The Shocking Tax Benefits of Going Electric: A Guide to Saving Money

Do you know that electric cars can help you save on taxes? Yes, you heard it right! With the rise of electric cars on the roads, governments have introduced tax benefits and incentives to promote clean energy transportation. If you’re thinking about buying an electric car, then this blog is for you. In this article, we’ll shed light on the tax benefits that come with owning an electric car.

Not only will you contribute to a greener environment, but you’ll also enjoy tax savings while doing so. So, fasten your seatbelts and let’s explore the tax breaks that come with owning an electric car.

Federal Tax Credits

If you’re considering buying an electric car, one of the biggest incentives is the tax benefits. The federal government provides various tax credits that can significantly reduce the cost of buying and owning an electric vehicle. For starters, buyers are eligible for a federal tax credit that can be up to $7,500, depending on the vehicle’s battery size.

Additionally, some states and local municipalities offer their tax credits and rebates. These credits can stack up, making electric cars more accessible to the average consumer. Not only does this save you money upfront, but it can also save you money over time by reducing fuel costs and maintenance expenses.

With the many tax incentives available, there’s never been a better time to invest in an electric car.

Up to $7,500 for qualifying electric vehicles

The Federal government offers a tax credit of up to $7,500 for qualifying electric vehicles, making them a more affordable and sustainable option for many car buyers. But what exactly qualifies as a qualifying electric vehicle? In general, the vehicle must be powered by a battery that has at least 4 kWh of capacity and is capable of being recharged from an external source. Many popular electric vehicles, such as Tesla’s Model S and Model X, Nissan’s Leaf, and Chevrolet’s Bolt, are eligible for the full credit.

However, it’s important to note that the credit begins to phase out once a manufacturer has sold 200,000 qualifying EVs in the US. So, if you’re in the market for an electric vehicle, be sure to do your research and take advantage of this valuable tax credit while it’s still available.

Phase-out period based on sales number

Federal Tax Credits Are you aware that the federal government is offering tax incentives to encourage people to use electric and hybrid vehicles? These incentives aim to reduce carbon emissions and dependence on foreign oil, among other things. However, there is a catch – the tax credits are being phased out over time. The phase-out period is based on the sales number of electric and hybrid vehicles sold by each manufacturer.

Once a manufacturer hits the sales threshold, their federal tax credit will gradually decrease until it is entirely phased out. So, if you’re considering buying an electric or hybrid vehicle, it’s best to do your research on the specific phase-out schedule for that manufacturer. Don’t wait too long, as the credits will eventually expire! However, keep in mind that the tax credit applies to the original purchaser of a new vehicle, and you must take delivery of the vehicle before the expiration date to be eligible for the credit.

So, if you’re thinking of buying an electric or hybrid vehicle, there’s no time like the present to take advantage of these tax incentives.

State Incentives

If you’re considering buying an electric car, you may be pleasantly surprised to learn about the many tax benefits available at the state level. Many states offer incentives, such as tax credits or rebates, for those who purchase electric vehicles (EVs). Some states even offer exemptions from sales tax or reduced registration fees.

Additionally, some states offer incentives for EV charging infrastructure. These incentives vary depending on where you live, so it’s essential to research what incentives are available in your state. Taking advantage of these incentives can help make the cost of buying an electric car more manageable, and it may even save you money in the long run on fuel and maintenance costs.

Ultimately, there are many reasons to consider an electric car, and the tax benefits available can make that decision even easier.

State credits, rebates, and exemptions

State Incentives When it comes to purchasing renewable energy systems or making energy-efficient upgrades to your home, you may be eligible for various state incentives such as credits, rebates, and exemptions. These incentives are designed to encourage homeowners to make eco-friendly upgrades and reduce their carbon footprint. Depending on where you live, you may be able to take advantage of tax credits for purchases of solar, wind, or geothermal energy systems, rebates for purchasing energy-efficient appliances, and exemptions for property taxes on renewable energy systems.

Some states even offer incentives for energy audits and weatherization improvements. To find out what incentives are available in your state, check with your state government or visit the Database of State Incentives for Renewables and Efficiency (DSIRE) website. By taking advantage of these incentives, you can save money while doing your part to help protect the environment.

Examples of state incentives (CA, CO, MA, etc.)

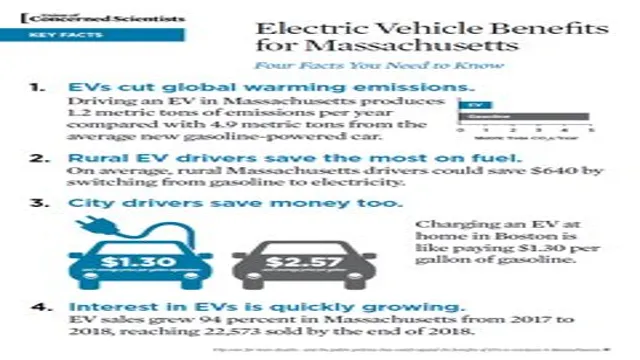

State incentives are a great way to stimulate economic growth while promoting environmentally friendly practices. California, Colorado, and Massachusetts are examples of states that offer attractive incentives to businesses that adopt sustainable practices. California, known for its strict environmental regulations, offers incentives such as tax rebates, grants, and low-interest loans to companies that adopt renewable energy sources or implement energy efficiency measures.

Colorado has a similar program, offering loans and grants to businesses that implement sustainable practices such as energy-efficient lighting or water-saving technologies. In Massachusetts, businesses that reduce their greenhouse gas emissions can receive financial incentives, and the state offers grants to companies that implement renewable energy sources. These incentives not only help businesses reduce their carbon footprint but also promote innovation and growth in the clean energy sector.

Lower Operating Costs

One of the greatest benefits of buying an electric car are the tax incentives you can receive. Many governments offer tax credits for purchasing an electric car as an incentive to switch to a more eco-friendly mode of transportation. These credits can help offset the higher upfront cost of an electric car and provide significant savings on your income tax bill.

Additionally, electric cars have significantly lower operating costs than gas-powered vehicles due to their lower maintenance and fuel expenses. Since electric cars have fewer moving parts, they require less maintenance and can save you money on routine repairs. Furthermore, charging an electric car is much cheaper than filling up a gas tank.

Overall, the tax benefits and lower operating costs of electric cars make them an attractive option for those looking to save money in the long run while also supporting environmental sustainability.

Electricity vs Gasoline costs

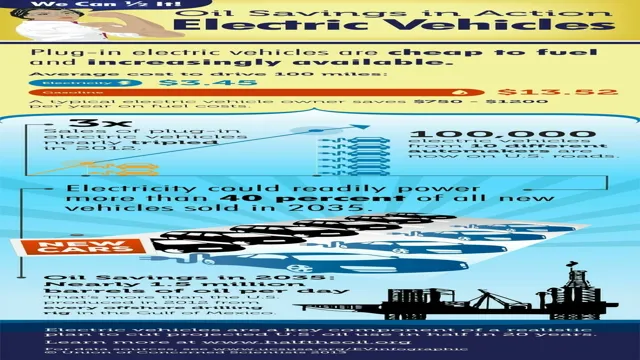

When it comes to operating costs, electricity wins hands down over gasoline. Electric cars are incredibly efficient, utilizing up to 80% of their energy for movement compared to only 20% for gas-powered vehicles. Additionally, electric cars require far less maintenance than their gas-guzzling counterparts, as they have fewer moving parts that need to be serviced.

This means you’ll save significantly on routine maintenance like oil changes and tune-ups, not to mention avoiding expensive repairs to complex engine components like transmissions and exhaust systems. The good news is that the cost of charging an electric vehicle is also significantly lower than filling up at the gas pump, with an average range of 100 miles costing only a few dollars’ worth of electricity. The bottom line is that if you’re looking for a vehicle with lower operating costs and long-term savings, it’s hard to beat an electric car.

Maintenance and repair savings

Lower Operating Costs One of the biggest advantages of maintaining and repairing your equipment is the savings that come with it. By taking good care of your machinery and staying on top of repairs, you can ensure that your equipment lasts longer and performs at its best. This means that you don’t have to shell out as much money on replacements and you’ll save money in the long run.

Additionally, regular maintenance can help prevent breakdowns and other issues that can cost a lot of money to fix. In other words, keeping up with your machinery can help keep your operating costs down. So, whether you’re a business owner or a homeowner, it’s important to stay on top of equipment maintenance and repair to save money in the long run.

Conclusion

In conclusion, purchasing an electric car not only helps save the environment, but it can also lead to some serious tax benefits. By opting for a more eco-friendly vehicle, you can earn tax credits and exemptions that will not only lighten your financial load but also make driving a guilt-free, thrilling experience. So, don’t just drive, charge up, and reap the rewards that come with saving the planet and your pocket simultaneously!”

FAQs

What are the tax benefits of buying an electric car?

There are several tax benefits of buying an electric car, including federal tax credits of up to $7,500 and state-specific incentives like rebates and exemptions from sales tax. Additionally, electric car owners may be eligible for tax deductions related to electric charging stations in their homes.

How long do the tax benefits for buying an electric car last?

The federal tax credit for buying an electric car begins to phase out once an automaker sells 200,000 eligible vehicles. Currently, Tesla and General Motors have surpassed this threshold, but other automakers still offer full tax credits. State-specific incentives may have different expiration dates.

Can I still get tax benefits for buying a used electric car?

Eligibility for federal tax credits is based on the original sale of the vehicle, so used electric cars are not eligible. However, some states offer incentives for used electric car purchases.

Do the tax benefits for buying an electric car vary by state?

Yes, each state has its own set of incentives and tax credits for electric car purchases. Some states offer rebates or tax exemptions while others have specific programs for electric vehicle charging infrastructure. It is important to research the incentives available in your state before purchasing an electric car.