Charge Up Your Savings: Uncovering the Tax Benefits of Electric Cars

Electric cars are revolutionizing the automobile industry with their eco-friendliness and cost-effective performance. Not only are they a greener option, but electric vehicles (EVs) also offer several tax benefits to owners. This blog post will explore the many tax benefits of owning an electric car, making it understandable for everyone.

So, if you’re considering purchasing an EV, keep reading to find out how it could benefit you come tax season. From federal tax credits to state incentives, we’ll break down each benefit in detail, helping you determine just how much you could save by going electric.

Federal Tax Credits

If you’re considering an electric car, you may be wondering what the tax benefits are. One of the most significant tax benefits of purchasing an electric car is the federal tax credit. This credit can range from $2,500 to $7,500, depending on the size of the battery in your electric car.

An added bonus of the federal tax credit is that it is applied to your tax bill, which means that it reduces the amount of taxes you owe directly. However, it’s essential to note that this tax credit is only available for a limited time, and once the manufacturer sells a certain number of electric vehicles, the credit starts to phase out. So if you’re considering an electric car, it’s a good idea to act sooner rather than later to take advantage of these tax benefits.

All in all, owning an electric car can not only help reduce carbon emissions but also save money on taxes.

Up to $7,500 in tax credits for qualifying electric cars

If you’re looking to purchase an electric car, now might be a good time to do so. That’s because the federal government offers up to $7,500 in tax credits for qualifying electric cars. These credits are available to those who purchase new electric vehicles or plug-in hybrids.

The amount of the tax credit depends on the size of the battery in the car. For example, if your car has a battery that’s 16 kWh or larger, you could be eligible for the full $7,500 credit. If your battery is smaller, the credit will be less.

These tax credits can help make electric cars more affordable and encourage drivers to make the switch to more environmentally friendly vehicles. So, if you’re in the market for a new car, consider going electric and taking advantage of these federal tax credits.

Credit amount varies based on battery capacity and manufacturer

When it comes to purchasing an electric vehicle, you may be eligible for a federal tax credit. The amount of this credit can vary based on the battery capacity and manufacturer of the vehicle. For example, a Tesla vehicle with a 75 kWh battery could potentially qualify for a credit of up to $7,500, while a Nissan Leaf with a 40 kWh battery may only qualify for a credit of up to $7,500.

Additionally, the manufacturer may reach a certain threshold of sales, and the credit may start to phase out for their vehicles. It’s important to do your research and consult with a tax professional to see if you qualify and how much of a credit you may be eligible for. The federal tax credit can be a great incentive to make the switch to an electric vehicle and help you save money in the long run.

State Incentives

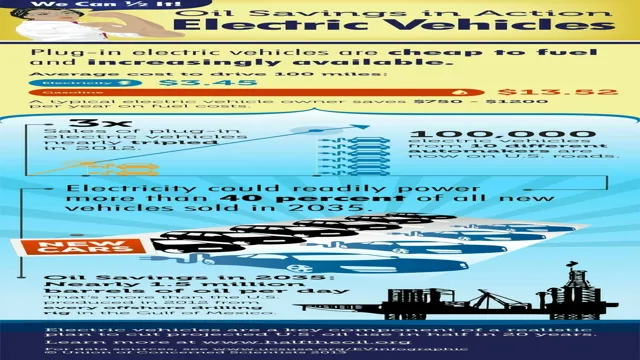

Electric cars are becoming more popular every day, especially due to their several benefits over gasoline-powered vehicles. One of the most significant benefits is the tax incentives that come with owning an electric car. Individuals who purchase an electric car are eligible for federal tax credits, which range from $2,500 to $7,500, depending on the model and battery size.

Additionally, many states offer their own incentives, such as direct cash rebates, reduced registration fees, access to carpool lanes, and free or reduced-cost charging stations. All these state incentives, combined with federal tax credits, make owning an electric car more economical for consumers. It also helps to reduce carbon emissions and negative impacts on the environment, making it an excellent choice for those who want to drive a clean and sustainable vehicle while saving money.

Several states offer their own tax incentives for electric car buyers

If you’re in the market for an electric car, be sure to research the tax incentives your state offers. Several states have their own tax incentives for electric car buyers, on top of the federal tax credit. For example, California offers a rebate of up to $1,500 for certain electric vehicles, as well as access to carpool lanes and free or discounted parking at certain locations.

New York offers a rebate of up to $2,000 for electric cars with a base price under $60,000. Colorado offers a tax credit of up to $5,000 for electric vehicles and plug-in hybrids. These incentives can often make a significant difference in the cost of purchasing an electric car, so it’s worth doing some research and taking advantage of the savings.

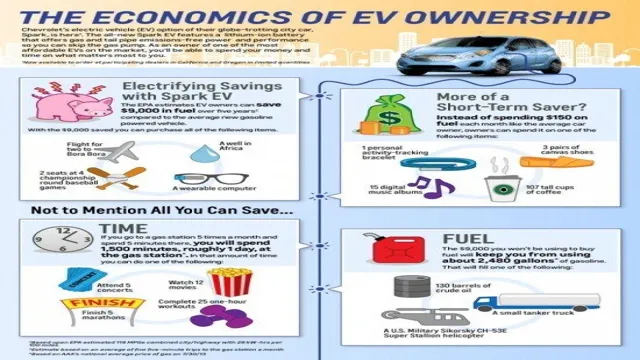

Don’t forget to also consider the savings on fuel and maintenance costs that come with owning an electric car.

Examples include rebates, tax credits, and reduced registration fees

State incentives are a great way to support individuals and businesses who are looking to make changes that benefit the environment. They often provide financial support through rebates, tax credits, and reduced registration fees. For example, many states offer rebates to homeowners who install solar panels.

This can help offset the initial cost of installation and encourage more people to switch to renewable energy sources. Additionally, some states offer tax credits to businesses that invest in energy-efficient equipment or vehicles, which can save them money on their tax bill and reduce their carbon emissions. Reduced registration fees are another common incentive offered by states for vehicles that have lower emissions, such as hybrid or electric cars.

By providing these incentives, states can encourage sustainable behavior and reduce the impact of human activity on the environment.

Check with your state’s department of revenue for more information

When it comes to state incentives, each state has its own unique programs and regulations. If you’re looking to start a business or make changes to an existing one, it’s important to do your research and see what incentives are available in your state. One great resource to consult is your state’s department of revenue.

They can provide you with valuable information on tax breaks, grants, and other incentives that may be available. It’s worth taking the time to reach out to them and ask any questions you may have. By taking advantage of these state incentives, you can save money and help your business thrive.

So, don’t hesitate to do your research and see what’s available in your state!

Business Tax Benefits

If you are a business owner considering investing in an electric car, it’s important to understand the potential tax benefits. First and foremost, businesses can claim a federal tax credit of up to $7,500 for the purchase of an electric vehicle. Additionally, electric cars are often exempt from state sales tax and other fees, which can result in significant savings.

By switching to electric vehicles, businesses can also potentially receive state and federal grants for investing in cleaner energy sources. Furthermore, companies that operate electric vehicles may be eligible for a number of tax deductions, including a deduction for the cost of charging stations. Altogether, these tax benefits can make it much more affordable for businesses to transition to electric vehicles, saving both money and the environment in the long run.

Businesses can potentially deduct the full cost of an electric car

One of the most significant advantages of owning an electric car for a business owner is the potential tax benefits. Unlike traditional gasoline-powered vehicles, electric vehicles are eligible for various incentives and tax credits that can substantially cut down on ownership costs. One such benefit is the ability to deduct the full cost of an electric car.

For instance, businesses can claim up to $18,100 in federal tax credits for each electric vehicle that they purchase. Moreover, state-level incentives and credits can bring the total savings to over $30,000 per vehicle. Additionally, businesses can write off the operational costs, such as charging and maintenance expenses, incurred while using electric cars.

By taking advantage of these tax benefits, businesses can not only reduce their carbon footprint but also save money while doing so.

Electric car charging stations may also be eligible for tax credits

Businesses that install electric car charging stations may be eligible for tax credits, providing a significant financial benefit. By claiming the Alternative Fuel Infrastructure Tax Credit, businesses can recoup a portion of the expenses incurred by installing charging stations. This is incredibly valuable because it can offset the upfront costs of purchasing and installing a charging station, which can be expensive.

Furthermore, it’s important to note that the credit applies to both private and public stations. However, it’s important to consult with a tax professional to determine eligibility and process the credit correctly. While the process may seem daunting, taking advantage of these tax credits can lead to significant savings for businesses, not to mention a positive impact on the environment.

Conclusion

In conclusion, the tax benefits of owning an electric car are shockingly impressive. With potential savings on federal tax credits, state incentives, and reduced operating costs, it’s clear that going electric could be the savvy financial choice for car buyers. Plus, not only will switching to an electric vehicle benefit your bank account, but it also benefits the environment by reducing carbon emissions.

So, if you’re looking to give your wallet and the planet a jolt, it’s time to consider making the switch to an electric car.”

Tax benefits make electric cars more affordable for consumers and businesses

Electric cars offer significant tax benefits for businesses, which has changed the game for many companies looking to lower their operating costs. One key perk is the ability to claim a federal tax credit, which can range from $2,500 to $7,500 per vehicle depending on the battery capacity. This is a huge incentive for businesses, as it can lower the overall cost of an electric car considerably.

Another advantage of owning an electric car is the potential for state incentives like rebates, tax credits, and other financial incentives. These incentives are often dependent on the state and can vary from one region to another. However, overall, businesses can save money on fuel, maintenance and other operational costs, which makes investing in electric cars an attractive option.

Additionally, electric vehicles also offer an opportunity for businesses to showcase their commitment to sustainable practices and contribute to a cleaner environment.

FAQs

What tax benefits are available for electric car owners?

Electric car owners may be eligible for federal tax credits up to $7,500. Additionally, many states offer their own incentives such as rebates, reduced registration fees, and exemption from certain taxes.

Are there any tax benefits for businesses that invest in electric vehicles?

Yes, businesses that purchase and use electric vehicles may qualify for a tax credit up to 30% of the cost of the vehicle and charging equipment.

Can electric car owners deduct charging expenses on their taxes?

Yes, electric car owners may be able to deduct expenses related to charging their vehicles, such as the cost of installing a charging station at their home.

Are there any tax benefits for leasing an electric car?

Yes, electric car leases may be eligible for the federal tax credit, which is often applied as a reduction in monthly lease payments. Additionally, some states offer incentives for electric car leases, such as reduced sales tax or lease-specific rebates.