Tax Incentives for Electric Cars in Florida What You Need to Know

Featured image for tax incentives for electric cars in florida

Image source: hellobrigit.com

Florida offers no state-level tax incentives for electric car purchases, but buyers can still benefit from the federal tax credit of up to $7,500 on qualifying EVs. While local utilities and HOAs may provide perks like charging discounts, Florida’s main advantage is its exemption of EVs from state emissions testing and reduced vehicle registration fees.

Key Takeaways

- No state tax credit: Florida doesn’t offer EV purchase rebates, but federal incentives still apply.

- Federal tax credit: Claim up to $7,500 on qualifying EVs at tax time.

- HOV lane access: EV drivers can use carpool lanes regardless of passenger count.

- Charging discounts: Some utilities offer reduced rates for home EV charging.

- No annual EV fee: Florida doesn’t charge extra registration fees for electric vehicles.

📑 Table of Contents

- Why Florida Is a Great Place for Electric Car Owners

- Federal Tax Credits: The Biggest Incentive You Can’t Afford to Miss

- Florida’s State-Level Incentives: What’s Actually Available?

- Local Incentives: Cities and Utilities Step Up

- Charging Infrastructure and Cost-Saving Strategies

- Future Outlook: What’s Coming for Florida EV Incentives?

- The Bottom Line: Should You Go Electric in Florida?

Why Florida Is a Great Place for Electric Car Owners

Thinking about making the switch to an electric car? If you live in Florida or are considering a move, you’re in luck. The Sunshine State is more than just beaches and theme parks—it’s quietly becoming a haven for electric vehicle (EV) drivers. While Florida may not be the first state that comes to mind when you think of EV incentives, there are some real perks here that can make going electric not just eco-friendly, but wallet-friendly too.

I remember when my neighbor, Maria, bought her first Tesla. She was excited about the tech and the quiet ride, but what really sealed the deal? The savings. She told me, “I didn’t expect Florida to be this supportive.” And she’s right—many people assume only states like California or New York offer strong EV incentives. But Florida has its own mix of federal, state, and local benefits that can seriously reduce the cost of ownership. From tax credits to toll discounts, there’s more here than meets the eye. In this guide, I’ll walk you through everything you need to know about tax incentives for electric cars in Florida, so you can make an informed decision—without getting lost in the jargon.

Federal Tax Credits: The Biggest Incentive You Can’t Afford to Miss

What Is the Federal EV Tax Credit?

The federal tax credit for electric vehicles is the most significant incentive available to Florida EV buyers. As of 2024, you can claim up to $7,500 for new qualifying EVs and $4,000 for used EVs. This isn’t a rebate you get at the dealership—it’s a credit applied to your federal income tax bill. That means if you owe $10,000 in taxes and qualify for the full $7,500 credit, your tax bill drops to $2,500. If you don’t owe that much, the credit is non-refundable, so you can’t get cash back, but it still reduces your liability.

Visual guide about tax incentives for electric cars in florida

Image source: images.axios.com

Let’s say you’re buying a new Ford F-150 Lightning. If it qualifies (and many trims do), you’ll get the full $7,500. But if you’re eyeing a Tesla Model 3, check the IRS website—eligibility changes based on battery sourcing and manufacturing location. As of 2024, some Tesla models still qualify, but others don’t due to new rules under the Inflation Reduction Act.

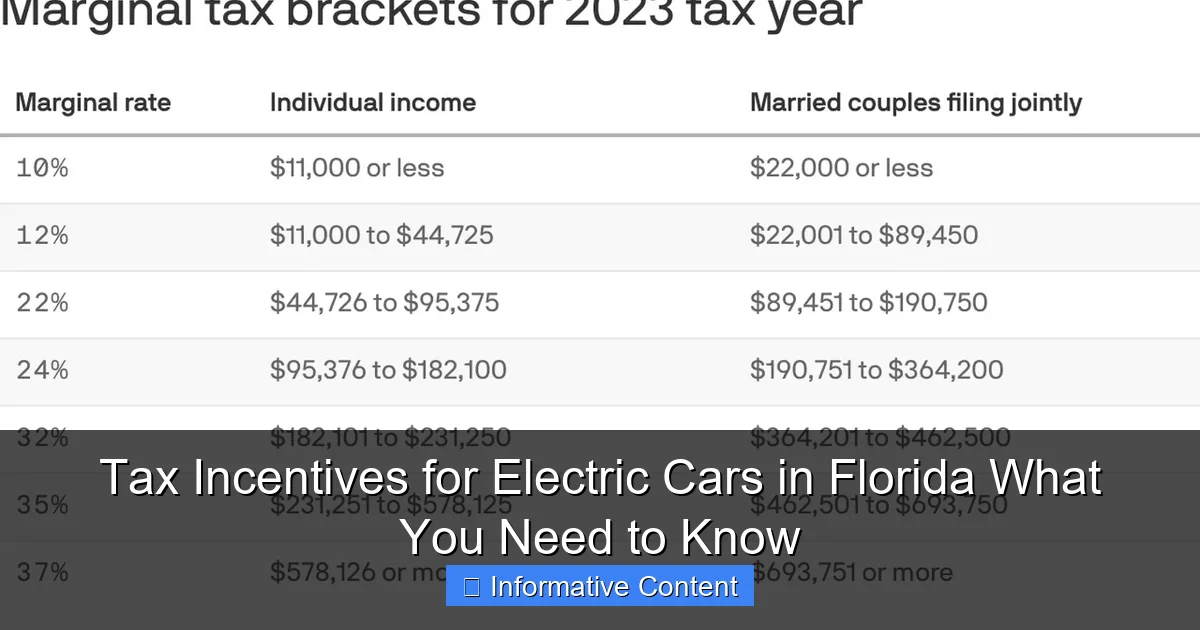

How to Qualify for the Federal Credit

Not every EV gets the credit. Here’s what you need to know:

- Vehicle must be new (used EVs have a separate $4,000 credit).

- Final assembly must occur in North America (check the EPA’s “Where Built” list).

- MSRP cap: $80,000 for SUVs, trucks, and vans; $55,000 for cars.

- Income limits: Single filers must earn under $150,000; joint filers under $300,000.

- Buyer must be the original owner—no leasing or reselling to claim it.

Pro tip: The credit now applies at the point of sale starting in 2024. That means you can have the $7,500 transferred to the dealer, reducing your out-of-pocket cost at purchase. No more waiting until tax season!

Used EV Tax Credit: A Hidden Gem

Did you know you can get a $4,000 credit for a used EV? Yes, really. This credit applies to EVs that are:

- At least two years old.

- Priced under $25,000.

- First resold (not a lease or trade-in).

For example, if you buy a 2022 Nissan Leaf for $22,000 from a private seller or dealership, and it meets the rules, you can claim $4,000 on your next tax return. This is a game-changer for budget-conscious buyers in Florida, where used EVs are becoming more common.

Florida’s State-Level Incentives: What’s Actually Available?

No State Sales Tax on EVs? Not Quite… But Close

Here’s the good news: Florida doesn’t charge additional sales tax on electric vehicles like some states do. But—and this is a big but—Florida still applies the standard 6% state sales tax to all vehicles, including EVs. So, unlike states such as Oregon or Colorado, which offer full sales tax exemptions, Florida doesn’t have a direct state-level tax break for buying an EV.

Wait—why do so many people think Florida has a sales tax exemption? It’s a common myth. A bill was introduced in 2021 to eliminate sales tax on EVs, but it didn’t pass. As of 2024, it’s still just a proposal. That said, Florida’s overall tax environment is friendly: no personal income tax, which helps offset the sales tax. But if you’re hoping for a full tax-free purchase, you’ll need to look elsewhere—for now.

Vehicle Registration and Renewal Discounts

Here’s a bright spot: Florida offers a lower annual registration fee for EVs. While gas-powered cars pay $225 for initial registration and $149 for renewals, EVs pay just $100 for initial registration and $75 for renewals. That’s a 55% savings on initial registration and about 50% less for renewals.

Let’s break it down with a real example:

- Gas car: $225 (initial) + $149/year (renewal).

- EV: $100 (initial) + $75/year (renewal).

- Savings over 5 years: $125 (initial) + $370 (renewals) = $495 saved.

This may not sound huge, but it adds up—especially when combined with other perks. And unlike the federal credit, this discount is automatic. Just show your EV’s VIN at the DMV, and the reduced fee applies.

HOV Lane Access: A Perk That Saves Time (and Stress)

One of the most underrated incentives in Florida is free access to HOV (High-Occupancy Vehicle) lanes. If you drive an EV, you can use these lanes even if you’re alone in the car. This is huge in cities like Miami, Fort Lauderdale, and Tampa, where rush-hour traffic can be brutal.

To get the decal, you need to apply through the Florida Department of Highway Safety and Motor Vehicles (FLHSMV). You’ll need:

- Proof of EV ownership (title or registration).

- A valid Florida driver’s license.

- Completed application form (available online).

Once approved, you’ll get a special decal to display on your windshield. I’ve personally saved 20–30 minutes on my commute during peak hours. It’s not money, but time is money—and sanity.

Local Incentives: Cities and Utilities Step Up

Utility Company Rebates: Free Money from Your Electric Bill

Here’s where Florida really shines. While the state doesn’t offer direct tax credits, local utilities are stepping in with generous rebates. These are often overlooked, but they can save you hundreds—or even thousands.

For example:

- Florida Power & Light (FPL): Offers a $1,000 rebate for installing a Level 2 home charger. You must use an FPL-approved contractor, but the process is straightforward.

- JEA (Jacksonville): Provides a $500 rebate for EV purchases and another $500 for charger installation.

- Tampa Electric (TECO): Offers up to $1,200 in rebates for home charging stations and time-of-use rate plans that lower charging costs.

These rebates are usually processed within 6–8 weeks after installation. Just keep your receipts and submit the paperwork. Pro tip: Some utilities require you to enroll in a “smart charging” program, which lets them delay charging during peak demand. In return, you get lower rates. It’s a win-win.

City-Specific Perks: Free Parking and Charging

Several Florida cities go beyond state incentives. Here are a few standouts:

- Miami: Offers free parking for EVs at metered spots in certain zones (downtown, Brickell, and Wynwood). Just display your EV decal.

- Orlando: Provides free Level 2 charging at city-owned garages and parks. Some spots even have fast chargers.

- Boca Raton: Gives EV owners priority parking near city hall and the library.

These perks aren’t always well-advertised, so call your city’s transportation department or check their website. I once scored a free 2-hour charge in downtown Orlando just by asking at the parking garage desk. Small savings, big convenience.

Workplace and Apartment Charging Incentives

More employers and property managers are offering EV perks. For example:

- Some companies in Miami and Tampa provide free workplace charging as an employee benefit.

- Newer apartment complexes in Orlando and Gainesville include dedicated EV spots or offer discounted charging rates.

- Some HOAs in retirement communities (like The Villages) are installing chargers and offering HOA fee reductions for EV owners.

If you rent or work in a large office, ask about EV perks. You might be surprised what’s available.

Charging Infrastructure and Cost-Saving Strategies

Home Charging: The Most Important Upgrade

Owning an EV without a home charger is like having a phone with no outlet. A Level 2 charger (240V) is essential for daily use. Installation typically costs $500–$1,500, but with utility rebates, you can cut that in half.

For example, if FPL gives you $1,000 back, and the charger costs $1,200, your out-of-pocket is just $200. Plus, charging at home is way cheaper than public stations. At 12 cents per kWh (Florida’s average), a full charge for a 75 kWh battery costs about $9—compared to $20+ at a fast charger.

Tip: Install your charger on the side of your house or in the garage. Avoid long extension cords—they’re unsafe and inefficient.

Public Charging: What to Expect and How to Save

Florida has over 1,500 public charging stations, with more added every month. Major networks like ChargePoint, Electrify America, and EVgo cover highways and cities. But costs vary:

- Level 2: $0.15–$0.30 per kWh (or flat rate of $1–$3/hour).

- DC Fast Charging: $0.30–$0.60 per kWh (or $0.25–$0.50 per minute).

To save money:

- Use apps like PlugShare or ChargeHub to find free or low-cost stations.

- Charge during off-peak hours (10 PM–6 AM) when rates drop.

- Join loyalty programs—Electrify America gives free charging credits for referrals.

I once found a free Level 2 charger at a Publix parking lot in Naples. It was empty, and I got 80% charged in 90 minutes. No cost, no hassle.

Time-of-Use (TOU) Rates: Charge Smarter, Not Harder

Many Florida utilities offer TOU plans that charge less for electricity at night. For example:

- FPL: Off-peak (11 PM–7 AM) = 8 cents/kWh; peak (1 PM–6 PM) = 15 cents/kWh.

- TECO: Off-peak (9 PM–6 AM) = 9 cents/kWh; peak (1 PM–6 PM) = 16 cents/kWh.

If you charge your EV at night, you could save $200–$300 per year. Just set your car or charger to start at 11 PM. Easy.

Future Outlook: What’s Coming for Florida EV Incentives?

Proposed State Legislation: Could Sales Tax Exemptions Become Real?

As of 2024, there are active bills in the Florida legislature to eliminate sales tax on EVs. One proposal would phase it in over three years, starting with a 50% reduction in 2025, then full exemption by 2027. If passed, a $50,000 EV would save you $3,000 in sales tax—no small change.

Why the shift? Florida’s EV market is growing fast. In 2023, EV sales hit 11% of all new car sales, up from 6% in 2021. Lawmakers are starting to see EVs as part of the state’s future—especially with climate resilience and energy independence on the agenda.

More Charging Stations and Incentives for Underserved Areas

The federal NEVI (National Electric Vehicle Infrastructure) program is sending $198 million to Florida for fast-charging stations every 50 miles along major highways. This means better access for rural areas and small towns.

Additionally, the state is exploring incentives for low-income EV buyers and EVs in ride-share fleets. Think: Uber and Lyft drivers in Miami getting subsidies to switch to electric. These programs are in early stages but could launch by 2025.

Long-Term Trends: What This Means for You

Florida is moving toward a more EV-friendly future. While it may not have the most generous incentives today, the combination of federal credits, utility rebates, HOV access, and growing infrastructure makes it a strong contender. And with more proposals on the table, the next few years could bring even better deals.

My advice? If you’re on the fence, don’t wait too long. The federal tax credit could change with new legislation, and utility rebates often have limited funding. Act while the incentives are strong.

The Bottom Line: Should You Go Electric in Florida?

So, are tax incentives for electric cars in Florida worth it? Absolutely—but not because of one big perk. It’s the combination of federal credits, lower registration fees, HOV access, utility rebates, and smart charging that makes the math work.

Let’s do a quick real-world example. Imagine you buy a new $52,000 Hyundai Ioniq 5 in Miami in 2024:

- Federal tax credit: $7,500 (if eligible).

- Registration fee savings: $125 (initial) + $370 (5 years) = $495.

- FPL charger rebate: $1,000.

- Free HOV lane access: Saves 15 minutes/day, 5 days/week = ~65 hours/year.

- TOU rate savings: ~$250/year on electricity.

Total savings over 5 years: $9,245 in direct cash savings, plus hundreds more in time and convenience.

Now, are there downsides? Sure. No full sales tax exemption yet. Public charging isn’t always cheap. And if you live in a rural area, charging options might be limited. But for most Floridians—especially in cities—the pros far outweigh the cons.

Final tip: Talk to your accountant and utility provider before buying. Make sure you qualify for all the incentives. And remember: going electric isn’t just about saving money. It’s about cleaner air, quieter roads, and being part of a movement. In Florida, that movement is gaining serious momentum.

| Incentive | Amount | Provider | Notes |

|---|---|---|---|

| Federal New EV Tax Credit | Up to $7,500 | IRS | Non-refundable; income and MSRP limits apply |

| Federal Used EV Tax Credit | Up to $4,000 | IRS | Vehicle must be ≥2 years old, ≤$25,000 |

| Florida EV Registration Fee | $100 initial, $75 renewal | FLHSMV | vs. $225/$149 for gas cars |

| FPL Charger Rebate | $1,000 | Florida Power & Light | For Level 2 home charger installation |

| HOV Lane Access | Free | FLHSMV | Requires EV decal; solo drivers allowed |

| Miami Free Parking | Free at metered spots | City of Miami | Limited zones; must display EV decal |

Frequently Asked Questions

What tax incentives for electric cars in Florida are currently available?

Florida offers a sales tax exemption on the purchase or lease of new electric vehicles (EVs), covering the full 6% state sales tax. Some counties may also waive additional discretionary sales surtaxes, but these vary by location.

Do I qualify for the federal tax credit if I buy an EV in Florida?

Yes, Florida residents are eligible for the federal EV tax credit (up to $7,500), provided the vehicle meets IRS requirements. This credit is separate from Florida’s sales tax exemption and can be claimed when filing your federal income taxes.

Are used electric cars eligible for tax incentives in Florida?

No, Florida’s sales tax exemption only applies to new EVs. However, used EVs may qualify for the federal tax credit under the Inflation Reduction Act, depending on the vehicle’s age and price.

Does Florida offer any rebates or grants for EV charging stations?

While Florida doesn’t have a statewide rebate program, some utility companies (like FPL) offer incentives for home charger installations. Check with your local provider for available programs.

Are there additional local tax incentives for electric cars in Florida?

Some cities and counties may offer reduced registration fees or parking perks for EVs. For example, Orlando and Miami have previously offered discounted parking rates for electric vehicles.

Is the Florida EV tax incentive available for leased vehicles?

Yes, the 6% sales tax exemption applies to leased EVs as well. The leasing company passes the tax savings to you, often reflected in lower monthly payments.