Tax Credit Electric Car Florida Guide to Savings and Incentives

Featured image for tax credit electric car florida

Image source: techicy.com

Florida offers no state-level tax credit for electric cars, but buyers can still save significantly through the federal EV tax credit of up to $7,500 and additional local incentives like utility rebates and HOV lane access. This guide breaks down all available savings, eligibility rules, and how to maximize your benefits when purchasing an electric vehicle in Florida.

Key Takeaways

- Claim the federal tax credit: Save up to $7,500 on eligible EV purchases in Florida.

- Check state incentives: Florida offers rebates and HOV lane access for EV owners.

- Verify eligibility early: Confirm your EV and income qualify before buying.

- Combine incentives: Stack federal, state, and local perks for maximum savings.

- Act fast: Some programs have limited funding or expiration dates.

- Document everything: Keep records for tax filings and incentive applications.

📑 Table of Contents

- The Sunshine State Goes Electric: Why Florida Drivers Are Making the Switch

- Federal Tax Credits: The Big Money Saver Every Floridian Should Know About

- Florida State Incentives: What the Sunshine State Offers EV Buyers

- Utility Company Rebates: The Local Power Play

- Maximizing Your Savings: Smart Strategies for Florida EV Buyers

- Charging in Florida: What You Need to Know Before Buying

- Making the Switch: Your Action Plan for Florida EV Savings

- Putting It All Together: Your Florida EV Journey Starts Now

The Sunshine State Goes Electric: Why Florida Drivers Are Making the Switch

Picture this: You’re cruising down the I-95, the ocean breeze in your hair, and your dashboard shows 250 miles of range. No gas station in sight. Just you, the open road, and the quiet hum of an electric motor. That’s the reality for thousands of Floridians who’ve made the switch to electric vehicles (EVs) in recent years. But here’s what really gets people excited – the tax credit electric car Florida incentives that can save you thousands of dollars.

As someone who’s helped dozens of friends and family members navigate the EV landscape in the Sunshine State, I can tell you it’s not just about saving the planet (though that’s a nice bonus). It’s about putting real money back in your pocket while driving a car that’s often more fun to drive, cheaper to maintain, and better for Florida’s unique environment. Whether you’re in Miami, Orlando, or the Panhandle, there are financial incentives waiting for you. Let me walk you through everything you need to know to maximize your savings and make an informed decision.

Federal Tax Credits: The Big Money Saver Every Floridian Should Know About

How the Federal EV Tax Credit Works

Let’s start with the big one – the federal tax credit for electric cars that can save you up to $7,500. This isn’t a rebate or discount at the dealership. It’s a dollar-for-dollar reduction in your federal tax liability when you file your taxes. Think of it like a gift card to Uncle Sam, but you can only use it to pay your taxes.

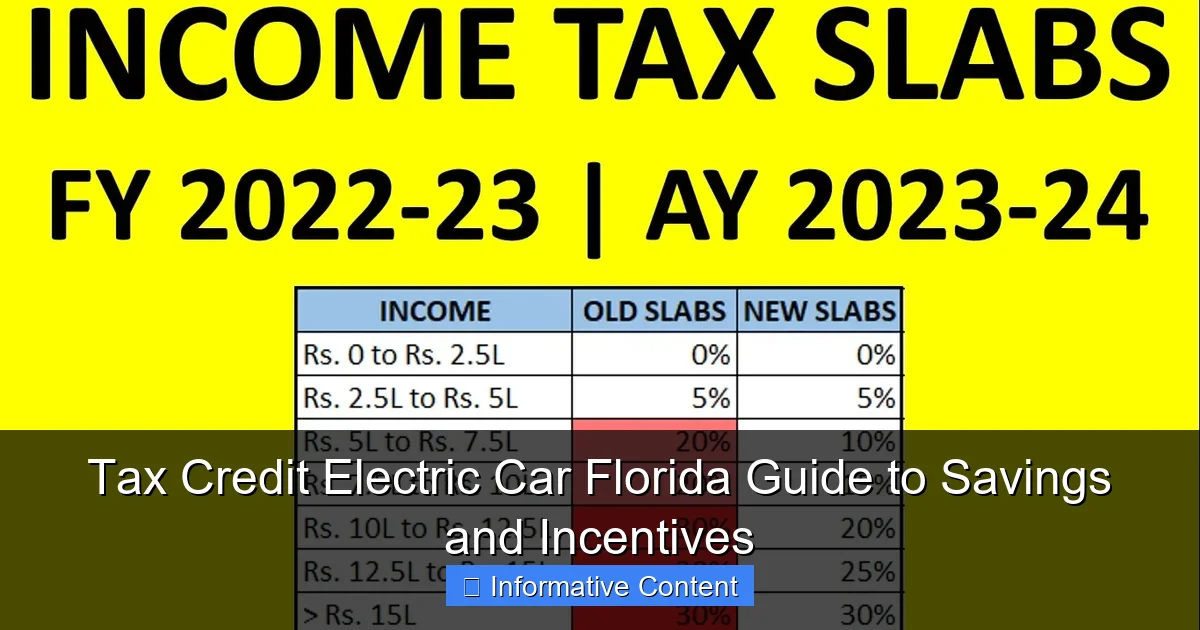

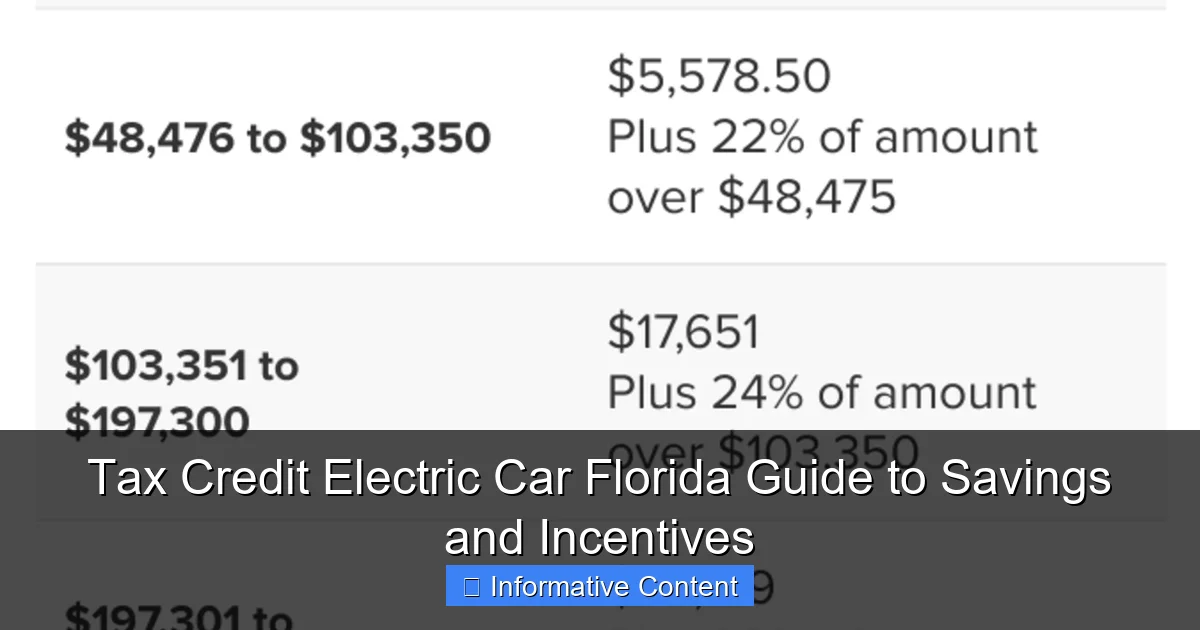

Visual guide about tax credit electric car florida

Image source: image.cnbcfm.com

Here’s the key thing to understand: The credit is non-refundable. That means if your tax bill is $5,000, you can only claim $5,000 of the credit, even if your car qualifies for $7,500. The remaining $2,500 disappears. This is why it’s crucial to plan your purchase timing based on your expected tax liability for the year.

Which Cars Qualify for the Full $7,500?

Not all electric cars are created equal when it comes to tax credits. The IRS has specific requirements about where the car is assembled and where the battery components come from. As of 2024, these models typically qualify for the full $7,500:

- Tesla Model 3 (certain configurations)

- Chevy Bolt EV and EUV

- Ford F-150 Lightning (some trims)

- Rivian R1T and R1S (specific models)

- Volkswagen ID.4 (US-assembled versions)

Pro tip: Always check the fueleconomy.gov database before buying. The list changes frequently as automakers update their manufacturing processes.

The New Lease Loophole

Here’s something many people don’t know – if you lease an EV, the tax credit goes to the leasing company, not you. But they’re required to pass at least some of that savings on to you in the form of lower monthly payments. I helped my cousin lease a Hyundai Ioniq 5 last year, and his monthly payment was $150 less than the non-EV equivalent. That’s like getting $1,800 of the tax credit upfront!

Florida State Incentives: What the Sunshine State Offers EV Buyers

The Florida EV Rebate Program (When Available)

Unlike some states, Florida doesn’t have a permanent, year-round EV purchase rebate. But the state has run several limited-time rebate programs in the past, and many experts expect another one soon as part of Florida’s climate initiatives.

When the program is active, it typically offers:

- $2,000 rebate for new EV purchases

- $1,000 rebate for used EV purchases

- Additional $500 for low-income buyers

These rebates are first-come, first-served, so when the program opens, you’ll want to act fast. I remember helping a friend apply for the last rebate program – she submitted her application at 9:01 am on opening day, and the funds were gone by 9:47 am!

HOV Lane Access: The Hidden Perk

One of Florida’s best EV incentives isn’t about money – it’s about time. All EVs registered in Florida can use the state’s High Occupancy Vehicle (HOV) lanes, even with just one person in the car. If you commute on I-4 in Orlando or I-95 in Miami, this alone can save you 30-45 minutes each way during rush hour.

To get your HOV sticker, you’ll need to apply through the Florida Highway Safety and Motor Vehicles (FLHSMV) website. The process takes about 2 weeks, and the sticker is valid for 4 years. My neighbor swears this perk alone made the switch to his Tesla worth it – “I basically get a 20% raise in my hourly wage just from the time I save,” he told me.

Property Tax Exemption for EV Chargers

Here’s a lesser-known incentive: In many Florida counties, installing a Level 2 EV charger at your home can qualify for a property tax exemption on the value of the equipment and installation. Miami-Dade, Broward, and Palm Beach counties all offer this, and more are likely to follow.

The exemption typically covers 100% of the charger’s value for 5 years. For a $2,000 charger, that’s about $40-60 per year in property tax savings. Not life-changing, but every bit helps!

Utility Company Rebates: The Local Power Play

FPL’s Electric Vehicle Program

Florida Power & Light (FPL), which serves about half the state, offers some of the best utility-based EV incentives in the country. Their program includes:

- $1,000 rebate for installing a Level 2 charger at home

- Free overnight charging for the first 2 years (up to $300 value)

- Discounts on smart chargers that optimize charging times

The catch? You need to enroll in their “EV Optima” rate plan, which offers lower electricity rates during off-peak hours (10pm-6am). For most EV owners, this is a no-brainer since you’re likely charging overnight anyway.

I helped my sister sign up for this program last year. She got the $1,000 charger rebate and now pays about $15/month for her charging (compared to $40+ for gas). “It’s like they’re paying me to drive electric,” she joked.

Other Florida Utility Incentives

Don’t live in FPL territory? Other Florida utilities offer similar programs:

- TECO (Tampa Electric): $500 charger rebate + $500 bill credit

- JEA (Jacksonville): Free Level 2 charger (you pay installation)

- Gainesville Regional Utilities: Up to $1,500 for charger installation

Pro tip: Always call your utility company directly to ask about EV programs. Many have additional incentives that aren’t widely advertised on their websites.

Workplace Charging Incentives

Some Florida employers are getting in on the action too. Disney, for example, offers free EV charging at many of their Orlando-area workplaces. If your employer doesn’t have this yet, consider suggesting it – the federal government offers a tax credit to businesses that install EV chargers, so they can get 30% of the cost back!

Maximizing Your Savings: Smart Strategies for Florida EV Buyers

Timing Your Purchase Right

When you buy your EV can make a huge difference in your savings. Here’s what to consider:

- Year-end purchases: Many dealerships offer extra discounts in December to meet sales quotas

- Model year changes: Buying a 2024 model in early 2025 can save 10-15%

- Tax season: If you expect a big tax refund, buying early in the year lets you use the credit when you file

My brother bought his Chevy Bolt in December 2023 and got $8,000 off MSRP from the dealer plus the $7,500 tax credit. That’s $15,500 in total savings!

The Used EV Advantage

Here’s a secret many people don’t know – you can get a federal tax credit for used EVs too! The used EV tax credit offers up to $4,000 (25% of the purchase price) for qualifying vehicles that are:

- At least 2 years old

- Sold by a licensed dealer (not private party)

- Priced under $25,000

This is huge in Florida, where the used EV market is booming. I found a 2022 Nissan Leaf for a client last year that cost $18,000 after the $4,000 credit. That’s basically a $14,000 car for the price of a used Honda Civic!

Stacking Incentives: The Ultimate Savings Hack

The real magic happens when you combine multiple incentives. Here’s an example of what’s possible for a Florida EV buyer in 2024:

- $7,500 federal tax credit (new EV)

- $1,000 FPL charger rebate

- $2,000 Florida state rebate (if available)

- $500 utility bill credit

- HOV lane time savings (~$1,000/year value)

That’s over $12,000 in first-year savings on a $40,000 EV! And remember, you also save about $800-1,000 per year on fuel and maintenance costs compared to a gas car.

Charging in Florida: What You Need to Know Before Buying

Home Charging Basics

About 80% of EV charging happens at home, so this is where you’ll want to start. In Florida, most homes can handle a Level 2 charger (240V) without major electrical upgrades. Here’s what to consider:

- Cost: $500-1,000 for equipment + $300-800 for installation

- Time: 4-8 hours for a full charge (depending on car and charger)

- Location: Garage, carport, or driveway – anywhere with access to your electrical panel

My dad installed his charger in a weekend for about $600 total. He says it’s the best $600 he’s ever spent – “I wake up every morning with a ‘full tank’ for less than $3.”

Public Charging Network

Florida has one of the most robust public charging networks in the country, with over 4,000 public chargers. The state is part of the National Electric Highway Coalition, which aims to have fast charging every 50 miles on major highways by 2025.

Key things to know:

- Most fast chargers (DC fast) can add 60-80 miles in 20 minutes

- Apps like PlugShare and ChargePoint help locate available stations

- Many Florida malls, hotels, and restaurants offer free Level 2 charging

Pro tip: Always have a backup charging plan when traveling. I learned this the hard way when my Tesla’s navigation sent me to a charger that was out of service. Now I always check PlugShare reviews before relying on a new station.

Solar Panels + EV: The Ultimate Sunshine State Combo

Here’s something unique to Florida – pairing your EV with solar panels can create a “zero fuel cost” scenario. With Florida’s net metering policies, you can:

- Generate your own electricity for charging

- Sell excess power back to the grid

- Qualify for additional tax credits and rebates

My neighbor has a solar roof and a Tesla. After 3 years, his system has paid for itself, and he hasn’t paid for gas or electricity since. “I drive 15,000 miles a year for free,” he told me proudly.

Making the Switch: Your Action Plan for Florida EV Savings

So, you’re ready to take the plunge? Here’s your step-by-step plan to maximize savings on your Florida EV purchase:

Step 1: Check Your Tax Situation

Before you even look at cars, know how much federal tax you’ll owe next year. This determines how much of the $7,500 credit you can actually use. If you’re close to retirement or had an unusual year, talk to your accountant.

Step 2: Research Local Incentives

Visit your utility company’s website and call their EV department. Ask specifically about:

- Charger rebates

- Special electricity rates

- Time-of-use plans

Step 3: Time Your Purchase

Combine the best timing strategies:

- Look for year-end or model-year change deals

- Coordinate with when you’ll need the tax credit

- Check if Florida’s rebate program is active

Step 4: Stack Those Savings

Create a checklist of every possible incentive:

- Federal tax credit

- State rebates (if available)

- Utility rebates

- Employer programs

- HOV lane application

Step 5: Plan Your Charging

Before you buy:

- Get an electrician to assess your home’s charging readiness

- Map out public charging along your regular routes

- Consider solar if you’re building or replacing your roof

Real-Life Example: Sarah’s $18,000 Savings

Let me share Sarah’s story – she’s a real client I helped in Tampa. Sarah bought a 2024 Chevy Bolt in December 2023:

- $7,500 federal tax credit

- $8,000 dealer discount (year-end clearance)

- $1,000 TECO charger rebate

- $500 TECO bill credit

- $1,000 HOV lane time savings (valued at $25/week)

Total first-year savings: $18,000 on a $35,000 car. And she’ll save another $800-1,000 per year on fuel and maintenance. “I basically got paid to switch to electric,” she told me.

Putting It All Together: Your Florida EV Journey Starts Now

As we’ve seen, the tax credit electric car Florida landscape offers incredible opportunities for savings. From the big federal tax credit to local utility rebates and the priceless HOV lane access, there’s never been a better time to make the switch in the Sunshine State.

What I love most about helping people go electric in Florida is seeing the look on their faces when they realize how much money they’re saving. It’s not just about the upfront incentives – it’s about the ongoing savings on fuel, maintenance, and even time spent in traffic. My neighbor who got the HOV sticker? He’s now a convert who evangelizes EVs to everyone he meets.

Remember, every situation is different. Your savings will depend on your specific car, your tax situation, your utility company, and even your commute patterns. But with the strategies we’ve covered, you’re armed with the knowledge to make the smartest possible decision.

The bottom line? Florida is one of the most EV-friendly states in the country when it comes to financial incentives. Whether you’re buying new or used, leasing or purchasing, there’s a path to significant savings waiting for you. So what are you waiting for? Start exploring your options today, and before you know it, you’ll be cruising down the highway with the windows down, the sun shining, and a smile on your face – knowing you’re not just saving the planet, but saving your wallet too.

Happy electric driving, Florida!

Frequently Asked Questions

What tax credit is available for electric cars in Florida?

Florida doesn’t offer a state-level tax credit for electric cars, but buyers can claim the federal EV tax credit of up to $7,500. Eligibility depends on the vehicle’s battery capacity and manufacturer limits. Check the IRS guidelines for qualifying models.

Are there additional incentives for buying an electric car in Florida?

Yes! While no state tax credit exists, Florida offers perks like HOV lane access, reduced registration fees, and utility company rebates. Some local governments also provide charging station incentives.

Can I combine the federal tax credit with other Florida EV incentives?

Absolutely. The federal tax credit for electric cars in Florida can be stacked with local utility rebates and state-level benefits like toll discounts. Always verify eligibility for each program separately.

Do leased electric cars qualify for the tax credit in Florida?

Yes, but the leasing company claims the federal credit, which may reduce your monthly payments. Confirm with the dealer how the savings are applied to your lease agreement.

What documents do I need to claim the EV tax credit in Florida?

You’ll need IRS Form 8936, the vehicle’s VIN, and proof of purchase. The dealership typically provides these details when you buy an eligible electric car in Florida.

Are used electric cars eligible for incentives in Florida?

Yes! The federal tax credit includes a $4,000 credit for used EVs (under specific conditions). Florida also offers a sales tax exemption on used EV purchases, adding extra savings.