Drive Towards Savings: Unveiling the Lucrative Tax Benefits on Electric Cars

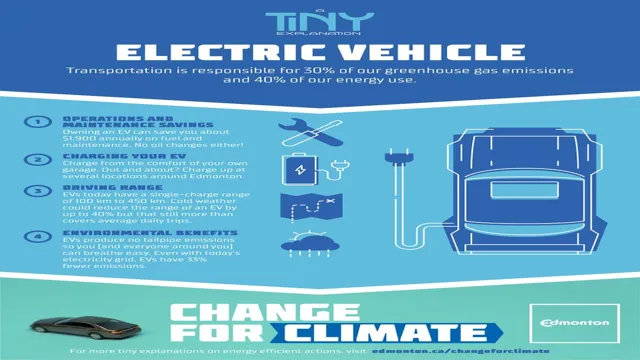

Electric cars have been gaining popularity in recent years and for good reason – they offer many benefits over their gas-guzzling counterparts. Not only are they environmentally friendly, producing no emissions when in use, but they also offer significant tax benefits to their owners. In this blog, we’ll explore the tax benefits of electric cars and why more people are making the switch to electric vehicles.

We’ll also cover how these tax incentives work and what you need to do to take advantage of them. So, if you’re interested in learning more about how owning an electric car can benefit both the environment and your wallet, keep reading!

Federal Tax Credits

Are you considering making the switch to an electric car? One of the biggest perks of driving an electric car is the tax benefits, specifically the federal tax credits. These credits vary depending on the make and model of the vehicle, but could result in saving up to $7,500 on your taxes. However, it’s important to note that these credits phase out after the manufacturer sells a certain number of vehicles.

Additionally, you’ll need to make sure you have enough tax liability to receive the full credit amount. Nevertheless, taking advantage of these tax benefits can make driving an electric car even more attractive, and could even save you money in the long run. So why not start researching which electric car models qualify for federal tax credits and see how you could potentially benefit?

Up to $7,500 in tax credit

If you’re considering purchasing an electric vehicle, you might be eligible for a federal tax credit of up to $7,500. This tax credit is a great incentive for making the switch to a more eco-friendly car. To qualify for the credit, your EV must be a new vehicle, with a gross vehicle weight rating of under 14,000 pounds, and be purchased or leased for use or lease by you, not for resale.

The exact amount you’ll receive depends on the make and model of your vehicle, as well as your individual tax situation. It’s important to note that this tax credit begins to phase out once a manufacturer sells a cumulative total of 200,000 electric vehicles in the US. Some manufacturers have already reached this limit, so it’s worth researching which brands and models are still eligible for the credit.

Overall, the federal tax credit is a great way to offset the cost of an electric vehicle and make the switch to a more sustainable mode of transportation.

Phase-out period based on manufacturer’s sales

If you’re considering purchasing an electric vehicle, you’ll be happy to know that the federal government offers tax credits for certain vehicles. However, the amount of credit varies depending on the manufacturer and their overall sales. This means that as a manufacturer sells more electric vehicles, the tax credit amount will decrease over time.

The phase-out period is based on the manufacturer’s sales, with the reduction starting after the manufacturer sells their 200,000th electric vehicle. For example, Tesla has already hit this 200,000 sales mark, so the tax credit for their vehicles will gradually decrease until no credit is available. This is important to keep in mind as you research different electric vehicle options and consider how much of a tax credit you may be eligible for.

It’s worth noting that certain states also offer their own incentives for electric vehicle purchases, so be sure to look into those as well.

State Tax Credits

When it comes to purchasing an electric car, tax benefits can certainly sweeten the deal. Many states offer tax credits to electric vehicle (EV) drivers, which can significantly reduce the overall cost of buying and owning these environmentally-friendly cars. For example, California offers a rebate of up to $2,000 for new, eligible battery EVs, while Colorado offers a tax credit of up to $4,000.

These tax benefits on electric cars can help remove some of the financial burden of going green while also encouraging more people to switch to clean energy vehicles. And the benefits don’t stop at the initial purchase – some states also offer additional incentives such as reduced toll fees and access to HOV lanes. So, not only can you save money on buying and maintaining an electric car, but you’ll also be doing your part to reduce carbon emissions and protect the planet.

Varies by state

State Tax Credits can vary by state, meaning that the credits available to residents in one state may differ significantly from those in another. These credits are typically offered as an incentive for individuals and businesses to invest and create jobs in a particular state. For example, some states offer tax credits for investment in renewable energy sources, while others provide incentives for businesses that create jobs in certain areas.

It’s also worth noting that not all states offer tax credits, so it’s important for individuals and businesses to research the tax incentives available in their state before making any investment decisions. By taking advantage of these state tax credits, individuals and businesses can not only save money on their taxes, but also help promote economic growth and development in their communities.

Examples: California, Ohio, Oregon

State Tax Credits California, Ohio, and Oregon are examples of states that offer tax credits to eligible individuals and businesses. State tax credits are incentives that aim to encourage taxpayers to invest in certain areas, such as renewable energy, historic preservation, or rural development. These tax credits can take various forms, such as direct deductions from tax liability or refundable credits that can be carried forward.

The availability and amount of tax credits depend on state-specific criteria and guidelines, such as project type, total investment, and local economic impact. State tax credits can be an effective way to reduce tax burdens while supporting local communities and industries. However, they also require careful planning and compliance to ensure eligibility and maximize benefits.

Therefore, taxpayers should consult with tax professionals and state authorities before applying for or claiming state tax credits.

Sales Tax Exemptions

If you’re considering buying an electric car, you may be wondering what tax benefits you might be able to take advantage of. One of the most popular tax benefits on electric cars is the sales tax exemption. Many states across the U.

S. offer sales tax exemptions on electric vehicles, meaning that you won’t have to pay the full sales tax on your purchase. This exemption can save you thousands of dollars, making it even more affordable to buy an electric car.

Additionally, some states offer other tax benefits for electric car owners, such as income tax credits or rebates. These incentives can further reduce the cost of owning an electric car. When you factor in the long-term savings on fuel and maintenance, going electric can be a smart financial choice – and the tax benefits just sweeten the deal.

Reduction or exemption in sales tax

Sales tax exemptions are benefits granted to certain individuals or businesses that allow them to avoid paying sales tax on certain goods or services. These exemptions are usually granted by the state government, and they are designed to promote certain industries, provide relief for low-income families, or stimulate economic growth. For example, some states offer sales tax exemptions for goods such as prescription drugs, food stamps, or medical equipment.

Others may provide tax breaks for businesses that operate in a certain location or meet certain criteria. These exemptions can be a significant cost savings for those who qualify, but it’s important to note that not all exemptions are created equal. Some may be limited in scope or duration, so be sure to research the details before applying for or claiming an exemption.

Overall, sales tax exemptions can be an important tool for promoting economic growth and supporting those in need, but it’s important to strike a balance that benefits both individuals and the community as a whole.

Varies by state and local government

Sales tax exemptions can vary depending on the state and local government. Some states offer no exemptions at all, while others may exempt certain products or services from sales tax. It’s important to carefully review your state’s laws to see if any exemptions apply to you or your business.

For example, some states allow non-profit organizations or religious groups to be exempt from certain taxes. Additionally, some states may have exemptions for products that are essential for medical purposes, such as prescription drugs or medical equipment. It’s important to keep in mind that sales tax exemptions may come with requirements or limitations, so it’s important to ensure that you meet all necessary criteria before claiming an exemption.

Overall, understanding sales tax exemptions in your state can help you save money and ensure compliance with applicable laws.

Additional Benefits

One of the greatest benefits of purchasing an electric car is the tax incentives that come with it. Not only will you be saving money on gas, but you’ll also receive federal and state tax credits for owning an electric vehicle. The federal tax credit can be up to $7,500, and many states also offer their own incentives, such as rebates or exemptions from sales tax and vehicle registration fees.

These benefits can make a substantial difference in the overall cost of your electric vehicle, lowering the amount of money you’ll have to pay upfront and over time. Plus, you can feel good about contributing to a cleaner environment and reducing your carbon footprint by driving an electric car.

HOV lane access in some states

One of the additional benefits of having access to HOV lanes in some states is that it can save you a significant amount of time in traffic. HOV lanes are designed to help reduce congestion by allowing cars with multiple passengers, or in some cases, electric or hybrid vehicles, to use a designated lane that is separated from regular traffic. By using an HOV lane, drivers can often bypass traffic jams and get to their destination much faster.

Additionally, HOV lanes can also help reduce air pollution and provide a more sustainable commuting option for those who carpool or drive electric or hybrid vehicles. So, if you have the option to use an HOV lane in your state, it’s definitely worth considering as a way to save time and help protect the environment.

Lower registration fees and tolls

Lower registration fees and tolls are a significant advantage for drivers. Imagine if you could save a few hundred dollars a year on registering your car or crossing toll bridges. It would be a great relief on your wallet.

Fortunately, some states in the US offer lower registration fees and toll rates for drivers who meet specific conditions. For example, California offers lower registration fees for hybrid, electric, and other alternative fuel vehicles. In some cases, low-income drivers may also qualify for discounted fees.

Likewise, there are some toll bridges and roads that offer discounted tolls for drivers who commit to carpooling. In addition to saving you money, this approach also encourages more people to share cars and reduce their carbon footprint. Overall, lower registration fees and tolls benefit drivers by reducing their transportation costs and providing environmentally friendly incentives.

Conclusion

In conclusion, tax benefits on electric cars are like having your cake and eating it too. You not only get to reduce your carbon footprint and contribute to a more sustainable future, but you also get to enjoy a range of tax incentives that could save you money in the long run. Let’s face it, there’s no better feeling than cruising around in your eco-friendly ride, knowing that you’re doing your part for the planet while also benefiting from some pretty sweet tax perks.

So why not make the switch to electric and reap the rewards? It’s a win-win situation for you and the environment.”

FAQs

What are the tax benefits of buying an electric car?

There are several tax benefits associated with purchasing an electric car, including federal tax credits of up to $7,500, state tax credits or rebates, and tax deductions for charging equipment installation costs. These incentives can significantly reduce the overall cost of an electric vehicle.

Are there any income restrictions to qualify for electric car tax credits?

No, there are no income restrictions to qualify for federal tax credits on electric cars. However, some state-level incentives may have income requirements.

Do leased electric cars qualify for tax credits?

Yes, if you lease an electric car, the tax credit is usually passed on to the leasing company, which can then factor the savings into your lease payments. However, it’s important to check with the leasing company to ensure that they are passing on the full tax credit amount.

Are there any restrictions on the types of electric cars that qualify for tax benefits?

In general, all-electric and plug-in hybrid electric vehicles qualify for tax benefits. However, the specific models and eligibility criteria can vary by state and federal programs. It’s important to research the available incentives and consult with a tax professional to determine which incentives you qualify for.