Tax Benefits of Leasing an Electric Car: Smart Savings!

Leasing an electric car can be smart and fun. Many people do not know the tax benefits. In this article, we will explore these benefits. We will also talk about how leasing works. Let’s dive in!

What is Leasing?

Leasing means borrowing a car for a time. You pay a monthly fee. At the end of the lease, you return the car. You do not own it. This is different from buying a car. When you buy a car, you own it forever. Leasing is a good option for many people.

Why Choose an Electric Car?

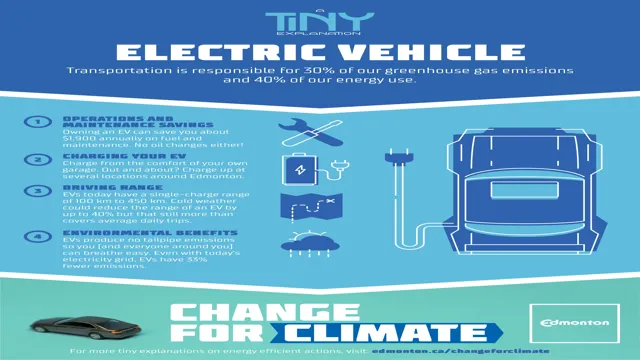

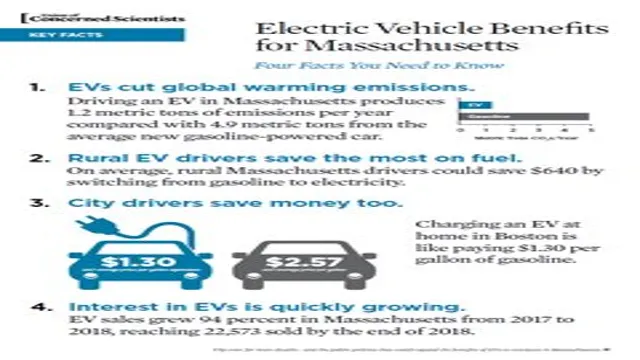

Electric cars are good for the environment. They produce less pollution. They are also often cheaper to run. You can save money on gas. Electric cars have many benefits. But what about tax benefits? Let’s find out!

Tax Credits for Electric Cars

In many countries, the government gives tax credits. These are for people who buy or lease electric cars. These credits can help you save money on taxes. The amount of the credit can vary. It depends on the car’s battery size. A bigger battery usually means a bigger tax credit.

How Do Tax Credits Work?

When you lease an electric car, you can get a tax credit. This credit lowers your tax bill. For example, if you owe $1,000 in taxes, and you have a $7,500 tax credit, you only pay $1,000 – $7,500. This means you owe nothing. Some people even get money back!

.jpg)

Leasing and Tax Deductions

Leasing can also give you tax deductions. Deductions lower your taxable income. This means you may pay less tax. If you use your electric car for work, you can deduct some costs. This includes lease payments, maintenance, and charging costs.

How To Calculate Deductions?

To calculate deductions, keep good records. Write down all your expenses. You will need this information when you file taxes. If you use the car 70% for work, you can deduct 70% of your lease payments. This can add up to big savings.

Incentives by State and Local Governments

Some states also offer incentives. These can be tax credits or rebates. They want to encourage people to use electric cars. Check with your state’s tax office. You may find more ways to save money.

Examples Of State Incentives

| State | Incentive |

|---|---|

| California | Up to $2,500 rebate |

| New York | Up to $2,000 rebate |

| Texas | Up to $2,500 rebate |

Environmental Benefits

Electric cars are good for the planet. They reduce greenhouse gases. This helps fight climate change. Many governments want to encourage electric cars. This is why they offer tax benefits. You can help the environment and save money.

Is Leasing Better Than Buying?

Leasing can be better for some people. You have lower monthly payments. You can drive a new car every few years. However, buying means you own the car. You can keep it as long as you want. Think about your needs before deciding.

Pros And Cons Of Leasing

- Pros:

- Lower monthly payments.

- Tax benefits.

- Drive a new car every few years.

- Cons:

- No ownership.

- Fees for extra mileage.

- Less freedom with modifications.

How to Lease an Electric Car

Leasing an electric car is easy. First, choose a car you like. Next, find a dealer. They can help you with leasing options. You will fill out an application. This will show you how much you can afford.

Understand The Terms

Make sure you understand the lease terms. Read the fine print. Check for mileage limits. Know the fees if you go over the limit. Ask questions before signing. This will help you avoid surprises.

Final Thoughts

Leasing an electric car has many benefits. You can save money with tax credits and deductions. Electric cars help the environment too. Think about your driving needs. Leasing may be the best choice for you.

Seek Professional Advice

Always consider talking to a tax professional. They can help you understand the best options. They know the rules. They can guide you through the process. This will help you maximize your savings.

Frequently Asked Questions

What Are The Tax Benefits Of Leasing An Electric Car?

Leasing an electric car can provide tax deductions and credits. These may lower your overall tax bill.

How Does Leasing An Electric Car Reduce Taxes?

Leasing allows you to claim the vehicle’s depreciation and other related expenses, which can lower taxable income.

Can I Get Federal Tax Credits For Leasing?

Yes, you may qualify for federal tax credits when leasing an electric car, depending on the vehicle’s make and model.

Are There State Tax Benefits For Electric Car Leasing?

Many states offer additional tax credits or rebates for leasing electric vehicles. Check your state’s specific rules.

Conclusion

In summary, leasing an electric car is a smart choice. You enjoy tax benefits and environmental advantages. Remember to look at local incentives. This can make leasing even more appealing. Enjoy driving your electric car, and save money!