Power up Your Savings: Discover the Tax Benefits of Electric Cars

Electric cars have been growing in popularity over the years as people become more conscious about their carbon footprint and the impact of their daily activities on the environment. However, aside from the obvious benefit of reducing emissions, there are also tax benefits to owning an electric car. These benefits can make electric cars not only an environmentally friendly choice but also a financially savvy one.

The tax benefits vary depending on where you live, but many countries and states offer incentives for those who own and operate electric cars. In some places, electric car owners can get tax credits, rebates, or exemptions. These tax benefits can be significant, with some credits and rebates offering thousands of dollars in savings.

But why are these tax benefits offered? The answer is simple: governments want to incentivize people to switch to electric cars and reduce the number of emissions from traditional gas cars. By offering tax benefits, they hope to make electric cars more accessible and attractive to consumers. In addition to tax benefits, owning an electric car can also save you money long-term.

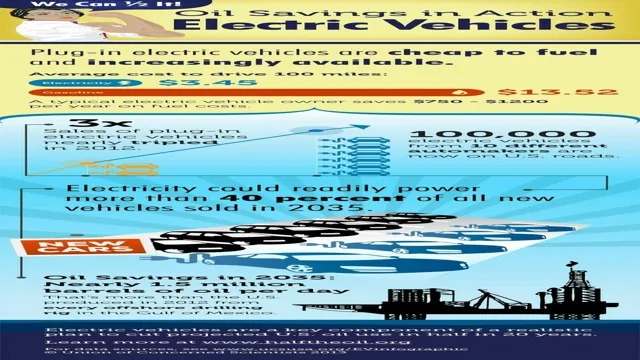

Electric cars require less maintenance and have fewer parts that need to be replaced, meaning that they can be less expensive to maintain. Plus, with the cost of electricity being lower than the cost of gas, the savings in fuel costs can add up over time. Overall, owning an electric car can not only be better for the environment but can also be a smart financial decision.

With tax benefits and long-term savings, it’s no wonder why electric cars are becoming more and more popular.

Federal Tax Credit

If you’re considering purchasing an electric car, there are several tax benefits to take advantage of. One of the most significant is the federal tax credit. This credit allows you to deduct up to $7,500 from your federal taxes for the year in which you purchase your electric car.

However, it’s important to note that this credit is only available for a limited time. Once a car manufacturer sells 200,000 electric cars, the tax credit begins to phase out. For example, Tesla buyers were eligible for the full $7,500 credit until the end of 2018, but it has since been reduced to $1,875 and will continue to decrease over time.

It’s also worth mentioning that this credit is non-refundable, meaning that it can only reduce your tax liability to zero – it won’t result in a tax refund. Nonetheless, if you’re in the market for an electric car, the federal tax credit can help offset the higher initial cost and make it a more affordable option in the long run.

Get up to $7,500 back on your taxes for eligible vehicles.

If you’re in the market for an electric or hybrid vehicle, you may want to consider the federal tax credit available to eligible buyers. This credit can result in significant savings, with up to $7,500 back on your taxes. To be eligible for the credit, your vehicle must meet certain criteria, including battery size and vehicle weight.

The credit begins to phase out once a manufacturer reaches a certain number of sales, so it’s important to act fast if you’re interested in taking advantage of this opportunity. In addition to the federal tax credit, some states also offer their own incentives for electric and hybrid vehicle owners. By choosing an eligible vehicle, you can not only help reduce your carbon footprint, but also save money in the process.

So why not consider making the switch to an electric or hybrid vehicle today?

Phase-out period begins after 200,000th vehicle is sold by manufacturer.

The Federal Tax Credit for electric vehicles is soon to undergo a phase-out period after the 200,000th vehicle is sold by the manufacturer. This credit has been a significant incentive for many customers looking to purchase an electric vehicle for their daily commutes. With this credit in place, many drivers have been able to enjoy significant savings on their taxes and fuel costs.

However, the timeline for this credit’s expiration is quickly approaching, and it’s important to consider it if you’re in the market for an electric car. While the expiration date varies among manufacturers, many are already in the phase-out period or will enter it soon. This means that the tax credit will begin to decrease in value over time until it’s eventually phased out completely.

So, if you’re in the market for an electric vehicle, now might be the best time to buy to take advantage of these incentives while they’re still available.

State and Local Incentives

One of the most significant advantages of owning an electric car is the potential tax benefits offered by state and local governments. Many states and municipalities offer incentives such as tax credits, rebates, and exemptions for electric vehicle owners. For example, California offers a rebate of up to $2,500 for electric cars, while New York provides its residents with a tax credit of up to $2,000.

These incentives can significantly reduce the cost of purchasing an electric car and make it a more financially viable choice. Additionally, some states offer other benefits like free parking and access to high-occupancy vehicle lanes, which can reduce commute times. Overall, electric cars are not only environmentally friendly but can also save you money in the long run with the help of these beneficial tax incentives.

Many states offer rebates, discounts, or tax credits for EV purchases.

When it comes to purchasing an electric vehicle, it’s important to consider the potential incentives available to you. Many states offer rebates, discounts, or tax credits for those looking to make the switch to an EV. These incentives can make the cost of purchasing an EV much more manageable for individuals and families.

Depending on your location, you may be eligible for additional incentives at the local level as well. It’s a good idea to do some research and see what incentives are available in your state or city before making a decision. By taking advantage of these incentives, you can not only save money, but also contribute to a more sustainable future.

So, don’t forget to look into state and local incentives before making your EV purchase!

Some cities offer free charging and other perks for EV drivers.

If you’re considering purchasing an electric vehicle (EV), you may be able to take advantage of state and local incentives, including free charging and other perks. Several cities across the country offer free charging stations for EV drivers, while others offer discounts on tolls, parking fees, and even carpool lane access. For example, in California, EV owners can apply for a Clean Air Vehicle Sticker that allows them to use carpool lanes regardless of the number of passengers in the vehicle.

In addition, some states offer tax credits or rebates for purchasing an EV. Be sure to check with your local government to see what incentives are available in your area. Taking advantage of these incentives can save you money and make owning an EV even more convenient and practical.

Plus, you’ll get the added benefit of reducing your carbon footprint and helping the environment. So why not go electric?

Check with your local government for potential incentives.

When it comes to residential solar panel installation, it’s always a good idea to check with your local government for any potential incentives that may be available to you. Many states and municipalities offer tax credits, rebates, and other incentives to homeowners who invest in solar energy. These incentives can go a long way in reducing the upfront costs of installation and speeding up the payback period for your solar investment.

For example, some states offer a solar tax credit that can be applied against your state income taxes for a specified number of years after installation. Others may offer rebates that are paid directly to you upon installation. By doing your research and finding out what incentives are available in your area, you can save thousands on your solar panel installation and start benefiting from clean, renewable energy sooner.

Avoidance of Gas Tax

One of the biggest tax benefits of electric cars is the avoidance of gas tax. Traditional gasoline-powered cars are subject to federal and state gas taxes, which can add up to a significant amount over time. However, since electric cars run entirely on electricity, they are not subject to the same gas taxes.

This means that electric car owners can save money on taxes each year and help reduce their overall transportation costs. Furthermore, many states offer additional tax incentives and rebates for purchasing electric vehicles, which can make owning an electric car even more affordable. So not only are electric cars better for the environment, but they can also help you save money on taxes and transportation expenses in the long run.

EV owners do not pay gas taxes that fund road maintenance and repairs.

Electric vehicle owners are exempt from paying gas taxes, which are used to fund road maintenance and repair programs. This is because EVs do not consume gasoline, which is the primary source of revenue for these programs. As a result, some people have raised concerns about the fairness of this exemption, arguing that EV drivers should contribute to the maintenance and repair of the roads they use just like their gasoline-powered counterparts.

However, others contend that this is an unfair burden to place on EV owners, who are already paying a premium for their environmentally-friendly vehicles. It’s a complex issue that requires careful consideration and an understanding of the nuances of both sides. One potential solution could be to implement alternative sources of revenue for road maintenance and repair, such as a mileage-based tax or a usage fee for EV drivers.

Whatever the solution, it’s clear that a thoughtful and fair approach is needed to ensure that our roads continue to be safe and well-maintained for all drivers, regardless of the type of vehicle they own.

Some states charge an additional fee for EV ownership to make up for lost revenue.

One thing to keep in mind when considering the ownership of an electric vehicle (EV) is that certain states may charge an additional fee due to the avoidance of gas tax. This fee is meant to make up for lost revenue that would have been gathered through traditional gasoline-powered vehicles. While this may seem like a deterrent to owning an EV, it’s important to note that the fee is generally small and is intended to help fund the maintenance of roads and infrastructure.

It’s also worth considering that the savings on gas and maintenance costs that come with owning an EV often outweigh the additional fee over time. So, if you’re thinking about making the switch to an electric vehicle, don’t let the potential for an additional fee deter you – the benefits of owning an EV can far outweigh any added costs.

Lower Operating Costs

Electric cars have several tax benefits, and one of the most significant advantages is lower operating costs. Since electric cars run purely on electricity, they don’t require gasoline to run, making them cheaper in the long run. Additionally, many states provide tax incentives for purchasing an electric vehicle.

For example, in California, eligible drivers can receive up to $2,500 for purchasing an electric car through the Clean Vehicle Rebate Project. Furthermore, electric car owners can also take advantage of federal tax credits, which can greatly reduce the overall costs of owning an EV. Ultimately, switching to an electric car can help you save money and reduce your carbon footprint, making it an excellent investment for both your wallet and the environment.

EVs have lower operating costs due to cheaper electricity and fewer maintenance requirements.

One of the most significant advantages that electric vehicles (EVs) have over traditional gas-powered vehicles is their lower operating costs. EVs run on electricity, which is considerably cheaper than gasoline, resulting in significant savings for drivers. Additionally, EVs have fewer maintenance requirements due to their simpler construction, cutting down on the costs associated with regular maintenance.

EV owners do not need to worry about oil changes or exhaust system repairs, as EVs have no internal combustion engines. With fewer moving parts, the potential for costly breakdowns or component failures is lower for EVs. These operating cost savings can add up over time, potentially saving EV owners thousands of dollars compared to drivers of traditional gas-powered vehicles.

Moreover, with the cost of electric vehicles becoming more affordable, it is evident that EVs are an excellent option for people looking to save money in the long run.

Conclusion

In conclusion, the tax benefits of electric cars are like a sweet melody to your wallet. With federal tax credits, state incentives, and potential savings on fuel and maintenance costs, switching to an electric ride can be a financially savvy move. Not only do you get to reduce your carbon footprint and contribute to a cleaner environment, but you also get to enjoy some extra cash in your bank account.

So why not join the green revolution and give your bank balance a boost at the same time? It’s a win-win situation, baby!”

FAQs

What tax credits are available for purchasing an electric car?

The federal government offers a tax credit of up to $7,500 for qualifying electric vehicles. Some states also offer additional tax incentives.

Can electric car owners deduct charging expenses on their taxes?

Electric car owners may be able to deduct their electric vehicle charging expenses if they are using the vehicle for business purposes. However, personal use of the vehicle does not qualify for a deduction.

Are there any tax penalties for not owning an electric car?

Currently, there are no tax penalties for not owning an electric car. However, some states may impose higher registration fees for gas-powered vehicles, which could incentivize drivers to switch to electric.

Do electric car owners have to pay any special taxes or fees?

Some states have implemented special taxes and fees on electric vehicles to make up for lost gas tax revenue. However, these fees are typically much lower than the amount saved on gas and maintenance costs for electric car owners.