Maximizing Your Savings: Exploring the Tax Benefits of Electric Cars

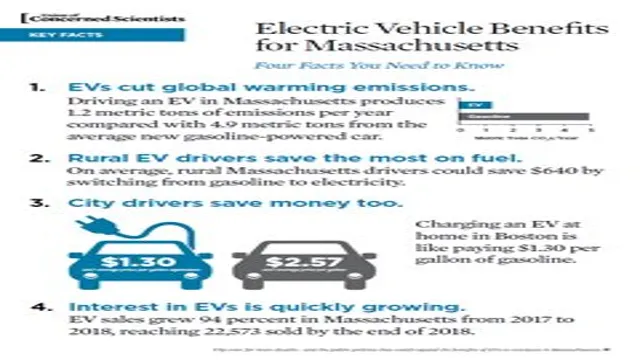

Are you considering buying an electric car? Electric cars have become increasingly popular in recent years due to their environmentally friendly and cost-effective nature. But did you know that there are also tax benefits to be had if you make the switch to an electric vehicle? Many countries and states offer tax incentives to make buying an electric car more appealing. These tax benefits can include a federal tax credit, state tax credit, or even a rebate.

These benefits can range anywhere from a few hundred dollars to several thousand dollars depending on where you live and the type of car you buy. Not only do electric car tax benefits make the switch more affordable, but they also help support the growth of the electric car industry. More demand for electric cars means more investment in research and development, which in turn leads to even better electric cars in the future.

So, if you’re interested in making a positive impact on the environment and saving money in the long run, consider taking advantage of the electric car tax benefits available to you. Not only will you be doing your part to reduce your carbon footprint, but you’ll also be making a smart financial decision.

Lower Tax Liability

Looking to save on taxes? Electric cars are your answer. These eco-friendly vehicles offer a wide range of tax benefits. First off, new electric car buyers can claim up to $7,500 in federal tax credit.

This means you can deduct that amount from your tax liability come tax season. Additionally, some states like California offer additional incentives, such as purchase rebates and qualifying for carpool lane usage. Since electric cars run on electricity rather than gas, you’ll also save on fuel costs in the long run.

Not only will you be helping the environment, but your wallet will thank you too. So, what is a tax benefit of electric cars? It’s the potential for lower tax liability and savings on fuel costs.

Electric cars are eligible for a federal tax credit.

Are you considering purchasing an electric car? Well, here’s good news for you! Electric cars are eligible for a federal tax credit to help you lower your tax liability. The federal government provides a tax credit of up to $7,500 for qualified electric vehicles. Moreover, the amount of the tax credit depends on the battery capacity of your electric vehicle.

For instance, electric cars with a battery capacity of under 17 kWh receive a lower tax credit, while those with a battery capacity of over 60 kWh receive the maximum tax credit. This tax credit is significant, and it can help you save a lot of money in the long term. Plus, it promotes the use of electric cars, which produce less pollution and are more environmentally friendly.

The tax credit is also an incentive for car manufacturers to make more EV models available to the public. As more people buy electric cars, the demand for them will increase, making them more affordable and accessible to everyone. In conclusion, purchasing an electric car can help you save money on gas, reduce environmental pollution, and qualify you for a federal tax credit.

So, why not consider buying an EV? With the tax credit, you can lower your tax liability and even invest in a more environmentally friendly car.

The credit can range from $2,500 to $7,500 depending on the car model and battery size.

If you’re considering purchasing an electric vehicle (EV), not only are you taking a step towards helping the environment by reducing your carbon footprint, but you may also be eligible for a tax credit. The amount of this credit depends on the specific model and battery size of the EV, ranging from $2,500 to $7,500. This tax credit can significantly decrease your tax liability and help make the upfront cost of purchasing an EV more accessible.

It’s essential to note that the credit is only available to those who purchase a new EV, and it begins to phase out after the manufacturer sells 200,000 electric vehicles in the US market. Keeping up with the latest updates about this tax credit can help you determine the best time to make a purchase and take advantage of this incentive. Overall, taking advantage of the tax credit can not only help you financially but also make a positive impact on the environment.

This credit can help reduce your overall tax liability for the year.

When tax season rolls around, many people start looking for ways to reduce their overall tax liability. One way to achieve this is by taking advantage of tax credits. Tax credits are a form of tax relief that directly reduces your tax bill.

One credit that taxpayers can take advantage of is the child tax credit. This credit is designed to help families with dependent children. It can be worth up to $2,000 per qualifying child.

By claiming the child tax credit, you can reduce your tax liability by up to $2,000 per child. This can make a significant difference in your overall tax bill. However, it’s important to note that the child tax credit has certain income limitations and other eligibility criteria that must be met, so it’s always a good idea to consult a tax professional before making any decisions.

But if you do qualify for the child tax credit, it can be a valuable tool in reducing your tax burden and putting more money back in your pocket.

State Incentives

If you’re considering purchasing an electric car, you’ll be glad to know that there are many state incentives available in addition to the environmental benefits. One of the biggest tax benefits of electric cars is the federal tax credit, which can be up to $7,500 depending on the vehicle’s battery size. Additionally, many states offer their own incentives, such as tax credits, rebates, or even exemption from certain taxes or fees.

For example, in California, electric vehicle (EV) drivers can get a rebate of up to $2,000, and they also receive access to carpool lanes, even with just one passenger. Other states offer other unique incentives, such as free public charging or discounts on toll roads. Be sure to check with your state’s department of transportation for the latest incentives available!

Many states offer their incentives for electric car owners.

If you’re considering purchasing an electric car, it’s worth exploring state incentives that may be available to you. Many states offer their own incentives to encourage the purchase and use of electric vehicles, ranging from tax credits and rebates to special HOV lane access and free parking. For example, California offers a rebate of up to $2,000 for eligible electric vehicle purchases, while Colorado provides a tax credit of up to $5,000.

Other states, such as Hawaii and Georgia, offer perks like free parking and HOV lane access for electric car owners. By taking advantage of these incentives, you can potentially save thousands of dollars and make owning an electric car even more worthwhile. So before making your purchase, be sure to research what incentives are available in your state and take advantage of them to maximize your savings.

These incentives can include tax credits, rebates, and reduced registration fees.

State incentives can be a significant factor in promoting the adoption of sustainable practices, particularly in the transportation sector. These incentives can come in various forms, including tax credits, rebates, and reduced registration fees. For example, in California, buyers of electric or hybrid vehicles can receive up to $1,500 in rebates, while in Colorado, drivers of alternative fuel vehicles can receive a tax credit of up to $7,500.

Furthermore, some states provide carpool lane access and free parking to EV owners, further incentivizing the switch to sustainable vehicles. State incentives can also encourage the installation of charging infrastructure, such as tax credits for charging station installation or reduced permit fees. Overall, state incentives can play a crucial role in promoting sustainable transportation practices, making them an essential consideration for policymakers.

Check with your state’s department of revenue to see what incentives are available in your area.

If you’re considering buying an electric vehicle, it’s definitely worth checking with your state’s department of revenue to see what incentives are available in your area. State incentives for EV buyers vary widely, but can include tax credits or exemptions, grants, and even free parking. Some states also offer extra incentives for low-income buyers or those who live in areas with poor air quality.

For example, in California, buyers of fully electric vehicles are eligible for a $2,000 rebate, while in Colorado, EVs are exempt from some sales taxes. Taking advantage of these incentives can not only save you money upfront but also help lower the long-term cost of ownership of an electric vehicle. So be sure to do your research and find out what’s available in your state before making your purchase.

Lower Fuel Costs

One of the tax benefits of electric cars that often gets overlooked is lower fuel costs. Electric vehicles require less energy to operate, which translates into lower electricity bills compared to gas-powered vehicles. Additionally, many states and local governments offer incentives to help offset the cost of charging infrastructure installation, making it easier and more cost-effective to own an electric car.

In fact, some states and cities offer free or discounted charging to EV owners, further reducing the cost of ownership. Plus, with the advent of more efficient batteries and improved charging technology, the cost of owning an electric car is rapidly decreasing, making it an increasingly affordable alternative to traditional gas-powered vehicles. So if you’re looking for a way to lower your fuel costs and reduce your emissions, an electric car might just be the perfect solution for you.

Electric cars have lower fuel costs than gas-powered cars.

Electric cars have a significant advantage over gas-powered cars when it comes to fuel costs. While gas prices continue to fluctuate, electric car owners can benefit from lower and more stable electricity rates. The average cost per mile for an electric car can be as low as half that of a gas car.

This is because electric cars are much more efficient than gas-powered cars. Electric cars convert nearly 60% of their energy into driving power, while gas-powered cars only convert about 20%. Additionally, electric car owners can take advantage of off-peak hours to charge their cars, which can further minimize fuel costs.

Overall, choosing an electric car can save you money in the long run and help reduce your carbon footprint.

By switching to an electric car, you could save thousands of dollars a year on fuel costs alone.

Electric car owners have the advantage of significantly lower fuel costs compared to traditional gasoline car drivers. With the increasing price of gas, electric cars have become popular as they offer substantial savings. By choosing an electric car, you no longer have to worry about fluctuating gasoline prices.

You can instead enjoy the convenience of simply charging your car overnight at home. According to recent studies, on average, electric vehicle drivers save around $1,000 per year on fuel costs alone. That’s a significant amount, especially when you factor in the long-term savings an electric car provides.

Imagine saving that much money every year just by switching to an electric car! Plus, with advancements in technology, electric cars offer an impressive range that can cover most daily commutes with ease. So, not only will you be contributing to a greener planet, but you will also save money in the long run.

Conclusion

In conclusion, the tax benefit of electric cars can be summed up in just a few words: power to the penny pinchers! Not only do these green machines help save the planet, but they also help keep money in our pockets. With tax incentives for buying and owning electric cars, we can enjoy the freedom of the open road without breaking the bank. So, if you’re looking to save some cash and feel good about your impact on the environment, it’s time to make the switch to electric.

As they say, every watt counts!”

FAQs

How do electric cars provide a tax benefit?

Electric cars can provide a federal tax credit worth up to $7,500. State and local incentives may also be available.

Is the tax benefit for electric cars only available for new cars?

No, the federal tax credit applies to both new and used electric cars.

Do all electric cars qualify for the tax benefit?

No, the tax credit is only available for electric cars that meet certain criteria, such as having a battery with a minimum capacity of 4 kilowatt hours.

Can the tax benefit for electric cars be claimed by leasing instead of purchasing?

Yes, the tax credit may be available for leased electric cars, but the leasing company may be the one who claims the credit.

What is the maximum amount of tax credit for electric cars?

The maximum federal tax credit for electric cars is $7,500, but it may be reduced depending on factors such as the battery capacity and the manufacturer’s production figures.

Are there any income limitations for claiming the tax benefit for electric cars?

Yes, there are income limitations for claiming the federal tax credit for electric cars. Once a manufacturer sells over 200,000 qualifying vehicles, the tax credit begins to phase out for that manufacturer.