Discover the Lucrative UK Electric Car Tax Benefits for a Greener Future

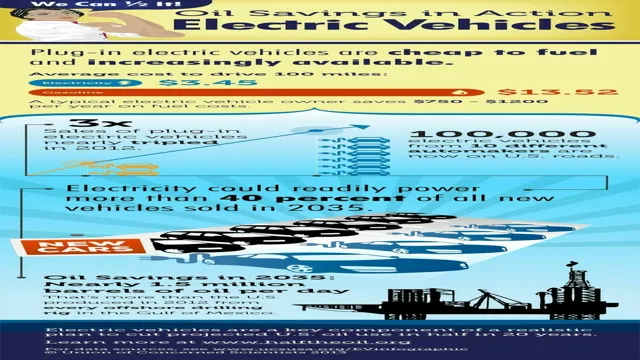

Are you considering purchasing an electric car in the UK? Not only will you be making a significant contribution to environmental sustainability, but you could also benefit from a range of tax incentives that make owning an electric car more affordable than ever before. The UK government is committed to reducing carbon emissions, and incentivizing electric vehicle (EV) ownership is one of the ways it is doing so. To encourage electric car adoption, the UK government is offering several tax benefits for both individuals and businesses.

EV owners enjoy an exemption from annual road tax and from the congestion charge in London. Additionally, businesses can claim relief on the purchase price of electric cars and benefit from reduced company car tax rates. Moreover, the UK government is investing heavily in developing the charging infrastructure necessary for EV adoption.

There are already over 20,000 public charging points across the country, and the government has committed to installing more. With the cost of EV ownership continuing to fall and the benefits of driving an electric vehicle plentiful, the shift towards EVs shows no sign of slowing down.

Overview of UK Electric Car Tax Incentives

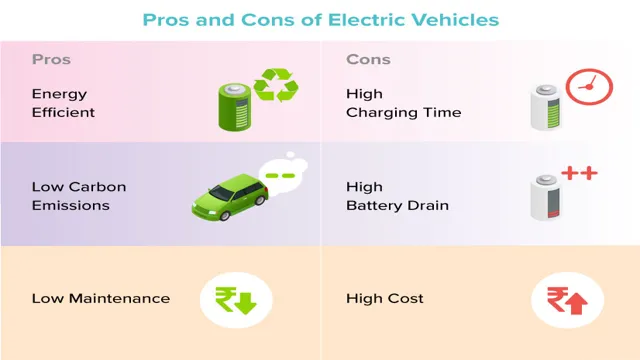

If you’re thinking about buying an electric car in the UK, you’ll be pleased to hear that there are several tax incentives available to make your purchase more affordable. Firstly, electric cars are exempt from the annual vehicle tax, also known as road tax, which can save you up to £400 per year. Additionally, electric cars are eligible for the OLEV grant, which provides up to £3,000 towards the purchase price of a new electric car.

There are also tax benefits available for businesses that purchase electric company cars, with reduced rates of company car tax and increased allowances for capital allowances. Not only do electric cars help to reduce your carbon footprint, but they can also save you money through these tax incentives. So, if you’re considering purchasing an electric car, it’s worth looking into these tax benefits to see how much you can save.

Value Added Tax (VAT) Exemption

As part of the UK Government’s efforts to reduce carbon emissions, there is a range of tax incentives available for electric car drivers, including VAT exemption. This means that when you purchase a fully electric vehicle, you don’t have to pay the 20% VAT that applies to petrol and diesel cars. Additionally, electric cars that emit less than 50g/km of carbon dioxide are eligible for road tax exemption.

This can result in significant savings for electric car owners compared to traditional vehicle owners. Not only is there the potential to save money on taxes, but electric cars are often cheaper to run on a day-to-day basis due to lower fuel costs. Overall, the UK Government’s electric car tax incentives are designed to make electric cars a more affordable and accessible option for drivers, whilst also encouraging the transition towards a greener, more sustainable future.

Plug-in Car Grant

If you’re thinking about purchasing an electric car in the UK, there are a number of incentives that can help make it more affordable. One of the most well-known incentives is the Plug-in Car Grant, which can provide up to £3,500 towards the cost of a new electric car. To be eligible for the grant, the car must have CO2 emissions of less than 50g/km and be capable of travelling at least 70 miles on a single charge.

In addition to the Plug-in Car Grant, there are also tax incentives available for electric car owners. For example, electric cars are exempt from vehicle tax and the London Congestion Charge, and can benefit from reduced company car tax rates. Plus, by switching to an electric car, you’ll also save money on fuel and maintenance costs, as well as reducing your carbon footprint.

Overall, the UK government is committed to promoting the uptake of electric cars, and there has never been a better time to make the switch.

Company Car Tax Benefits

If you’re contemplating purchasing an electric company car, you’ll be glad to know that in the United Kingdom, there are plenty of electric car tax benefits to take advantage of. For starters, employees will not need to pay any personal tax on their electric company cars. Additionally, if your company was to charge the electric vehicle at work, this would not be seen as a taxable expense, bringing extra savings.

Moreover, you’ll be pleased to find out that company car tax rates are low for electric vehicles because they have zero Carbon dioxide emissions, allowing the company to save more money. On top of that, electric company cars are not subjected to the annual Vehicle Excise Duty, again highlighting further cost savings to your company. By opting for an electric company car, you can reduce your carbon footprint, cut down on fuel costs, and save on tax expenses.

So why not contact a reputable dealership today and find out more about the benefits of electric company cars?

Lower Benefit-in-Kind (BiK) Tax Rates

The lower benefit-in-kind (BiK) tax rates are one of the most significant company car tax benefits that employees can enjoy. BiK tax is a tax that is charged on an employee’s benefit from using a company car for personal use. This tax is calculated on the car’s list price, CO2 emissions, and fuel type.

However, the government has recently introduced lower BiK tax rates for electric and hybrid cars. This means that employees driving electric or hybrid company cars enjoy reduced BiK tax rates, resulting in significant cost savings. Furthermore, companies that opt for electric or hybrid cars can save money on National Insurance contributions, making it a win-win situation for both employees and employers.

This change is undoubtedly a step in the right direction towards promoting the use of environmentally friendly vehicles and reducing carbon emissions.

Electric Vehicle Home Charging Scheme

If you’re considering making the switch to an electric vehicle, the Electric Vehicle Home Charging Scheme could help offset the costs of installing a charging station at your home. This scheme is available to all electric vehicle drivers, including those who have a company car. As a company car driver, you can take advantage of the benefits of electric vehicles such as zero emissions and low running costs.

In addition, electric vehicles are exempt from company car tax. This means you can save money on your tax bill while also reducing your impact on the environment. By installing a charging station at your home, you’ll also have the convenience of charging your vehicle overnight and waking up to a fully charged battery.

The Electric Vehicle Home Charging Scheme offers up to £350 towards the cost of installation, making it an attractive option for company car drivers looking to go electric.

Road Tax Exemptions and Discounts

If you’re considering purchasing an electric car in the UK, it’s important to know about the various tax benefits you may be eligible for. One major advantage of electric cars is that they are exempt from paying road tax. This means that you won’t have to pay an annual fee for the right to drive your car on public roads.

Additionally, some local councils and cities offer discounts on parking fees and congestion charges for electric car owners. This can save you a significant amount of money if you frequently drive in urban areas. Furthermore, if you own an electric car for business purposes, you may be eligible for tax breaks and incentives from the UK government.

Overall, owning an electric car can be a financially advantageous choice, with plenty of tax benefits available to help you save money.

Vehicle Excise Duty (VED) Exemption

Vehicle Excise Duty (VED) exemption is a government scheme that offers incentives to drivers of low-emission vehicles by exempting them from paying road tax or granting discounts. VED is currently based on carbon dioxide (CO2) emissions and a vehicle’s list price. Cars emitting less than 50g/km of CO2 are completely exempt from VED, while those emitting less than 75g/km pay reduced rates.

Moreover, drivers of hybrid and electric vehicles are eligible for a full exemption from the London Congestion Charge and other city-based low emission zones. It is worth mentioning that VED exemptions and discounts often change, so staying up to date with the latest government policy is crucial in minimizing your motoring costs. Overall, VED exemption is a powerful motivator for car buyers to make eco-friendly choices, leading to reduced emissions and improved air quality.

Congestion Charge Exemption

If you live in a congested area, you may be familiar with the concept of road congestion charges. These charges are designed to discourage people from driving in congested areas during peak travel times. However, some people are exempt from paying these charges, including those who drive electric or hybrid vehicles.

In addition to this, there may be other road tax exemptions and discounts available to people who drive environmentally-friendly vehicles. These exemptions and discounts can make a significant difference to the cost of owning a vehicle, and can encourage people to switch to more eco-friendly modes of transport. So, if you’re thinking of buying a new car, it may be worth considering an electric or hybrid vehicle to take advantage of potential savings on your road taxes and congestion charges.

Conclusion: Make the Switch to Electric Vehicles Today

In conclusion, it’s clear that the UK government is zapping traditional car drivers with electric car tax benefits. With incentives like lower road taxes, cheaper charging rates, and decreased emissions, it’s no wonder more and more Brits are plugging in to the electric revolution. So why get left in the exhaust fumes of the past when you could join the current and drive into a electrifying future of reduced costs and a greener planet?”

FAQs

What are the tax benefits of owning an electric car in the UK?

In the UK, electric cars are exempt from paying vehicle tax and have a lower company car tax rate. Additionally, owners of electric cars may be eligible for a government grant towards the purchase price.

How much money can I save on taxes by owning an electric car in the UK?

The amount of money you can save on taxes by owning an electric car in the UK varies depending on individual circumstances. However, electric cars are exempt from paying vehicle tax and have a lower company car tax rate, which can add up to significant savings over time.

Do I still need to pay for charging my electric car at public charging points in the UK?

Yes, you will still need to pay for charging your electric car at public charging points in the UK. However, some charging points may be free to use, and the cost of charging is generally lower than the cost of fueling a petrol or diesel car.

Are there any other incentives for owning an electric car in the UK besides tax benefits?

Yes, there are other incentives for owning an electric car in the UK besides tax benefits. For example, some local authorities offer free or discounted parking for electric cars, and electric car owners may be exempt from certain congestion charging schemes. Additionally, electric cars are eligible for government grants towards the installation of home charging points.