Tax Benefits of Electric Cars: Maximize Your Savings!

Electric cars are becoming popular. More people want to drive them. They are good for the environment. They also have many tax benefits. In this article, we will talk about those benefits.

What Are Electric Cars?

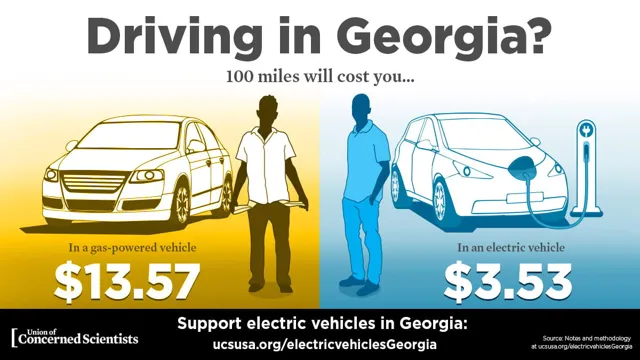

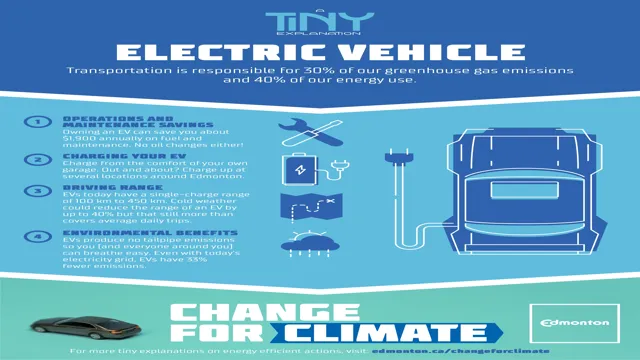

Electric cars run on electricity. They do not use gasoline or diesel. This means they do not pollute the air as much. Many cities are now offering incentives for electric car owners. The goal is to reduce pollution and save energy.

Why Choose Electric Cars?

There are many reasons to choose electric cars. They are quiet. They are cheaper to run than gas cars. You can charge them at home. This is convenient for many people. Most importantly, they help the environment.

Tax Credits for Electric Cars

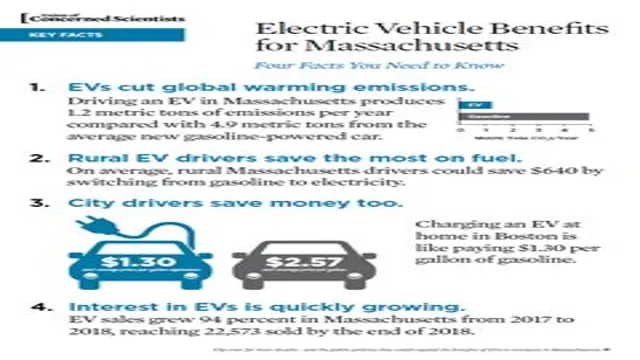

One of the best benefits of electric cars is tax credits. A tax credit lowers the amount you owe to the government. This makes electric cars more affordable. The federal government offers tax credits for electric vehicle buyers.

How Much Can You Save?

The federal tax credit can be up to $7,500. This amount depends on the car’s battery size. Bigger batteries mean bigger credits. However, this credit does not last forever. Once a car company sells 200,000 electric cars, the credit starts to decrease.

State Tax Credits

Many states offer their own tax credits too. These credits can be very helpful. They can add to the federal credit. Some states give up to $5,000 in credit. Check your state’s rules to find out more.

Deductions for Business Owners

If you own a business, electric cars can also help you save money. You can deduct the cost of the car from your taxes. This means you pay less tax overall. You can also deduct the charging station installation costs. This can save you a lot of money.

Charging Station Tax Credits

Installing a charging station at home has benefits. The government gives tax credits for these too. You can get 30% of the cost back. This helps people charge their cars at home. It makes owning an electric car easier.

Sales Tax Exemptions

Some states offer sales tax exemptions for electric cars. This means you do not pay sales tax when buying one. This can save you hundreds of dollars. Check with your state for details.

Lower Registration Fees

Electric cars may have lower registration fees. Some states reduce or waive these fees. This is an extra way to save money. Always check local laws for registration costs.

Insurance Discounts

Insurance companies sometimes offer discounts for electric cars. This can help you save more money. When you buy an electric car, ask your insurance agent about discounts.

Environmental Benefits

Driving an electric car is good for the planet. They produce less pollution. This helps fight climate change. Many people want to help the environment. Driving electric cars is one way to do it.

Government Support for Electric Cars

The government supports electric cars. They want more people to buy them. This is why there are so many tax benefits. Governments want to reduce pollution. They want cleaner air for everyone.

How to Take Advantage of Tax Benefits

To enjoy tax benefits, follow these steps:

- Research the electric cars available.

- Check federal and state tax credits.

- Ask your dealer about tax benefits.

- Keep all receipts and documents.

- Consult a tax professional for advice.

Frequently Asked Questions

What Are The Tax Benefits Of Electric Cars?

Electric cars can offer tax credits, deductions, and lower registration fees. These benefits help reduce overall costs.

How Much Is The Federal Tax Credit For Electric Vehicles?

The federal tax credit can be up to $7,500, depending on the car’s battery size.

Can I Claim State Tax Credits For Electric Cars?

Many states offer additional credits or rebates for electric car purchases. Check your state’s program for details.

Do Electric Cars Qualify For Tax Deductions?

Yes, you may be able to deduct certain expenses related to electric vehicle charging and business use.

Conclusion

Electric cars offer many tax benefits. These make them more affordable. Tax credits, deductions, and exemptions can save you money. Driving electric cars is also good for the environment. More people should consider making the switch.

Frequently Asked Questions (FAQs)

1. What Is The Federal Tax Credit For Electric Cars?

The federal tax credit can be up to $7,500. It depends on the car’s battery size.

2. Do All States Offer Tax Credits For Electric Cars?

No, not all states offer tax credits. Check your state’s rules for details.

3. Can Business Owners Get Tax Benefits From Electric Cars?

Yes, business owners can deduct costs and save on taxes.

4. What Is A Charging Station Tax Credit?

You can get back 30% of the cost for installing a charging station.

5. Are There Insurance Discounts For Electric Cars?

Yes, many insurance companies offer discounts for electric cars.

Final Thoughts

Electric cars are not just a trend. They help reduce pollution. They come with many tax benefits. Whether you are an individual or a business owner, consider electric cars. The savings can be significant. Plus, you are doing a good thing for the planet.