles, and offering tax incentives is one of them. By investing in these sustainable alternatives, the country is not only reducing its carbon footprint, but it’s also paving the way for a cleaner, more efficient future.

The tax benefits for electric cars in India include lower taxes on the purchase price, exemption from road taxes, and a reduced GST rate. Not only do these incentives make electric cars more affordable, but they also encourage individuals and businesses to adopt greener alternatives. So if you’re in the market for a new car, consider going electric and taking advantage of these great tax benefits.

FAME-II Scheme

The Indian government’s FAME-II scheme is providing incentives to encourage the adoption of electric vehicles in the country. FAME-II, or the Faster Adoption and Manufacturing of Electric Vehicles in India, was launched in 2019 with a budget of ₹10,000 crore. The scheme offers financial incentives to buyers of electric vehicles, as well as incentives for the development of electric vehicle charging infrastructure.

Under FAME-II, buyers of electric vehicles are eligible for a subsidy of up to ₹5 lakh, depending on the type of vehicle. The scheme also provides subsidies for the purchase of electric buses, as well as for the development of charging infrastructure.

This scheme is a significant step towards reducing India’s carbon footprint and promoting sustainable transportation in the country. With the government’s support, more people are expected to adopt electric vehicles, leading to a cleaner and greener future for India.

GST Reduction

The recent reduction of goods and services tax (GST) in India has provided a much-needed incentive for businesses and consumers alike. With the aim of reviving the economy and boosting consumer spending, the government has reduced the GST rates on a range of products from 18% to 5%. This move has not only made everyday goods more affordable for consumers, but has also reduced the burden on small and medium-sized enterprises (SMEs) facing liquidity pressures.

The reduction in GST rates will also incentivize businesses to produce more, invest in technology, or expand their operations. It’s a win-win situation for all parties involved as consumers can now purchase goods at lower prices, SMEs can reduce costs while increasing production, and the government can expect to see a boost in tax collection due to increased consumer spending. Overall, the GST reduction will go a long way in helping the economy bounce back from the COVID-induced slowdown.

Road Tax Exemption

If you’re considering buying an electric vehicle (EV), you might be interested to know that the government offers some incentives to encourage people to make the switch. One of these incentives is road tax exemption. That’s right – if you buy an electric car, you won’t have to pay road tax! This might not seem like a big deal, but road tax can add up to several hundred dollars per year.

The aim of these incentives is to make EV ownership more affordable and accessible, and to help reduce emissions and improve air quality in our cities. So not only will you save money on road tax, but you’ll also be doing your bit for the environment. If you’re thinking about making the switch to electric, it’s worth doing your research to see what other incentives might be available in your area.

Other Benefits of Owning an Electric Car

Government-Provided Incentives for Electric Cars Owning an electric car has become more financially feasible thanks to the various incentives, tax credits, and rebates provided by governments worldwide. Governments have recognized the importance of encouraging drivers to switch to electric cars, and are offering plenty of incentives to make the transition easier. For instance, in the United States, electric car buyers are eligible for a federal tax credit of up to $7,500, while in the United Kingdom, the government offers a Plug-in Car Grant of £2,500.

Many other countries, including Canada, Australia, and Germany, also have similar programs in place to help electric car owners. Additionally, some countries offer free parking, toll road exemptions, and reduced registration fees for electric car owners, making the overall cost of ownership more affordable. By availing these incentives, electric vehicle owners are not only reducing their carbon footprint but also saving money in the long run.

Environmental Benefits

Are you aware of the tax benefits that electric car owners receive in India? Not only are electric vehicles more energy-efficient, but they also provide various environmental benefits. Switching to an electric car can help reduce air pollution, noise pollution, and carbon emissions. The Indian government has recognized the need to support the transition towards cleaner transportation by offering tax incentives to electric car owners.

Under the Faster Adoption and Manufacturing of Electric Vehicles scheme (FAME), the government provides a subsidy of up to Rs. 5 lakh for electric cars with a battery capacity of up to 25 kWh.

There is also a reduction in GST rates for electric cars, making them more affordable for the average consumer. Moreover, electric vehicles are exempt from road tax, making them an even more economical alternative. These tax benefits not only help encourage the adoption of electric vehicles but also contribute to the creation of a cleaner and greener environment.

So, the next time you are considering buying a new car, think about opting for an electric one and avail the tax benefits provided by the government.

Reduced Pollution

Reduced pollution is one of the most significant environmental benefits that we can achieve through sustainable practices. Pollution is a major problem in many parts of the world, and it has serious consequences for human health and the natural environment. By reducing our carbon footprint, we can help to reduce the amount of pollution that is released into the atmosphere, which can have a positive impact on climate change and air quality.

There are many ways to reduce pollution, including using renewable energy, promoting sustainable transportation, and minimizing waste. These practices can help to reduce the amount of greenhouse gas emissions that are produced, which can help to improve the quality of the air we breathe and protect our natural ecosystems. Ultimately, reducing pollution is an important step in creating a healthier, more sustainable world for generations to come.

Reduced Petroleum Dependency

Reduced petroleum dependency is a topic of growing importance, particularly in light of the environmental damage caused by traditional fossil fuels. By reducing our dependence on petroleum products, we can not only reduce our carbon footprint, but also protect our natural resources and wildlife. When we rely less on oil, we decrease the amount of drilling, fracking, and other destructive practices that can harm our planet.

Additionally, using alternative energy sources like wind and solar power can help reduce air pollution and create cleaner, healthier communities. So, why not make the switch to a more sustainable future? By making small changes in our daily lives, we can reduce our petroleum dependency and leave a better world for future generations.

Future of Electric Cars in India

In recent years, electric cars have gained immense popularity due to their eco-friendliness and cost-effectiveness. To encourage more people to opt for electric cars in India, the government has introduced various tax benefits. One of the main tax benefits for electric cars in India is the exemption of road tax.

This means that individuals who purchase electric cars are not required to pay road tax for the next few years. Additionally, there is a GST reduction of 5% for electric cars, making them more affordable for people. Another benefit is the provision of income tax deduction of up to

5 lakhs for individuals who take an electric car loan. These tax benefits have encouraged more people to invest in electric cars, making them a preferred choice for city commuting. As we move towards a greener future, it is important to consider the advantages of electric cars and explore opportunities for more sustainable transportation options.

Conclusion

In conclusion, the tax benefits for electric cars in India serve as a shining beacon of hope for the future of sustainable transportation. By incentivizing the use of electric vehicles, the Indian government is taking a bold step towards promoting cleaner air and reducing carbon emissions. And for those of us who have always dreamed of owning a Tesla or a Nio, these tax benefits make our dreams a little more attainable.

So, let’s strap on our seatbelts and prepare for a greener, cleaner, and more electrifying future!”

FAQs

What are the tax benefits available for electric car buyers in India?

The Indian government offers a tax benefit of up to Rs. 1.5 lakh on the interest paid on loans taken to purchase electric cars under Section 80EEB of the Income Tax Act.

Is there any exemption on road tax for electric cars in India?

Yes, currently, several state governments in India, including Delhi and Maharashtra, offer complete exemption on road tax for electric vehicles.

Can businesses claim tax benefits on the purchase of electric cars in India?

Yes, businesses that buy electric cars in India can claim up to 50% depreciation in the first year under Section 32 of the Income Tax Act.

Are there any customs duty exemptions on electric cars in India?

Yes, customs duty exemptions are available for electric cars that are imported into India, provided they meet certain criteria set by the government. This is aimed at promoting the adoption of electric cars in India.