Drive Green, Save Green: Revealing the Tax Benefits of Owning an Electric Car

Did you know owning an electric car can not only make a positive impact on the environment, but also on your wallet? That’s right, electric cars offer great tax benefits that can potentially save you thousands of dollars. This is because the government is incentivizing people to switch to electric cars in order to reduce carbon emissions and promote sustainable transportation. In this blog, we’ll dive into the specific tax benefits of owning an electric car and how you can take advantage of them.

From federal tax credits to state-specific rebates, there are multiple ways to save money while making a difference. Let’s get started!

Lower Income Taxes

If you’re considering purchasing an electric car, the tax benefits alone make the investment worthwhile. The government provides lower income taxes for electric car owners as a way of encouraging more people to adopt cleaner transportation methods. This means that you can not only save money on fuel costs, but you can also save on taxes.

Additionally, electric cars are often eligible for federal and state tax credits, further reducing the financial burden of owning one. If you live in a state that offers additional incentives, such as free HOV lane access or reduced registration fees, the tax benefits become even more attractive. Overall, investing in an electric car not only benefits the environment but also your wallet.

Federal Tax Credit

One of the benefits of the federal tax system is the federal tax credit, which can help alleviate some of the financial burden of lower income taxes. This credit is especially crucial for those who earn a modest income and struggle to make ends meet. A federal tax credit functions differently from a tax deduction, as it directly lowers the total amount of tax liability that a taxpayer owes.

In other words, a federal tax credit reduces the amount of taxes owed dollar-for-dollar, rather than merely reducing the taxable income subject to the tax. This can be a significant difference in how much a taxpayer owes and can be highly beneficial in situations where individuals are experiencing financial hardships. To qualify for this tax credit, one must meet specific eligibility criteria set by the IRS, and taxpayers should take advantage of this benefit wherever possible.

Overall, a federal tax credit is an effective way to help taxpayers pay less money at tax time, resulting in a more financially stable situation.

State Tax Credits or Rebates

State tax credits or rebates can be a great way to lower your income taxes, especially if you qualify for them based on your income level or other criteria. These incentives vary by state, so it’s important to research what’s available to you. For example, some states offer tax credits for installing energy-efficient appliances or producing renewable energy, while others have specific credits for small businesses or individuals with low to moderate incomes.

If you’re not sure where to start, you can always consult with a tax professional or visit your state’s department of revenue website for more information. Remember, every little bit helps when it comes to lowering your tax bill, so it’s worth taking the time to explore what options are available to you.

Deductions on Operating Costs

If you’re considering buying an electric car, you’ll be happy to know that beyond the environmental benefits, there are also several tax benefits to owning one. One of the primary benefits is that you can deduct a significant portion of your operating costs. As a business owner, this can make a big difference in your bottom line.

The IRS allows you to deduct expenses related to operating an electric car, such as the cost of electricity used to recharge, parking fees, and tolls. Additionally, if you use your electric car for business purposes, you may be eligible for larger deductions. It’s important to keep accurate records of your expenses and consult with a tax professional to ensure you’re taking advantage of all available deductions.

Overall, investing in an electric car can be a smart financial decision, as the tax benefits and savings on operating costs can add up significantly over time.

Standard Deduction

As a business owner, it’s important to understand tax deductions on operating costs in order to minimize the amount of tax you’ll owe. One key deduction to consider is the standard deduction, which is an amount you can deduct from your taxable income without needing to itemize individual expenses. For the 2021 tax year, the standard deduction is $12,550 for single filers and $25,100 for married couples filing jointly.

This deduction can be especially useful if your total deductible expenses fall below the standard deduction amount. However, if your total expenses exceed the standard deduction, it may be more beneficial to itemize instead. By understanding your options and maximizing your deductions, you can minimize your tax burden and keep more money in your pocket.

Special Depreciation Allowance

As a business owner, it’s important to take advantage of every deduction possible, and the Special Depreciation Allowance is one to consider. This deduction allows businesses to write off up to 100% of the cost of certain property in the year it is purchased, rather than depreciating it over a number of years. Eligible property includes equipment, machinery, furniture, and even some improvements to buildings.

This deduction can significantly reduce a business’s taxable income, making it an important way to save money on operating costs. It’s important to note that not all property is eligible for the Special Depreciation Allowance, and there are specific rules and limitations that must be followed in order to qualify. However, with careful planning and professional guidance, businesses can take advantage of this valuable deduction and improve their financial bottom line.

So, if you’re a business owner, take a closer look at the Special Depreciation Allowance and see if it can benefit your company.

Reduced Sales Tax

Reduced Sales Tax One way to boost your business’s profit margin is by taking advantage of deductions on operating costs. When expenses are high, it’s important to minimize how much you’re required to pay in taxes. When you take advantage of every available tax deduction, the amount of taxes you’re required to pay gets smaller.

One deduction that business owners may overlook is sales tax. By paying close attention to your sales tax invoices, you may find that you’re being incorrectly charged. Some states offer exemptions on sales tax for certain goods and services.

Make sure you’re aware of what’s exempt in your state so you can take advantage of these deductions and lower your overall sales tax bill. Doing so can help you keep more money in your pocket and reinvest in your business.

Business Tax Incentives

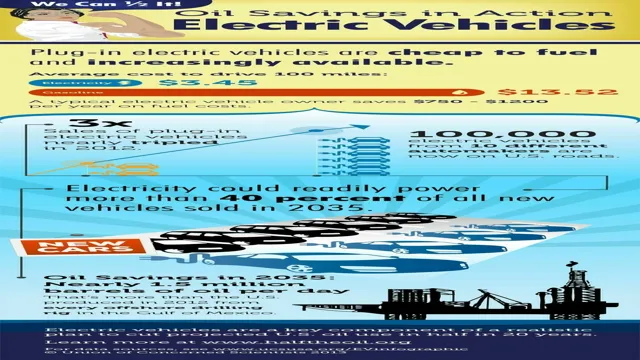

One of the significant tax benefits of owning an electric car is the federal tax credit. Owners of electric vehicles can get up to $7,500 tax credit from the federal government, which reduces the total amount of taxes they owe. The credit applies to the purchase of new electric cars and can be claimed in the year of purchase.

Certain states also have additional tax incentives for owning electric cars, such as tax exemptions, rebates, and reduced registration fees. These incentives not only benefit individual car owners but also help businesses reduce their tax liabilities. For instance, businesses can take advantage of the tax credit by purchasing electric cars for their employees to use for business purposes.

Thus, businesses can not only cut their taxes but also contribute to a sustainable environment by reducing carbon emissions.

Federal Income Tax Credit

The federal income tax credit is one of the most significant business tax incentives available today. It is designed to help businesses save money on their tax bills by providing tax credits based on their eligible expenses, such as research and development, hiring employees, or investing in certain equipment and technologies. With this credit, eligible businesses can claim a percentage of their qualifying expenses as a credit against their federal income tax.

The amount of the credit varies depending on the nature of the expenses and the type of business involved. Taking advantage of this tax credit can be a great way for businesses to reduce their tax burden and reinvest those savings back into their organizations. If you’re a business owner, it’s worth exploring whether you qualify for this credit and how you can take advantage of it to help your business grow and thrive in today’s competitive marketplace.

State Incentives for Businesses

Business tax incentives are programs designed by the government to encourage businesses to invest and grow within a specific area. States offer numerous tax breaks, credits, and deductions to companies that meet certain qualifications, including job creation, location, and industry. These incentives can range from corporate income tax reductions and property tax exemptions to sales and use tax exemptions, payroll tax credits, and research and development tax credits.

Additionally, businesses may be eligible for cash grants, loans, and other financial assistance. Overall, these incentives can significantly reduce a company’s tax burden and ultimately increase profitability. By providing businesses with financial support and encouraging economic growth, states can improve the standard of living for their residents and promote job creation in the area.

Conclusion

In conclusion, owning an electric car not only benefits the environment, but it also provides significant tax advantages. By purchasing an electric vehicle, you can reduce your tax liability and lower your fuel costs while driving in style. So why pay more taxes and pump more pollutants into the atmosphere when you can switch to an EV? It’s time to rev up your tax savings and power up your ride with an electric car.

It’s the smart and eco-friendly choice of the future!”

FAQs

What are the tax benefits of owning an electric car?

Electric car owners can receive federal tax credits of up to $7,500, as well as state and local tax incentives such as rebates, exemptions from emissions testing, and reduced registration fees.

Are there any limitations on the tax benefits for electric car ownership?

Yes, the federal tax credit begins to phase out once an automaker sells 200,000 qualifying electric vehicles. Several automakers, including Tesla and GM, have already hit this cap.

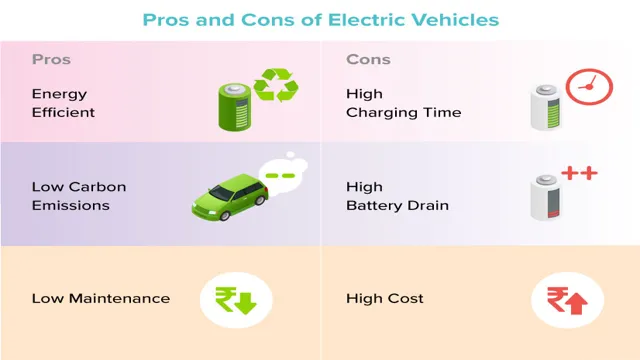

Can electric car owners also benefit from lower fuel and maintenance costs?

Yes, electric cars typically require less maintenance and have lower fuel costs than gasoline-powered vehicles, providing additional financial benefits in addition to tax incentives.

What other environmental benefits are associated with owning an electric car?

Electric cars produce no emissions, reducing overall air pollution and contributing to efforts to combat climate change. Additionally, electric car batteries can often be recycled, reducing environmental impact further.