Uncovering the Hidden Gems: Know Your Tax Benefits of Owning an Electric Car

Electric cars are becoming more prevalent in today’s world, and for a good reason! They are not only environmentally friendly but also offer significant tax benefits. The tax benefits of owning an electric car can vary by state and country, but they can help offset the cost of the car and save you money in the long run. In this blog post, we will dive into the tax benefits of electric cars and how they can help you save money.

From federal incentives to state-specific programs, there are many ways you can take advantage of these benefits and make the switch to an electric car. So, let’s take a closer look at the tax benefits of electric cars and see how they can benefit you!

Federal Tax Credits

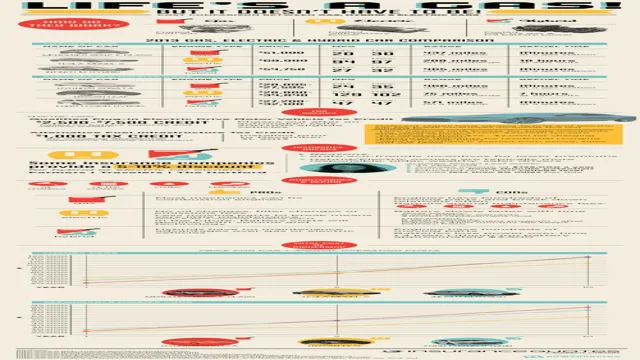

If you’re considering purchasing an electric car, you may be wondering what the tax benefits are. One of the main tax benefits of owning an electric car is the federal tax credit. This credit can be up to $7,500 and is available for qualified buyers.

Eligibility depends on the make and model of the electric car you choose, as well as the battery capacity. The tax credit can be used to offset income tax liability or may even be used to receive a refund. Keep in mind that the federal tax credit is not available indefinitely and is set to expire once automakers have sold a certain number of qualified vehicles.

It’s important to take advantage of this tax credit while you still can, as it can significantly reduce the overall cost of owning an electric car.

Up to $7,500 credit for eligible vehicles

Are you considering buying a new electric vehicle but worried about the high cost? Don’t worry, you can save up to $7,500 in Federal Tax Credits for eligible vehicles. The U.S.

Government is offering this incentive to promote the use of environmentally friendly cars that emit less or no pollutants. However, not all electric vehicles are eligible for the full credit; the amount is based on the battery size and manufacturer. For example, Tesla models are no longer eligible for the full credit while newer models from other manufacturers can qualify for the full $7,500.

This credit is a significant relief, and it’s a way to reduce the total cost of ownership of an electric vehicle. Keep in mind that this credit is limited in quantity and will eventually expire. So, if you’re planning to buy an eligible electric vehicle, now is the right time to enjoy this incentive as it might not be available for long.

Credit decreases as manufacturer sells more EVs

Federal Tax Credits If you’re considering purchasing an electric vehicle (EV), you may want to do so sooner rather than later to take advantage of federal tax credits. Currently, the federal government provides tax credits of up to $7,500 to consumers who purchase qualifying EVs. However, this credit amount can decrease as manufacturers sell more EVs.

For example, once a manufacturer sells 200,000 qualifying EVs, the tax credit begins to phase out. This means that if you’re considering purchasing an EV from a popular brand like Tesla or General Motors, you may only be eligible for a partial tax credit, depending on how many EVs that manufacturer has sold. It’s important to consider this when deciding on a vehicle and timing your purchase to maximize your tax credit.

Don’t wait too long, though – the federal tax credit is set to expire for many manufacturers once they sell 200,000 qualifying EVs, so act fast if you want to take advantage of this incentive.

State Incentives

Electric cars have become increasingly popular due to their environmental benefits and low operating costs. Another significant advantage of owning an electric car is the tax benefits offered by many states. For instance, some states offer tax credits and rebates for electric car purchases or leasing, including discounts on sales taxes, income taxes, or even vehicle registration fees.

These incentives help offset the higher upfront cost of electric cars, making them more accessible to a wider range of consumers. Additionally, some electric car owners may qualify for high-occupancy vehicle (HOV) lane exemptions, allowing them to save time during their daily commutes. Overall, the tax benefits of electric cars are an appealing factor for those considering purchasing an eco-friendly vehicle.

Various states offer tax credits, rebates, and exemptions

State incentives are a great way to take advantage of tax credits, rebates, and exemptions. Many states offer a variety of incentives to businesses and individuals, including renewable energy incentives, education and job training incentives, and even historic preservation incentives. Renewable energy incentives often include tax credits or rebates for installing solar panels or wind turbines.

Education and job training incentives can provide financial assistance for individuals looking to further their careers and obtain skills that are in high demand. Historic preservation incentives can help offset the costs of restoring or renovating historic properties. Overall, taking advantage of state incentives can help individuals and businesses save money and promote sustainable practices.

So, if you’re looking to take advantage of these incentives, be sure to research what’s available in your state and see how you can apply.

Amounts and criteria vary by state

State incentives for renewable energy can vary greatly from one state to another. Each state has its programs and criteria, which can make it challenging to navigate the various options available. However, these incentives can make a significant difference in the cost of a renewable energy system.

Some states offer tax credits, while others provide rebates or grants. Tax credits are typically based on a percentage of the total system cost and can reduce the amount of taxes owed, while rebates are a one-time payment for the purchase or installation of a renewable energy system. Grants are another type of incentive, often provided through state energy offices, which can help offset the initial costs of renewable energy systems.

It’s essential to research and understand what incentives are available in your state and what the criteria are to qualify for them. Doing so could save you a significant amount of money on your renewable energy system investment.

Lowered Operating Costs

So, what are the tax benefits of an electric car besides its positive impact on the environment? One of the biggest reasons to consider an electric car is the lowered operating costs. Not only are electric cars cheaper to fuel on a daily basis, but the government incentivizes owning one through tax credits. For example, the federal government offers a tax credit of up to $7,500 for purchasing an electric car.

Additionally, some states offer their own incentives such as rebates, tax credits, or exemptions from sales tax. You could save a lot of money by making the switch to an electric vehicle. Not only that, but electric vehicles require less maintenance than traditional cars as there are fewer parts that need to be replaced.

All of these factors combined contribute to significant savings in the long run, making an electric car a smart investment for both your wallet and the environment.

No gas expenses and lower maintenance costs

Operating an electric car is a dream come true for those who are looking to cut down on their expenses. With no gas expenses and lower maintenance costs, you can save significantly on your operating costs. Opting for an electric car means that you no longer need to worry about fluctuating gas prices or the costs associated with regular maintenance such as oil changes, spark plugs replacements, and exhaust system repairs.

Plus, electric cars have fewer moving parts, so there’s less need for repairs and replacements. This translates into a longer lifespan of the vehicle and lower overall operating costs. In addition to the financial benefits, you can also feel good about driving an eco-friendly car that produces zero emissions.

So, why not make the switch to an electric car and save on operating costs while helping to reduce your carbon footprint?

State-specific discounts on tolls, parking, and registration fees

As a driver, one major thing to consider is the cost of operating a vehicle. Luckily, there are many state-specific discounts available to drivers that can help reduce tolls, parking fees, and registration costs. These discounts vary by state but can often save drivers a significant amount of money.

For example, some states offer discounts to drivers who use electronic toll collection systems, while others provide reduced parking rates for seniors or disabled individuals. Additionally, some states offer discounts on vehicle registration fees for military members or veterans. These discounts not only help drivers save money but can also make it easier for individuals who rely on their cars to get around.

By taking advantage of these state-specific discounts, drivers can significantly lower their operating costs and keep more money in their pockets. So next time you’re on the road, be sure to research what discounts are available in your state and take advantage of any that apply to you.

Tax Deductions for Business Use

When it comes to owning an electric car for business purposes, there are several tax deductions to keep in mind. One of the biggest benefits is the Federal Tax Credit, which can be up to $7,500 for a new electric vehicle. Additionally, electric cars may also qualify for state and local incentives, such as rebates, tax credits, or exemption from sales tax.

Another deduction that business owners can take advantage of is the depreciation of the electric car. The IRS allows a business to deduct up to $18,000 in the first year of owning an electric car. Furthermore, business owners can claim deductions for the cost of charging stations, as well as the electricity used to charge the car.

Overall, owning an electric car for business use can result in significant tax savings and be beneficial for both the environment and the bottom line.

Businesses can claim a tax deduction for EVs used for business purposes

If you’re a business owner who’s considering buying an EV for your work-related trips, you’ll be pleased to hear that the IRS allows you to claim tax deductions for EVs used for business purposes. This can activate several benefits such as saving money on taxes and lowering your carbon footprint. However, it’s essential to note that the amount you can save through these deductions is subject to change and depends on the electric vehicle and your location.

Moreover, while an EV can be a substantial upfront investment, the potential deductions you can obtain may turn your purchase into a possible and profitable one. Therefore, it’s suggested to consult a tax professional to ensure the tax code’s validity and that all requirements are met. In conclusion, choosing an electric car for your business can have many advantages, and when done correctly, taking advantage of tax deductions will put you ahead in the game.

Deduction amount based on the percentage of business use

Tax deductions for business use can provide substantial financial relief to small business owners. The deduction amount is based on the percentage of business use of the asset in question. For example, if a business owner purchases a car and uses it 75% of the time for work-related travel, they can deduct 75% of the vehicle’s expenses such as gas, maintenance, and insurance.

Similarly, for home offices, the deduction is based on the percentage of the home that is used solely for business purposes. It is important to keep detailed records of business and personal use to accurately calculate the deduction amount. Overall, claiming tax deductions for business use is a smart financial move for small business owners looking to reduce their tax liability and improve their cash flow.

Conclusion

In conclusion, the tax benefits of owning an electric car can truly power up your finances. From generous federal tax credits to state tax incentives, the government is incentivizing drivers to make the switch to eco-friendly vehicles. Not only will you be reducing your carbon footprint, but you’ll also save money on gas and maintenance costs in the long run.

So, if you’re looking to charge ahead and drive tax savings home, an electric car might just be the electric charge you need in your life.”

FAQs

What is the federal tax credit for purchasing an electric car?

The federal tax credit for purchasing an electric car is up to $7,500.

Are there any state tax incentives for owning an electric car?

Yes, many states offer additional tax incentives for owning an electric car such as rebates, exemptions, and credits.

Do electric cars have lower maintenance costs compared to gasoline cars?

Yes, electric cars have lower maintenance costs because they do not require oil changes, transmission fluid changes, or spark plug replacements.

Can businesses claim tax benefits for purchasing electric cars?

Yes, businesses can claim tax benefits for purchasing electric cars under the Section 179 Deduction or Bonus Depreciation laws.