Going Green and Saving Green: The Tax Benefits of Electric Cars and Solar Panels

Looking to save big on your taxes? Then it’s time to look into electric cars and solar panels! Both of these technologies offer numerous benefits, not just for the planet but for your wallet as well. With tax credits and deductions available, you could potentially save thousands of dollars on your taxes. But figuring out how to take advantage of these benefits can be confusing.

That’s why we’re here to help you navigate the complex world of tax incentives for electric cars and solar panels. In this blog post, we’ll provide you with everything you need to know to maximize your tax benefits and start reaping the rewards of clean, efficient energy. So, let’s get started!

Introduction

As we become more conscious about our carbon footprint, investing in electric cars and solar panels is becoming increasingly popular. Not only are they environmentally friendly, but they also come with some significant tax benefits. For starters, purchasing an electric car can qualify you for a federal tax credit of up to $7,500.

This credit can significantly decrease the cost of the car and make it a more affordable option. On the other hand, installing solar panels on your home can also generate tax credits and deductions. For instance, the Federal government allows up to 26% off the total cost of installation in tax credits.

By investing in these products, you not only reduce your reliance on fossil fuels, but you can also save money in the long run. So why not take advantage of these tax benefits and make a conscious effort towards a more sustainable future?

Exploring the Benefits of Electric Cars and Solar Panels

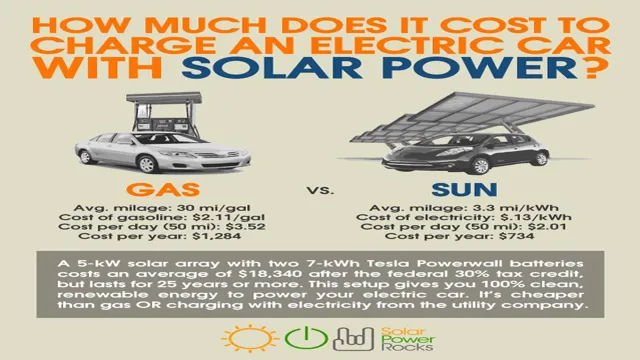

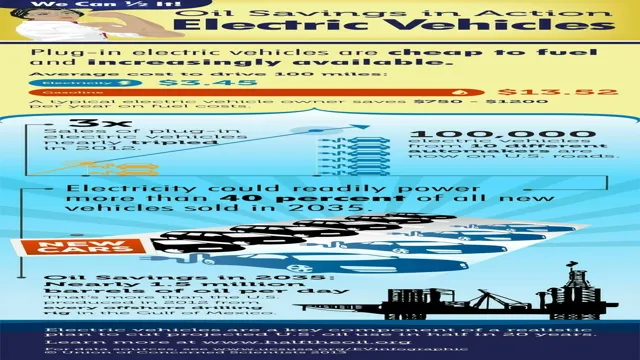

Are you considering upgrading to an electric car and installing solar panels in your home? If so, you’re not alone. Many people are turning to renewable energy sources to save money on gas and electricity while also reducing their environmental footprint. The benefits of electric cars and solar panels are numerous, with the most significant being a decrease in greenhouse gas emissions and the potential for significant cost savings over time.

By using solar panels to power your home and charging your electric car with that energy, you can dramatically reduce your dependence on fossil fuels. This means you’ll not only save money in the long run, but you’ll also be doing your part to protect the planet. So, what are you waiting for? Let’s explore the benefits of electric cars and solar panels together and see how they can benefit you and the environment!

How Tax Credits Can Help You Save Money

Tax credits can be a great way to save money on your taxes each year. While they may seem confusing at first, tax credits are actually quite simple to understand. Essentially, a tax credit operates as a dollar-for-dollar reduction in your tax bill.

This means that if you owe $1,000 in taxes and receive a $500 tax credit, you will only owe $500 in taxes. The best part? Tax credits are available in a wide range of categories, from education to home renovations, so there is a good chance that you will be able to take advantage of one or more tax credits each year. By doing so, you can lower your overall tax burden and keep more of your hard-earned money in your pocket.

Electric Cars and Tax Benefits

If you’re considering going green and purchasing an electric car or solar panels, there are numerous tax benefits you can take advantage of. The federal government is currently offering tax credits of up to $7,500 for electric vehicle purchases, which can significantly reduce the overall cost. Additionally, if you install solar panels on your home, you may be eligible for a federal tax credit of up to 26% of the installation costs.

State and local governments also offer various incentives such as rebates, grants, and sales tax exemptions, so it’s worth researching what options you have in your area. Not only do these tax benefits provide immediate savings, but they also help promote a cleaner and more sustainable future. So, if you’re looking to make a switch to a more eco-friendly lifestyle, don’t forget to explore the tax benefits available for electric cars and solar panels.

Federal Tax Credit for Electric Vehicles

If you’re considering purchasing an electric car, it’s important to know about the federal tax credit available to help you save money. The federal tax credit for electric vehicles was created to encourage people to buy electric cars, which emit less pollution and are more fuel-efficient than traditional gasoline-powered cars. Depending on the make and model of the electric vehicle you purchase, you could be eligible for a tax credit of up to $7,500.

However, it’s important to note that this is a one-time credit and you must purchase the car new to be eligible. Additionally, the credit begins to phase out once a manufacturer reaches 200,000 electric vehicle sales. So if you’re thinking about buying an electric car, be sure to research the tax credit options available to you, as it could help offset some of the costs and make it a more affordable option.

State Tax Credits and Incentives for Electric Cars

If you’re in the market for an electric car, there are a variety of state tax credits and incentives that can make your purchase even more affordable. Many states offer tax credits for the purchase of electric vehicles, which can significantly reduce the cost of buying a car. Additionally, some states offer incentives such as free parking or HOV lane access for electric vehicles.

These benefits aren’t just good for your wallet, though – they can also help reduce your carbon footprint and contribute to a cleaner, healthier environment. So if you’re considering making the switch to an electric car, be sure to explore the tax credits and incentives available in your state. It just might be the boost you need to finally make the switch.

Additional Tax Benefits for Electric Vehicle Owners

If you’re in the market for an electric car, there are quite a few tax benefits to consider that could save you money in the long run. The federal government offers a tax credit of up to $7,500 for qualified electric vehicles, and some states also offer additional incentives. These incentives vary from state to state, but they can include rebates, tax credits, and reduced registration fees.

Additionally, electric vehicle owners can also save money on gas and maintenance costs, which can add up over time. With electric cars becoming more mainstream, taking advantage of the tax benefits and long-term savings could be a smart move for environmentally conscious car buyers looking to save money and reduce their carbon footprint.

Solar Panels and Tax Benefits

If you have recently purchased an electric car or installed solar panels on your home, you may be eligible for tax benefits. The federal government offers a tax credit of up to $7,500 for electric cars, while state governments may also offer additional incentives, such as tax exemptions or rebates. For solar panels, the federal government provides a 26% tax credit for the cost of installation, which can save thousands of dollars.

Some state governments also offer additional incentives for solar energy, such as property tax exemptions or sales tax exemptions. Whether you are looking to reduce your carbon footprint or simply save some money on taxes, taking advantage of these benefits can have a significant impact on your financial well-being. So why not explore your options and see if you qualify for any of these tax benefits for electric cars or solar panels? It could be the first step towards a more sustainable and affordable future.

Federal Tax Credit for Residential Solar Energy Systems

If you’re considering installing solar panels on your home, you may be eligible for a federal tax credit. As part of the Residential Renewable Energy Tax Credit program, homeowners can receive a credit worth 26% of the total cost of installing a solar energy system. This credit applies to both solar panel systems and solar water heating systems.

The credit can also be carried over for up to five years if the full amount cannot be claimed in one year. Taking advantage of this tax credit can significantly reduce the cost of going solar and make it a more accessible option for homeowners. Investing in solar energy not only benefits the environment, but also your wallet in the long run, as it can lower your monthly energy bills and potentially increase the value of your home.

So, if you’re looking for a way to reduce your carbon footprint and save money, installing solar panels on your home and taking advantage of the federal tax credit may be the way to go.

State-Specific Solar Panel Incentives and Rebates

When it comes to solar panel installation, there are a variety of state-specific incentives and rebates available to help reduce the financial burden. One of the most significant benefits is the federal Investment Tax Credit (ITC), which allows homeowners to deduct up to 26% of the total cost of their solar panel system from their federal taxes. Additionally, some states offer their own tax credits or exemptions, such as California’s property tax exclusion for solar panel installations.

It’s important to note that these incentives and rebates vary by state and can change over time, so it’s essential to do your research and work with a reputable installer who can help you navigate the process. While solar panel installation can be a significant upfront cost, taking advantage of these tax benefits can make it a worthwhile investment in the long run.

Conclusion

In conclusion, investing in electric cars and solar panels not only benefits the planet by reducing carbon emissions, but also benefits your wallet through tax incentives. It’s a win-win situation – you save money on fuel and energy bills while simultaneously contributing to a cleaner, greener world. So go ahead, make the environmentally savvy choice and “charge ahead” to those tax benefits.

“

FAQs

What tax benefits are available for purchasing an electric car?

Electric car buyers may qualify for federal tax credits of up to $7,500, as well as additional state and local incentives for purchasing and owning an electric car.

Are there tax benefits for installing solar panels on a home or business?

Yes, individuals and businesses who install solar panels may be eligible for federal tax credits of up to 26%, as well as state and local incentives depending on where they are located.

Can you get tax benefits for hybrid or plug-in hybrid vehicles?

Yes, hybrid car buyers may qualify for federal tax credits of up to $4,500, and plug-in hybrid buyers may be eligible for up to $7,500 in tax credits.

Do you have to own your electric car or solar panels outright to receive tax benefits?

No, individuals who lease an electric car or solar panels may also be eligible for tax credits and incentives, depending on the terms of the lease agreement.