Maximize Your Savings: The Top Tax Benefits of Electric Cars for Your Business

If you’re a business owner, you might be considering investing in electric cars for your company fleet. After all, they’re environmentally friendly, cost-effective, and low maintenance. But did you know that electric cars also come with tax benefits for businesses? That’s right, the government offers incentives to encourage companies to switch to electric vehicles.

And these incentives can add up to significant savings on your tax bill. But how exactly do these tax benefits work, and what do you need to know to take advantage of them? In this blog post, we’ll explore the tax benefits of electric cars for business and help you understand how to maximize your savings. So buckle up, and let’s get started!

Lower Taxable Income

If you own an electric car and use it for business purposes, you can enjoy some amazing tax advantages. One of the most significant benefits is lower taxable income. With an electric car, you can deduct up to $18,000 in depreciation costs, which is significantly more than what you can claim with a gas-powered car.

Additionally, you can also claim a tax credit of up to $7,500 for purchasing the vehicle which can directly reduce your business’s tax bill. This can go a long way in reducing your taxable income at the end of the year, allowing you to invest more money in your business instead of paying it to the government. If your business experiences a considerable amount of driving, purchasing an electric car is a smart investment that not only saves you money in the long run, but also helps reduce your carbon footprint.

By choosing an electric vehicle, you can claim numerous tax benefits while also contributing towards a sustainable environment.

Electric Vehicles vs. Gasoline Vehicles

When it comes to buying a car, one factor that people often consider is the cost of ownership, including taxes. Electric vehicles (EVs) have a tax advantage over gasoline vehicles due to their lower taxable income. This is because the federal government offers a tax credit for certain types of EVs, which can be applied to the taxpayer’s federal tax liability.

In addition, some states also offer tax credits or rebates for purchasing an EV. This can result in significant savings for the owner of an electric car. However, it’s important to note that not all electric vehicles are eligible for these tax credits, and the amount of the credit can vary based on factors such as battery size and cost.

As more and more people turn to electric vehicles, it’s likely that governments will continue to incentivize their adoption through tax breaks and other means. So, if you’re considering purchasing a car and want to save money on taxes, an electric vehicle may be worth considering.

Section 179 Deduction

The Section 179 Deduction is a significant tax break that can help businesses save money by lowering their taxable income. This deduction allows businesses to deduct the full cost of qualifying equipment and software purchased or financed within the tax year. It means that businesses can deduct up to $1,050,000 in qualifying purchases, which can result in meaningful savings.

However, the deduction has limits on how much or what type of purchases can be claimed. It’s essential to consult with a tax professional to maximize the benefits of the Section 179 Deduction. By reducing taxable income, businesses can reinvest the savings into their operations, expand their enterprises, or pay off debts.

The benefits of Section 179 Deduction are undeniable and offer a fantastic opportunity for entrepreneurs and small business owners to keep their capital costs low.

Increased Depreciation Deduction

If you are a business owner, investing in electric cars can come with a host of tax benefits. One such benefit is the increased depreciation deduction. With the passage of the Protecting Americans from Tax Hikes (PATH) Act of 2015, businesses can now deduct up to $18,000 in the first year for electric cars purchased for business purposes.

This is a significant increase from the previous limit of $3,160. Furthermore, the depreciation deduction per year for the remaining cost of the car has also increased to $5,760, up from $1,875 for gasoline-powered cars. Overall, investing in electric cars can be a smart move for business owners looking to reduce their tax liabilities while also promoting sustainability and reducing their carbon footprint.

MACRS Depreciation for Electric Cars

Electric cars have become increasingly popular in recent years, not only amongst individuals who are environmentally conscious but also amongst entrepreneurs who have realized the tax benefits. Under the tax code, businesses can now deduct the full cost of electric vehicles that are used for business purposes. These tax benefits have increased with the implementation of MACRS (Modified Accelerated Cost Recovery System) depreciation for electric cars.

MACRS is a depreciation system used for tax purposes in the United States, and it allows businesses to recover the cost of an asset over a set number of years, starting from when it was placed in service. With MACRS, electric cars can be fully depreciated over a period of five years, allowing businesses to make significant deductions on their tax returns. Whether you are self-employed, part of a partnership or own a corporation, be sure to take advantage of this deduction to maximize your tax savings.

Bonus Depreciation for Electric Cars

If you’re in the market for an electric car for your business, you’ll be happy to know that the government is offering increased depreciation deductions as a bonus. Essentially, this means that you can write off more of the cost of your electric vehicle in the year you purchase it, rather than spreading the deductions out over several years. This is great news for businesses looking to make the switch to electric, as it can significantly reduce the upfront costs of investing in a new vehicle.

Not only will you save money in the long run thanks to lower fuel and maintenance costs, but you can also take advantage of this bonus depreciation to make the initial purchase more affordable. So why not consider making the switch today and start reaping the benefits of clean, sustainable, and cost-efficient transportation?

Tax Credits and Incentives

As a business owner, it’s important to take advantage of any tax benefits available. If you own an electric car for business use, you may be eligible for significant tax credits and incentives. In fact, the federal government offers a tax credit of up to $7,500 for qualifying electric vehicles used for business purposes.

Additionally, some states offer their own incentives, such as rebates or tax exemptions. Not only do these benefits help to offset the initial cost of an electric car, but they also lower operating costs over time. By reducing your reliance on fossil fuels, electric cars can also improve your company’s image and help to attract eco-conscious customers.

Plus, with advances in technology, electric cars are becoming more practical for everyday use. If you’re considering purchasing an electric car for your business, be sure to speak with a tax professional to help you take full advantage of available tax benefits.

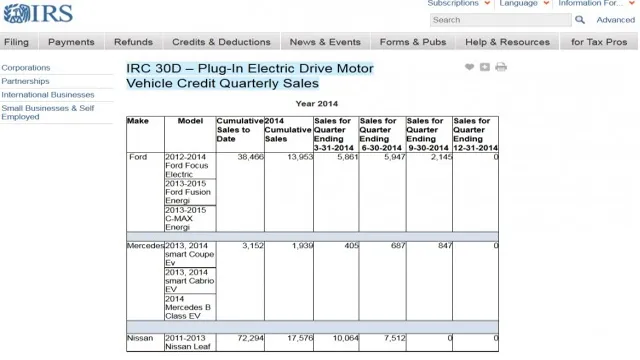

Federal Tax Credits for Electric Cars

Electric cars are becoming increasingly popular as people become more environmentally conscious. But did you know that there are federal tax credits available for those who buy electric cars? The federal government offers a tax credit of up to $7,500 for the purchase of new electric cars. This credit can reduce your tax bill by a significant amount and make electric cars more affordable.

However, it’s important to keep in mind that the credit is only available to those who purchase a new electric car, not a used one. Additionally, the amount of the credit varies depending on the make and model of the car, with some models being eligible for a lesser credit or no credit at all. If you’re considering purchasing an electric car, it’s important to do your research and find out what tax incentives are available to you.

Not only will you be helping the environment, but you might also be able to save some money on your taxes!

State and Local Incentives

State and local governments often offer tax credits and incentives to attract businesses and encourage economic growth in their communities. These incentives can include property tax abatements, investment tax credits, and grants for job creation. For example, some states offer tax credits for businesses that bring jobs to economically depressed areas or hire workers from certain demographics.

Local governments may offer partial sales tax exemptions for businesses that purchase equipment or invest in infrastructure improvements. Taking advantage of these incentives can significantly reduce a company’s tax burden and help offset the costs of expansion and relocation. However, navigating the complex web of state and local regulations can be overwhelming, so it’s essential to work with knowledgeable professionals to determine which credits and incentives are available and how to qualify for them.

Fuel Savings

As electric vehicles become more mainstream, business owners are starting to explore the tax benefits that come with making the switch. One of the most significant advantages of owning an electric car for your business is the fuel savings. Because electric cars run on electricity instead of gas, the cost of powering your vehicle is far lower than traditional gas-powered cars.

This means that businesses can save a significant amount of money in fuel expenses, allowing them to reallocate those funds towards other aspects of the company. In addition, using electric cars can also qualify businesses for various tax credits and incentives, further increasing the value of making the switch. By considering the tax benefits of electric cars for your business, you can reduce your operating costs and improve your overall bottom line.

Comparison of Electric and Gasoline Costs

Electric and gasoline cars are a popular topic of discussion when it comes to fuel costs. It’s no secret that electric vehicles (EVs) have lower fuel costs in general compared to their gasoline counterparts. Depending on where you live, electricity rates can vary, so it’s essential to look up the estimated cost per kilowatt-hour (kWh) in your area.

On average, EVs cost around $0.14 per kWh, while gasoline cars cost between $25 to $

50 per gallon on average. Given that EVs are more energy-efficient, they can travel a more considerable distance on a single kWh compared to the number of miles a gasoline car can cover with a gallon. In simpler terms, EV drivers can save anywhere between $2,000 to $10,000 on fuel costs alone over several years.

The savings can differ based on driving habits, the cost of electricity, and the type of gasoline used in gasoline vehicles. Nonetheless, EVs are still more cost-efficient and better for the environment in the long run.

Conclusion

In conclusion, the tax benefits of driving an electric car for business are truly electrifying. Not only do you get to reduce your carbon footprint and contribute to a cleaner environment, but you also get to enjoy some serious financial perks. From federal tax credits to state incentives, owning an electric vehicle can save your business money in the long run.

So, if you’re looking for a smart investment that pays off both morally and financially, it’s time to plug in and go electric!”

FAQs

What tax benefits are available for businesses that purchase electric cars?

Businesses that purchase electric cars may be eligible for a federal tax credit of up to $7,500. Additionally, they may also be eligible for state and local tax incentives, such as sales tax exemptions and reduced registration fees.

Can businesses also write off the cost of charging stations for electric cars?

Yes, businesses can generally write off the cost of charging stations as a business expense. However, the specific tax treatment may vary depending on the type of charging station and the business’s tax situation.

Are there any restrictions on the types of businesses that can claim tax benefits for electric cars?

Generally, any business that purchases an electric car and uses it for business purposes is eligible for tax benefits. However, certain restrictions may apply depending on the business’s size, tax status, and other factors.

What happens if a business sells or disposes of an electric car that they claimed tax benefits for?

If a business sells or disposes of an electric car that they claimed tax benefits for, they may need to recapture some or all of the tax benefits they received. The specific rules for recapturing tax benefits will depend on the type of tax benefit and the business’s tax situation.