Rev Up Your Savings: Discover the Tax Benefits of Going Electric

Are you aware of the tax benefits that come with owning an electric car? Not only are these vehicles more environmentally friendly, but they also offer significant financial advantages. Switching to an electric car could potentially save you thousands of dollars in taxes and other expenses. In this blog post, we’ll explore some of the various tax benefits you can enjoy by making the switch, as well as other reasons why owning an electric car is a smart move.

Get ready to discover how going green can save you some serious green!

Federal Tax Credits

One of the best tax benefits of owning an electric car is the federal tax credit. When you purchase an electric vehicle, you may be eligible for a tax credit of up to $7,500. The amount of the tax credit varies depending on the make and model of the electric car, as well as the battery size.

However, it’s important to note that once a manufacturer has sold 200,000 eligible vehicles, the tax credit reduces and eventually phases out entirely. So, if you’re considering purchasing an electric car, it’s important to research the tax credit and ensure you take advantage of it before it’s too late. Additionally, some states and localities offer their own incentives for electric car owners, such as rebates and free charging stations.

Overall, the tax benefits of an electric car can make it a financially smart choice while also helping to reduce your carbon footprint.

Up to $7,500 per vehicle

If you’re in the market for a new electric vehicle, you may be eligible for a Federal Tax Credit of up to $7,500 per vehicle. This tax credit is designed to incentivize the purchase of electric and plug-in hybrid vehicles, ultimately reducing our dependence on fossil fuels and lowering our carbon footprint. The exact amount of the tax credit you’ll receive depends on the size of the vehicle’s battery and the manufacturer.

For example, Tesla’s vehicles are no longer eligible for the full $7,500 credit, as they’ve sold enough electric vehicles to surpass the threshold set by the government. However, there are still many other manufacturers that offer the full tax credit, such as Chevrolet and Nissan. Keep in mind that the tax credit will eventually phase out for each manufacturer as they reach a certain number of electric vehicle sales.

So if you’re considering purchasing an electric vehicle, now may be the perfect time to take advantage of these tax credits. Not only can you lower your carbon footprint, but you can also save money on your taxes at the same time.

Depends on battery size and vehicle manufacturer

When it comes to federal tax credits for electric vehicles, the amount you can receive varies depending on the battery size and the manufacturer of the vehicle. Generally speaking, the larger the battery size, the higher the tax credit you can receive. This is because the federal government is keen to incentivize the adoption of electric vehicles with larger batteries, as they generally have a longer range and are more practical for everyday use.

However, it’s worth noting that while some manufacturers are still eligible for the maximum tax credit of $7,500, this amount has reduced for others as they have reached a certain number of electric vehicles sold. So, if you’re thinking about purchasing an electric vehicle, make sure you do your research to find out whether you’re eligible for federal tax credits and how much you could receive. Not only will this help you make an informed decision about which vehicle to buy, but it could also save you thousands of dollars in the long run.

State Incentives

If you’re thinking about buying an electric car, you may be wondering about the tax benefits. The good news is, many states offer incentives to encourage the purchase of electric vehicles. For example, some states offer tax credits or rebates for electric car owners.

These incentives can help offset the higher upfront costs of electric cars, making them a more attractive option for many people. Additionally, some states offer other benefits like free parking or access to carpool lanes, which can also be a big plus for commuters. To find out what incentives are available in your state, check with your local government or consult an online resource.

With tax benefits and other incentives, electric cars are becoming an increasingly practical and affordable option for many drivers.

Various state incentives available

If you are looking to invest in a new business or expand an existing one, there are numerous state incentives available to take advantage of. From tax credits and exemptions to low-interest loans and grants, each state has its unique set of programs designed to encourage economic growth and job creation. Some common incentives include property tax abatements, research and development tax credits, workforce training grants, and energy efficiency rebates.

These incentives can vary depending on the state, industry, and the size of your business. It’s always a good idea to research and consult with a professional to determine which incentives you are eligible for and how to apply for them. By taking advantage of state incentives, you can save money, increase your profits, and contribute to your local economy.

Examples: sales tax exemption, reduced registration fees

State incentives are a powerful tool for encouraging economic growth and development within a given geographic area. One common example of a state incentive is a sales tax exemption, which allows businesses to avoid paying state sales taxes on certain goods or services. This can help to lower overall costs for businesses, making it easier for them to stay competitive and expand their operations.

Another common example is reduced registration fees for businesses that are starting up or expanding in a particular area. This can help to lower the overall barriers to entry for new businesses, encouraging more companies to set up shop and create jobs in the region. Whether through tax exemptions, reduced fees, or other incentives, state governments have a range of tools at their disposal for driving economic growth and creating new opportunities for their citizens.

By working together with businesses and other stakeholders, they can help to create a brighter future for everyone in their communities.

Fuel Savings

One of the biggest draws of electric cars, other than reducing one’s carbon footprint, is the tax benefits that come with owning one. First and foremost, electric car owners are eligible for the federal electric vehicle tax credit, which can be as much as $7,500 depending on the make and model of the car. Additionally, some states offer their own tax credits or rebates for electric car owners as well.

On top of that, owning an electric car can also save money on fuel costs, as they require less maintenance and upkeep compared to traditional gas-powered cars. Overall, investing in an electric car not only makes a positive impact on the environment, but it can also provide significant financial benefits in the long run.

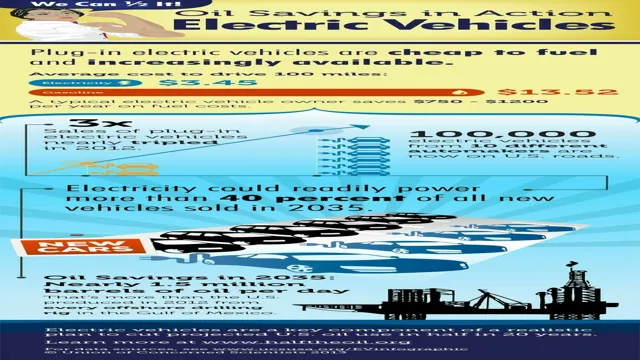

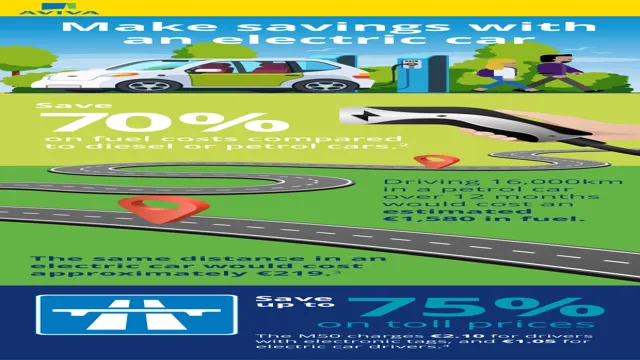

Electricity costs less than gasoline

Electricity costs less than gasoline, and this is great news for anyone looking to save on fuel costs. Electric vehicles (EVs) are becoming more and more popular, and for good reason. They are not only less expensive to run than gasoline-powered cars, but they are also cleaner and more environmentally friendly.

The average EV user can expect to save thousands of dollars over the lifetime of their vehicle when compared to the cost of gasoline. It’s important to note that the cost savings may vary depending on where you live and the price of electricity in your area. However, even in areas with higher electricity prices, EVs are still more cost-efficient than gasoline cars.

So, if you’re in the market for a new car, consider an EV. You’ll not only save money on fuel costs but also do your part in reducing harmful emissions.

May save thousands of dollars in fuel costs over vehicle lifetime

When it comes to buying a vehicle, the cost of fuel can add up quickly and become a significant expense. This is why many people are now looking for more fuel-efficient options that can help save them thousands of dollars over the lifetime of their vehicle. Investing in a car that prioritizes fuel savings can make a significant difference in your budget in the long run.

Not only will you save money on gas, but you’ll also be reducing your carbon footprint and contributing positively to the environment. When considering fuel savings, it’s crucial to prioritize efficiency over flashy features, as the benefits to your wallet will be significant. Choosing a vehicle that prioritizes fuel savings can help you save money and maximize your budget in the long run.

Green Vehicle Incentives

Electric cars have come a long way in recent years, and more drivers are choosing them over traditional gas-powered vehicles. Not only do they offer a cleaner alternative that benefits the environment, but they also come with several tax benefits. For instance, you may be eligible for federal tax credits of up to $7,500, depending on the type of vehicle you purchase.

You may also be able to get state tax incentives, which could reduce your overall tax bill even further. In some states, you may not have to pay sales tax on your electric car purchase, and you may be able to receive additional perks like free parking or access to HOV lanes. These incentives are a great way to save money while also making a positive impact on the environment.

By choosing an electric car, you can enjoy the convenience of low-cost charging and the satisfaction of knowing you are doing your part to reduce emissions. So, why not consider an electric car today and take advantage of the tax benefits?

Additional incentives for fuel-efficient and low-emission vehicles

If you’re considering purchasing a fuel-efficient or low-emission vehicle, you may be eligible for several green vehicle incentives. Some states offer tax credits or rebates for electric or hybrid vehicles, while others provide access to carpool lanes or discounted registration fees. The federal government also offers tax credits for certain vehicles, ranging from a few thousand dollars to over $7,000.

Additionally, some automakers offer incentives for purchasing their green vehicles, such as free charging or maintenance for a certain amount of time. These incentives can significantly lower the cost of owning a green vehicle and make them more financially feasible. Furthermore, driving a fuel-efficient or low-emission vehicle can save you money on gas and reduce your carbon footprint.

So, not only can you feel good about making a positive impact on the environment, but you can also benefit financially by taking advantage of green vehicle incentives.

Examples: carpool lane access, free parking in some areas

Green vehicles have been introduced as a great initiative to move towards a greener and cleaner environment. Several green vehicle incentives have been put in place to encourage drivers to switch to environmentally friendly modes of transportation. One such incentive is carpool lane access.

Here, vehicles that meet specific clean air standards are rewarded with access to carpool lanes, which can save them significant time during peak hours. Additionally, free parking in some areas is another incentive that can be availed by drivers of green vehicles. This can lead to significant cost savings as parking costs can add up over time.

These incentives have proven quite successful in motivating drivers to switch to green vehicles and contribute to a sustainable future. So, if you’re a car owner looking to make a difference, consider investing in a green vehicle and taking advantage of these incentives.

Conclusion

In summary, the tax benefits of owning an electric car are quite shocking! Not only do they save you money on gas and maintenance, but the federal tax credit can help offset the initial cost of the vehicle. Additionally, some states offer their own tax incentives and exemptions, making electric cars an even more attractive option. So, if you’re looking for a way to drive green and save some green, an electric car might just be the spark you need.

“

FAQs

What are the tax benefits of owning an electric car?

Owners of electric vehicles can qualify for a federal tax credit, which ranges from $2,500 to $7,500 depending on the make and model of the car. Additionally, some states offer additional tax incentives for electric car owners.

Do electric car tax credits expire?

Yes, the federal tax credit for electric vehicles is limited to the first 200,000 vehicles sold by each manufacturer. Once a manufacturer hits that threshold, the credit starts to phase out. Some states may also have expiration dates for their tax incentives.

How do I claim the federal tax credit for my electric vehicle?

To claim the federal tax credit for your electric car, you must fill out IRS Form 8936 and submit it with your tax return. Make sure to have all the necessary documentation, such as proof of purchase and the manufacturer’s certification, to support your claim.

Are there any other financial benefits to owning an electric car besides tax credits?

Yes, electric cars are typically cheaper to fuel and maintain compared to traditional gas-powered cars. Plus, some states offer additional perks such as free or discounted parking, reduced tolls, and carpool lane access for electric car owners.