Tax Benefits of Buying Electric Car: Maximize Savings!

Buying an electric car is a great choice. It is good for the planet. It can also save you money. Many people do not know about the tax benefits. This article will explain those benefits. Let’s dive in!

What is an Electric Car?

An electric car runs on electricity. It does not use gasoline or diesel. These cars are better for the environment. They produce less pollution. People are buying them more every year. They are becoming very popular. But there is more to them than just being green.

Tax Credits for Electric Cars

One of the main benefits of buying an electric car is tax credits. A tax credit reduces the amount of tax you pay. In the United States, the federal government offers a tax credit. This credit can be up to $7,500. This depends on the car you buy. It can make your electric car cheaper.

Who Qualifies For The Tax Credit?

To get the tax credit, you must meet some rules:

- You must buy a new electric car.

- The car must be on the list of qualified vehicles.

- You must have enough tax liability to use the credit.

Not everyone will get the full $7,500. It depends on the car’s battery size. Cars with larger batteries usually qualify for more money. So, it is smart to check the details before buying.

State Tax Incentives

Many states also offer tax benefits. These benefits are often called state tax incentives. Each state has its own rules. Some states provide tax credits. Others give tax rebates. A tax rebate is money back after you file your taxes.

Examples Of State Incentives

Here are some examples of state incentives:

- California offers up to $2,500 for electric cars.

- New York has a rebate program that can give you $2,000.

- Texas offers a rebate of $2,500 for some electric cars.

These amounts vary by state. Always check your local laws. This can save you a lot of money.

Local Incentives and Benefits

Some cities also give benefits. Local governments want to encourage electric car use. They may offer discounts or rebates. Some cities provide free parking for electric cars. Others give access to carpool lanes. These local benefits add up.

Charging Station Incentives

Installing a charging station at home can also have benefits. Some states offer tax credits for this. You may save on your installation costs. This makes owning an electric car easier.

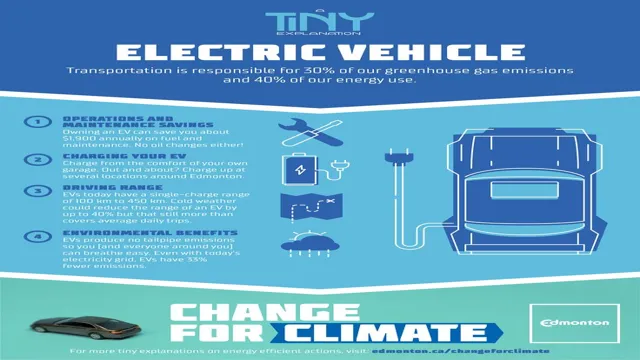

Lower Maintenance Costs

Electric cars often have lower maintenance costs. They do not need oil changes like gas cars. This can save you money over time. Fewer moving parts mean less to fix. This is a hidden benefit of owning an electric car.

Fuel Savings

Electric cars are cheaper to fuel. Charging an electric car costs less than gas. This is true in most places. You can save money every month. Some people even charge their cars at work for free.

Time To Break Even

Buying an electric car can feel expensive. But the savings add up. You may break even in a few years. This depends on gas prices and how much you drive.

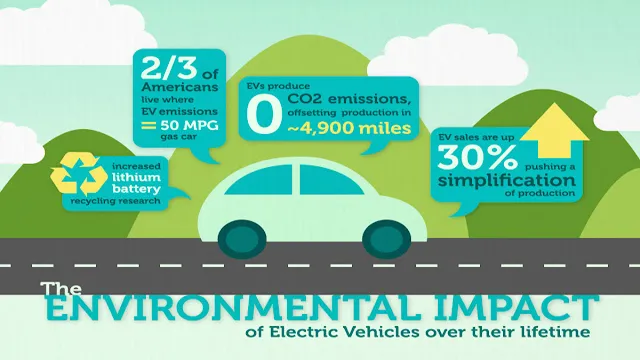

Environmental Benefits

Electric cars help the planet. They produce no tailpipe emissions. This means cleaner air. Fewer emissions mean less climate change. Many people buy electric cars to help the environment.

Frequently Asked Questions

What Are The Tax Benefits Of Buying An Electric Car?

Buying an electric car can give you tax credits, rebates, and deductions. These help lower your overall tax bill.

How Much Is The Federal Tax Credit For Electric Vehicles?

The federal tax credit can be up to $7,500. The amount depends on the car’s battery size.

Do State Tax Credits Exist For Electric Cars?

Yes, many states offer their own tax credits and rebates. Check your state’s program for specific details.

Can I Claim Tax Benefits For Used Electric Cars?

Yes, some states offer benefits for used electric vehicles. Federal tax credits usually apply only to new cars.

Conclusion

Buying an electric car comes with many benefits. Tax credits can save you money. State and local incentives can help too. Lower maintenance costs and fuel savings are big pluses. Remember, electric cars are good for the planet.

Consider all these benefits. They can help you make a smart choice. Buying an electric car may be a good decision for you. Always research your options. This way, you can enjoy the savings and help the earth.

FAQs About Electric Car Tax Benefits

1. How Much Is The Federal Tax Credit For Electric Cars?

The federal tax credit can be up to $7,500. It depends on the car you buy.

2. Do All States Offer Tax Incentives For Electric Cars?

No, not all states offer incentives. Each state has different rules.

3. Can I Get A Tax Rebate For Charging Station Installation?

Yes, some states offer tax rebates for installing charging stations.

4. What Are The Environmental Benefits Of Electric Cars?

Electric cars produce less pollution. This helps to clean the air.

5. Are Electric Cars Really Cheaper To Maintain?

Yes, electric cars usually have lower maintenance costs. They need fewer repairs.

Final Thoughts

In summary, the tax benefits of buying an electric car are significant. You can save money and help the environment. Whether through federal credits or local incentives, every bit helps. Take the time to explore your options. You may find that an electric car is right for you.