Tax Benefits on Electric Cars: Maximize Your Savings!

Electric cars are becoming popular. Many people like them. They are good for the environment. They help reduce pollution. But did you know they can also save you money on taxes? In this article, we will explore the tax benefits of electric cars. Understanding these benefits can help you make a smart choice.

What is an Electric Car?

An electric car uses electricity to run. It does not use gas or diesel. This means it does not produce harmful gases. Electric cars are often called EVs. EV stands for electric vehicle. These cars are quiet and clean. They can be charged at home or at charging stations.

Why Choose an Electric Car?

Many people choose electric cars for different reasons. Here are some common reasons:

- They are better for the environment.

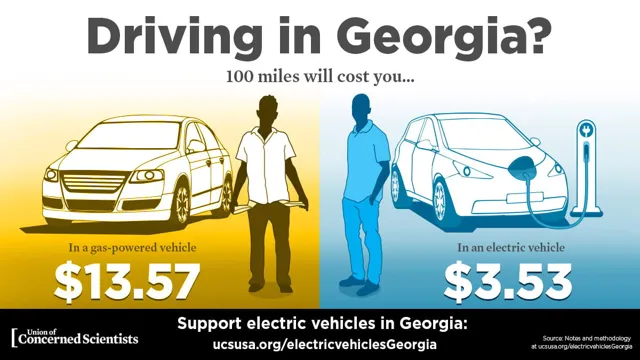

- They can save money on gas.

- They have lower maintenance costs.

- They are often eligible for tax benefits.

Tax Benefits of Electric Cars

One of the main reasons to buy an electric car is the tax benefits. There are several types of tax benefits. Let’s look at them closely.

1. Federal Tax Credit

The federal government offers a tax credit for electric cars. This credit can be up to $7,500. To get this credit, you must buy a new electric car. The car must meet certain requirements. The credit amount depends on the size of the car’s battery. Larger batteries give you a bigger credit.

2. State Tax Credits

Many states also offer tax credits. These credits can vary by state. Some states give more than $2,000. Others might provide rebates. Check your state’s rules. This can help you save more money.

3. Sales Tax Exemptions

Some places do not charge sales tax on electric cars. This means you pay less when you buy the car. For example, if the car costs $30,000, you save a lot on taxes. Not paying sales tax can lead to big savings.

4. Reduced Registration Fees

Some states have lower registration fees for electric cars. This can save you money each year. Regular cars might have higher fees. Electric cars often have discounts. Check your state for details on registration fees.

5. Hov Lane Access

In some areas, electric cars can use HOV lanes. HOV stands for High Occupancy Vehicle. This means you can drive in special lanes. These lanes are often less crowded. This can save you time on your daily commute.

How to Claim These Tax Benefits

To get the tax benefits, you need to follow steps. Here are the steps to claim benefits:

- Buy a qualifying electric car.

- Keep all purchase documents.

- Check federal and state tax rules.

- Complete tax forms correctly.

- Submit your tax return.

Important Points to Remember

Before you buy an electric car, consider these points:

- Not all electric cars qualify for tax credits.

- Check if your state offers benefits.

- Understand the size of the tax credit you can get.

- Keep documents safe for tax time.

Frequently Asked Questions

What Are Tax Credits For Electric Cars?

Tax credits for electric cars reduce the amount of tax you owe. They encourage people to buy electric vehicles.

How Much Is The Federal Tax Credit?

The federal tax credit can be up to $7,500. The amount depends on the car’s battery capacity.

Do All Electric Cars Qualify For Tax Credits?

Not all electric cars qualify. Only certain models meet the necessary requirements for tax credits.

Can I Claim Tax Credits For Used Electric Cars?

Yes, you can claim tax credits for used electric cars. But specific conditions must be met.

Conclusion

Buying an electric car can be a smart choice. You can help the environment and save money. The tax benefits make it even better. Make sure to research the options available. Understanding these benefits is key. You can make a good decision. If you have questions, talk to a tax professional. They can help you understand more about these benefits.

Frequently Asked Questions (FAQs)

1. Can I Get A Tax Credit For A Used Electric Car?

No, the federal tax credit is only for new electric cars.

2. How Do I Know If My Car Qualifies For The Tax Credit?

Check the IRS website or ask the dealer.

3. Are There Any Tax Benefits For Charging Stations At Home?

Yes, some states offer tax credits for home charging stations.

4. How Often Do Tax Credits Change?

Tax credits can change every year. Always check for updates.

5. Do I Need To File My Taxes To Get The Credit?

Yes, you must file your taxes to claim the credit.